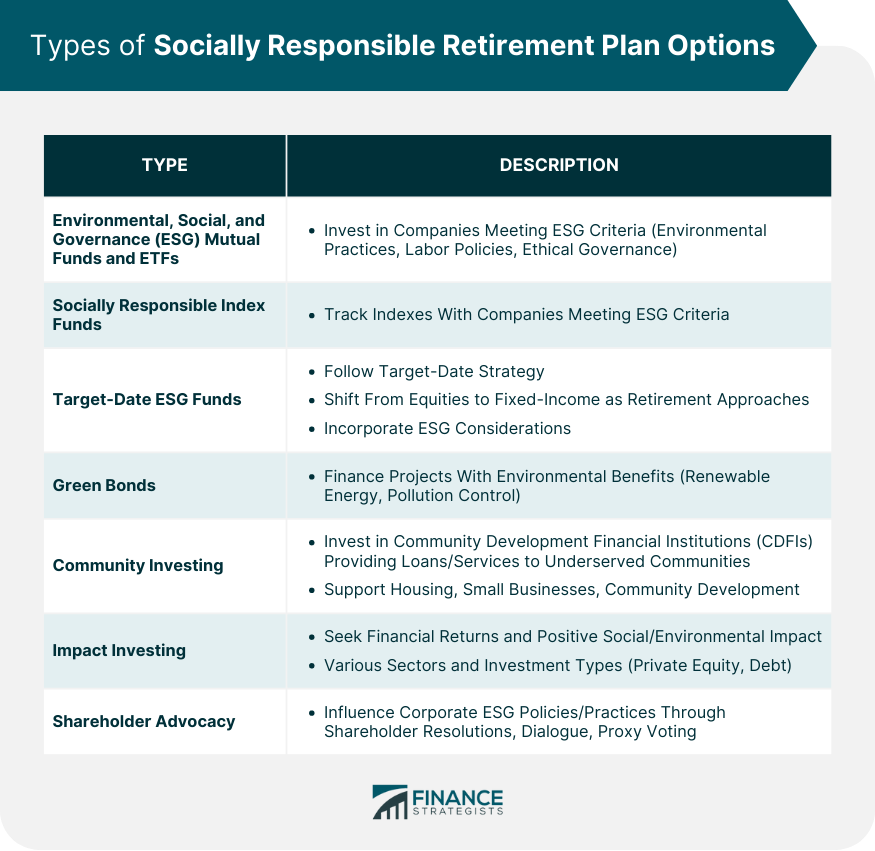

Socially responsible retirement plan options are investment vehicles that prioritize environmental, social, and governance (ESG) factors in their investment decisions. These options aim to generate positive social and environmental impacts while delivering financial returns to investors. Socially responsible retirement plan options are becoming increasingly popular among investors who want to align their financial goals with their values and beliefs. These options may include ESG mutual funds, exchange-traded funds, and other investment vehicles that prioritize sustainability, social justice, and ethical business practices. By investing in socially responsible retirement plan options, investors can make a positive impact on society while securing their financial future. There are several types of socially responsible retirement plan options available: These funds invest in companies that meet certain ESG criteria, such as strong environmental practices, fair labor policies, and ethical governance. Examples of ESG-focused funds include those managed by firms like BlackRock, Vanguard, or Calvert. These funds track indexes that specifically include companies that meet ESG criteria, like the MSCI KLD 400 Social Index or the FTSE4Good Index Series. These index funds offer passive investment strategies while maintaining a focus on ESG factors. These funds follow a target-date strategy, which gradually shifts the asset allocation from equities to fixed-income investments as the investor approaches retirement. Target-date ESG funds incorporate ESG considerations into the investment process, ensuring that the companies in the fund meet certain ESG criteria. These are fixed-income investments issued by governments, corporations, or other organizations to finance projects with positive environmental benefits, such as renewable energy or pollution control. By investing in green bonds, retirees can support environmentally friendly projects while generating income. This option involves investing in community development financial institutions (CDFIs), which provide loans and financial services to underserved communities. These investments can help support affordable housing, small business growth, and other community development initiatives. This investment strategy seeks to generate both financial returns and positive social or environmental impact. Impact investments can be made in various sectors, such as clean energy, sustainable agriculture, or affordable housing, and may include private equity, venture capital, or debt instruments. Some investment managers and funds engage in shareholder advocacy, using their ownership stake in companies to influence corporate policies and practices related to ESG issues. This can involve filing shareholder resolutions, engaging in dialogue with company management, or voting proxies on ESG-related proposals. When considering socially responsible retirement plan options, it is essential to carefully research and evaluate each option's performance, fees, and alignment with your values and investment objectives. When considering socially responsible retirement plan options, it's essential to assess personal values and priorities to determine which investments best align with one's ethical beliefs and financial goals. This process involves reflecting on the issues that matter most and identifying the ESG factors that resonate with individual preferences. Before selecting a socially responsible investment, it's crucial to analyze the investment's ESG factors to ensure that it meets the desired criteria. Investors should examine a company's environmental, social, and governance practices to determine whether the investment aligns with their values and priorities. When evaluating socially responsible retirement plan options, it's important to review the investment's performance and fees. Investors should consider historical performance, risk-adjusted returns, and management fees to ensure that the investment offers competitive returns while remaining cost-effective. To minimize risk and maximize potential returns, investors should ensure diversification within their socially responsible investment portfolio. Diversification involves spreading investments across various asset classes, sectors, and regions to reduce the impact of any single investment on the overall portfolio. Once an investor has assessed their values, priorities, and investment criteria, they can begin selecting the appropriate investment vehicles for their socially responsible retirement plan. These vehicles may include socially responsible mutual funds, ETFs, target-date funds, or bonds, depending on the investor's preferences and risk tolerance. Investors can establish a self-directed retirement account to gain more control over their investment choices and access a wider range of socially responsible investment options. These accounts enable investors to select specific investments that align with their values, priorities, and financial goals. Working with a financial advisor experienced in especially responsible investing (SRI) can help investors navigate the complexities of socially responsible retirement planning. Advisors can provide guidance on selecting appropriate investments, managing risk, and optimizing the investment portfolio to meet long-term retirement goals. As with any retirement plan, it's essential to regularly monitor and adjust the socially responsible investment portfolio to ensure it remains aligned with the investor's goals and risk tolerance. This may involve rebalancing the portfolio, reassessing investment priorities, or making changes based on evolving personal values and market conditions. Socially responsible retirement plan options enable investors to align their personal values with their investment strategies. By choosing investments that reflect their beliefs and priorities, individuals can feel confident that their financial decisions align with their ethical principles. Investing in socially responsible retirement plan options can help promote sustainable and ethical business practices. Companies with strong ESG performance are more likely to receive investments from SRI-focused funds, incentivizing these businesses to maintain or improve their ESG practices. ESG-focused investments can potentially reduce portfolio risk by mitigating certain environmental, social, and governance issues that may negatively impact a company's performance. Companies with strong ESG practices tend to be more resilient, which can benefit long-term investors. Investing in socially responsible retirement plan options can encourage long-term growth and shareholder activism. As shareholders, SRI investors can advocate for responsible corporate practices and support companies that prioritize sustainability and ethical conduct. Socially responsible retirement plan options prioritize environmental, social, and governance factors in investment decisions, aiming to generate positive social and environmental impacts while delivering financial returns. Types of these options include ESG mutual funds and ETFs, socially responsible index funds, target-date ESG funds, green bonds, community investing, impact investing, and shareholder advocacy. When evaluating socially responsible retirement plan options, it's important to assess personal values and priorities, analyze the investment's ESG factors, review the investment's performance and fees, and ensure diversification within the investment portfolio. Benefits of socially responsible retirement plan options include aligning personal values with investment strategies, promoting sustainable and ethical business practices, potentially reducing portfolio risk, and encouraging long-term growth and shareholder activism. For those interested in integrating SRI into their retirement planning, seeking the guidance of a financial advisor experienced in socially responsible investing can be invaluable.What Is Socially Responsible Retirement Plan Options?

Types of Socially Responsible Retirement Plan Options

ESG Mutual Funds and Exchange-Traded Funds (ETFs)

Socially Responsible Index Funds

Target-Date ESG Funds

Green Bonds

Community Investing

Impact Investing

Shareholder Advocacy

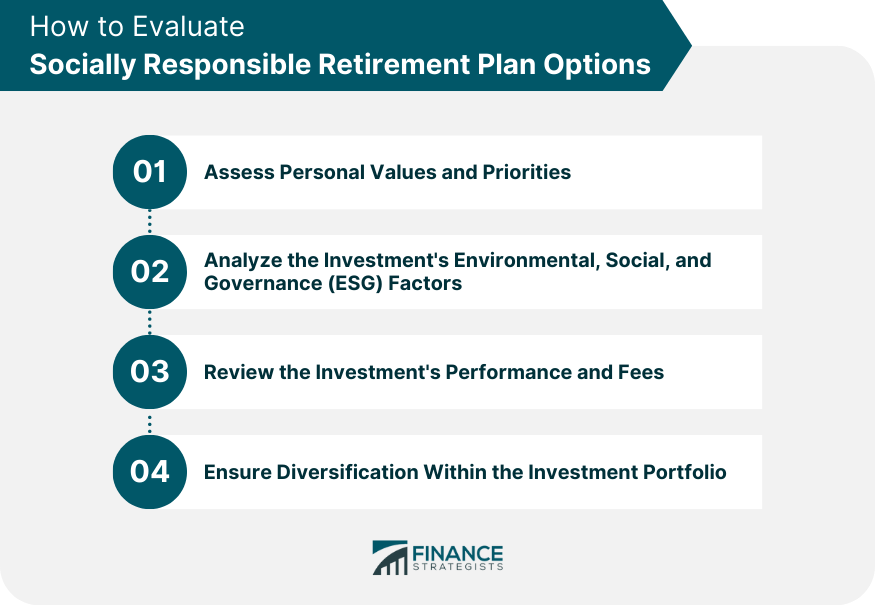

Evaluating Socially Responsible Retirement Plan Options

Assessing Personal Values and Priorities

Analyzing the Investment's Environmental, Social, and Governance (ESG) Factors

Reviewing the Investment's Performance and Fees

Ensuring Diversification Within the Investment Portfolio

Implementing a Socially Responsible Retirement Plan

Choose the Right Investment Vehicles

Set up a Self-Directed Retirement Account

Collaborate With a Financial Advisor Experienced in SRI

Monitor and Adjust the Investment Portfolio Over Time

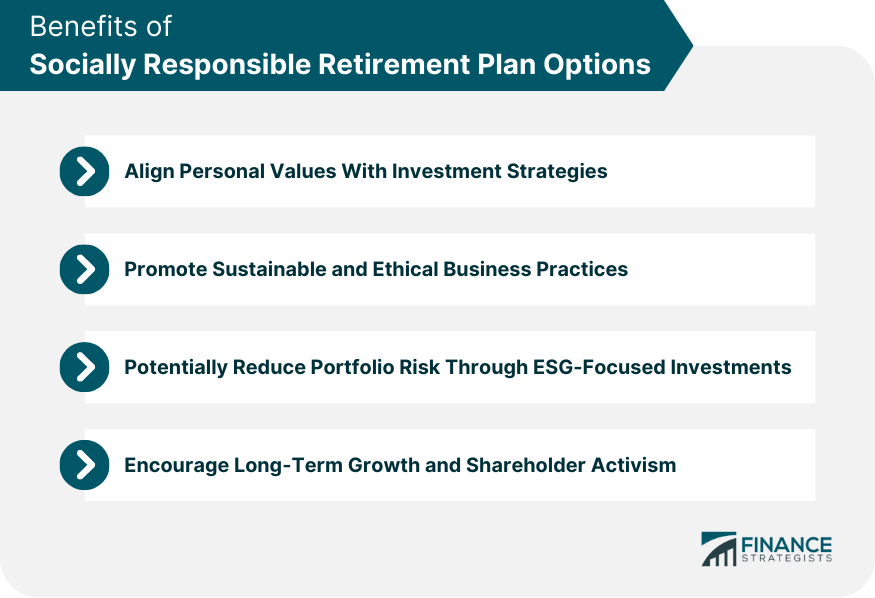

Benefits of Socially Responsible Retirement Plan Options

Aligning Personal Values With Investment Strategies

Promoting Sustainable and Ethical Business Practices

Potentially Reducing Portfolio Risk Through ESG-Focused Investments

Encouraging Long-Term Growth and Shareholder Activism

Final Thoughts

Socially Responsible Retirement Plan Options FAQs

Socially responsible retirement plan options are investment vehicles that consider environmental, social, and governance (ESG) factors in addition to financial returns. They allow investors to align their personal values with their investment strategies, promote sustainable and ethical business practices, and potentially reduce portfolio risk. The growing popularity of these options reflects increasing awareness and demand for investments that support positive change in the world.

Socially responsible mutual funds are a type of investment vehicle within socially responsible retirement plan options. These funds pool investors' money to invest in a diversified portfolio of companies with strong ESG performance, focusing on different aspects of ESG factors such as environmental, social, or governance practices.

There are three main types of socially responsible bonds that can be included in socially responsible retirement plan options: green bonds, social bonds, and sustainability bonds. Green bonds finance environmentally friendly projects, social bonds fund initiatives that address social challenges, and sustainability bonds combine elements of both green and social bonds to finance projects with both environmental and social benefits.

Investors can evaluate socially responsible retirement plan options by assessing their personal values and priorities, analyzing the investment's ESG factors, reviewing the investment's performance and fees, and ensuring diversification within their investment portfolio. This process helps investors select investments that align with their ethical beliefs, financial goals, and risk tolerance.

To implement socially responsible retirement plan options into their retirement planning strategy, investors can choose the right investment vehicles based on their values and priorities, set up a self-directed retirement account, collaborate with a financial advisor experienced in socially responsible investing (SRI), and regularly monitor and adjust their investment portfolio to align with their goals and risk tolerance. This approach ensures a tailored strategy that supports both financial security and positive societal impact.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.