Taxation of retirement account withdrawals refers to the process by which the government levies taxes on the money that individuals withdraw from their retirement accounts. When individuals contribute to retirement accounts, they are often able to defer taxes on those contributions and the investment gains they earn over time. However, when the time comes to withdraw funds from these accounts, the government assesses taxes on the withdrawals based on a variety of factors. The specific tax treatment of these withdrawals is determined by several factors, including the type of retirement account, the age of the account holder, and the circumstances under which the withdrawal is made. Taxation on retirement account withdrawals serves as a way to maintain government revenue and incentivize long-term saving.

A Traditional IRA is a tax-deferred retirement account that allows individuals to contribute pre-tax income, which grows tax-deferred until withdrawal. Upon withdrawal, distributions are taxed as ordinary income, based on the individual's current tax bracket. A Roth IRA is a retirement account funded with after-tax income, allowing investments to grow tax-free. Qualified withdrawals from a Roth IRA are tax-free and penalty-free, offering significant tax advantages during retirement. A 401(k) is an employer-sponsored retirement plan that allows employees to contribute a portion of their pre-tax income into a tax-deferred account. Employers may also offer matching contributions, providing additional retirement savings. Withdrawals are taxed as ordinary income. A 403(b) is a retirement plan for employees of certain tax-exempt organizations, such as public schools and nonprofit organizations. Similar to a 401(k), participants contribute pre-tax income to a tax-deferred account, with withdrawals being taxed as ordinary income. A 457(b) is a deferred compensation plan for state and local government employees and some nonprofit organizations. Like 401(k) and 403(b) plans, participants contribute pre-tax income, but 457(b) plans have unique withdrawal rules, offering more flexibility in certain situations. The Thrift Savings Plan is a retirement savings plan for federal employees and members of the uniformed services. Similar to a 401(k), the TSP offers both traditional and Roth options, with contributions being made on a pre-tax or after-tax basis, depending on the chosen option. Annuities are financial products offered by insurance companies that provide a stream of income during retirement. They can be funded with pre-tax or after-tax dollars and offer various payout options, with taxation on withdrawals dependent on the type of annuity and funding method. Withdrawals from traditional IRA and 401(k) accounts are taxed as ordinary income, based on the individual's current tax bracket. This treatment is because contributions were made with pre-tax income, and taxes were deferred during the account's growth phase. Required Minimum Distributions (RMDs) are mandatory withdrawals that must be taken from traditional IRA and 401(k) accounts beginning at age 73. The amount of the RMD is determined by the account balance and the account holder's life expectancy, with penalties for not taking the required amount. A 10% penalty is applied to withdrawals from traditional IRA and 401(k) accounts made before the account holder reaches 59.5 years old. This penalty is in addition to the income tax owed on the withdrawal amount, discouraging early withdrawals and promoting long-term saving. There are specific exceptions to the 10% early withdrawal penalty for traditional IRA and 401(k) accounts. Some exceptions include qualified higher education expenses, first-time home purchases, unreimbursed medical expenses, and disability. Each exception has its own rules and requirements. Qualified withdrawals from a Roth IRA are tax-free and penalty-free, offering significant tax advantages during retirement. This tax treatment is possible because Roth IRA contributions are made with after-tax dollars, allowing for tax-free growth and withdrawals. To be considered a qualified withdrawal from a Roth IRA, the account must meet the five-year rule, and the account holder must be at least 59.5 years old, disabled, or using the withdrawal for a first-time home purchase. If these requirements are met, both contributions and earnings can be withdrawn tax-free and penalty-free. Non-qualified withdrawals from a Roth IRA may be subject to taxes on earnings. While Roth IRA contributions can always be withdrawn tax-free, earnings are subject to income tax if the withdrawal is non-qualified and the five-year rule is not met. A 10% early withdrawal penalty may apply to non-qualified withdrawals of earnings from a Roth IRA before age 59.5. However, certain exceptions, similar to traditional IRA and 401(k) accounts, can eliminate the penalty for early withdrawals. Taxation on withdrawals from 403(b), 457(b), and Thrift Savings Plan (TSP) accounts is similar to traditional IRA and 401(k) accounts. Contributions are made with pre-tax dollars, and withdrawals are taxed as ordinary income. Annuities taxation depends on the type of annuity and funding method, with some similarities to traditional IRA and 401(k) taxation. Each retirement account has unique features that affect taxation. For example, 457(b) plans do not impose a 10% early withdrawal penalty, making them more flexible for early withdrawals. Annuities can have various payout options, affecting the tax treatment of withdrawals. Tax diversification involves allocating retirement savings across different types of accounts, such as traditional IRAs, Roth IRAs, and taxable accounts. This strategy provides flexibility in managing tax liabilities during retirement, allowing for optimal withdrawal strategies. A Roth IRA conversion involves transferring funds from a traditional IRA to a Roth IRA. This strategy incurs taxes on the converted amount but can provide long-term tax benefits, especially if future tax rates are expected to be higher than current rates. The withdrawal sequence strategy involves strategically withdrawing funds from different accounts to minimize taxes. This may include withdrawing from taxable accounts first, followed by tax-deferred accounts, and finally, Roth accounts to optimize tax efficiency. Charitable giving strategies, such as Qualified Charitable Distributions (QCDs) or donating appreciated assets, can help reduce taxes on retirement account withdrawals. These strategies allow individuals to fulfill philanthropic goals while taking advantage of tax benefits. Tax-efficient investment choices involve selecting investments that minimize taxes on gains, dividends, and interest. This strategy can include investing in tax-exempt bonds, index funds, or exchange-traded funds (ETFs) to reduce the overall tax burden on retirement income. Effective tax planning for retirement can significantly impact retirement income by minimizing taxes on withdrawals. A well-structured retirement plan ensures that individuals can maximize their savings and maintain a comfortable lifestyle throughout retirement. Proper tax planning helps individuals prepare for a comfortable retirement by optimizing their financial resources. By minimizing taxes, individuals can preserve more of their retirement savings and achieve their retirement goals. The taxation of retirement account withdrawals is a critical component of retirement planning. Contributions to retirement accounts are often tax-deferred, but the government assesses taxes on withdrawals based on various factors, including the type of account, age, and circumstances of the withdrawal. Traditional IRA and 401(k) withdrawals are taxed as ordinary income, and Roth IRA withdrawals are tax-free and penalty-free if they are qualified withdrawals. To minimize taxes on retirement account withdrawals, strategies such as tax diversification, Roth IRA conversions, withdrawal sequencing, charitable giving, and tax-efficient investment choices can be employed. Effective tax planning for retirement can significantly impact retirement income, ensuring a comfortable retirement and maximizing financial resources. It is essential to understand the taxation of retirement account withdrawals and the various strategies to minimize taxes to achieve retirement goals.What Are Taxation of Retirement Account Withdrawals?

Types of Retirement Accounts

Traditional IRA (Individual Retirement Account)

Roth IRA

401(k)

403(b)

457(b)

Thrift Savings Plan (TSP)

Annuities

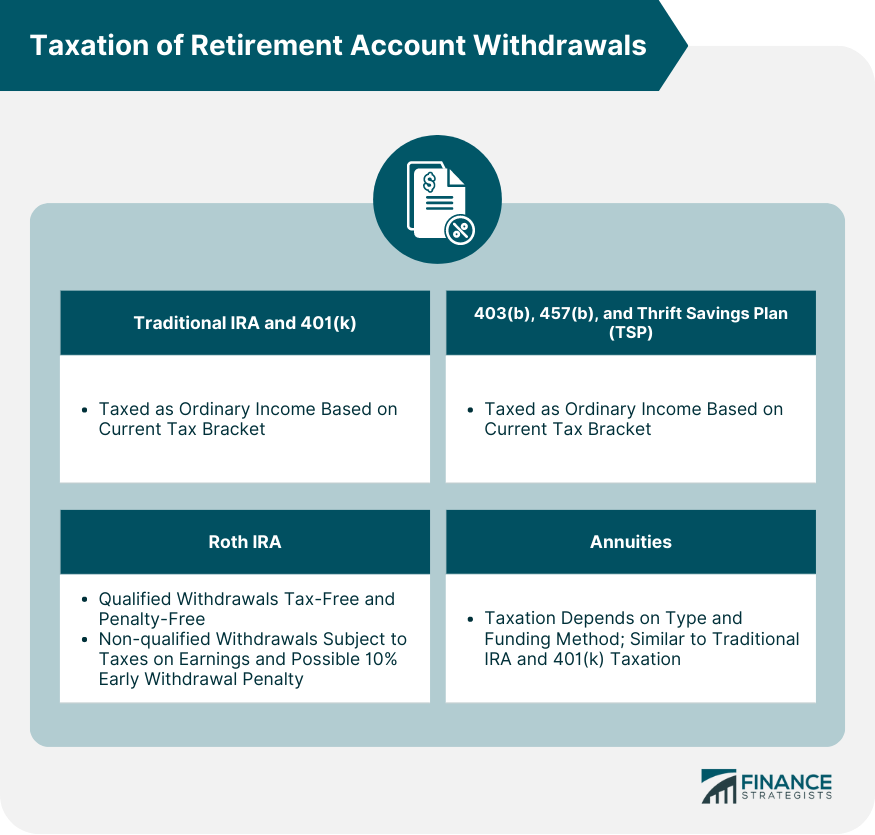

Taxation on Traditional IRA and 401(k) Withdrawals

General Rules

Withdrawals Taxed as Ordinary Income

Required Minimum Distributions (RMDs)

Early Withdrawal Penalties

10% Penalty for Withdrawals Before Age 59.5

Exceptions to Early Withdrawal Penalties

Taxation on Roth IRA Withdrawals

Qualified Withdrawals

Tax-Free and Penalty-Free Withdrawals

Requirements for Qualified Withdrawals

Non-Qualified Withdrawals

Taxation of Earnings

Early Withdrawal Penalties and Exceptions

Taxation on Other Retirement Accounts (403(b), 457(b), TSP, Annuities)

General Rules and Similarities to Traditional IRA and 401(k)

Unique Features and Differences in Taxation

Strategies for Minimizing Taxes on Retirement Account Withdrawals

Tax Diversification

Roth IRA Conversion

Withdrawal Sequence

Charitable Giving Strategies

Tax-Efficient Investment Choices

Importance of Tax Planning for Retirement

Impact on Retirement Income

Ensuring a Comfortable Retirement

Final Thoughts

Taxation of Retirement Account Withdrawals FAQs

The taxation of retirement account withdrawals from a Traditional IRA requires that withdrawals be taxed as ordinary income, based on the individual's current tax bracket. In contrast, qualified withdrawals from a Roth IRA are tax-free and penalty-free since contributions were made with after-tax income.

Early withdrawals from traditional IRA and 401(k) accounts, taken before the account holder reaches 59.5 years old, are subject to a 10% penalty in addition to income tax owed on the withdrawal amount. However, there are specific exceptions to this penalty, such as qualified higher education expenses or first-time home purchases.

Yes, strategies to minimize taxation on retirement account withdrawals include tax diversification, Roth IRA conversion, strategic withdrawal sequencing, charitable giving strategies, and tax-efficient investment choices. Employing these strategies can help optimize tax efficiency and preserve retirement savings.

The taxation of retirement account withdrawals directly impacts your retirement income by affecting the amount of money you have available after taxes. Effective tax planning for retirement can minimize taxes on withdrawals, ensuring that you can maintain a comfortable lifestyle and achieve your retirement goals.

To better understand the taxation of retirement account withdrawals and plan for a financially secure retirement, you should consult financial planners or tax professionals. These experts can provide guidance on tax laws, investment options, and various strategies to minimize taxes and maximize retirement savings.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.