501(c)(3) organizations are entities that have been granted tax-exempt status by the Internal Revenue Service (IRS) due to their charitable, religious, educational, scientific, or literary focus. By their nature, they are designed to serve the public interest and are required to reinvest any profits back into the organization to further their mission, rather than distributing earnings to owners or shareholders. Operating in the public trust, these organizations are under significant scrutiny to uphold their commitments and obligations. This involves fulfilling certain transparency requirements, such as making their tax returns publicly available. The IRS is given the power to oversee these entities, including granting, maintaining, or revoking their tax-exempt status as necessary. A 501(c)(3) lookup serves as an essential tool to verify the legitimacy and status of an organization claiming to be a 501(c)(3) entity. This can be incredibly valuable for individuals looking to donate money or time, as it allows them to confirm that the organization is recognized as a tax-exempt entity by the IRS, thus ensuring their donations are tax-deductible. Additionally, conducting a 501(c)(3) lookup helps in understanding the mission, activities, and financial health of an organization. For stakeholders such as donors, volunteers, or grantmaking bodies, this information provides vital context for decision-making and engagement with the nonprofit entity. In today's digital world, a variety of online databases and resources provide a wealth of information about 501(c)(3) organizations. Platforms such as Guidestar, the Foundation Center, and Charity Navigator offer comprehensive listings of nonprofit entities, along with detailed information on their financials, governance, and impact. These databases are user-friendly and can offer a wealth of information with just a few keystrokes. However, users should be mindful that while these platforms are generally reliable, the quality and timeliness of data can vary. It is advisable to cross-reference the obtained information with other sources to ensure accuracy. The easiest way to look up a 501(c)(3) organization is by using the IRS's search tool: It's typically easier to search for an organization by name. Toggle the "Search By" field from "Employer Identification Number (EIN)" to "Organization Name" as shown in the screenshot below: After searching the organization's name, you will be able to view their recent filings with the IRS, such as their Form 990N. The IRS regularly publishes data related to ongoing 501(c)(3) organizations in an easy to search format on their website. Much of the information about any particular 501(c)(3) is public, and the IRS publishes a list of active organizations, form 990 returns, and more. This tool allows users to search for and verify the tax-exempt status of an organization, and can also provide access to certain key tax documents, such as the Form 990 series. The IRS website offers the most official and updated status of a 501(c)(3) organization's tax-exempt status. It's important to remember, however, that while the IRS website is authoritative, it may not provide a complete picture of an organization's operations or impact. For those who require additional assistance or cannot find the information they need through other channels, contacting the IRS directly can be an option. The IRS provides assistance through its hotline for questions related to exempt organizations. Although this method can be more time-consuming, it can provide authoritative and specific answers to inquiries about an organization's 501(c)(3) status. Be prepared to provide the name, address, and possibly the Employer Identification Number (EIN) of the organization you are inquiring about when calling the IRS. When conducting a 501(c)(3) lookup, it's crucial to ensure the accuracy and relevance of the obtained information. Databases and resources should be reliable and up-to-date. The IRS' Exempt Organizations Select Check (EOSC) tool is a solid starting point, but complementing this data with information from other databases can provide a more rounded picture. Furthermore, it's important to ensure the information is relevant to the questions or concerns at hand. For instance, if an individual is primarily concerned about an organization's financial health, they should focus on obtaining and analyzing relevant financial documents and data. As mentioned earlier, cross-referencing multiple sources of data can enhance the reliability of a 501(c)(3) lookup. No single source can provide all the necessary information about an organization. Diversifying sources - from official databases like the EOSC to third-party platforms such as Guidestar and Charity Navigator - ensures a broader, more nuanced understanding of the organization. This method can be particularly beneficial when there are inconsistencies between different sources. Cross-referencing allows you to identify and resolve these discrepancies, ensuring you have the most accurate picture of the organization. Beyond just validating the tax-exempt status, a thorough 501(c)(3) lookup should involve analyzing the organization's mission and activities. This information is often available on the organization's website, in their annual reports, or in the narrative portions of their Form 990. Understanding the mission and activities of a 501(c)(3) organization provides insight into its impact and alignment with a potential donor or volunteer's personal values or interests. This step helps to create a deeper connection and fosters trust between the stakeholder and the organization. Financial information and public disclosures form another critical aspect of a 501(c)(3) lookup. Reviewing these documents can reveal important insights about the organization's financial health, efficiency, and governance practices. Key documents to review include the Form 990, which contains information about an organization's revenue, expenses, assets, liabilities, and executive compensation. Annual reports and audited financial statements, where available, can also provide valuable information. When reviewing these documents, potential red flags might include excessive spending on administrative costs or significantly high executive salaries. In some instances, particularly for large donations or ongoing relationships, it might be beneficial to seek legal or professional advice during a 501(c)(3) lookup. Tax professionals or lawyers with experience in nonprofit law can provide additional insight into an organization's status, financial health, and compliance with regulations. While this step may not be necessary for every individual, it can provide peace of mind and ensure that the individual is making a fully informed decision based on accurate and comprehensive information. Not all nonprofit organizations are tax-exempt, and not all donations to tax-exempt organizations are tax-deductible. The IRS specifically grants 501(c)(3) status to organizations that meet certain requirements, and donations to these organizations are typically tax-deductible. Verifying an organization's 501(c)(3) status before making a donation allows the donor to ensure they can legally claim the donation on their tax return. This is an important consideration for many donors and can influence the decision to donate to one organization over another. Unfortunately, scams disguised as charitable organizations do exist, and conducting due diligence can help potential donors avoid falling victim to such frauds. A legitimate 501(c)(3) organization will be transparent about its mission, activities, and finances. Verifying this information helps to ensure that the organization is credible and reputable, and that it is genuinely committed to its stated mission. A thorough 501(c)(3) lookup also supports informed decision-making for donors and volunteers. By providing insight into an organization's mission, activities, and financial health, a lookup can help stakeholders decide if the organization aligns with their values and goals. This information is especially important for volunteers who want to invest their time and skills effectively. Similarly, donors can ensure that their funds will be used responsibly and will contribute to a cause they care about. Lastly, 501(c)(3) lookups play a crucial role in promoting transparency and accountability within the nonprofit sector. By making this information publicly available and easy to access, organizations are held accountable for their operations and financial management. This transparency helps to build trust with stakeholders and the general public. It can also deter potential misuse of funds or other unethical behaviors within organizations, thereby helping to maintain the overall integrity of the sector. This can occur if an organization has not recently updated its information, or if there are delays in updating the database after changes have been made. It's always important to verify the date of the information and cross-reference with multiple sources when possible. It's also advisable to reach out to the organization directly if there are any doubts or discrepancies in the data. For instance, religious organizations are not always required to file the same reports with the IRS as other 501(c)(3) organizations, which can make it more challenging to find information on them. Additionally, smaller organizations that fall below certain income thresholds may be exempt from filing detailed Form 990s, which could limit the availability of their financial information. In these cases, potential donors or volunteers may need to reach out to the organization directly for more information. Lastly, the complexity of legal terminology and documentation can be a challenge when performing a 501(c)(3) lookup. The IRS forms and other official documents often involve technical language that may be difficult for laypersons to understand. In such cases, consulting with a legal or tax professional can be beneficial. It may also be helpful to refer to guides or other resources that break down these documents and terms in a more accessible way. Performing a 501(c)(3) lookup is essential for verifying the legitimacy and tax-exempt status of nonprofit organizations. The lookup process involves utilizing online databases and resources like the IRS Exempt Organizations Select Check, GuideStar, and the Foundation Center. Additionally, the IRS website and direct contact with the IRS can provide authoritative information. When conducting a lookup, it is crucial to validate accuracy, cross-reference multiple sources, analyze an organization's mission and activities, review financial information, and seek professional advice if needed. Benefits of performing a lookup include ensuring tax-deductibility of donations, verifying an organization's credibility, supporting informed decision-making for donors and volunteers, and promoting transparency and accountability in the nonprofit sector. Despite challenges such as outdated information, limited coverage, and complex legal terminology, conducting a thorough 501(c)(3) lookup empowers individuals to engage with reputable and impactful organizations.Overview of a 501(c)(3) Organization

Purpose of a 501(c)(3) Lookup

How to Look Up a 501(c)(3) Organization

Online Databases and Resources

Using the IRS Website

Contacting the IRS Directly

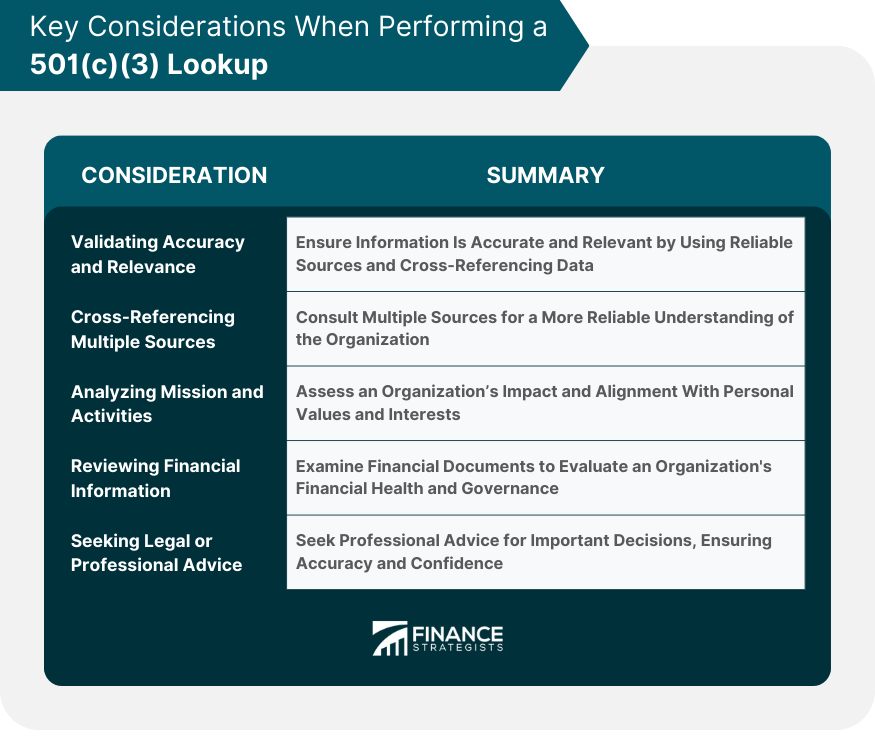

Key Considerations When Performing a 501(c)(3) Lookup

Validating the Accuracy and Relevance of the Information

Cross-Referencing Multiple Sources

Analyzing the Organization's Mission and Activities

Reviewing Financial Information and Public Disclosures

Seeking Legal or Professional Advice if Necessary

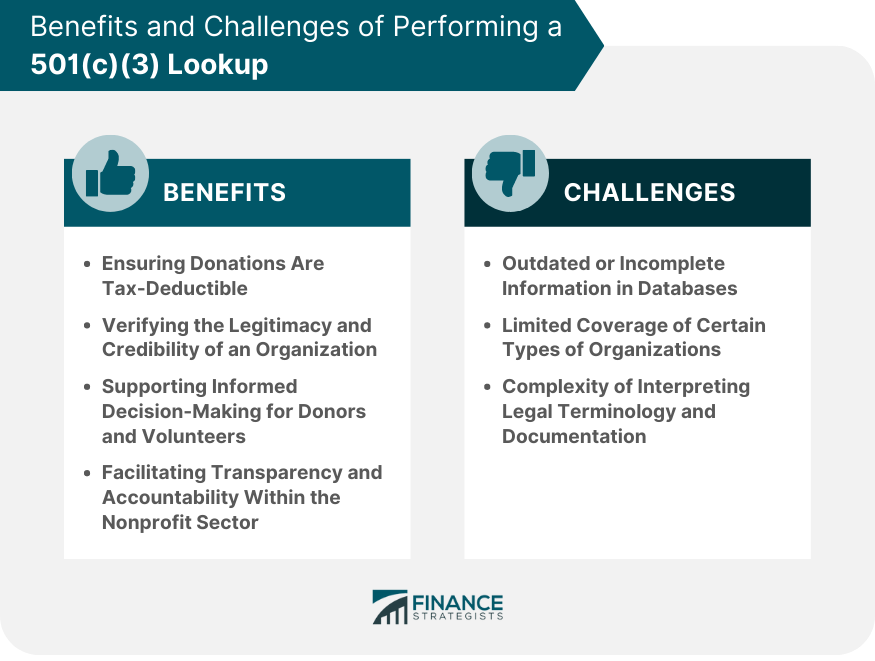

Benefits of Performing a 501(c)(3) Lookup

Ensuring Donations are Tax-Deductible

Verifying the Legitimacy and Credibility of an Organization

Supporting Informed Decision-Making for Donors and Volunteers

Facilitating Transparency and Accountability within the Nonprofit Sector

Challenges of Performing a 501(c)(3) Lookup

Outdated or Incomplete Information in Databases

Limited Coverage of Certain Types of Organizations

Complexity of Interpreting Legal Terminology and Documentation

Conclusion

How to Perform a 501(c)(3) Lookup FAQs

A 501(c)(3) organization is a non-profit organization with tax exempt status that is dedicated to the general well-being of society.

The IRS regularly publishes data related to ongoing 501(c)(3) organizations in an easy to search format on their website.

A 501(c)(3) organization is tax exempt so long as it remains true to its stated mission and remains compliant with the IRS.

501(c)(3) is the internal revenue code (IRC) section for organizations with tax exempt status. 501(c)(3) falls under internal revenue code 501(c).

The easiest way to look up a 501(c)(3) is by using the IRS's search tool: https://apps.irs.gov/app/eos/

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.