Yes, 501(c)(3) financial records are public information. A 501(c)(3) organization is required to provide information on salaries and other financial statements to the IRS through form 990, which is required to be published by the IRS regularly. 501(c)(3) financial records are subject to public disclosure requirements. This means that any member of the public can request and receive copies of an organization's financial records. However, some exceptions to public disclosure exist. For example, organizations may redact certain sensitive information, such as donor names and addresses, to protect their privacy. The process for requesting financial records varies by state. In most cases, individuals must submit a formal request in writing to the organization. The request must specify the records being sought and provide the name and address of the requester. Organizations have a set time period, usually, 30 days, to respond to the request. If the organization denies the request, the requester may appeal the decision and seek a court order to compel disclosure. There are several reasons why stakeholders may want to access 501(c)(3) financial records. Transparency is critical to building trust between nonprofits and their stakeholders. By making their financial records publicly available, nonprofits can demonstrate their commitment to transparency and accountability. Stakeholders can review financial records to understand how organizations are spending their resources and to evaluate their effectiveness in achieving their mission. Nonprofits have a responsibility to use their resources in the best interest of their beneficiaries. Financial records can provide stakeholders with insight into an organization's financial management practices, including how it is using donations and other resources. By holding nonprofits accountable for their financial decisions, stakeholders can help ensure that resources are being used effectively to achieve the organization's mission. Nonprofits exist to address social, environmental, and humanitarian challenges. Financial records can help stakeholders evaluate an organization's effectiveness in achieving its mission. By reviewing an organization's financial records, stakeholders can determine if the organization is making progress toward its goals and if it is using its resources effectively. Several high-profile cases illustrate the importance of financial record-keeping and transparency for 501(c)(3) organizations. One example is the case of the National Heritage Foundation (NHF), a nonprofit organization that claims to support charities and conservation efforts. In 2017, the Washington Post conducted an investigation into NHF's financial practices and found that the organization was operating as a pass-through for questionable charities. NHF was collecting millions of dollars in donations and then funneling the money to other organizations that were not qualified to receive tax-exempt status. NHF was also paying large salaries to its top executives while giving little to nothing to the charities it claimed to support. The investigation led to NHF's revocation of tax-exempt status and a $1.7 million penalty. The cases of NHF illustrate the importance of financial record-keeping and transparency for 501(c)(3) organizations. Nonprofits have a responsibility to use their resources in the best interest of their beneficiaries. By maintaining accurate financial records and making them publicly available, nonprofits can demonstrate their commitment to transparency and accountability. Stakeholders can review financial records to evaluate an organization's effectiveness in achieving its mission and to hold the organization accountable for its financial decisions. 501(c)(3) organizations play an essential role in addressing social, environmental, and humanitarian challenges. However, with great power comes great responsibility. 501(c)(3) organizations must comply with strict financial record-keeping requirements, and their financial records are subject to public scrutiny. While the public disclosure of financial records may seem daunting, it is essential for building trust between nonprofits and their stakeholders. By maintaining accurate financial records and making them publicly available, nonprofits can demonstrate their commitment to transparency and accountability. Stakeholders can use financial records to evaluate an organization's effectiveness in achieving its mission and to hold the organization accountable for its financial decisions. Ultimately, financial record-keeping and transparency are critical to the success of 501(c)(3) organizations and their ability to address social, environmental, and humanitarian challenges.Are 501(c)(3) Financial Records Public?

Who Can Access 501(c)(3) Financial Records?

Process for Requesting 501(c)(3) Financial Records

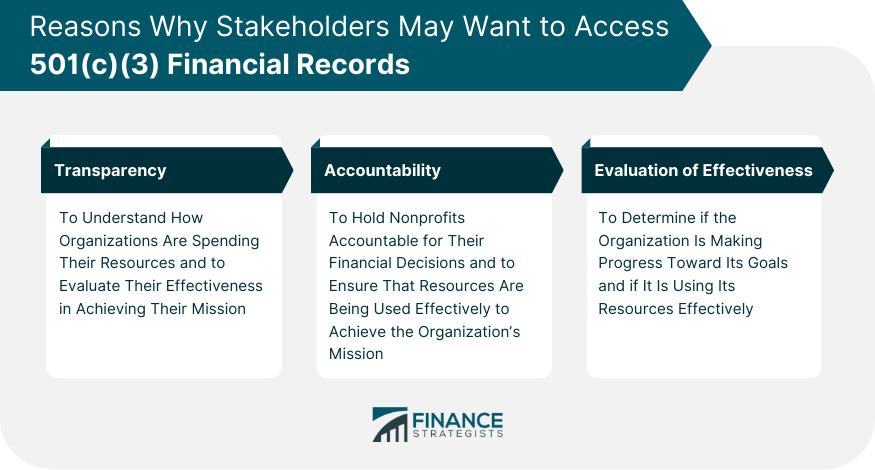

Why Do Stakeholders Want to Access 501(c)(3) Financial Records?

Transparency

Accountability

Evaluation of Effectiveness

Case Studies

Implications for Transparency and Accountability

Conclusion

Are 501(c)(3) Financial Records Public? FAQs

Any member of the public can request and receive copies of an organization's financial records, as they are subject to public disclosure requirements.

Yes, organizations may redact certain sensitive information, such as donor names and addresses, to protect their privacy.

501(c)(3) organizations must maintain financial records for at least three years from the date the organization filed its tax return.

If a 501(c)(3) organization fails to maintain accurate financial records, the IRS may revoke its tax-exempt status and assess penalties. Penalties can range from fines to revocation of tax-exempt status, and in severe cases, individuals responsible for financial mismanagement may face personal liability.

Stakeholders want access to 501(c)(3) financial records for several reasons, including transparency, accountability, and evaluation of effectiveness. Financial records can provide insight into an organization's financial management practices, including how it is using donations and other resources. By holding nonprofits accountable for their financial decisions, stakeholders can help ensure that resources are being used effectively to achieve the organization's mission.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.