501(c)(3) nonprofit organizations are tax-exempt organizations in the United States that are organized and operated for religious, charitable, scientific, literary, or educational purposes. Understanding the different types of 501(c)(3) nonprofit organizations and their requirements can help individuals and organizations choose the right type of nonprofit organization for their needs. Below are the different types of 501(c)(3) nonprofit organizations: Charitable organizations are the most common type of nonprofit organization. These organizations are created to benefit the general public, and their primary purpose is to assist those in need. Charitable organizations can provide various services, including education, health care, housing, and food assistance. Examples of charitable organizations include the American Red Cross, Habitat for Humanity, and the Salvation Army. The requirements to qualify as a charitable organization are the following: The organization must be operated exclusively for charitable purposes. The organization must benefit the public or a significant public segment. The organization must not engage in any activities that are illegal or violate public policy. The benefits of being a charitable organization include exemption from federal income tax, receiving tax-deductible contributions from donors, and applying for grants from government agencies and private foundations. Educational organizations are nonprofit organizations dedicated to providing educational services to the public. These organizations can include schools, universities, museums, and research institutions. Some examples of educational organizations include Harvard University, the Smithsonian Institution, and the National Science Foundation. To qualify as an educational organization, an organization must meet the following requirements: The organization must be organized exclusively for educational purposes. The organization must not engage in any activities that are illegal or violate public policy. The benefits of being an educational organization include exemption from federal income tax, receiving tax-deductible contributions from donors, and applying for grants from government agencies and private foundations. Religious organizations are nonprofit organizations that are organized and operated for religious purposes. These organizations can include churches, synagogues, mosques, and other religious institutions. Some examples of religious organizations include the Catholic Church, the Jewish Federation of North America, and the Islamic Society of North America. To qualify as a religious organization, an organization must meet the following requirements: The organization must be organized and operated exclusively for religious purposes. The organization must not engage in any activities that are illegal or violate public policy. The benefits of being a religious organization include exemption from federal income tax, receiving tax-deductible contributions from donors, and applying for grants from government agencies and private foundations. Scientific organizations are nonprofit organizations organized and operated for scientific research and education purposes. These organizations can include research institutions, scientific societies, and educational organizations. Examples of scientific organizations include the American Association for the Advancement of Science, the National Academy of Sciences, and the Smithsonian Institution. To qualify as a scientific organization, an organization must meet the following requirements: The organization must be organized and operated exclusively for scientific research and education purposes. The organization must not engage in any activities that are illegal or violate public policy. The benefits of being a scientific organization include exemption from federal income tax, receiving tax-deductible contributions from donors, and applying for grants from government agencies and private foundations. Literary organizations are nonprofit organizations organized and operated for literary purposes. These organizations can include libraries, bookstores, publishers, and writers' organizations. Examples of literary organizations include the American Library Association, the National Book Foundation, and the Writers' Guild of America. To qualify as a literary organization, an organization must meet the following requirements: The organization must be organized and operated exclusively for literary purposes. The organization must not engage in any activities that are illegal or violate public policy. The benefits of being a literary organization include exemption from federal income tax, receiving tax-deductible contributions from donors, and applying for grants from government agencies and private foundations. Prevention of cruelty to children or animals organizations are nonprofit organizations organized and operated to prevent cruelty to children or animals. These organizations can include animal rescue shelters, child abuse prevention organizations, and animal welfare organizations. Examples of prevention of cruelty to children or animal organizations include the American Society for the Prevention of Cruelty to Animals, the National Children's Alliance, and the Humane Society of the United States. To qualify as prevention of cruelty to children or animals organization, an organization must meet the following requirements: The organization must be organized and operated exclusively to prevent cruelty to children or animals. The organization must not engage in any activities that are illegal or violate public policy. The benefits of preventing cruelty to children or animals include exemption from federal income tax, the ability to receive tax-deductible contributions from donors, and the ability to apply for grants from government agencies and private foundations. 501(c)(3) nonprofit organizations play a critical role in our society by providing essential services and programs to those in need. The six main categories of nonprofit organizations include charitable organizations, educational organizations, religious organizations, scientific organizations, literary organizations, and prevention of cruelty to children or animals. By meeting the requirements of these categories, nonprofit organizations can receive tax-exempt status and benefits that help them achieve their mission and goals.What Are 501(c)(3) Nonprofit Organizations?

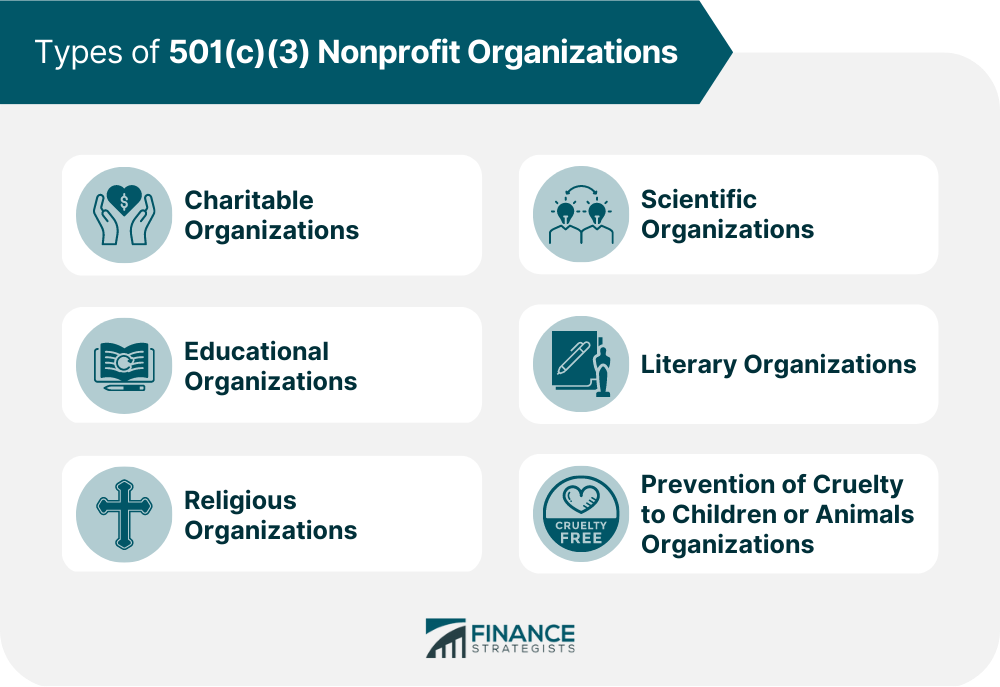

Types of 501(c)(3) Nonprofit Organizations

Charitable Organizations

Requirements to Qualify as a Charitable Organization

Benefits of Charitable Organizations

Educational Organizations

Requirements to Qualify as an Educational Organization

Benefits of Educational Organizations

Religious Organizations

Requirements to Qualify as a Religious Organization

Benefits of Religious Organizations

Scientific Organizations

Requirements to Qualify as a Scientific Organization

Benefits of Scientific Organizations

Literary Organizations

Requirements to Qualify as a Literary Organization

Benefits of Literary Organizations

Prevention of Cruelty to Children and/or Animals Organizations

Requirements to Qualify as a Prevention of Cruelty to Children and/or Animals Organization

Benefits of Prevention of Cruelty to Children and/or Animals Organizations

Final Thoughts

Individuals and organizations interested in starting a nonprofit organization should consult with a legal and financial advisor to ensure that they follow the correct procedures and meet all of the tax-exempt status requirements.

Types of 501(c)(3) Nonprofit Organizations FAQs

There are six main types of 501(c)(3) nonprofit organizations: charitable organizations, educational organizations, religious organizations, scientific organizations, literary organizations, and prevention of cruelty to children or animals organizations.

To qualify as a 501(c)(3) nonprofit organization, an organization must be organized and operated exclusively for one of the six main purposes (charitable, educational, religious, scientific, literary, or prevention of cruelty to children or animals). It must not engage in any activities that are illegal or violate public policy.

The benefits of being a 501(c)(3) nonprofit organization include exemption from federal income tax, receiving tax-deductible contributions from donors, and applying for grants from government agencies and private foundations.

Examples of charitable organizations that are 501(c)(3) nonprofits include the American Red Cross, Habitat for Humanity, and the Salvation Army.

Yes, other nonprofit organizations can qualify for tax-exempt status under different sections of the Internal Revenue Code. However, these organizations do not qualify as 501(c)(3) nonprofits and are subject to different requirements and benefits.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.