A donation receipt is a document issued by a 501(c)(3) organization to a donor who has made a charitable contribution. The receipt serves as proof of the donation and provides the donor with the information necessary for claiming a tax deduction. A donation receipt should include the name of the organization, the date of the donation, the amount of the donation, and a statement that no goods or services were received in exchange for the donation. 501(c)(3) organizations are required to issue donation receipts for any contribution of $250 or more. For contributions under $250, a donation receipt is not required but is still recommended. The receipt should include the same information as a receipt for a larger contribution. In addition to providing information about the donation, the receipt should also include the organization's name, address, and tax identification number (TIN). The TIN is assigned by the IRS and is used to identify the organization for tax purposes. The receipt should also indicate whether the organization is a public charity or a private foundation. While donation receipts and tax receipts are often used interchangeably, there are some differences between the two. A donation receipt is a document issued by a 501(c)(3) organization to a donor to acknowledge their charitable contribution. A tax receipt, on the other hand, is a document issued by the IRS to the taxpayer as proof of their tax payment or refund. Donation receipts are issued by the organization receiving the donation, while tax receipts are issued by the IRS. Donation receipts are not required to be filed with tax returns, but they are required to be retained by the donor in case of an IRS audit. Tax receipts, on the other hand, are filed with tax returns as proof of tax payment or refund. 501(c)(3) donation receipts are important for nonprofit organizations as they confirm the tax-deductible status of a donation, provide documentation for donors to use on their tax returns, and help the organization maintain accurate records of donations received. Failing to issue proper receipts can result in penalties and loss of tax-exempt status. Donors who contribute $250 or more to a 501(c)(3) organization are required to obtain a donation receipt in order to claim a tax deduction. The receipt serves as proof of the donation and provides the information necessary for the donor to claim a tax deduction. Failure to obtain a donation receipt for contributions of $250 or more can result in the disallowance of the tax deduction. Donation receipts are important for tax purposes because they provide the documentation necessary for donors to claim a tax deduction. Without a donation receipt, donors may be unable to claim a tax deduction for their charitable contributions. Additionally, if a donor is audited by the IRS, they may be required to provide documentation, including donation receipts, to support their tax deductions. Donation receipts also serve an important role in ensuring transparency and accountability for 501(c)(3) organizations. By issuing a donation receipt, the organization is providing evidence of the charitable contribution and the use of the funds. This helps to establish trust and credibility with donors and the general public. It also helps to prevent fraud and abuse by ensuring that donations are being used for their intended charitable purposes. A donation receipt is a document given to a donor as a record of their donation. The IRS requires that 501(c)(3) organizations provide donors this receipt. Donations to 501(c)(3)s may be tax deductible, and so having a receipt as proof of donation for the IRS is required. Generally, you may deduct up to 50% of your gross adjusted income. In order to deduct donations to a 501(c)(3) or other qualified institution, the donations must be itemized. A 501(c)(3) should send you a donation receipt, but if they have not, ask for one before trying to deduct the donation. Issuing a 501(c)(3) donation receipt is an important process for nonprofit organizations to show appreciation to donors and ensure compliance with IRS regulations. This involves confirming eligibility, collecting necessary information, creating and delivering the receipt, retaining a copy, and following up with the donor. It is important to avoid common mistakes such as providing incomplete or inaccurate receipts or issuing receipts for non-deductible items. When issuing a donation receipt, it is important to include all of the required information. The receipt should include the name and address of the organization, the date of the donation, the amount of the donation, and a statement that no goods or services were received in exchange for the donation. The receipt should also include the organization's tax identification number (TIN) and indicate whether the organization is a public charity or a private foundation. It is also recommended to include a brief description of the organization's mission and how the donation will be used. This helps to establish the organization's credibility and promotes transparency and accountability. Donation receipts should be issued promptly after the donation is received. For contributions of $250 or more, the receipt must be provided to the donor no later than January 31st of the year following the donation. For contributions under $250, the receipt should still be provided promptly, but there is no specific deadline. Donation receipts can be provided in a variety of formats, including paper, email, or digital. The important thing is to ensure that the donor receives a copy of the receipt and that it includes all of the required information. In addition to including all of the required information and issuing the receipt promptly, there are some best practices to follow when issuing donation receipts. These include: Personalizing the Receipt: Address the receipt to the donor by name to make it more personal and show appreciation for their contribution. Acknowledging the Donor's Generosity: Use language that acknowledges the donor's contribution and expresses gratitude for their support. Providing Contact Information: Include contact information for the organization in case the donor has any questions or concerns. Following Up With Donors: Consider following up with donors to provide updates on the organization's activities and how their donation is being used. When issuing a 501(c)(3) donation receipt, there are common mistakes that nonprofits should avoid. These include failing to confirm eligibility, providing incomplete or inaccurate receipts, providing receipts for non-deductible items or services, and failing to include required statements. Avoiding these mistakes ensures compliance with IRS regulations and helps build strong relationships with donors. One of the most common mistakes when issuing donation receipts is failing to provide all of the required information. This can result in the disallowance of the donor's tax deduction and can damage the organization's credibility. To avoid this mistake, ensure that all of the required information is included on the receipt and that it is accurate and up-to-date. Another common mistake is issuing incorrect information on the donation receipt. This can include errors in the donor's name or address, the amount of the donation, or the organization's tax identification number. To avoid this mistake, double-check all of the information on the receipt before issuing it to the donor. Timing issues can also arise when issuing donation receipts. If the receipt is not issued promptly, the donor may be unable to claim their tax deduction or may be audited by the IRS. To avoid this mistake, ensure that donation receipts are issued promptly after the donation is received and that they include all of the required information. Donation receipts play a crucial role in the operations of 501(c)(3) organizations. They serve as proof of the donation, provide information necessary for claiming a tax deduction, and promote transparency and accountability. To ensure that donation receipts are issued correctly, organizations should follow the requirements for issuing them, include all of the required information, issue them promptly, and avoid common mistakes. By doing so, organizations can establish trust and credibility with donors and ensure that their charitable contributions are being used for their intended purposes. Overall, donation receipts are a valuable tool for both donors and organizations, and it is important to understand their importance and how to issue them properly.What Is a 501(c)(3) Donation Receipt?

Requirements for a 501(c)(3) Donation Receipt

Differences Between a Donation Receipt and a Tax Receipt

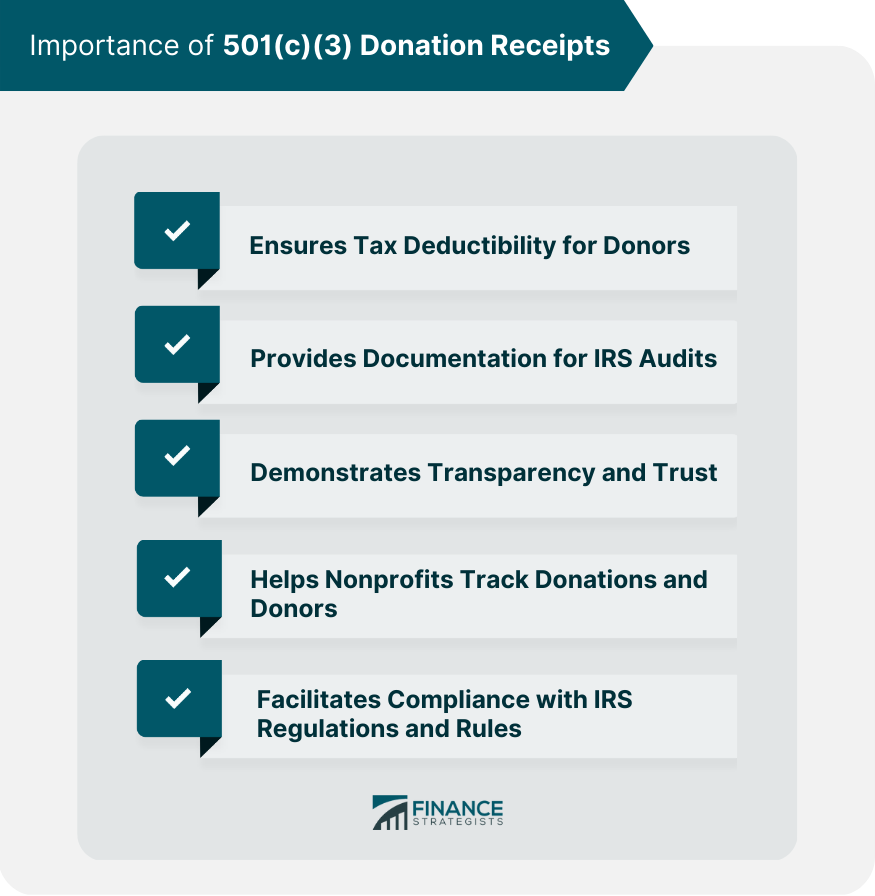

Why Are 501(c)(3) Donation Receipts Important?

Legal Requirements for Donors

Importance of Donation Receipts for Tax Purposes

Ensuring Transparency and Accountability

Is a Donation to a 501(c)(3) Tax Deductible?

How Much of a Donation to a 501(c)(3) Is Tax Deductible?

How to Issue a 501(c)(3) Donation Receipt

Information to Include on a Donation Receipt

Timing and Delivery of Donation Receipts

Best Practices for Issuing Donation Receipts

Common Mistakes to Avoid When Issuing 501(c)(3) Donation Receipts

Failing to Provide All Required Information

Issuing Incorrect Information

Timing Issues

Conclusion

501(c)(3) Donation Receipt FAQs

A 501(c)(3) donation receipt is a written acknowledgment provided by a nonprofit organization to a donor for a tax-deductible donation. It includes specific information required by the IRS to confirm the tax-exempt status of the organization and the deductible amount of the donation.

Nonprofit organizations with 501(c)(3) tax-exempt status must issue donation receipts to donors who make tax-deductible donations of $250 or more. However, it is recommended to issue receipts for all donations, regardless of the amount.

A 501(c)(3) donation receipt should include the organization's name, address, and EIN, the donor's name and contact information, the date and amount of the donation, and a statement indicating that no goods or services were provided in exchange for the donation.

Failing to issue proper 501(c)(3) donation receipts can result in penalties from the IRS, loss of tax-exempt status, and damage to the organization's reputation. Donors may also be unable to claim tax deductions for their donations without a proper receipt.

Yes, the IRS permits 501(c)(3) donation receipts to be issued electronically, as long as the receipt contains all required information and is readily accessible to the donor. However, the organization must obtain the donor's consent to receive electronic receipts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.