Family Limited Liability Companies (FLLCs) are a type of business entity specifically designed for family members to manage their assets, provide asset protection, and enable efficient tax planning. Structured like traditional LLCs, FLLCs are limited to family members as owners. They offer numerous benefits, including limited liability protection, centralized management and control, and flexibility in business operations while helping preserve family wealth and facilitating estate planning. To form an FLLC, families must register with the appropriate state agency, typically the Secretary of State, and pay any required fees. Each state has its own set of rules and regulations governing FLLCs, so families must ensure that they comply with the specific requirements of their jurisdiction. FLLCs must draft and file Articles of Organization with the relevant state authority. These documents outline the FLLC's basic structure and purpose and include information such as the company's name, address, and management structure. FLLCs need an Operating Agreement that outlines the management structure and decision-making process. This includes defining whether the FLLC will be manager-managed or member-managed and identifying the managers' or members' roles and responsibilities. The Operating Agreement should also define the rights and responsibilities of FLLC members, including their voting rights, profit and loss allocations, and any restrictions on the transfer of membership interests. The Operating Agreement must specify how the FLLC will allocate profits and losses among its members. This allocation is typically based on the members' ownership percentages in the FLLC. FLLC membership is limited to family members, which can include spouses, children, grandchildren, and other close relatives. This structure promotes family unity and ensures that the FLLC remains family-controlled. The Operating Agreement should outline the process for admitting new members to the FLLC, including any required approvals and the determination of ownership interests. The Operating Agreement should also address the withdrawal of existing members, detailing the process for voluntary withdrawal and any potential buyout provisions or restrictions on withdrawal. FLLCs can be either manager-managed or member-managed. In a manager-managed FLLC, one or more managers make decisions on behalf of the company, while in a member-managed FLLC, all members have an active role in the decision-making process. The Operating Agreement should specify the process for selecting and removing managers and outline their roles, responsibilities, and authority within the FLLC. The Operating Agreement should outline the decision-making process for FLLCs, including details on voting rights, quorum requirements, and procedures for resolving disputes among members or managers. FLLCs are considered pass-through entities for tax purposes, meaning that the company itself is not taxed. Instead, profits and losses pass through to the individual members, who report them on their personal income tax returns. This structure can provide significant tax benefits for FLLC members. FLLCs must file annual tax returns with the Internal Revenue Service (IRS), reporting their income, deductions, and credits. Additionally, FLLCs may need to file state tax returns, depending on the jurisdiction in which they operate. FLLCs provide limited liability protection for their members, meaning that members are generally not personally responsible for the company's debts and liabilities. This protection is crucial for preserving family wealth and shielding members from potential financial risks associated with the FLLC's operations. FLLCs can offer protection from creditors, as the company's assets are separate from those of its members. This separation can help protect family wealth from potential claims by creditors and prevent the seizure of personal assets to satisfy business debts. FLLCs can serve as an effective tool for preserving family wealth, allowing families to pass on assets to future generations while maintaining control over the management and distribution of those assets. FLLC interests are often subject to a lack of marketability discount, which can lower the value of the interests for gift and estate tax purposes. This discount reflects the limited market for FLLC interests, as they are not easily transferable or sold to third parties. FLLC interests may also be subject to a minority interest discount, which reduces the value of the interests for gift and estate tax purposes. This discount reflects the limited control that minority interest holders have over the FLLC's operations and decision-making. Families can use FLLCs to transfer wealth to future generations through gifts or sales of FLLC interests. The valuation discounts associated with FLLC interests can help minimize gift and estate tax liabilities, making this an attractive option for estate planning. The transfer of FLLC interests can have significant estate tax implications, particularly if the transfers are subject to valuation discounts. Proper planning and documentation are crucial for minimizing potential tax liabilities and ensuring that the FLLC's assets are distributed according to the family's wishes. FLLCs offer limited liability protection, shielding members from personal liability for the company's debts and liabilities. FLLCs provide pass-through taxation, which can result in tax savings for members. FLLCs allow families to maintain control over their assets and facilitate the transfer of wealth to future generations. FLLCs enable families to centralize the management and control of their assets, streamlining decision-making and promoting family unity. FLLCs provide flexibility in business operations, allowing families to adapt to changing circumstances and pursue new opportunities. FLLCs can be legally complex, requiring compliance with state-specific regulations and ongoing filing requirements. FLLCs are subject to the laws and regulations of the state in which they are formed, which can vary widely and impact the FLLC's operations. FLLCs can potentially exacerbate family conflicts, particularly if disputes arise over management decisions or the distribution of assets. FLLCs involve formation, registration, and ongoing compliance costs, which may be a disadvantage for some families. Family Limited Liability Companies can offer numerous benefits for families looking to manage their assets, plan for the future, and protect their wealth. However, FLLCs also have legal complexity, state-specific regulations, and potential family conflicts. Therefore, it is essential for families to carefully consider whether an FLLC is the right choice for their unique circumstances and objectives. It is also crucial for families to seek professional advice from tax services professionals, experienced attorneys, accountants, or financial planners when forming and managing an FLLC. This expertise can help ensure that the FLLC is structured and operated in compliance with relevant laws and regulations and that it effectively serves its intended purpose. FLLCs can be a valuable tool for families looking to preserve and manage their wealth. Still, it is essential to understand the advantages, disadvantages, and potential risks associated with establishing and operating an FLLC. By carefully considering these factors and seeking professional advice, families can make informed decisions that align with their long-term goals and objectives.What Are Family Limited Liability Companies (FLLCs)?

Formation of FLLCs

Legal Requirements

State Registration and Fees

Drafting and Filing of Articles of Organization

Creating an Operating Agreement

Establishing Management Structure

Defining Members' Rights and Responsibilities

Allocating Profits and Losses

FLLC Structure and Management

Membership

Family Members as Owners

Admission of New Members

Withdrawal of Existing Members

Management

Manager-Managed vs. Member-Managed FLLCs

Selection and Role of Managers

Decision-Making Process

FLLC Taxation and Asset Protection

Pass-Through Taxation

Tax Benefits for Members

Filing Requirements

Asset Protection

Limited Liability for Members

Protection From Creditors

Preservation of Family Wealth

Estate and Gift Tax Planning with FLLCs

Valuation Discounts

Lack of Marketability Discount

Minority Interest Discount

Transfer of FLLC Interests

Gifting and Sales of Interests

Estate Tax Implications

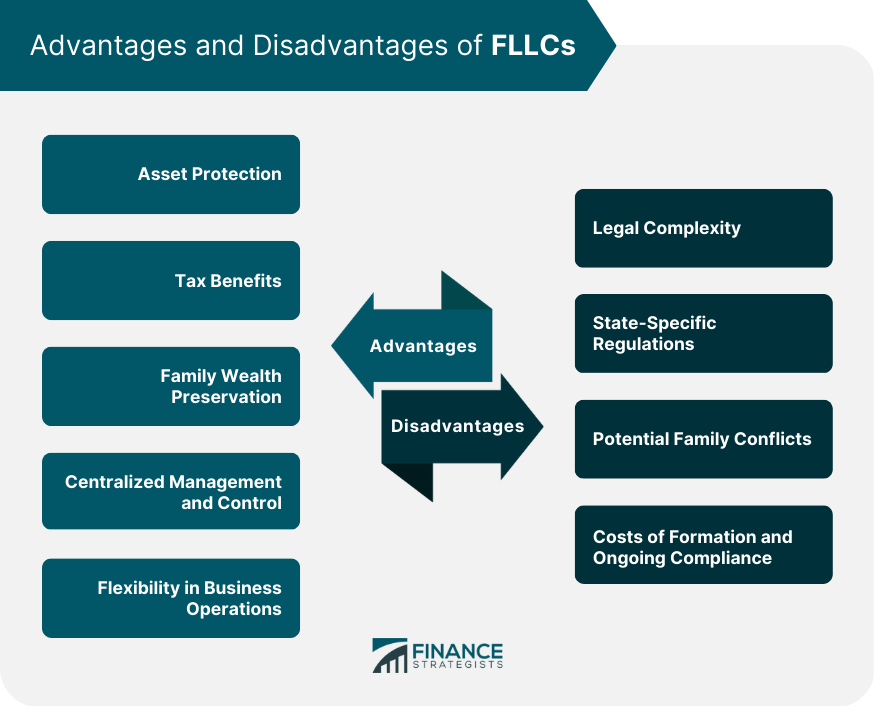

Advantages of FLLCs

Asset Protection

Tax Benefits

Family Wealth Preservation

Centralized Management and Control

Flexibility in Business Operations

Disadvantages and Limitations of FLLCs

Legal Complexity

State-Specific Regulations

Potential Family Conflicts

Costs of Formation and Ongoing Compliance

Conclusion

Family Limited Liability Companies (FLLCs) FAQs

A Family Limited Liability Company (FLLC) is a type of business entity designed specifically for family members to manage assets, provide asset protection, and enable efficient tax planning. FLLCs are structured like traditional LLCs but are limited to family members as owners.

Some primary advantages of forming an FLLC include asset protection, tax benefits, family wealth preservation, centralized management and control, and flexibility in business operations.

Potential disadvantages or limitations of forming an FLLC include legal complexity, state-specific regulations, family conflicts, and costs associated with the formation and ongoing compliance.

FLLCs provide tax benefits through pass-through taxation, meaning the company is not taxed. Instead, profits and losses pass through to individual members, who report them on their personal income tax returns. This structure can result in tax savings for FLLC members.

FLLCs can be used for estate and gift tax planning by transferring wealth to future generations through gifts or sales of FLLC interests. Valuation discounts, such as lack of marketability and minority interest discounts, can help minimize gift and estate tax liabilities, making FLLCs an attractive option for estate planning.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.