A 501(c)(3) is a type of nonprofit organization that is exempt from federal income tax and enjoys other benefits for carrying out its charitable, educational, religious, or scientific mission. This type of organization must have an established purpose of operating for public benefit, must prohibit distributing profits to members or shareholders, and must limit its activities to those that are related to its purpose. It can receive donations from individuals and companies as well as grants from foundations and government agencies. In addition, it can seek private foundation support and/or sponsor fund-raising events. Many organizations in the United States qualify as 501(c)(3), including charities, churches, social service organizations, medical research centers, libraries, and more. Applying for 501(c)(3) status can be a complex process, but it is a crucial step that allows organizations to benefit from tax-exempt status and other advantages associated with being nonprofit. Becoming a 501(c)(3) is no easy feat, and the process can take some time and require paperwork to be filed with the IRS. The two main factors that impact how quickly the application is processed are the completeness and accuracy of the information included on the form, and the organization’s readiness in terms of providing all necessary supporting documentation. When applying for 501(c)(3) status with either form 1023 or 1023-EZ, it is very important to make sure all necessary information is provided accurately and completely. This includes proper details about the organization, its activities, financials, and purpose, as well as any articles of incorporation that were filed with the state government. Providing complete and accurate information will help to expedite the processing time from the IRS or state government. The other major factor that can determine how long it takes for your application to be approved is your organization’s readiness in terms of having everything ready when you submit your form. If all paperwork has been completed but not yet submitted or still needs to be collected from various outside sources, this can slow down the entire process by a few weeks or months. To avoid delays, it’s essential to have everything ready before submitting your application so you are giving yourself plenty of time for any questions or corrections that may arise during the processing period. Applying for 501(c)(3) status can be a long, complicated process, but there are certain steps you can take to expedite the timeline. Before you submit your form, double check to make sure everything is in order. This includes information on the organization and its operations, finances, and goals. Have all supporting documents ready so that you can submit them along with your form. Be sure to include any other relevant paperwork or attachments that may be required depending on where you live and whether you are filing Form 1023 or 1023-EZ. Depending on which state your organization resides in, there may be additional paperwork required in order to gain 501(c)(3) recognition from your local government. Make sure to investigate what documentation may be needed ahead of time. This may take some time, but it is necessary to obtain 501(c)(3) status and file federal taxes each year. If you have any questions or need assistance during the process, don’t hesitate to reach out to the IRS directly for help or clarification on any issues that arise during the application review period. Applying for 501(c)(3) status is a lengthy but crucial process in order to gain recognition as a charitable organization. Depending on which form you file, you could receive a decision as early as 2 weeks, or as late as 6 months. While it may take some time and effort, following the tips outlined in this article should help to expedite the process and make it less stressful. The most important thing is to make sure you have all your paperwork and supporting documents ready before submitting your form so that your application can be processed quickly and accurately.Overview of 501(c)(3)

Application Process of 501(c)(3)

1. Choose a name for your organization and make sure it’s not already in use.

2. Gather the required documents to form your nonprofit corporation.

3. Submit the Application for Recognition of Exemption (Form 1023 or Form 1023-EZ) to the IRS with the appropriate filing fee.

4. Provide additional documents as requested by the IRS within 30 days of submitting your application for expedited processing.

5. Receive a determination letter from the IRS informing you of their decision regarding whether your organization is either granted or denied tax-exempt status under section 501(c)(3).Timeline of Becoming a 501(c)(3)

Using Form 1023 to File

1. Obtain form 1023 from the IRS website.

2. Fill out form 1023 and submit it along with articles of incorporation and required attachments.

3. The IRS reviews your application and makes a decision within 3 to 4 months after submission.

4. You will receive a notification that your organization has been approved for tax exemption status if your application is approved by the IRS.Using Form 1023-EZ to File

1. Obtain form 1023-EZ from the IRS website and fill it out with your organization's information.

2. Submit form 1023-EZ along with articles of incorporation, required attachments, and user fee schedule if applicable to your state or federal laws/regulations/guidelines (amount varies).

3. The IRS reviews your application and generally makes a decision within 2 weeks after submission, as long as all required information is included in the application packet sent in for processing purposes (the IRS does not accept incomplete applications).

4. You may receive confirmation that your organization has been granted tax-exempt status if the IRS approves your application within 1 to 2 weeks after you have submitted form 1023-EZ, complete with all necessary documents.

5. The IRS will not accept incomplete applications; thus, it is essential to submit everything required when sending in the packet for processing.Factors Affecting the 501(c)(3) Application Timeline

Completeness and Accuracy of Information

Organization’s Readiness

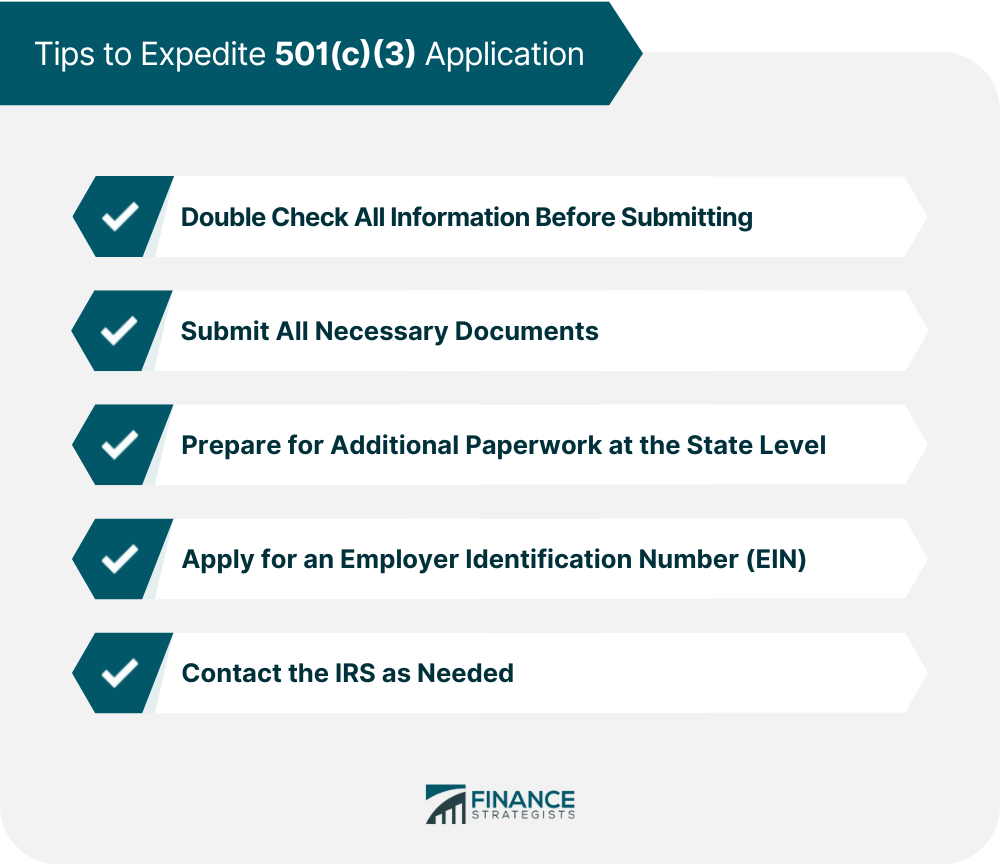

Tips to Expedite 501(c)(3) Application

Double Check All Information Before Submitting

Submit All Necessary Documents

Prepare for Additional Paperwork at the State Level

Apply for an Employer Identification Number (EIN)

Contact the IRS as Needed

Final Thoughts

How Long Does It Take to Become a 501(c)(3)? FAQs

Filing form 1023 typically takes between 3-6 months, while filing Form 1023-EZ has an average IRS processing time of 2-4 weeks. The complexity of the application and how quickly it is reviewed by the IRS can impact these timelines.

The initial step is to submit Form 1023 or 1023-EZ with all the necessary supporting documents. You will then receive a letter granting tax-exempt status if your application is approved by the IRS.

Yes. Make sure you have all your paperwork and supporting documents ready before submitting your form and double check that everything is accurate in order to expedite the processing time by the IRS.

The IRS does not accept incomplete applications, so make sure all required documents are included in the packet sent in for processing purposes.

Once granted tax-exempt status, your organization will be exempt from federal income taxes and may also qualify for other benefits such as exemption from state income taxes or eligibility for government grants and contracts reserved specifically for non-profit organizations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.