A 72(t) distribution refers to a series of substantially equal periodic payments (SEPPs) taken from a qualified retirement account, such as an IRA or 401(k), before the account owner reaches age 59½. These distributions are named after Section 72(t) of the Internal Revenue Code, which provides guidelines for early withdrawals from retirement accounts. The primary purpose of a 72(t) distribution is to allow individuals access to their retirement funds before the standard retirement age without incurring the typical 10% early withdrawal penalty. This option can be beneficial for those facing early retirement, unforeseen financial needs, or seeking additional financial flexibility. Eligible retirement accounts for 72(t) distributions include traditional IRAs, Roth IRAs, and qualified employer-sponsored plans such as 401(k), 403(b), and 457(b) plans. However, Roth IRAs are subject to different rules and may not require a 72(t) distribution to access funds without penalty. There is no minimum age requirement to initiate a 72(t) distribution. However, these distributions are specifically designed for individuals who need to access their retirement funds before the standard retirement age of 59½. The RMD method calculates the 72(t) distribution amount using the account balance and life expectancy factors from the IRS's Single or Uniform Lifetime Table. This method typically results in the lowest payment amount and may fluctuate annually due to changes in the account balance. The amortization method calculates the 72(t) distribution amount by amortizing the retirement account balance over the account owner's life expectancy using a reasonable interest rate. This method results in a fixed payment amount for the duration of the SEPPs. The annuitization method calculates the 72(t) distribution amount by dividing the account balance by an annuity factor, which is derived from the IRS's mortality table and a reasonable interest rate. This method also produces a fixed payment amount for the duration of the SEPPs. Each calculation method has its advantages and disadvantages, with the RMD method generally providing the most conservative payout and the amortization and annuitization methods offering potentially higher, fixed payments. Individuals should carefully consider their financial needs and goals when choosing a calculation method. Once a 72(t) distribution is initiated, the account owner must take SEPPs at least annually, with the payment amounts based on one of the approved IRS calculation methods. SEPPs must continue for at least five years or until the account owner reaches age 59½, whichever comes later. If the 72(t) distribution is stopped or modified before meeting these requirements, the account owner may be subject to retroactive penalties and taxes on the previously withdrawn funds. Any modification to the SEPPs, such as changing the payment amount or stopping the payments before the required period ends, may result in the account owner being subject to a 10% penalty on all distributions taken up to that point, plus any applicable interest and taxes. While 72(t) distributions can help avoid the 10% early withdrawal penalty, the distributions are still considered taxable income. The account owner will need to report the distribution amounts on their income tax return and pay any applicable taxes. One of the main benefits of 72(t) distributions is the ability to access retirement funds before the standard retirement age without incurring early withdrawal penalties. This can provide financial flexibility for individuals who need to tap into their retirement savings early. By following the IRS rules and guidelines for 72(t) distributions, individuals can avoid the 10% early withdrawal penalty that typically applies to retirement account withdrawals made before age 59½. For some individuals, a 72(t) distribution can provide additional financial planning options, such as funding early retirement, supplementing income during a career transition, or covering unexpected expenses. One of the primary risks associated with 72(t) distributions is the possibility of depleting retirement savings too early, which can jeopardize long-term financial security. It's essential to carefully consider the potential impact of early withdrawals on future retirement income. Once a 72(t) distribution is initiated, the payment amounts and schedule are generally inflexible. Changes to the SEPPs can result in penalties and taxes, making it crucial to ensure that the chosen distribution plan aligns with the individual's financial needs and goals. While 72(t) distributions can help avoid early withdrawal penalties, they are still subject to income taxes, which can impact overall financial planning. Additionally, failure to follow IRS rules and requirements can result in penalties and additional taxes. For individuals planning for early retirement, a 72(t) distribution can provide a means to access retirement funds without incurring penalties. It's essential to carefully evaluate the potential impact on long-term financial security and ensure that the chosen distribution strategy aligns with retirement goals. In the case of unforeseen financial needs, a 72(t) distribution can provide a source of income without incurring early withdrawal penalties. However, it's important to weigh the potential risks and drawbacks, such as depleting retirement savings or the inflexibility of SEPPs. Before initiating a 72(t) distribution, individuals should carefully weigh the pros and cons, considering their unique financial circumstances, needs, and goals. Consulting with a financial advisor can help ensure that the chosen strategy is appropriate and aligns with long-term financial objectives. Navigating the complexities of 72(t) distribution planning can be challenging, and professional guidance from a financial advisor can help ensure that individuals make informed decisions that align with their financial goals. Selecting a financial advisor with expertise in 72(t) distributions and retirement planning can provide valuable insight and support in developing an appropriate distribution strategy. Working with a financial advisor can also help ensure that the 72(t) distribution plan is regularly monitored and adjusted as needed to account for changes in personal circumstances, market conditions, or tax laws. 72(t) distributions can play a valuable role in financial planning for individuals who need to access their retirement funds before the standard retirement age. By following IRS rules and guidelines, it's possible to avoid early withdrawal penalties and gain financial flexibility. However, careful consideration must be given to the potential risks and drawbacks associated with early withdrawals from retirement accounts. Before initiating a 72(t) distribution, it's essential for individuals to carefully evaluate their personal circumstances and financial goals, weighing the potential benefits and risks. Consulting with a knowledgeable financial advisor can provide valuable guidance and support in developing an appropriate distribution strategy that aligns with long-term financial objectives and helps ensure ongoing financial security.What Is a 72(t) Distribution?

Eligibility for 72(t) Distributions

Types of Retirement Accounts Eligible for 72(t) Distributions

Age Requirements

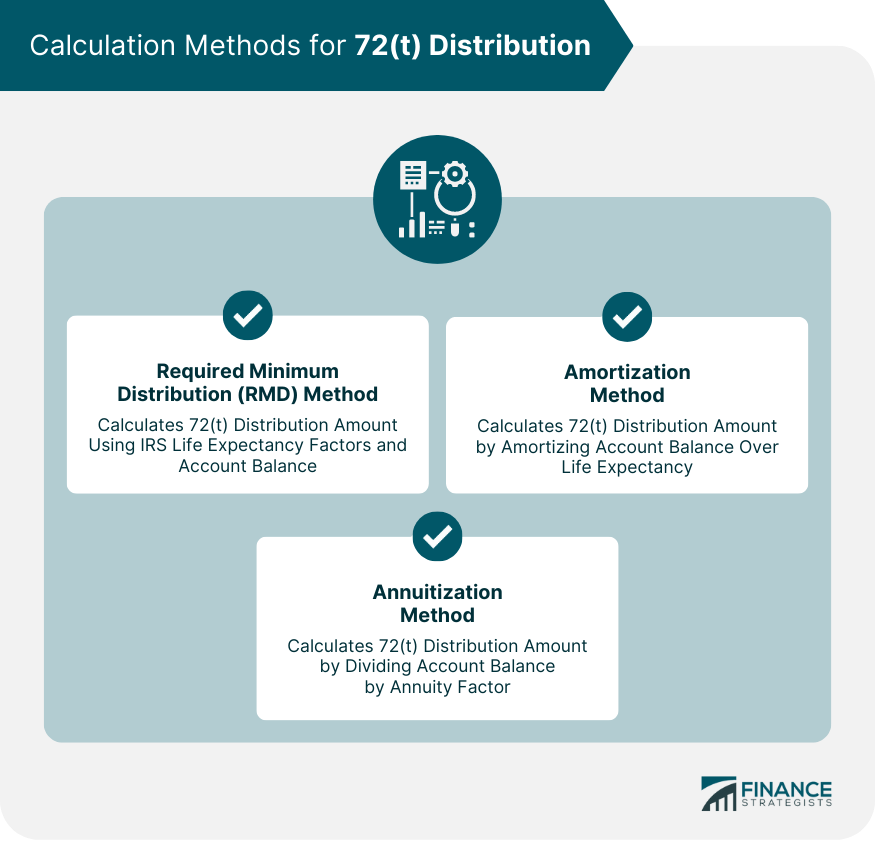

Calculation Methods for 72(t) Distributions

Required Minimum Distribution (RMD) Method

Amortization Method

Annuitization Method

Comparison of the Calculation Methods

Rules and Requirements for 72(t) Distributions

Substantially Equal Periodic Payments (SEPPs)

Five-Year Rule and Age 59½ Requirement

Penalties for Modification of 72(t) Distributions

Tax Implications

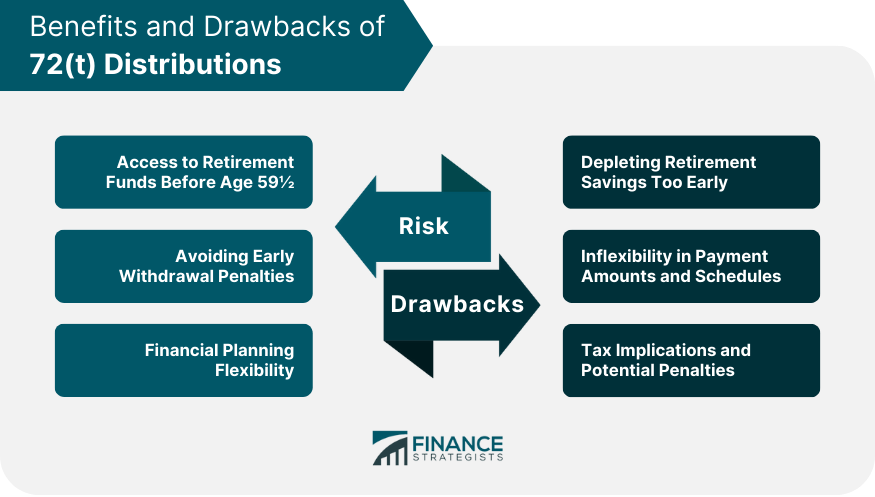

Benefits of 72(t) Distributions

Access to Retirement Funds Before Age 59½

Avoiding Early Withdrawal Penalties

Financial Planning Flexibility

Potential Risks and Drawbacks

Depleting Retirement Savings Too Early

Inflexibility in Payment Amounts and Schedules

Tax Implications and Potential Penalties

72(t) Distribution Scenarios and Considerations

Early Retirement Planning

Unforeseen Financial Needs

Weighing the Pros and Cons

Working With a Financial Advisor

Importance of Professional Guidance in 72(t) Distribution Planning

Choosing a Knowledgeable Financial Advisor

Ongoing Monitoring and Adjustments

Conclusion

72(t) Distribution FAQs

A 72(t) distribution is a way to withdraw money from a retirement account penalty-free before the age of 59½ by taking substantially equal periodic payments (SEPPs) over a period of at least five years or until the account owner turns 59½, whichever is later.

A 72(t) distribution may be a good option for those who need to withdraw money from their retirement accounts before the age of 59½ without paying the 10% early withdrawal penalty. It's important to note that once you begin taking 72(t) distributions, you are required to continue taking them for the specified period of time, or until you turn 59½, whichever is later.

The amount of the 72(t) distribution is based on the account balance and the life expectancy of the account owner (or the joint life expectancy of the account owner and a designated beneficiary).

The three methods for calculating 72(t) distributions are the Required Minimum Distribution (RMD) method, the Fixed Amortization method, and the Fixed Annuitization method. Each method has its own calculation formula and may result in different distribution amounts.

One potential drawback of taking 72(t) distributions is that the amount of the distribution is fixed and cannot be changed once the SEPPs have begun. Additionally, if the distribution amount is too high, it may deplete the retirement account too quickly and leave the account owner with insufficient funds in later years. Finally, the account owner may miss out on potential market gains if the account balance is locked in at a fixed distribution amount.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.