A Joint Venture, or JV, is an arrangement or partnership between two or more entities in which they pool their resources to accomplish a specific task. This may be a new project or another type of business activity. In a joint venture, each participant is responsible for the associated profits and costs, however the venture itself is its own entity, separate from the other existing businesses. Rather than merging their entire operations and forming a single entity, the parties maintain their separate identities. In essence, a joint venture is a sort of business partnership, but it typically focuses on a single, predetermined goal or project. While the collaboration might be short-lived, lasting just as long as the project, some joint ventures can span many years, especially if the parties find their partnership particularly beneficial. The purpose of a joint venture is to take advantage of the resources of multiple companies at once in order to realize greater total gains through leveraged resources and minimize costs through economies of scale. A joint venture also allows multiple companies to make use of the skills and specializations of each party. By teaming up, the companies involved can potentially gain a competitive advantage and share the risks associated with the venture, as well as the profits. This is particularly useful for projects that require significant investments or those that come with substantial uncertainties. Joint ventures also enable companies to share their unique skill sets and expertise, leading to synergistic outcomes that might be tough for a single company to achieve alone. Equity-based joint ventures are formed when the involved parties contribute assets to the JV and receive equity shares in return. Essentially, an entirely new business entity is created, with the participants owning a part of it proportional to their contributions. This kind of JV arrangement is particularly common when large projects are involved, necessitating substantial resources and capital. The equity structure also tends to ensure that all parties have a vested interest in the JV's success. In contractual joint ventures, the collaboration between the parties is established through contracts rather than the creation of a new entity. No separate business is formed; instead, specific agreements dictate the roles, responsibilities, and profit-sharing mechanisms for each partner. These JVs are flexible, often temporary, and suited for projects with a clearly defined scope and duration. Joint ventures often enable companies to penetrate new markets or enhance their distribution in markets where they already operate. Partnering with a local business can provide essential insights into consumer behaviors, market dynamics, and regulatory environments. This can make the entry smoother and more successful than trying to venture alone. Business projects often require vast resources, both in terms of capital and expertise. A JV allows companies to pool their resources, thereby reducing the financial burden on each participant. By leveraging combined resources, the JV can also potentially achieve better economies of scale and efficiency. Entering new markets or launching innovative projects comes with inherent risks. Through joint ventures, companies can distribute these risks. If the project fails, the impact on each participant is cushioned, as they only bear a portion of the losses. Moreover, JVs provide an opportunity for companies to diversify their business operations. In today's rapidly advancing technological landscape, collaboration is often the key to innovation. Companies with different technological strengths can join hands to develop groundbreaking solutions. Through JVs, they can access new technologies, share research and development costs, and speed up the innovation process. Some of the considerations when forming a joint venture are: How many parties are involved The operational scope of the venture (such as geography, technology, and the products offered) The contribution requirements of each party The joint venture's organizational structure The initial contributions and division of ownership of each party The arrangements for once the deal has been completed How the venture will be managed and staffed An example of a successful joint venture is when Google and NASA teamed up to develop Google Earth. The success of a JV often hinges on choosing the right partners. It's vital to identify companies with complementary strengths and shared objectives. Once potential partners are shortlisted, due diligence is crucial. This involves assessing the financial health, reputation, and operational capabilities of the prospective partner to ensure they're a good fit. Drafting a comprehensive agreement is the backbone of a successful JV. This document should clarify terms related to profit sharing, intellectual property rights, operational responsibilities, and more. Clear communication and negotiation skills are essential during this stage to ensure that all parties are on the same page. Deciding on the JV's structure is pivotal. As discussed earlier, this could be an equity-based JV where a new entity is formed, or a contractual JV that relies solely on agreements. The chosen structure should align with the venture's objectives and the partners' comfort levels. Clearly defining the roles and responsibilities of each partner ensures smooth functioning. Governance structures, which include decision-making processes and conflict resolution mechanisms, should also be established to guide the JV's operations and management. JVs act as a powerful tool for companies aspiring to make their mark in unfamiliar territories. The synergy of combining local know-how with global perspectives can be invaluable. For instance, when a company is trying to penetrate a new geographical region, the local partner's understanding of the culture, consumer behavior, and regulatory environment can fast-track the expansion process. This ensures that the joint venture doesn't just enter the market but thrives in it. Joint ventures often lead to a pooling of resources that wouldn't be accessible to companies individually. This goes beyond just financial resources. It encompasses technology, workforce expertise, infrastructural assets, and more. Such collaborative pooling can drastically reduce redundancies and lead to more streamlined operations, resulting in cost reductions. Moreover, shared costs mean reduced individual capital expenditure. For projects that require significant investments, this is a boon. One of the prime attractions of a JV is the shared risk model. When two or more entities collaborate on a project, the inherent risks associated with that project are distributed. This means that if the venture faces challenges or even fails, no single party has to bear the entirety of the loss. Such distribution of risk makes companies more resilient to potential business downturns. Diversification, another advantage, means companies aren't overly reliant on a single revenue stream. Joint ventures often allow companies to venture into sectors or markets different from their core business. Joint ventures can bring together companies with varied technological capabilities. Such collaborations can lead to breakthrough innovations that might be challenging for individual companies to achieve. Furthermore, shared research and development efforts can accelerate the innovation process. With combined expertise and resources, JVs can tackle bigger technological challenges, explore diverse research areas, and reduce the time-to-market for innovative solutions. When two distinct corporate cultures come together, the potential for misunderstandings is high. These differences can be subtle, such as varying communication styles or decision-making processes, or more pronounced in the case of international JVs, where differences in national cultures come into play. Such disparities can lead to inefficiencies, misaligned objectives, and even conflicts if not managed correctly. Every company enters a JV with its set of objectives and priorities. At times, these objectives might not fully align with those of the partner. Such conflicts of interest can lead to disagreements, especially when tough decisions have to be made regarding resource allocation, profit distribution, or strategic direction. Moreover, differences in management styles can exacerbate these conflicts. If one company follows a top-down management approach while the other values decentralized decision-making, friction is almost inevitable. Navigating the legal landscape of joint ventures can be challenging, especially when they span across multiple jurisdictions. Every region has its regulatory requirements, compliance mandates, and legal nuances. Ensuring that the JV adheres to all these can be a herculean task, requiring dedicated resources and expertise. Moreover, legal challenges aren't just about regulatory compliance. The terms of the JV agreement, intellectual property rights, profit-sharing mechanisms, and potential disputes all have legal implications. It's not uncommon for partners in a JV to perform at different levels. One company might consistently meet its obligations and expectations, while the other lags. Such performance disparities can strain the relationship, leading to doubts about the underperforming partner's commitment or capabilities. Additionally, every JV should have a clearly defined exit strategy. However, if the venture faces challenges or if partners have differing views on its future, exiting can become complex. Without a clear exit plan, disagreements can arise on valuation, asset distribution, and other key aspects. This can further strain the relationship and even jeopardize the JV's operations. For tax purposes, a joint venture will often involve the establishment of a new corporate entity. The IRS does not recognize joint ventures on their own, so creating another entity for the venture, such as an LLC, allows the entity to be taxed as normal. The distribution of taxes, expenses and profits are spelled out in a joint venture agreement, a written document detailing the terms of the venture. A Joint Venture (JV) is a collaborative arrangement between two or more entities to achieve a specific objective, often through shared resources and responsibilities. JVs serve the purpose of maximizing gains by leveraging resources and minimizing costs. They offer companies access to new markets, distribution networks, and technological advancements. By sharing resources and costs, JVs enhance efficiency and economies of scale. Furthermore, the risk-sharing aspect of JVs allows companies to navigate uncertain terrains with reduced individual exposure. However, JVs also come with challenges, including cultural differences, conflicts of interest, and legal complexities. Successful JVs require careful partner selection, transparent agreements, defined roles, and effective governance. The advantages of JVs, such as market expansion, resource sharing, risk mitigation, and technological innovation, make them a valuable strategy for companies seeking growth and competitive advantage in an ever-evolving business landscape.What Is a Joint Venture (JV)?

The Purpose of a Joint Venture

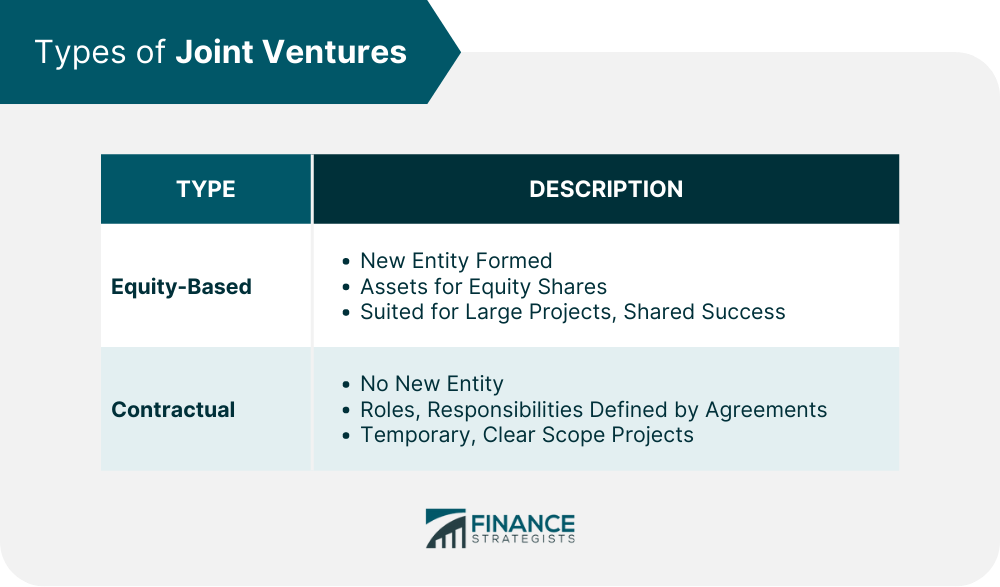

Types of Joint Ventures

Equity-Based

Contractual

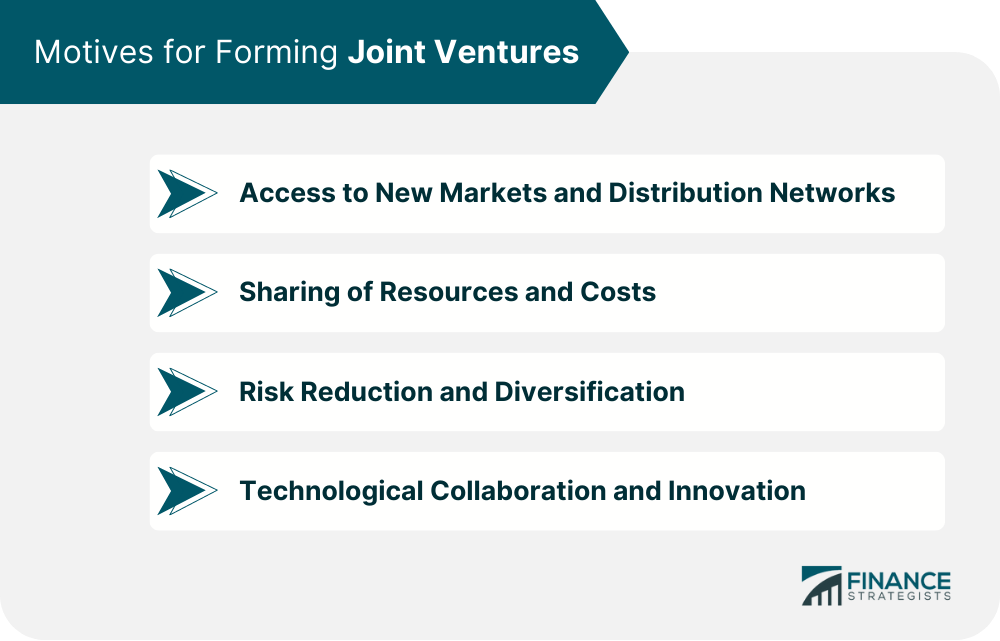

Motives for Forming Joint Ventures

Access to New Markets and Distribution Networks

Sharing of Resources and Costs

Risk Reduction and Diversification

Technological Collaboration and Innovation

Before You Form a Joint Venture

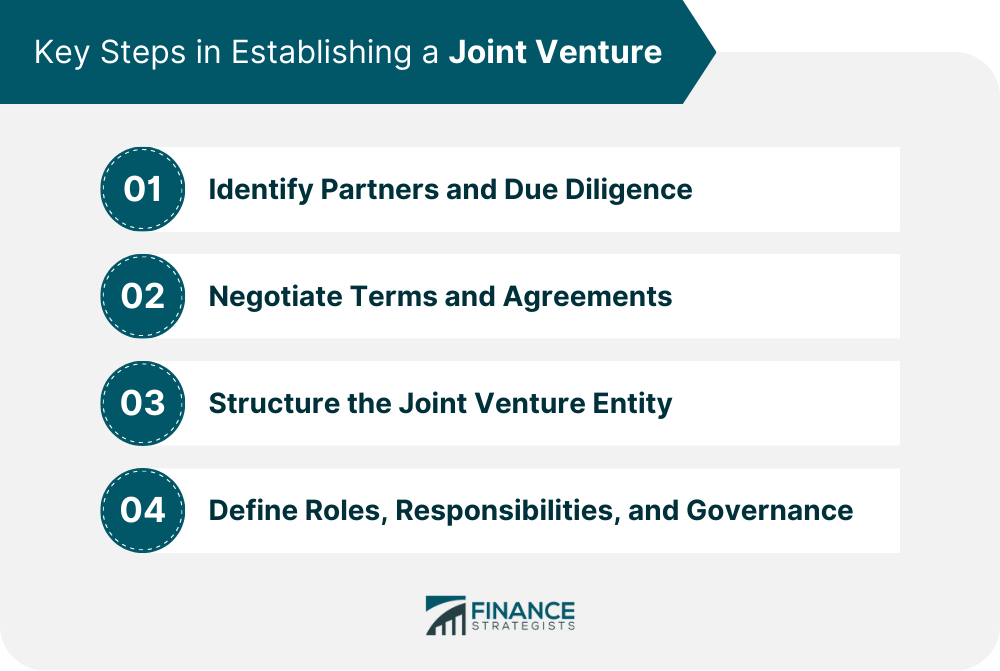

Key Steps in Establishing a Joint Venture

Identify Partners and Due Diligence

Negotiate Terms and Agreements

Structure the Joint Venture Entity

Define Roles, Responsibilities, and Governance

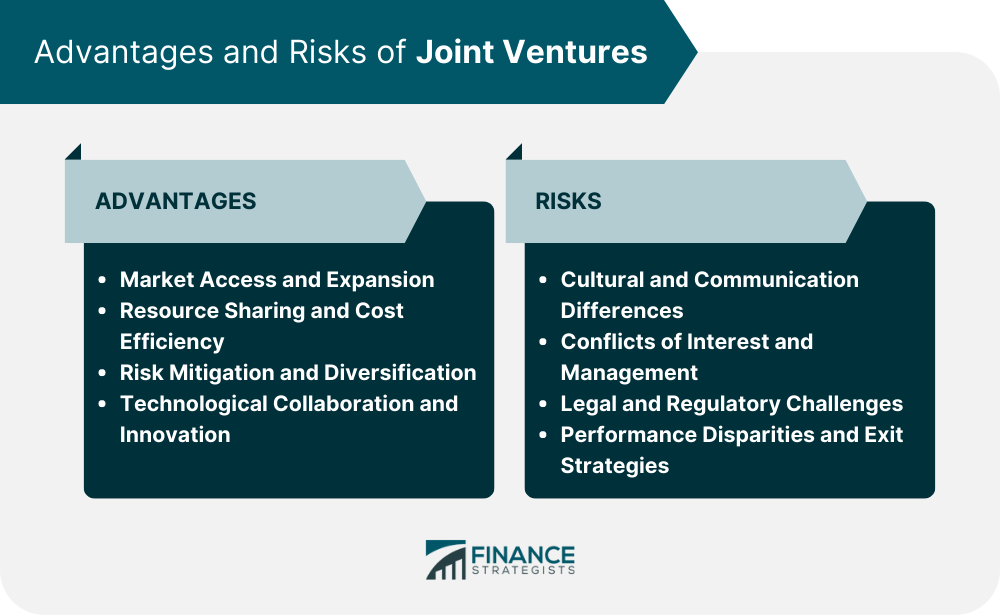

Advantages of Joint Ventures

Market Access and Expansion

Resource Sharing and Cost Efficiency

Risk Mitigation and Diversification

Technological Collaboration and Innovation

Risks of Joint Ventures

Cultural and Communication Differences

Conflicts of Interest and Management

Legal and Regulatory Challenges

Performance Disparities and Exit Strategies

How Are Joint Ventures Taxed?

Conclusion

Joint Venture (JV) FAQs

JV is an acronym for Joint Venture.

A Joint Venture, or JV, is an arrangement or partnership between two or more entities in which they pool their resources to accomplish a specific task.

The purpose of a joint venture is to take advantage of the resources of multiple companies at once in order to realize greater total gains through leveraged resources and minimize costs through economies of scale.

The IRS does not recognize joint ventures on their own, so creating another entity for the venture, such as an LLC, allows the entity to be taxed as normal.

An example of a successful joint venture would be when Google and NASA teamed up to develop Google Earth.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.