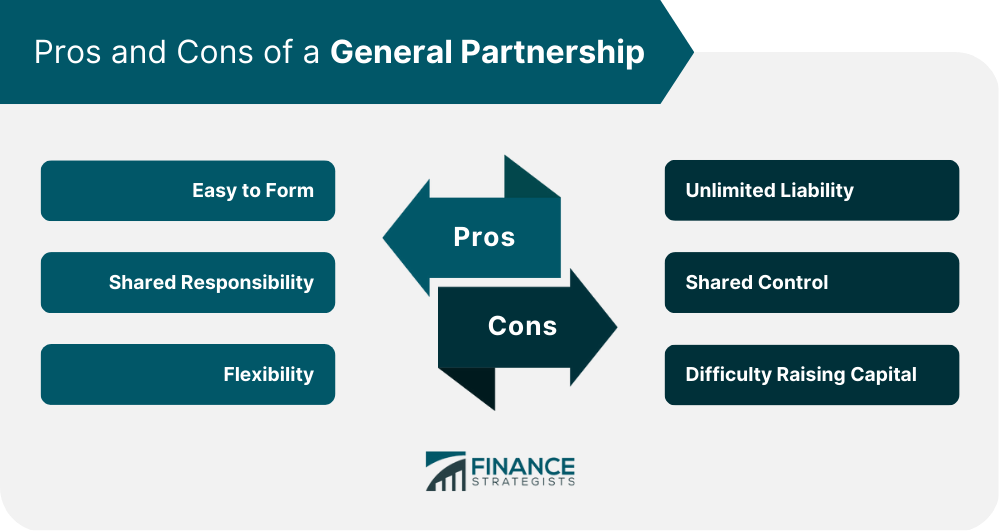

A general partnership is a type of business structure in which two or more individuals share the ownership and management of a business. This form of business is popular among small companies, where partners pool resources, skills, and expertise to achieve a common goal. In a general partnership, all partners share the business's profits, losses, and liabilities. The obligations and liabilities of a general partnership are individually liable to each partner. This implies that if the partnership faces financial issues, the partners' personal assets can be used to settle the partnership's debts. Starting a general partnership requires following the rules and regulations set forth by the state where the business operates. The rules for forming a one vary from state to state, but there are some common requirements that must be met. These include: Choosing a Business Name. Partners should choose a unique name for the business that another company in the same state does not already use. Drafting a Partnership Agreement. Partners should prepare a written agreement outlining their terms and conditions. The contract should specify each partner's responsibilities, contributions, and shares of profits and losses. Registering with the State. Partners should register their General Partnership with the state where the business is located. In a general partnership, partners are accountable for the partnership's debts and obligations, leaving them exposed to personal liability. This implies that their personal assets can be used to satisfy the partnership's debts and liabilities. Partners can mitigate their risk by securing liability insurance coverage to shield them from partnership debts and liabilities. They can have equal management rights, or they can allocate specific tasks to each partner based on their skills and expertise. Decision-making in a general partnership is typically done by consensus, and each partner has an equal say in major decisions affecting the business. A general partnership is not taxed as a separate entity. Instead, the partnership's income and losses are passed through to the partners, who report them on their individual tax returns. This means that while the partnership does not pay income taxes on its profits, the partners are taxed on their portion of the profits. Accounting for a general partnership is also flexible, and partners can choose to use either cash or accrual accounting methods. Partners are required to maintain accurate records of the partnership's income and expenses, and each partner is entitled to receive a share of the partnership's profits or losses. A general partnership can be dissolved for several reasons, such as retirement, death, bankruptcy, or disagreement between partners. When it is dissolved, the partners must wind up the business and distribute the partnership's assets and liabilities among themselves. The process of terminating a general partnership involves several steps, including notifying clients and customers, settling debts and obligations, filing final tax returns, and canceling licenses and permits. Partners should also review the partnership agreement and state laws to ensure that they comply with all requirements. General partnerships are subject to state and federal laws and regulations, and partners must comply with all requirements. Some legal and regulatory considerations for include: Fiduciary Duty. Partners owe each other a fiduciary duty to act in the best interests of the partnership and not to engage in any activity that could harm the partnership. Taxation. Partners must report their share of the partnership's profits or losses on their individual tax returns and pay taxes on their share of the profits. Workers' Compensation. Partners may be required to provide workers' compensation insurance to their employees, depending on the state in which the business operates. General partnerships are prevalent in various industries, including accounting, law, and medicine. One example of a successful General Partnership is the law firm Skadden, Arps, Slate, Meagher & Flom, which was founded in 1948 by four partners. Today, the firm has over 20 offices worldwide and is one of the most prestigious law firms in the world. However, general partnerships can also face legal and financial issues, as was the case with between Donald Trump and his former lawyer Michael Cohen. Cohen pleaded guilty to several charges, including tax evasion and campaign finance violations, which put the partnership at risk. Another example of facing legal and financial issues is the case of "In re Radcliffe Killam, L.P." in 2015. The partnership faced allegations of breaching fiduciary duties, misappropriating funds, and engaging in fraudulent conduct. The case resulted in settlement of $3.6 million, and the partnership was dissolved. A General Partnership has several advantages, including: Easy to Form. A General Partnership is easy to form and does not require complex legal documents or filings. Shared Responsibility. Partners share the responsibility of running the business, and each partner can contribute their unique skills and expertise. Flexibility. A General Partnership is a flexible business structure that allows partners to decide on the management structure, decision-making process, and division of profits and losses. However, there are also some disadvantages and risks associated with a General Partnership, including: Unlimited Liability. All partners are personally liable for the debts and obligations of the partnership. This means that each partner's personal assets can be used to pay off the partnership's debts, and one partner's actions can put all partners at risk. Shared Control. Each partner has an equal say in the management and decision-making of the business, which can lead to conflicts and disagreements. Difficulty Raising Capital. Partnerships may find it difficult to raise capital since they cannot issue stock or other equity interests. General partnerships are a popular business structure for small businesses that want to share resources, skills, and expertise to achieve a common goal. Partnerships offer several advantages, including easy formation, shared responsibility, and flexibility. However, partnerships also have risks and disadvantages, including unlimited liability and shared control. Partners considering forming a general partnership should carefully consider the pros and cons and seek advice from experts who specialize in legal and tax services to ensure that they comply with all legal and regulatory requirements.What Is General Partnership?

Formation and Registration for General Partnership

The registration process typically involves submitting the partnership agreement, paying a registration fee, and obtaining a certificate of partnership.Liability and Management in a General Partnership

Taxation and Accounting of a General Partnership

Dissolution and Termination of a General Partnership

Legal and Regulatory Considerations In a General Partnership

Examples and Case Studies of General Partnership

Pros and Cons of a General Partnership

The Bottom Line

General Partnership FAQs

A general partnership is a type of business structure in which two or more individuals share ownership and management of a business. It is different from other business structures, such as sole proprietorship, corporation, and limited liability company, because partners share the profits, losses, and liabilities of the business, and their personal assets can be used to pay off the partnership's debts.

General partnerships offer several advantages, including easy formation, shared responsibility, and flexibility. Partners can pool their resources, skills, and expertise to achieve a common goal and share the profits and losses equally.

One of the main risks of a general partnership is unlimited liability. Partners are personally liable for the debts and obligations of the partnership, and their personal assets can be used to pay off the partnership's debts. Partnerships can also face conflicts and disagreements between partners, which can lead to a breakdown of the business.

A general partnership is not taxed as a separate entity. Instead, the partnership's income and losses are passed through to the partners, who report them on their individual tax returns. This means that while the partnership does not pay income taxes on its profits, the partners are taxed on their portion of the profits.

When a general partnership is dissolved, the partners must wind up the business and distribute the partnership's assets and liabilities among themselves. The process of terminating a general partnership involves several steps, including notifying clients and customers, settling debts and obligations, filing final tax returns, and canceling licenses and permits. Partners should also review the partnership agreement and state laws to ensure that they comply with all requirements.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.