What Is 501(c)(3) Status?

501(c)(3) status is a federal tax designation that is granted to charitable organizations in the United States. This status exempts qualifying organizations from paying federal income tax and provides donors with the ability to make tax-deductible contributions.

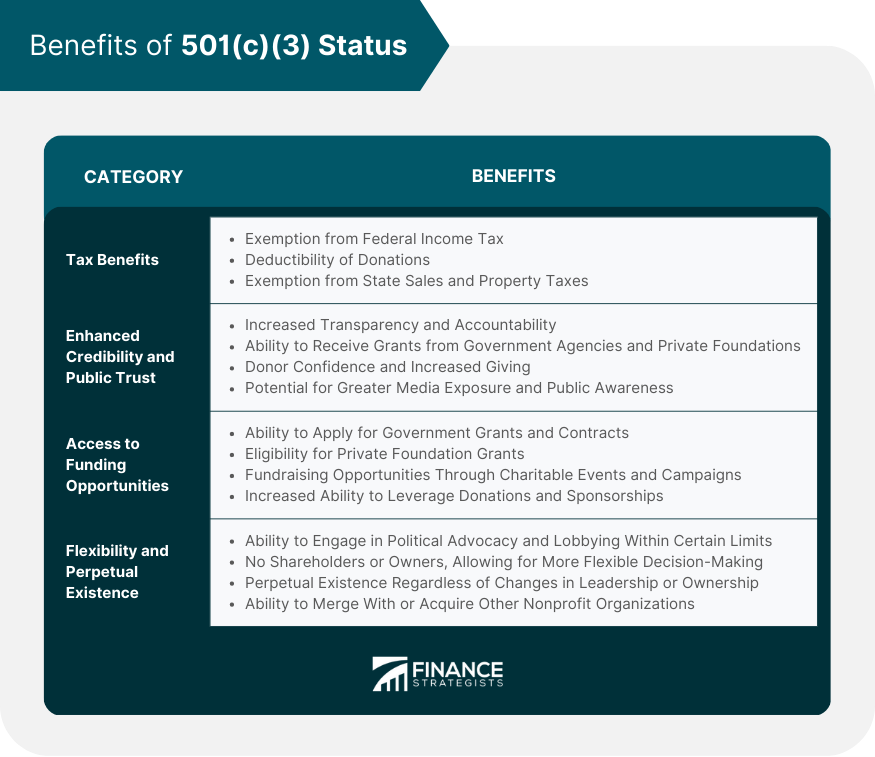

501(c)(3) status is a critical component of any nonprofit organization, as it not only provides a significant financial benefit but also provides enhanced credibility, access to funding opportunities, and more flexibility in decision-making.

The primary benefit to having 501(c)3 status for your organization is exemption from federal income tax, as well as potentially some state taxes.

Any donations made to your organization may also be written off to reduce the donor's taxable income, which may draw in more or larger donations.

Tax Benefits of 501(c)(3) Status

One of the most significant benefits of 501(c)(3) status is the tax benefits that come with it. These benefits can result in significant savings for nonprofit organizations and donors alike.

Exemption From Federal Income Tax

501(c)(3) organizations are exempt from federal income tax. This means that the organization does not need to pay taxes on any income that it generates through its activities. This exemption applies to all types of income, including donations, grants, and program revenue.

The exemption from federal income tax can result in significant savings for nonprofit organizations. Without this exemption, many organizations would struggle to remain financially sustainable.

The savings that organizations experience through this exemption can be used to further the mission of the organization, including funding programs and services.

Deductibility of Donations

Another key tax benefit of 501(c)(3) status is the deductibility of donations. When a donor contributes to a 501(c)(3) organization, they can deduct that contribution from their taxable income.

This deduction is only available to donors who contribute to qualified organizations, such as those with 501(c)(3) status.

The deductibility of donations can be a significant incentive for donors to give to charitable organizations. It not only provides a financial benefit to the donor but also allows them to support causes that they care about.

Exemption From State Sales and Property Taxes

In addition to the exemption from federal income tax, 501(c)(3) organizations are also exempt from many state sales and property taxes. This exemption varies by state, and organizations must follow state-specific requirements to qualify for the 501(c)(3) tax exemption.

Enhanced Credibility and Public Trust for 501(c)(3) Organizations

In addition to the tax benefits, 501(c)(3) status also provides enhanced credibility and public trust for nonprofit organizations.

Increased Transparency and Accountability

501(c)(3) organizations must adhere to strict reporting and governance requirements.

This includes filing an annual information return with the IRS, which provides transparency into the organization's activities, governance, and financials. Additionally, many states require annual reporting from nonprofit organizations.

By following these requirements, 501(c)(3) organizations demonstrate their commitment to transparency and accountability. This, in turn, can increase the public's trust in the organization.

Ability to Receive Grants From Government Agencies and Private Foundations

501(c)(3) organizations are eligible to receive grants from government agencies and private foundations. These grants can provide a significant source of funding for organizations, enabling them to further their missions.

Government agencies and private foundations often have strict requirements for grant eligibility. One of these requirements is often 501(c)(3) status. By obtaining this status, organizations can open up a range of funding opportunities.

Donor Confidence and Increased Giving

The enhanced credibility and public trust that comes with 501(c)(3) status can also lead to increased donor confidence and giving. Donors want to support organizations that are transparent, accountable, and have a track record of achieving their mission.

By adhering to the strict reporting and governance requirements of 501(c)(3) status, organizations can demonstrate their commitment to these values.

Potential for Greater Media Exposure and Public Awareness

501(c)(3) organizations also have the potential for greater media exposure and public awareness. This can come in the form of news coverage, social media mentions, and other forms of publicity.

By promoting their mission and activities, organizations can raise awareness of their cause and increase support.

Access to Funding Opportunities for 501(c)(3) Organizations

501(c)(3) status also provides access to funding opportunities that may not be available to organizations without this designation.

Ability to Apply for Government Grants and Contracts

501(c)(3) organizations are eligible to apply for government grants and contracts. These opportunities can provide a significant source of funding for organizations.

However, the application process for government grants and contracts can be complex and competitive. Organizations must have a strong understanding of the requirements and a well-developed proposal to be successful.

Eligibility for Private Foundation Grants

501(c)(3) organizations are also eligible for private foundation grants. Private foundations are non-governmental organizations that provide funding to charitable causes. These foundations often have specific areas of focus and requirements for grant eligibility.

Fundraising Opportunities Through Charitable Events and Campaigns

501(c)(3) organizations can also leverage their status to raise funds through charitable events and campaigns.

For example, an organization may hold a charity walk or auction to raise funds. Donors can feel confident that their contributions are going to a qualified organization and may be tax-deductible.

Increased Ability to Leverage Donations and Sponsorships

501(c)(3) organizations can also leverage their status to secure donations and sponsorships from corporations and other entities. These organizations may be more likely to support organizations that are tax-exempt and have a strong reputation for accountability and impact.

Flexibility and Perpetual Existence of 501(c)(3) Organizations

501(c)(3) status also provides flexibility and perpetual existence for organizations.

Ability to Engage in Political Advocacy and Lobbying Within Certain Limits

501(c)(3) organizations can engage in political advocacy and lobbying within certain limits. However, they must follow specific requirements to maintain their tax-exempt status. For example, they cannot endorse political candidates or parties.

No Shareholders or Owners, Allowing For More Flexible Decision-Making

501(c)(3) organizations do not have shareholders or owners. This allows for more flexible decision-making and a greater focus on achieving the organization's mission.

Perpetual Existence Regardless of Changes in Leadership or Ownership

501(c)(3) organizations also have perpetual existence, regardless of changes in leadership or ownership. This allows organizations to maintain a long-term focus on their mission and activities.

Ability to Merge With or Acquire Other Nonprofit Organizations

501(c)(3) organizations can also merge with or acquire other nonprofit organizations. This can enable organizations to achieve greater impact and efficiency through collaboration and consolidation.

Conclusion

501(c)(3) status provides numerous benefits for nonprofit organizations, including tax benefits, enhanced credibility and public trust, access to funding opportunities, and flexibility and perpetual existence.

Organizations that obtain and maintain 501(c)(3) status can position themselves for long-term success and achieve their missions more effectively.

However, obtaining and maintaining this status requires a strong understanding of the requirements and the support of experienced legal and financial professionals.

Nonprofit organizations should carefully consider the benefits of 501(c)(3) status and take the necessary steps to obtain and maintain this designation. Doing so can lead to significant financial savings, increased donor confidence and support, and greater access to funding opportunities.

Additionally, adhering to the strict reporting and governance requirements can demonstrate an organization's commitment to transparency and accountability, leading to enhanced public trust and support.

With careful planning and execution, 501(c)(3) organizations can achieve their missions and create positive change in their communities and the world.

What Are the Benefits of 501(c)(3) Status? FAQs

501(c)(3) status is a federal tax designation that is granted to charitable organizations in the United States. This status exempts qualifying organizations from paying federal income tax and provides donors with the ability to make tax-deductible contributions.

The tax benefits of 501(c)(3) status include exemption from federal income tax, deductibility of donations, and exemption from state sales and property taxes. These benefits can result in significant savings for nonprofit organizations and donors alike.

501(c)(3) status enhances credibility and public trust by requiring organizations to adhere to strict reporting and governance requirements. This includes filing an annual information return with the IRS and adhering to state-specific reporting requirements. By following these requirements, organizations demonstrate their commitment to transparency and accountability, which can increase the public's trust in the organization.

Organizations with 501(c)(3) status have access to government grants and contracts, private foundation grants, and fundraising opportunities through charitable events and campaigns. These opportunities can provide a significant source of funding for organizations.

Perpetual existence allows organizations to maintain a long-term focus on their mission and activities, regardless of changes in leadership or ownership. Additionally, the ability to merge with or acquire other nonprofit organizations can enable organizations to achieve greater impact and efficiency through collaboration and consolidation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.