The Teacher Retirement System (TRS) is a public retirement plan established to provide retirement benefits for educators. It's a key part of the financial safety net for teachers, providing them with a level of financial security in their retirement years. It's a defined benefit plan, meaning that the amount of retirement income an educator receives is predetermined by their salary, years of service, and a retirement factor specified by the plan. The TRS is crucial as it functions as a substitute for Social Security for many educators, particularly in states where teachers do not participate in the Social Security system. As such, the health and sustainability of the TRS directly impacts the long-term financial well-being of these educators. In the context of retirement planning, the Teacher Retirement System (TRS) holds significant importance. It provides a stable source of income in the post-work phase of life, ensuring that educators, who have dedicated their lives to the service of others, can retire with dignity. The system is designed to reward long service, and thus, the longer an educator serves, the higher the benefits they receive upon retirement. Moreover, TRS not only provides a regular pension but also extends other benefits such as health insurance and disability benefits, thus offering a comprehensive retirement package. It is a testament to society's respect and gratitude towards educators and their contribution to shaping future generations. The Teacher Retirement System (TRS) finds its roots in the early 20th century when it was established to provide retirement benefits for educators. The primary motivation behind setting up the TRS was to attract and retain talented individuals in the teaching profession by providing them with financial security in their retirement years. Initially, the TRS was a relatively modest program, with benefits and contribution rates far lower than what we see today. However, the fundamental principle has remained the same: to provide a secure retirement for educators, honoring their service and dedication to their profession. Over the years, the TRS has undergone several legislative changes aimed at improving its sustainability and enhancing the benefits provided to teachers. These legislative interventions have shaped the current form of the TRS, expanding its coverage, increasing benefits, and improving its financial stability. One significant legislative milestone was the inclusion of TRS in the Employee Retirement Income Security Act (ERISA), which provided increased protection to plan participants. Over time, lawmakers have also increased contribution rates and enhanced benefits, demonstrating a commitment to preserving the financial health of the TRS for current and future retirees. The TRS has evolved significantly since its inception, adapting to changes in the economic environment, demographic shifts, and legislative mandates. Contribution rates have increased, benefit formulas have been adjusted, and investment strategies have been modified in response to these changes. One of the most notable shifts has been the growing focus on investment returns as a key source of funding for the system. As state contributions and employee contributions have struggled to keep pace with growing benefit obligations, the TRS has increasingly relied on investment income to bridge the gap. This shift has brought about a greater emphasis on investment management within the TRS, requiring sophisticated strategies to achieve the required returns while managing risk. The TRS is governed by a Board of Trustees, which is responsible for overseeing the operation and management of the system. This board is typically composed of a combination of elected teacher representatives, appointed officials, and ex-officio members. The board's primary responsibilities include setting policy, approving the system's budget, hiring the executive director, and overseeing the system's investment program. The board also plays a crucial role in advocating for the system and its members, working with lawmakers and other stakeholders to ensure the long-term sustainability and success of the TRS. The funding of the Teacher Retirement System (TRS) is a shared responsibility between the state, the participating employers (such as school districts), and the educators themselves. The primary funding sources for the TRS include employer contributions, employee contributions, and investment income generated by the assets held in the system's trust fund. Each of these funding sources plays a vital role in maintaining the financial health of the TRS. Employee contributions are typically a fixed percentage of an educator's salary, while employer contributions are determined by a funding formula based on actuarial assumptions and the system's overall financial health. Investment income, as noted earlier, has become an increasingly important component of TRS funding, with the system relying on strong investment performance to help meet its benefit obligations. The TRS trust fund is managed with a long-term investment horizon, aiming to generate sufficient returns to meet the system's current and future benefit obligations. The investment strategy is determined by the Board of Trustees, with the assistance of professional investment staff and external advisors. The TRS typically employs a diversified investment approach, allocating assets across various asset classes such as equities, fixed income, real estate, and alternative investments. This diversification helps to manage risk and reduce the impact of market fluctuations on the system's overall portfolio. The investment strategy is continually reviewed and adjusted to ensure it remains aligned with the system's long-term objectives and risk tolerance. The primary benefit provided by the Teacher Retirement System (TRS) is a defined benefit pension, which offers a guaranteed monthly income to educators upon retirement. The pension amount is calculated based on a formula that considers factors such as the educator's final average salary, years of service, and a retirement factor specified by the plan. This pension benefit provides a stable, predictable source of income for retired educators, allowing them to maintain their standard of living and financial independence during their retirement years. In addition to the pension benefit, the TRS often provides health insurance coverage for eligible retirees and their dependents. This coverage typically includes medical, dental, and vision benefits, ensuring that retirees have access to essential healthcare services during their retirement years. Health benefits are a critical component of the TRS package, as they help to protect retired educators from the potentially significant financial burden of healthcare expenses, which can be particularly challenging for individuals on a fixed income. The TRS also provides disability benefits to eligible educators who become unable to work due to a physical or mental disability. These benefits are designed to provide financial support to educators during a difficult period, ensuring that they can continue to meet their basic needs and maintain their dignity. Disability benefits are typically calculated based on a formula that takes into account the educator's salary and years of service, offering a level of income replacement that allows the educator to maintain a reasonable standard of living while unable to work. One of the most pressing challenges facing the Teacher Retirement System (TRS) is the issue of funding. As pension liabilities have grown due to factors such as longer life expectancies and an aging teacher workforce, many TRS systems have struggled to keep pace with these rising obligations. The challenge of adequately funding the TRS requires a careful balance between ensuring that the system remains sustainable and providing a fair and competitive retirement package for educators. This may necessitate difficult decisions regarding contribution rates, benefit adjustments, and investment strategies to ensure the long-term health of the system. The TRS is often subject to political pressures, as lawmakers and other stakeholders debate the appropriate level of support and funding for the system. In some cases, the TRS has become a political football, with various interest groups pushing for changes to the system that may benefit their constituents but could have negative long-term consequences for the system's sustainability. Maintaining the financial health of the TRS requires strong advocacy from the Board of Trustees and other stakeholders, as well as a commitment from lawmakers to prioritize the needs of educators and ensure that the system remains viable for current and future retirees. Demographic shifts, such as an aging population and a growing number of retirees, also pose challenges for the Teacher Retirement System (TRS). As the ratio of active educators to retirees declines, the pressure on the system to generate sufficient investment returns and contributions to meet its benefit obligations increases. Addressing these demographic challenges will likely require a combination of policy changes, such as adjustments to benefit formulas, retirement ages, and contribution rates, as well as innovative investment strategies to help maximize the system's returns while managing risk. The Teacher Retirement System (TRS) is designed to serve educators who work in public schools, colleges, and universities. Eligibility criteria for participation in the TRS may vary by state and specific plan, but generally, teachers, administrators, and other education professionals employed by public educational institutions are eligible to join. In some cases, participation in the TRS may be mandatory for eligible employees, while in others, it may be optional. It is essential for educators to understand the specific eligibility rules and requirements for their particular TRS plan to ensure they are taking full advantage of the benefits available to them. In order to qualify for retirement benefits from the TRS, educators must meet certain service credit requirements. These requirements are typically expressed in terms of years of service, with a minimum threshold that must be met in order for an educator to be eligible for a pension. Service credit requirements can vary by state and plan, but generally, educators must have a minimum number of years of service, often ranging from five to ten years, to qualify for a TRS pension. Additional service credits can be earned for each year of service beyond the minimum threshold, increasing the pension benefit that the educator will ultimately receive upon retirement. The retirement age for the Teacher Retirement System (TRS) can vary depending on the specific plan and the educator's years of service. In many cases, the TRS offers several retirement options, including early retirement, normal retirement, and deferred retirement. Early retirement allows educators to begin receiving pension benefits before reaching the normal retirement age, often with reduced benefits to account for the longer payout period. Normal retirement typically occurs when an educator has met both the age and service credit requirements for full pension benefits. Deferred retirement allows educators who have met the eligibility requirements to delay the start of their pension benefits, potentially resulting in higher monthly payments when they ultimately begin receiving their pension. The Teacher Retirement System (TRS) is a vital component of the financial safety net for educators, providing a secure source of retirement income and other benefits such as health insurance and disability coverage. With a comprehensive understanding of TRS and its eligibility requirements, educators can plan for a comfortable retirement and enjoy the benefits of a stable pension plan. The TRS offers a range of benefits, including retirement benefits, health benefits, and disability benefits, that are designed to provide financial security to educators and their families. However, the TRS faces several challenges, including funding challenges, political challenges, and demographic challenges. It is important for policymakers, educators, and other stakeholders to work together to address these challenges and ensure the sustainability of the TRS. By doing so, we can ensure that educators have access to the financial support they need to live fulfilling lives during retirement. Through effective management, funding, and policymaking, we can support educators and their families and help them achieve financial security and peace of mind throughout their retirement years.What Is the Teacher Retirement System (TRS)?

History of TRS

Establishment of TRS

Key Legislation

Changes in TRS Over Time

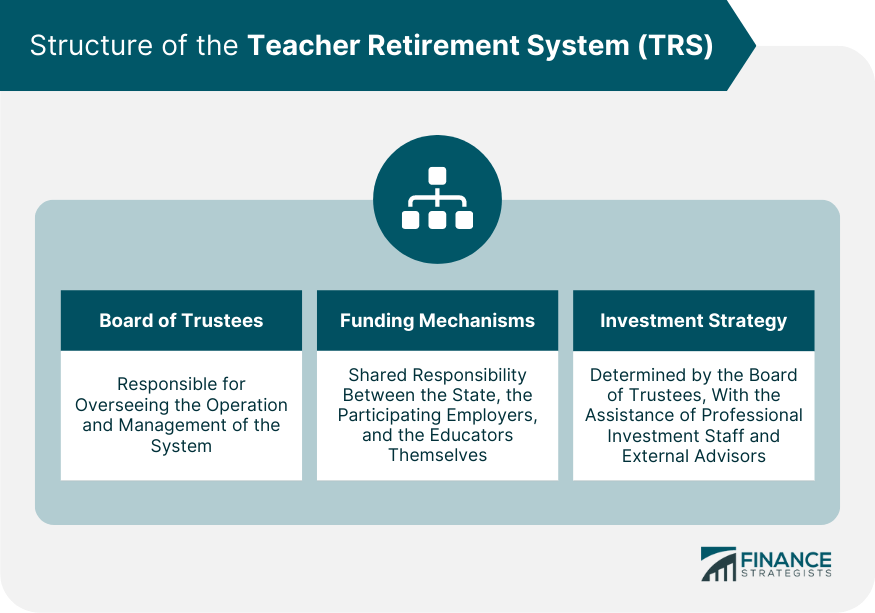

Structure of the Teacher Retirement System (TRS)

Board of Trustees

Funding Mechanisms

Investment Strategy

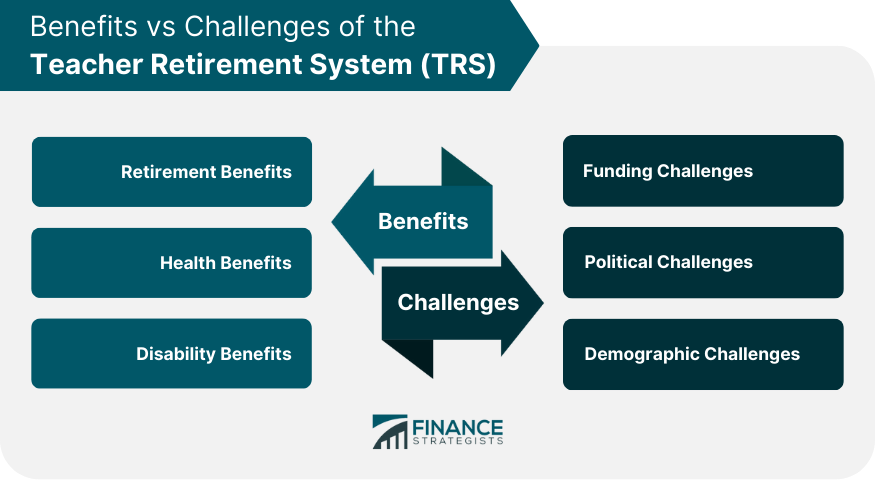

Benefits of TRS

Retirement Benefits

Health Benefits

Disability Benefits

Challenges Facing TRS

Funding Challenges

Political Challenges

Demographic Challenges

Eligibility for TRS

Who Is Eligible to Participate

Service Credit Requirements

Retirement Age and Options

Bottom Line

Teacher Retirement System (TRS) FAQs

The Teacher Retirement System (TRS) is a retirement benefit plan designed for public school educators in the United States.

TRS benefits are available to educators who meet service credit requirements and have retired from a qualifying public school system.

TRS provides retirement benefits, health benefits, and disability benefits to eligible educators.

TRS is funded through a combination of contributions from employees and employers, as well as investments made by the TRS Board of Trustees.

The TRS faces funding challenges, political challenges, and demographic challenges such as an aging population of retirees and a shortage of young educators.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.