A family foundation is a charitable organization established and funded by a family, managed by family members or a combination of family members and professionals. Family foundations hold about 44% of all foundation holdings, with total assets ranging from a few hundred thousand dollars to over $1 billion. Family foundations have been a popular way for wealthy families to give back to their communities, establish a legacy of philanthropy, and exercise control over their charitable giving.

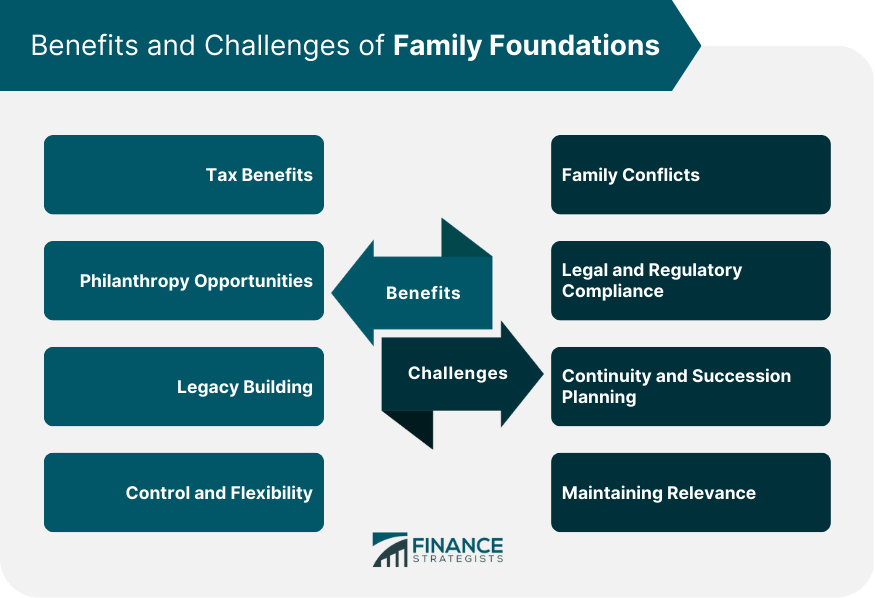

Setting up a family foundation involves several steps, including choosing the right structure, establishing governance policies, and seeking professional advice. The first step in setting up a family foundation is to choose the right structure. Family foundations can be set up as either a trust or a nonprofit corporation. Trusts are a popular option for family foundations because they offer greater flexibility and privacy. Nonprofit corporations are more complex to set up and require more regulatory compliance, but they offer greater liability protection. Once the structure has been chosen, the next step is to establish governance policies. Governance policies outline the foundation's mission, objectives, and guidelines for grantmaking. Governance policies also establish the roles and responsibilities of the foundation's board of directors, which is responsible for overseeing the foundation's operations. Establishing a family foundation can be a complex process, and seeking professional advice from attorneys, accountants, and other experts is essential. These professionals can help families navigate the legal and tax implications of setting up a family foundation and ensure that the foundation is set up correctly. Managing a family foundation involves several tasks, including funding the foundation, strategic planning, evaluating impact, and grantmaking. Funding the foundation is one of the most critical tasks in managing a family foundation. Foundations can be funded with cash, stocks, real estate, or other assets. Families should consider their long-term giving goals and establish a funding plan that ensures the foundation has the resources it needs to achieve its mission. Establishing policies for accepting donations from outside sources and managing the foundation's endowment is also essential. Strategic planning is critical to the success of a family foundation. It's essential to establish a clear mission and objectives for the foundation and develop a strategic plan outlining how it will achieve its goals. Strategic planning should involve input from all stakeholders, including family members, staff, and community leaders. Establishing performance metrics and regularly evaluating the foundation's progress toward its goals is also important. Evaluating the impact of the foundation's activities is an important part of managing a family foundation. By measuring the impact of the foundation's grantmaking, families can determine which activities are most effective and adjust their giving strategies accordingly. Impact evaluation can also help families communicate the foundation's successes to stakeholders and demonstrate the foundation's value to the community. Grantmaking is the primary way that family foundations support charitable causes. When making grants, families should consider the foundation's mission and objectives, the needs of the community, and the impact the grant will have. Donor-advised funds are also a popular option for family foundations. Donor-advised funds allow families to make a charitable contribution to the foundation and advise the foundation on which causes to support. There are several benefits associated with family foundations, including tax benefits, philanthropy opportunities, legacy building, and control and flexibility. One of the primary benefits of establishing a family foundation is the tax benefits. Donations made to a family foundation are tax-deductible, which can result in significant savings for the donor. Family foundations are also exempt from income taxes, which means that the foundation's assets can grow tax-free. Additionally, family foundations can minimize estate taxes by allowing the founder to transfer assets to the foundation during their lifetime, rather than leaving them in their estate. Family foundations allow families to give back to their communities and support causes they are passionate about. By establishing a family foundation, families can pool their resources and significantly impact the causes they care about. Family foundations also provide a platform for families to involve future generations in their philanthropic efforts, instilling values of giving and service in their children and grandchildren. Family foundations provide a way for families to establish a lasting legacy of philanthropy. By creating a foundation in their family's name, families can ensure their charitable efforts continue long after they are gone. Family foundations can also help families establish a reputation as philanthropists, which can positively impact their family's legacy and reputation. Family foundations provide families with greater control over their charitable giving. By establishing a family foundation, families can decide which causes and organizations to support, how much to donate, and when to make donations. Family foundations also offer greater flexibility in how donations are made, allowing families to make grants, establish scholarship funds, and support other charitable activities. While family foundations offer many benefits, they also come with several challenges, including family conflicts, legal and regulatory compliance, continuity and succession planning, and maintaining relevance. Family conflicts can arise when managing a family foundation, particularly when multiple family members are involved. Conflicts can arise over the foundation's mission, governance, grantmaking, and other issues. It's important to establish clear policies for resolving conflicts and to have a decision-making process involving multiple family members. Family foundations are subject to a complex set of legal and regulatory requirements. Failure to comply with these requirements can result in significant penalties and damage to the foundation's reputation. It's critical to clearly understand the legal and regulatory requirements that apply to the foundation and establish policies and procedures to ensure compliance. Continuity and succession planning is critical to the long-term success of a family foundation. It's vital to establish policies for selecting new board members and officers, ensure that the foundation's mission and objectives are preserved over time, and establish a process for transitioning leadership from generation to generation. Finally, family foundations must adapt to changing circumstances and remain relevant to the community's needs. It's important to regularly evaluate the foundation's mission and strategies and make adjustments as necessary to ensure that the foundation continues to have a meaningful impact. Family foundations offer many benefits to families, including tax benefits, philanthropy opportunities, legacy building, and control and flexibility. Setting up and managing a family foundation involves several steps, including choosing the right structure, establishing governance policies, and seeking professional advice. While family foundations come with several challenges, including family conflicts, legal and regulatory compliance, continuity and succession planning, and maintaining relevance, with careful planning and management, family foundations can provide a lasting legacy of philanthropy and control over charitable giving. Family foundations provide a powerful tool for families to establish a lasting legacy of philanthropy and control over their charitable giving. However, setting up and managing a family foundation can be complex, and it's essential to seek professional advice from legal and tax planning experts. When establishing a family foundation, seek the guidance of experienced professionals to ensure that their foundation is set up correctly and that they take full advantage of the tax benefits available. By working with experts, families can establish a foundation that has a meaningful impact on their community and helps to build a lasting legacy of giving..What Are Family Foundations?

Setting up a Family Foundation

Choosing the Right Structure

Establishing Governance Policies

Seeking Professional Advice

Managing a Family Foundation

Funding the Foundation

Strategic Planning

Evaluating Impact

Grantmaking and Donor Advised Funds

Benefits of Family Foundations

Tax Benefits

Philanthropy Opportunities

Legacy Building

Control and Flexibility

Challenges of Family Foundations

Family Conflicts

Legal and Regulatory Compliance

Continuity and Succession Planning

Maintaining Relevance

Final Thoughts

Family Foundations FAQs

A family foundation is a charitable organization established and funded by a family, which is managed by family members or by a combination of family members and professionals.

The benefits of establishing a family foundation include tax benefits, philanthropy opportunities, legacy building, and control and flexibility over charitable giving.

To set up a family foundation, you need to choose the right structure, establish governance policies, and seek professional advice from attorneys, accountants, and other experts.

The challenges associated with managing a family foundation include family conflicts, legal and regulatory compliance, continuity and succession planning, and maintaining relevance.

To ensure that your family foundation is tax-efficient, you should seek the guidance of experienced tax planning experts who can help you navigate the legal and tax implications of setting up a family foundation and take full advantage of the tax benefits available to you.