Variable withdrawal strategies in retirement planning refer to the approaches used to determine the amount of money individuals can withdraw from their retirement savings each year during their retirement years. Unlike fixed withdrawal strategies that involve withdrawing a constant amount annually, variable withdrawal strategies adjust the withdrawal amount based on various factors such as market performance, portfolio value, and remaining life expectancy. These strategies aim to strike a balance between providing income for retirees while ensuring their savings last throughout their retirement. Retirement planning is a crucial aspect of financial preparation, and determining the appropriate withdrawal strategy is vital for individuals to sustain their lifestyle and meet their financial needs during retirement. Variable withdrawal strategies offer flexibility and adaptability to changing circumstances, allowing retirees to make adjustments based on the performance of their investments and their changing financial requirements. The performance of financial markets directly impacts the value of retirees' portfolios. Variable withdrawal strategies allow retirees to adjust their withdrawal amounts based on market conditions, helping to preserve their savings during market downturns and take advantage of upswings. Inflation erodes the purchasing power of money, necessitating adjustments to withdrawal amounts to maintain retirees' desired lifestyle. Variable withdrawal strategies take inflation into account, ensuring that retirees can maintain their purchasing power throughout retirement. Longevity risk, or the risk of outliving one's savings, is a critical concern for retirees. Variable withdrawal strategies help mitigate this risk by adjusting withdrawal amounts based on life expectancy, providing financial security for a longer period. Retirees' spending needs and goals may change over time, and variable withdrawal strategies offer the flexibility to adapt to these changes. By adjusting withdrawal amounts based on evolving priorities, retirees can better align their financial resources with their desired lifestyle. Taxes can significantly impact retirees' financial well-being. Variable withdrawal strategies can help minimize tax burdens by adjusting withdrawals based on prevailing tax laws and individual circumstances. This strategy involves withdrawing a fixed percentage of the portfolio's value each year. It ensures that retirees never fully deplete their savings but may result in fluctuating withdrawal amounts based on market performance. This approach begins with a conservative asset allocation and gradually increases the allocation to equities over time. It aims to strike a balance between portfolio growth and stability while providing income during retirement. This strategy is based on the Internal Revenue Service (IRS) guidelines for required minimum distributions from retirement accounts. It calculates annual withdrawals based on life expectancy and account balances, ensuring that retirees meet the minimum withdrawal requirements and avoid penalties. This approach divides a retiree's portfolio into several "buckets," each allocated to a specific time horizon and risk level. Retirees withdraw from the most conservative bucket first, allowing the higher-risk buckets to continue growing. The guardrail strategy involves setting upper and lower limits for portfolio withdrawals and adjusting the withdrawal amount based on market performance and pre-determined thresholds. This method aims to balance the need for income with preserving the portfolio's value. This strategy combines elements of fixed and variable withdrawal strategies. Retirees determine a target percentage for annual withdrawals, then adjust the amount based on market performance and other factors. Variable withdrawal strategies offer the ability to adjust withdrawal amounts based on market conditions, helping to preserve retirees' savings during downturns and capitalize on upswings. By adjusting withdrawals to reflect market performance and other factors, variable withdrawal strategies may help prolong the life of a retiree's portfolio, reducing the risk of outliving their savings. Variable withdrawal strategies can adapt to changing spending needs and goals, ensuring that retirees can maintain their desired lifestyle throughout retirement. By adjusting withdrawal amounts based on market performance, variable withdrawal strategies can help mitigate the sequence of returns risk, which occurs when a retiree experiences poor investment returns early in retirement. This risk can have a lasting impact on the longevity of their portfolio. Variable withdrawal strategies often require more active management and monitoring compared to fixed withdrawal strategies, making them potentially more complex and time-consuming for retirees. Since variable withdrawal strategies adjust based on market performance and other factors, the withdrawal amounts may fluctuate from year to year, making budgeting more challenging for retirees. Retirees using variable withdrawal strategies must closely monitor their investments and market conditions to make informed decisions about withdrawal adjustments, which can be a burden for those without financial expertise. The uncertainty in withdrawal amounts inherent in variable withdrawal strategies can make budgeting more difficult, as retirees may not know precisely how much income they can expect from their portfolio in any given year. Retirees with a higher risk tolerance may be better suited for variable withdrawal strategies, as these approaches often involve more exposure to market fluctuations and uncertainty. Those with a longer investment horizon may benefit more from variable withdrawal strategies, as these approaches can provide greater potential for portfolio growth and longevity. Retirees with multiple, stable income sources may be better positioned to handle the fluctuations associated with variable withdrawal strategies, as they can rely on other income streams to cover expenses during periods of lower withdrawals. Retirees with flexible spending goals and priorities may find variable withdrawal strategies more suitable, as these approaches allow for adjustments in withdrawal amounts based on changing needs and goals. Retirees considering variable withdrawal strategies should consult with financial professionals to help determine the best approach for their individual circumstances and provide ongoing support in managing their portfolios. Variable withdrawal strategies can play a significant role in a comprehensive retirement plan. They offer flexibility, the potential for increased portfolio longevity, and better alignment with spending needs and goals. However, they also come with challenges, including complexity, uncertainty in withdrawal amounts, and increased responsibility for ongoing monitoring. As such, retirees should carefully assess their risk tolerance, investment horizon, income sources, spending goals, and priorities to determine if a variable withdrawal strategy is suitable for them. Consulting with a financial professional can help ensure that retirees make informed decisions and effectively manage their variable withdrawal strategy throughout retirement.Definition of Variable Withdrawal Strategies

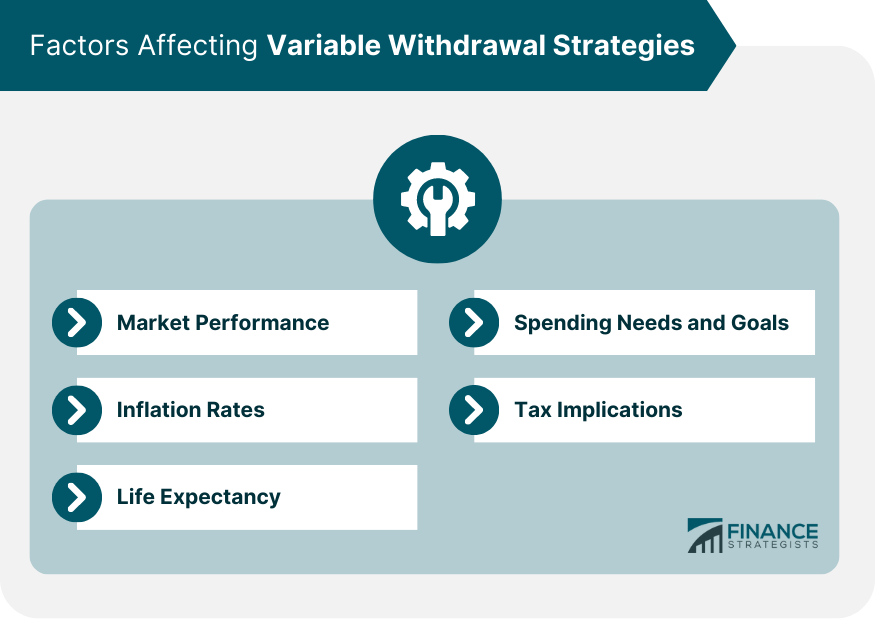

Factors Affecting Variable Withdrawal Strategies

Market Performance

Inflation Rates

Life Expectancy

Spending Needs and Goals

Tax Implications

Types of Variable Withdrawal Strategies

Percentage-Based Strategies

Constant Percentage Withdrawal

Inverse Glide Path Strategy

Time-Based Strategies

Required Minimum Distribution (RMD) Method

Bucket Strategy

Hybrid Strategies

Guardrail Strategy

Target Percentage Adjustment

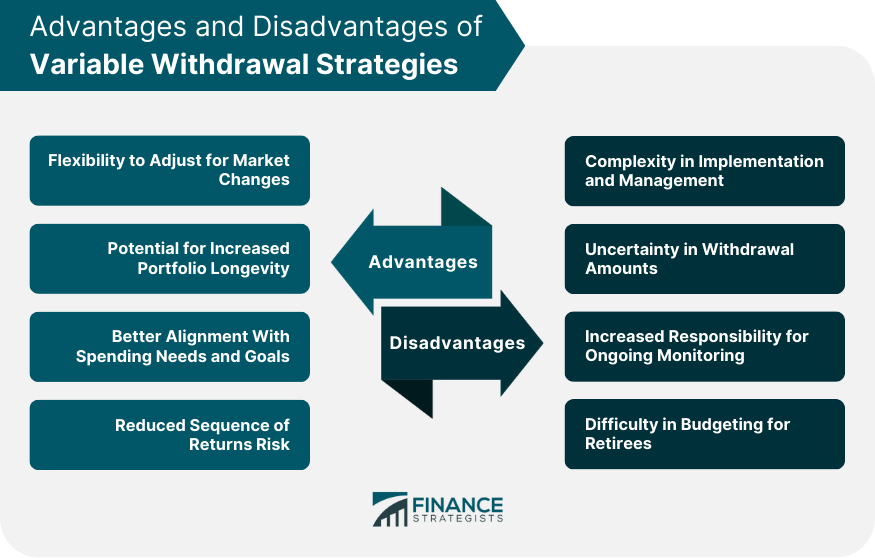

Advantages of Variable Withdrawal Strategies

Flexibility to Adjust for Market Changes

Potential for Increased Portfolio Longevity

Better Alignment With Spending Needs and Goals

Reduced Sequence of Returns Risk

Disadvantages of Variable Withdrawal Strategies

Complexity in Implementation and Management

Uncertainty in Withdrawal Amounts

Increased Responsibility for Ongoing Monitoring

Difficulty in Budgeting for Retirees

Assessing the Suitability of Variable Withdrawal Strategies

Risk Tolerance

Investment Horizon

Income Sources and Stability

Spending Goals and Priorities

Expert Advice and Support

Final Thoughts

Variable Withdrawal Strategies FAQs

Variable withdrawal strategies are approaches that allow retirees to adjust their withdrawal amounts from their savings and investments based on factors like market performance, inflation, and spending needs. They differ from fixed withdrawal strategies, which involve withdrawing a predetermined amount annually, by offering more flexibility and the potential to better align with retirees' changing needs and goals.

Common types of variable withdrawal strategies include percentage-based strategies, such as constant percentage withdrawal and inverse glide path strategy; time-based strategies, like required minimum distribution (RMD) method and bucket strategy; and hybrid strategies, such as guardrail strategy and target percentage adjustment.

The main advantages of variable withdrawal strategies include flexibility to adjust for market changes, the potential for increased portfolio longevity, better alignment with spending needs and goals, and reduced sequence of returns risk.

Yes, variable withdrawal strategies come with several drawbacks, including complexity in implementation and management, uncertainty in withdrawal amounts, increased responsibility for ongoing monitoring, and difficulty in budgeting for retirees.

To determine if a variable withdrawal strategy is suitable for your retirement planning needs, consider factors such as your risk tolerance, investment horizon, income sources, and stability, spending goals and priorities, and the availability of expert advice and support. Consulting with a financial professional can help you make informed decisions and select the most appropriate withdrawal strategy for your individual circumstances.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.