A nonprofit organization that wants to operate in the United States as a tax-exempt organization needs to apply for 501(c)(3) status with the Internal Revenue Service (IRS). 501(c)(3) allows eligible organizations to be exempt from paying federal income tax and to receive tax-deductible donations from individuals and other entities. However, the process of obtaining 501(c)(3) status can be complex and time-consuming. It is important to monitor the status of the application to ensure it is moving forward and to be aware of any potential issues that may arise. The IRS provides options for organizations to monitor the status of their application online, by phone, or through the mail. The Exempt Organizations Select Check page allows users to search for the status of an organization's application using either the organization's name or Employer Identification Number (EIN). To access the Exempt Organizations Select Check page, users can visit the IRS website and select "Charities and Non-Profits" from the top navigation menu. From there, users can select "Search for Charities" and, finally “Tax Exempt Organization Search Tool” before entering either the organization's name or EIN. Nonprofit organizations can call the IRS customer service line at the toll-free number 877-829-5500. Applicants simply provide the organization's name and EIN. The customer service representative can then provide an update on the status of the 501(c)(3) application. It is important to note that wait times on the IRS customer service line can be long, especially during peak times, such as tax season. Nonetheless, this option may be helpful for applicants experiencing technical difficulties with the online system or needing to speak directly with an IRS representative. The IRS will also communicate with nonprofit organizations by mail. After submitting an application for 501(c)(3) status, the organization will receive a letter from the IRS acknowledging receipt of the application. This letter will include the organization's case number and the name of the assigned agent who will be handling the application. After the initial letter, the IRS may request additional information from the organization, which will be communicated through the mail. Therefore, it is important to regularly check the organization's mailbox for any correspondence from the IRS regarding the application. Understanding the following factors can help applicants manage their expectations and avoid unnecessary delays. According to the IRS, the processing time for a complete application can range from three to six months. The average processing time for a 501(c)(3) application varies depending on various factors, including the volume and complexity of applications received. The IRS receives thousands of applications for tax-exempt status each year. This fact alone can cause certain delays in a 501(c)(3) application. It can be exacerbated by submitting incomplete, inconsistent, or unclear information. The IRS may require further information or clarifications by mail, which causes long delays. Common mistakes can delay the processing of a 501(c)(3) application. Therefore, it is important to take the time to ensure that the application is complete and accurate before submitting it to the IRS. These mistakes include missing or incomplete information made on the 501(c)(3) application form. Some applicants also fill out the wrong form. Applicants must ensure that all required fields are filled out and that all necessary documents are included. Numerical errors are also frequent. Applicants miscalculate their budgets and expenses or misreport information on tax forms. Sometimes, nonprofit organizations also submit incomplete financial statements or apply under improper classification. These errors cause delays in the processing of 501(c)(3) applications. Grave oversights may also lead to outright denial. During the application process, the IRS may request additional information from the applicant, often referred to as a Request for Information (RFI). RFI may be triggered by ambiguities, inconsistencies, or errors in the information provided. It can also arise from questions about a nonprofit organization’s activities and financial status. Additionally, an RFI may be made for clarification of further details related to the 501(c)(3) application. It is important to provide clear and concise answers to the questions posed by the IRS. If supplementary documents or evidence is required, ensure to provide all necessary documents in a timely manner. Mitigating 501(c)(3) application status can be challenging, but there are steps nonprofit organizations can take to help prevent delays or even denial of their application. Consider the following: Nonprofit organizations should have a clear understanding of the application process and the requirements for 501(c)(3) status. It can include reading the instructions carefully, knowing the documentary and other requirements, attending informational seminars or workshops, and seeking professional guidance. Applying for 501(c)(3) status can be a lengthy process. Organizations should start the application process as early as possible to allow enough time to gather all necessary documentation, complete the application, and respond to any requests for additional information. Before submitting the application, it is important to review it thoroughly and ensure all required information is included. This process can include having multiple people review the application to maintain accuracy and completeness. If the IRS requests additional information, it is important to respond promptly and provide all requested information. It can help prevent unnecessary delays in the processing of the application. Compiling detailed records of all correspondence with the IRS, including copies of all documents submitted and received, can help nonprofit organizations stay organized and respond to any requests for information quickly and accurately. It can also help in potential clarifications or requests for reconsideration in case of denial. Hiring an attorney or a tax professional who has experience working with nonprofit organizations can help ensure that the application is complete and accurate. They can provide guidance on the application process, review the application for errors, and help respond to any requests for legal or other information. Obtaining 501(c)(3) status is an important step for nonprofit organizations that want to operate in the United States as tax-exempt organizations. 501(c)(3) applications are affected by processing time, application errors, and requests for additional information. Monitoring the status of the application online, by phone, or through the mail is crucial to ensuring that the process moves forward smoothly and addressing any potential issues that may arise. While the average processing of 501(c)(3) applications can reach 3 to 6 months, nonprofit organizations can do their due diligence by understanding the process, starting early, checking and re-checking documents and forms, and keeping detailed records. Nonprofit organizations can also seek the help of a lawyer or financial advisor offering tax services for further guidance in ensuring the approval of their 501(c)(3) application. If you have sent in your 501(c)3 application, and have not yet received contact from the IRS, you can get in touch with them via phone, mail, or fax. They, unfortunately, cannot answer inquiries over email. They have a list of required information to include in your communication available on their website.Overview of 501(c)(3) Application

How to Check 501(c)(3) Application Status

Visit the IRS Website

Call the IRS

Check the Organization's Mailbox

Factors Affecting 501(c)(3) Application Status

Processing Time

Application Errors

Additional Information Requests

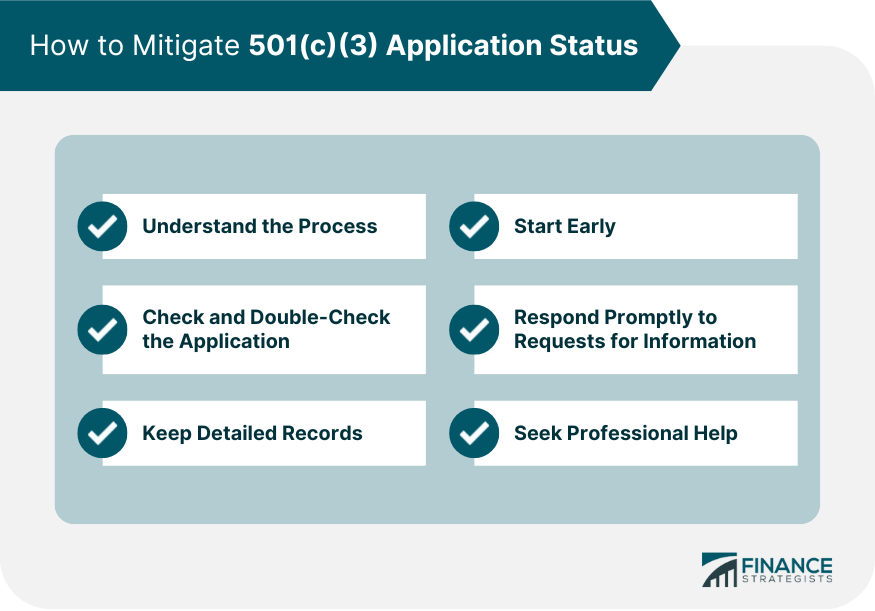

How to Mitigate 501(c)(3) Application Status

Understand the Process

Start Early

Check and Double-Check the Application

Respond Promptly to Requests for Information (RFI)

Keep Detailed Records

Seek Professional Help

Final Thoughts

Checking the 501c3 Application Status

How to Check 501(c)(3) Application Status FAQs

There are several ways to check the status of a 501(c)(3) application, including visiting the IRS website, contacting the IRS customer service line, and checking the organization's mailbox for any correspondence from the IRS.

Some common errors in 501(c)(3) applications include missing or incomplete information, calculation errors, improperly completed forms, lack of supporting documentation, incomplete financial statements, and improper classification.

Factors that can affect the processing time of a 501(c)(3) application include the volume of applications received, the complexity of the application, and the accuracy of the information provided.

Nonprofit organizations can start early, check and double-check the application, seek professional help, respond promptly to requests for additional information, understand the process, and keep detailed records.

The processing time for a 501(c)(3) application varies depending on various factors, such as the volume of applications received and the complexity of the application. The average processing time for a complete application can range from three to six months.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.