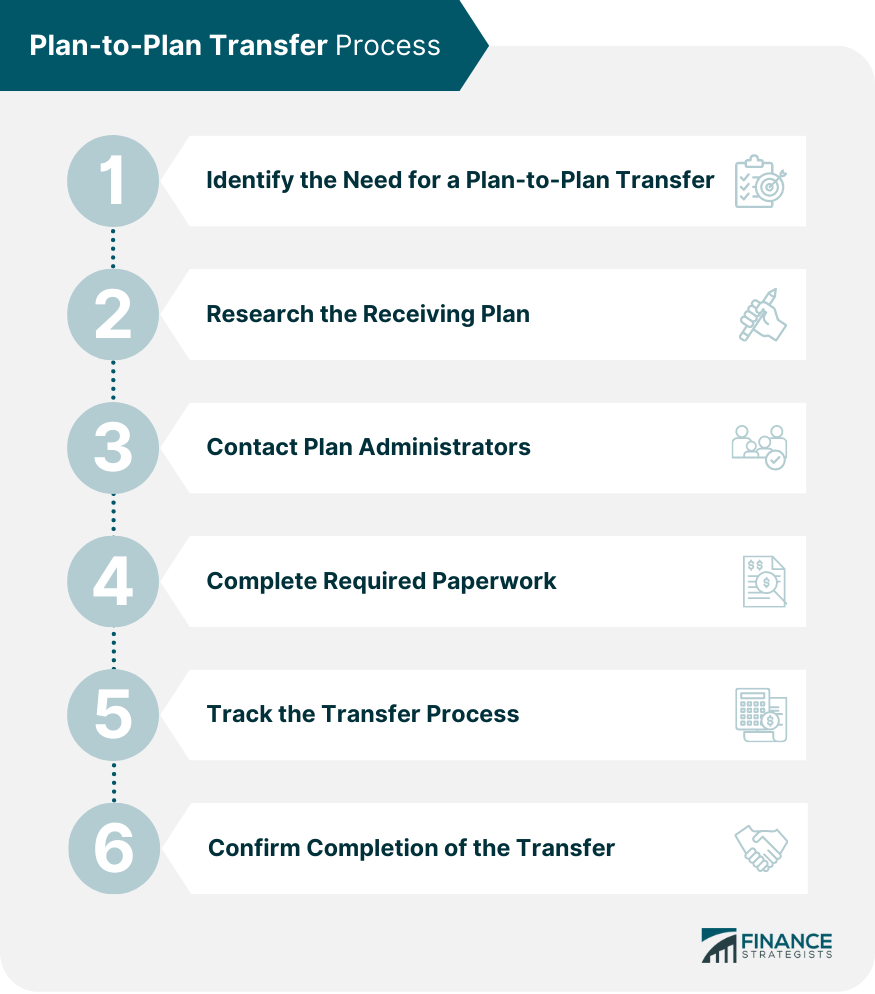

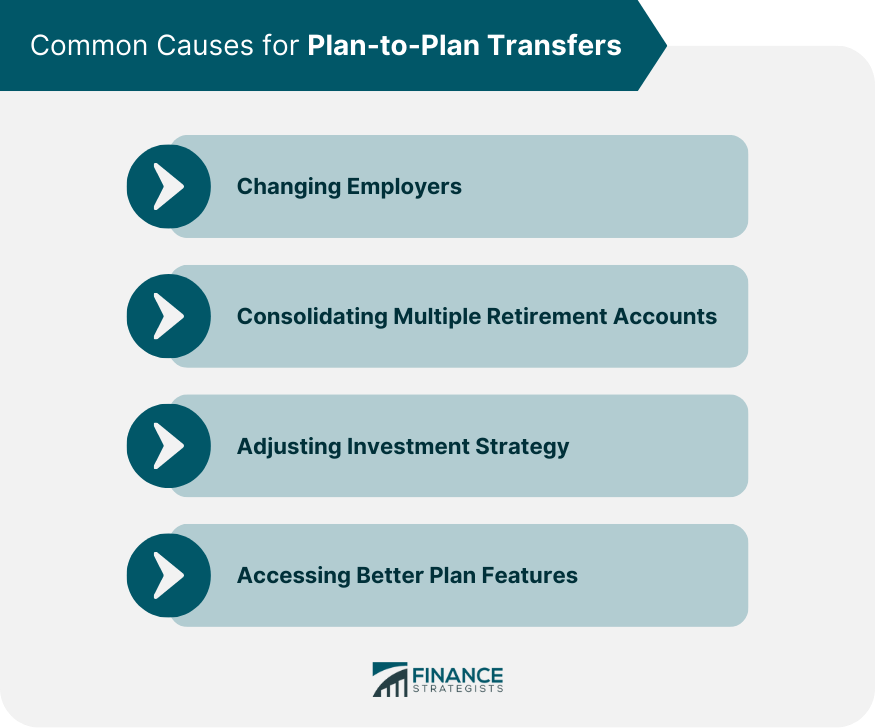

A Plan-to-Plan Transfer is the process of moving assets from one retirement plan to another without incurring taxes or penalties. It is a tax-free and direct method of transferring funds between two qualified retirement plans, allowing individuals to consolidate accounts, change investment strategies, or access better plan features. Plan-to-Plan Transfers offer various benefits, such as maintaining the tax-deferred status of retirement savings, streamlining account management, and aligning investment strategies with changing financial goals. Transfers can also help individuals avoid the risks and limitations associated with other types of transactions, such as indirect rollovers. Individuals may consider a Plan-to-Plan Transfer when changing employers, consolidating multiple retirement accounts, adjusting their investment strategy, or accessing better plan features. A 401(k) plan is a tax-advantaged retirement savings plan offered by private employers, allowing employees to contribute a portion of their income to a designated account. A 403(b) plan is similar to a 401(k) but is designed for employees of non-profit organizations, public schools, and certain religious institutions. A 457(b) plan is a deferred compensation plan for state and local government employees and select non-profit organizations. The Thrift Savings Plan (TSP) is a retirement savings plan for federal employees and members of the uniformed services, similar to a 401(k). A Traditional Individual Retirement Account (IRA) is an individual retirement account that offers tax-deductible contributions and tax-deferred growth on investments. A Roth IRA is an individual retirement account with tax-free growth and withdrawals, funded by after-tax contributions. A Simplified Employee Pension (SEP) IRA is a retirement plan for self-employed individuals and small business owners. A Savings Incentive Match Plan for Employees (SIMPLE) IRA is a retirement plan for small businesses that allows both employer and employee contributions. Not all retirement plans permit Plan-to-Plan Transfers. Consult with both the sending and receiving plan administrators to determine eligibility. There is no limit to the number of Plan-to-Plan Transfers an individual can complete. However, some plans may have specific restrictions or requirements. Plan-to-Plan Transfers are generally tax-free, but certain transactions, such as moving funds from a Traditional IRA to a Roth IRA, may trigger tax consequences. The specific documentation and forms required for a Plan-to-Plan Transfer vary depending on the plans involved. Consult with plan administrators for guidance. The timeline for completing a Plan-to-Plan Transfer varies depending on the transaction's complexity and the plan administrators' responsiveness. Evaluate your financial goals, investment strategy, and retirement plan features to determine whether a Plan-to-Plan Transfer is appropriate. Before initiating a transfer, review the receiving plan's fees, investment options, and other features to ensure it aligns with your goals and needs. Notify both the sending and receiving plan administrators of your intent to complete a Plan-to-Plan Transfer. Fill out and submit any necessary documentation and forms as directed by the plan administrators. Ensure all information is accurate to avoid delays or complications. Monitor the progress of your Plan-to-Plan Transfer by maintaining communication with both plan administrators and keeping records of all correspondence and transactions. Once the transfer is complete, verify the updated account balances and investment allocations in both the sending and receiving plans. Individuals who change jobs may consider a Plan-to-Plan Transfer to move their retirement savings from their previous employer's plan to their new employer's plan, provided both plans allow such transfers. Consolidating multiple retirement accounts into one can simplify account management and streamline investment strategies. A Plan-to-Plan Transfer can help individuals align their retirement savings with their evolving financial goals and risk tolerance by accessing a new plan with different investment options. Transferring to a plan with lower fees, better investment options, or more flexible withdrawal options can improve long-term retirement outcomes. Some plans may charge fees for processing Plan-to-Plan Transfers or impose penalties for early withdrawals or other account changes. Transferring to a new plan may result in losing specific investment options, which could impact an individual's investment strategy. Plan-to-Plan Transfers may affect vesting schedules, especially when transferring employer-sponsored plans with employer-matching contributions. While most Plan-to-Plan Transfers are tax-free, certain transactions may trigger tax liabilities. Consult a financial professional for guidance on potential tax implications. Direct rollovers involve transferring funds from one retirement account to another without the individual taking possession of the funds, thus avoiding taxes and penalties. Indirect rollovers involve the individual receiving a distribution from one retirement account and depositing the funds into another account within 60 days, subject to taxes and penalties if the deadline is missed. In-service distributions are withdrawals from a retirement plan while still employed by the plan sponsor. These are typically subject to taxes and penalties. Plan loans allow individuals to borrow from their retirement plan, subject to plan rules and repayment requirements. Individuals may choose to leave their retirement assets in the original plan if it offers suitable investment options and features. A Plan-to-Plan Transfer is a tax-free method of moving assets between qualified retirement plans, allowing individuals to consolidate accounts, change investment strategies, or access better plan features. This process offers benefits such as maintaining tax-deferred status and streamlining account management. Common scenarios for Plan-to-Plan Transfers include changing employers, consolidating multiple accounts, adjusting investment strategies, and accessing better plan features. However, individuals should consider potential risks, such as fees, loss of investment options, impact on vesting, and unintended tax consequences. Retirement plans that may be involved in Plan-to-Plan Transfers include 401(k), 403(b), 457(b), TSP, Traditional IRA, Roth IRA, SEP IRA, and SIMPLE IRA. The transfer process involves identifying the need, researching the receiving plan, contacting plan administrators, completing paperwork, tracking the transfer, and confirming completion. Alternatives to Plan-to-Plan Transfers include direct and indirect rollovers, in-service distributions, plan loans, and leaving assets in the original plan. Individuals should consult plan administrators and financial professionals to ensure a smooth transfer and avoid pitfalls.What Is a Plan-to-Plan Transfer?

Types of Retirement Plans Allowing Plan-to-Plan Transfers

Defined Contribution Plans

401(k)

403(b)

457(b)

Thrift Savings Plan (TSP)

Individual Retirement Accounts (IRAs)

Traditional IRA

Roth IRA

SEP IRA

SIMPLE IRA

Rules and Regulations for Plan-to-Plan Transfers

Transfer Eligibility

Transfer Limits

Impact on Taxes

Required Documentation and Forms

Timeline for Completing Transfers

Plan-to-Plan Transfer Process

Identify the Need for a Plan-to-Plan Transfer

Research the Receiving Plan

Contact Plan Administrators

Complete Required Paperwork

Track the Transfer Process

Confirm Completion of the Transfer

Common Causes for Plan-to-Plan Transfers

Changing Employers

Consolidating Multiple Retirement Accounts

Adjusting Investment Strategy

Accessing Better Plan Features

Potential Risks and Considerations of Plan-to-Plan Transfer

Incurring Fees or Penalties

Loss of Investment Options

Impact on Vesting Schedules

Unintended Tax Consequences

Alternatives to Plan-to-Plan Transfers

Rollovers

Direct Rollovers

Indirect Rollovers

In-Service Distributions

Plan Loans

Leaving Assets in the Original Plan

Conclusion

Plan-to-Plan Transfer FAQs

A Plan-to-Plan Transfer is the movement of assets from one retirement savings plan, such as a 401(k), to another retirement savings plan, such as an IRA or another 401(k) plan.

No, you cannot transfer funds from an IRA to a 401(k) plan. Plan-to-Plan Transfers are only allowed between retirement savings plans of the same type, such as between two 401(k) plans or between two IRAs.

No, a Plan-to-Plan Transfer has no tax implications as long as the transfer is done correctly. The funds are moved directly from one plan to the other, so there is no distribution and no tax is owed.

No, there is no limit on how often you can do a Plan-to-Plan Transfer. However, some plans may limit the frequency of transfers, so it is best to check with your plan administrator.

Plan-to-Plan Transfers can offer several benefits, including consolidating retirement savings into one account, gaining access to a wider range of investment options, and potentially reducing fees and expenses associated with multiple retirement accounts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.