The Free 501(c)(3) Application, officially known as Form 1023, is the form that non-profit organizations submit to the IRS to apply for recognition as a tax-exempt entity under Section 501(c)(3) of the Internal Revenue Code. The form is a comprehensive document that requires detailed information about the organization's structure, governance, finances, and activities. The purpose of the Free 501(c)(3) Application is to provide the IRS with enough information to determine whether an organization qualifies for tax-exempt status. It requires organizations to document their purpose, activities, governance structure, and finances in detail. The information provided in the application helps the IRS ensure that the organization is organized and operated exclusively for the exempt purposes outlined in section 501(c)(3) and that its earnings do not benefit any private shareholder or individual. To be eligible to apply for 501(c)(3) status, an organization must be organized and operated exclusively for one or more of the purposes specified in section 501(c)(3) of the Internal Revenue Code. These purposes include charity, religion, education, science, literature, testing for public safety, fostering amateur sports, and preventing cruelty to children or animals. In addition, the organization's activities must primarily serve these exempt purposes. This requirement is closely scrutinized during the application review process. The IRS requires that 501(c)(3) organizations be structured as a corporation, trust, or association. The organization must have a governing document, such as an article of incorporation for corporations, that includes required provisions detailing its exempt purposes and certain restrictions on its activities. The organizational structure of the entity should clearly indicate that it operates for the public benefit and not for the private interests of individuals. While there is no limit to the amount of money a 501(c)(3) organization can earn, there are restrictions on how the funds are used. Profits cannot be distributed to individuals or stakeholders and must be reinvested into the organization's exempt purposes. Moreover, the organization must not exist for the benefit of private interests. The income and assets of the organization should be dedicated to its exempt purposes. 501(c)(3) organizations are restricted in the amount of lobbying they can do, and they are prohibited from engaging in political campaign activity. If an organization engages in excessive lobbying or any political campaign activity, it can jeopardize its tax-exempt status. The application requires an organization to describe its current or planned activities in these areas, and the IRS closely scrutinizes these activities during the application review process. Organizations seeking 501(c)(3) status must include a dissolution clause in their governing document. This clause states that upon the dissolution of the organization, its assets will be distributed for one or more exempt purposes, to the federal, state, or local government or to another organization that is recognized as exempt under section 501(c)(3). This requirement ensures that the organization's assets will continue to be used for exempt purposes even if the organization ceases to exist. In addition to these requirements, organizations must also comply with other legal requirements applicable to non-profit organizations. This includes compliance with employment laws, state non-profit regulations, and any other regulations relevant to the organization's activities. The first step in the application process is to gather the necessary documents. These include the organization's governing document, bylaws, financial data, and information about the organization's activities and governance. Having these documents on hand before starting the application can streamline the process and help ensure that the information provided is accurate and consistent. Before filling out Form 1023, the organization must establish its legal structure. This involves creating a governing document that includes the required provisions about the organization's exempt purposes and restrictions on its activities. In addition to the governing document, the organization should also establish its bylaws, which outline the rules and procedures for its governance and operations. Filling out Form 1023 involves providing detailed information about the organization in several areas. In this section, organizations provide basic information about themselves. This includes the organization's name, mailing address, Employer Identification Number (EIN), and contact information. Organizations also provide information about their legal structure, the date they were legally formed, and their state of legal domicile. Here, organizations provide information about their legal structure and their activities. They specify whether they are a corporation, trust, or association, and they describe their exempt purposes and their current and planned activities in detail. In this part, organizations confirm that their governing document contains the required provisions about their exempt purposes and restrictions on their activities. They also confirm that they have a dissolution clause stating that their assets will be distributed for exempt purposes if the organization is dissolved. In this section, organizations provide a narrative description of their activities. They describe their past, present, and planned activities in detail and explain how these activities further their exempt purposes. Here, organizations provide detailed financial data for the past, current, and future years. This includes information about their revenue and expenses, assets and liabilities, and compensation of officers, directors, and key employees. Organizations confirm that they have paid the required user fee, which is used to cover the costs of processing the application. Finally, an authorized individual must sign the application under penalties of perjury, confirming that the information provided is true, correct, and complete. Once the application is complete, it is submitted to the IRS along with the required user fee. The application can be submitted online through the IRS website or by mail. Organizations should keep a copy of the completed application and all supporting documents for their records. After the application is submitted, the IRS reviews it to determine whether the organization qualifies for tax-exempt status. This involves a detailed review of the information provided in the application and any supporting documents. The IRS may contact the organization for additional information or clarification during the review process. Common issues that can arise during the review process include incomplete or inconsistent information, lack of required provisions in the governing document, or activities that don't clearly serve exempt purposes. These issues can cause delays in the review process and may require the organization to provide additional information or make changes to its governing document or activities. Once the review process is complete, the IRS sends a determination letter to the organization. If the application is approved, the determination letter confirms that the organization is recognized as exempt under section 501(c)(3) and provides information about its reporting and compliance obligations. If the application is denied, the determination letter explains the reasons for the denial and provides information about the organization's right to appeal the decision. Once an organization is recognized as a 501(c)(3) entity, it must file an annual information return with the IRS, known as Form 990. This form provides detailed financial information about the organization and helps the IRS and the public evaluate the organization's operations and compliance with tax laws. Organizations that fail to file Form 990 for three consecutive years automatically lose their tax-exempt status. In addition to filing Form 990, organizations must comply with various IRS regulations and reporting requirements. This includes maintaining detailed financial records, complying with public disclosure requirements, and refraining from activities that could jeopardize their tax-exempt status. Organizations should be proactive in understanding and meeting these requirements to maintain their tax-exempt status over the long term. Non-compliance with the requirements and obligations of a 501(c)(3) organization can have serious consequences. These can range from penalties and fines to revocation of tax-exempt status. Revocation of tax-exempt status can have a significant impact on an organization, affecting its ability to raise funds and fulfill its mission. Therefore, maintaining compliance should be a priority for every 501(c)(3) organization. The Free 501(c)(3) Application, or Form 1023, is a comprehensive document that organizations submit to the IRS to be recognized as a tax-exempt entity. It requires detailed information about the organization's structure, governance, finances, and activities. The process of completing the application involves gathering necessary documents, establishing an organizational structure, filling out Form 1023 in detail, and submitting the application to the IRS. Once approved, organizations have several post-approval requirements and obligations. These include filing annual Form 990, complying with IRS regulations and reporting, and maintaining compliance to avoid potential consequences.What Is the Free 501(c)(3) Application?

Eligibility Requirements for the Free 501(c)(3) Application

Non-Profit Purpose

Organizational Structure

Financial Limitations

Political and Lobbying Activities

Dissolution Clause

Other Legal Compliance

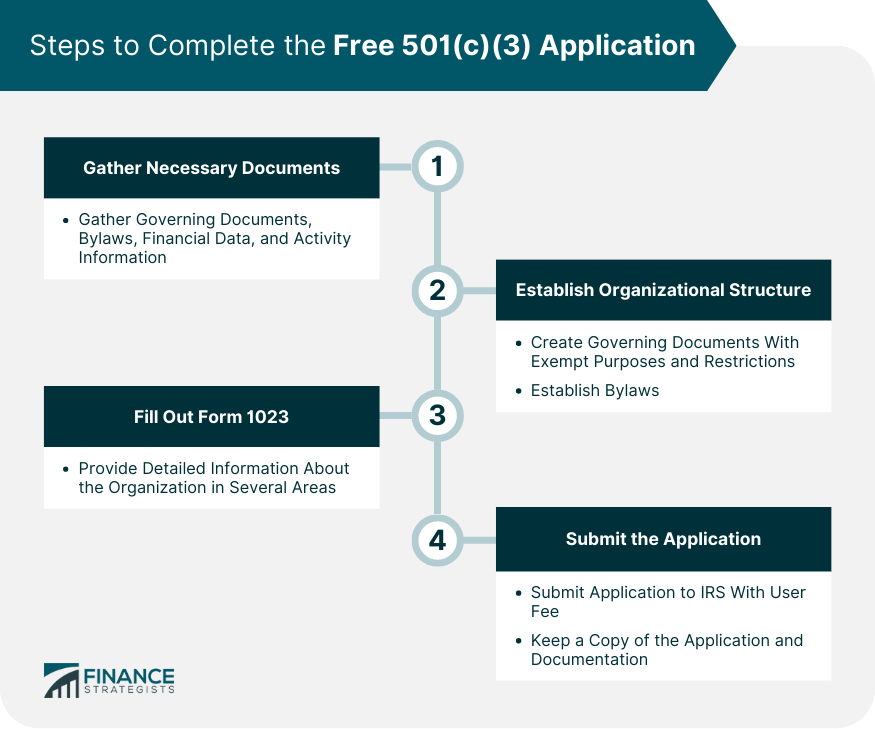

Steps to Complete the Free 501(c)(3) Application

Gathering Necessary Documents

Establishing Organizational Structure

Filling out Form 1023

Part I: Identification of Applicant

Part II: Organizational Structure and Activities

Part III: Required Provisions

Part IV: Narrative Description of Activities

Part V: Financial Data

Part VI: User Fee Information

Part VII: Signature and Declaration

Submitting the Application

Review and Approval Process

IRS Review of the Free 501(c)(3) Application

Common Issues and Potential Delays

Notification of Approval or Denial

Post-Approval Requirements and Obligations

Filing Annual Form 990

Compliance with IRS Regulations and Reporting

Potential Consequences for Non-compliance

Conclusion

Free 501(c)(3) Application FAQs

A 501(c)(3) organization is a non-profit entity that has been recognized by the IRS as exempt from federal income tax due to its charitable purposes.

The Free 501(c)(3) Application, or Form 1023, is the form that organizations submit to the IRS to apply for recognition as a tax-exempt entity under section 501(c)(3) of the Internal Revenue Code.

Eligibility requirements include a non-profit purpose, an appropriate organizational structure, financial limitations, restrictions on political and lobbying activities, a dissolution clause in the governing document, and compliance with other legal requirements.

Steps include gathering necessary documents, establishing an organizational structure, filling out Form 1023, and submitting the application to the IRS.

These include filing annual Form 990, complying with IRS regulations and reporting, and maintaining compliance to avoid potential consequences.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.