What Are Wait-and-See Buy-Sell Agreements?

A wait-and-see buy-sell agreement is a contractual arrangement between business owners that outlines the terms and conditions for the transfer of ownership interests in the event of certain triggering events, such as death, disability, or retirement.

Buy-sell agreements serve as a vital tool for businesses, allowing for smooth ownership transitions and preventing disputes among remaining owners.

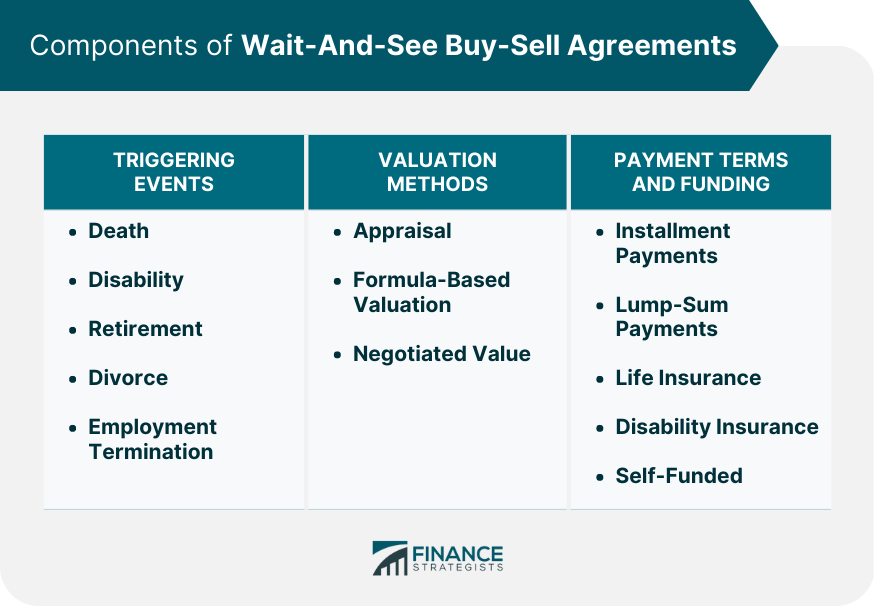

Components of Wait-And-See Buy-Sell Agreements

Triggering Events

Triggering events are occurrences that activate the buy-sell agreement provisions. These events may include:

1. Death: The death of an owner may require the remaining owners or the business itself to buy out the deceased owner's shares.

2. Disability: If an owner becomes disabled and is no longer able to contribute to the business, the buy-sell agreement may be activated.

3. Retirement: An owner's retirement may trigger the buy-sell agreement to facilitate the transfer of their ownership interests.

4. Divorce: Divorce may necessitate the division of ownership interests, prompting the implementation of the buy-sell agreement.

5. Termination of Employment: If an owner's employment is terminated, the buy-sell agreement may be triggered to address the transfer of ownership interests.

Valuation Methods

Wait-and-see buy-sell agreements allow for various valuation methods:

1. Appraisal: An independent appraiser may be hired to determine the fair market value of the business.

2. Formula-Based Valuation: A predetermined formula may be used to calculate the value of the business, such as a multiple of earnings or revenue.

3. Negotiated Value: The parties may negotiate the value of the business at the time of the triggering event.

Payment Terms and Funding

Payment terms and funding options may include:

1. Installment Payments: The purchase price may be paid over a specified period.

2. Lump-Sum Payments: The purchase price may be paid in a single payment.

3. Life Insurance: Life insurance policies may be used to fund the buyout in the event of death.

4. Disability Insurance: Disability insurance may be used to fund the buyout in the event of disability.

5. Self-Funded: The remaining owners or the business itself may fund the buyout using cash or other assets.

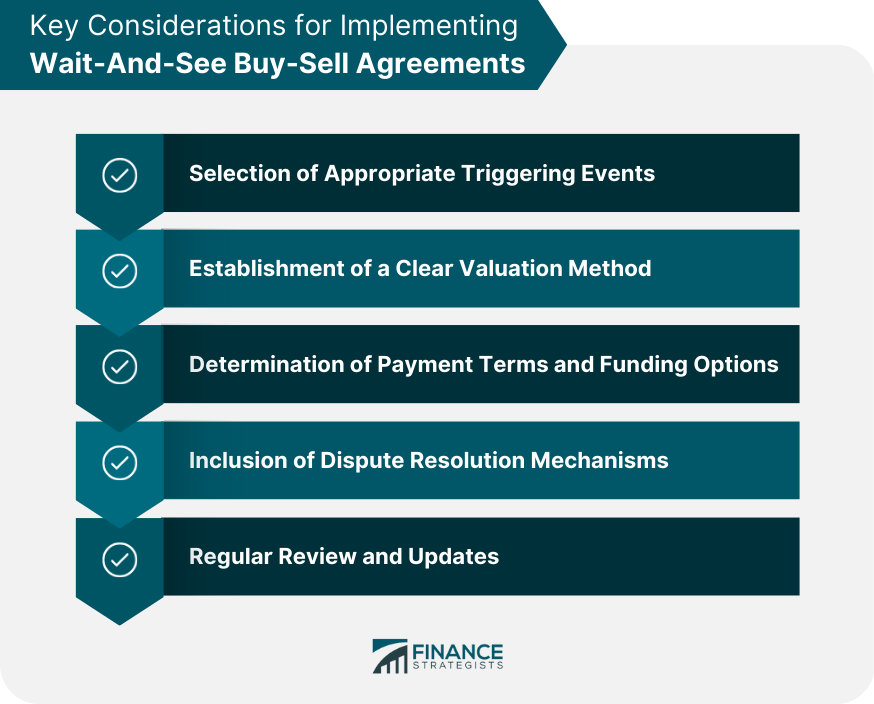

Key Considerations for Implementing Wait-And-See Buy-Sell Agreements

Selection of Appropriate Triggering Events

It is essential to carefully choose triggering events that suit the specific needs and circumstances of the business and its owners.

Establishment of a Clear Valuation Method

To minimize disputes and provide clarity, the parties should agree on a well-defined valuation method for determining the value of the business at the time of the triggering event.

Determination of Payment Terms and Funding Options

The parties must establish payment terms and funding options that align with the financial capabilities of the remaining owners and the business.

Inclusion of Dispute Resolution Mechanisms

To address potential disputes, it is advisable to include dispute resolution mechanisms, such as mediation or arbitration, in the buy-sell agreement.

Regular Review and Updates

Given the potential for changing business circumstances, it is essential to regularly review and update the wait-and-see buy-sell agreement to ensure its continued relevance and effectiveness.

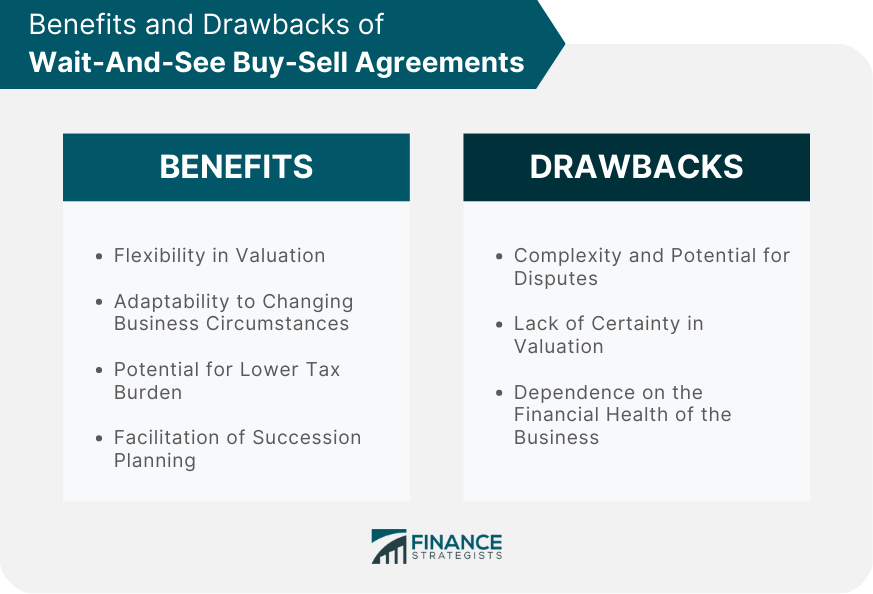

Advantages of Wait-And-See Buy-Sell Agreements

Flexibility in Valuation

Wait-and-see agreements provide flexibility in determining the value of the business at the time of the triggering event, allowing the parties to account for changing market conditions and business performance.

Adaptability to Changing Business Circumstances

The wait-and-see approach enables the parties to adjust the terms of the agreement as needed, ensuring that the buyout provisions remain relevant and appropriate as the business evolves.

Potential for Lower Tax Burden

By negotiating the value of the business at the time of the triggering event, the parties may be able to minimize their tax liability.

Facilitation of Succession Planning

Wait-and-see buy-sell agreements can facilitate succession planning by providing a clear roadmap for the transfer of ownership interests in the event of a triggering event.

Disadvantages of Wait-And-See Buy-Sell Agreements

Complexity and Potential for Disputes

The flexibility and adaptability of wait-and-see agreements can result in increased complexity and a higher likelihood of disputes, particularly if the valuation method is not clearly defined.

Lack of Certainty in Valuation

Unlike fixed-price or formula-based agreements, wait-and-see agreements do not provide a predetermined value for the business, which can create uncertainty for the parties involved.

Dependence on the Financial Health of the Business

Wait-and-see agreements often rely on the financial health of the business or the remaining owners to fund the buyout, which can be problematic if the business experiences financial difficulties.

Comparing Wait-And-See Buy-Sell Agreements With Other Types

Fixed-Price Agreements

Pros and Cons

Fixed-price agreements offer simplicity and predictability, as the value of the business is predetermined. However, they may become outdated and fail to accurately reflect the business's current value, leading to potential disputes and unfair buyout prices.

Suitability for Different Businesses

Fixed-price agreements are typically more suitable for small, stable businesses with predictable growth patterns and limited fluctuations in value.

Formula-Based Agreements

Pros and Cons

Formula-based agreements provide a more flexible valuation method than fixed-price agreements, as they rely on a predetermined formula that accounts for various factors.

However, the chosen formula may not always accurately reflect the business's value, particularly if there are significant changes in the market or the business's performance.

Suitability for Different Businesses

Formula-based agreements are generally appropriate for businesses with more predictable financial performance and those operating in stable industries.

Bottom Line

The wait-and-see buy-sell agreement is a contractual arrangement between business owners that outlines the terms and conditions for the transfer of ownership interests in the event of triggering events such as death, disability, or retirement.

It allows for flexibility in valuation, adaptability to changing business circumstances, and succession planning. However, it can result in complexity, lack of certainty in valuation, and dependence on the financial health of the business.

Key considerations for implementing wait-and-see buy-sell agreements include selecting appropriate triggering events, establishing a clear valuation method, and determining payment terms and funding options.

Included as well are dispute resolution mechanisms, and regularly reviewing and updating the agreement.

Wait-and-see agreements can be compared with fixed-price agreements and formula-based agreements, with each having its own pros and cons and being more suitable for different types of businesses.

Engaging legal and financial advisors in the creation and implementation of a successful agreement is crucial to safeguard the interests of all parties involved.

Wait-And-See Buy-Sell Agreements FAQs

A wait-and-see buy-sell agreement is a type of buy-sell agreement where the price and terms of a sale are not determined at the time of the agreement. Instead, the price is determined at a future date based on a predetermined formula or valuation method. This approach is often used when the value of the business is uncertain, and the parties want to wait and see how the business develops before setting a price.

In a wait-and-see buy-sell agreement, the parties agree to a valuation formula or method that will be used to determine the price at a future date. This could be a multiple of earnings, a percentage of revenue, or some other formula. When the trigger event occurs (such as the death or retirement of one of the owners), the parties will use the predetermined formula to calculate the price of the business at that time.

One advantage of a wait-and-see buy-sell agreement is that it allows the parties to defer setting a price until the value of the business is clearer. This can be useful if the business is still in its early stages or if there is uncertainty around future earnings. Additionally, because the price is predetermined, it can help avoid disputes between the parties over the value of the business.

One disadvantage of a wait-and-see buy-sell agreement is that it can be difficult to agree on a valuation formula or method that is fair to all parties. Additionally, if the formula or method is not well-crafted, it can lead to disputes over the value of the business at the time of the trigger event. Finally, because the price is not determined until a future date, it can be challenging to plan for the financial implications of the sale.

A wait-and-see buy-sell agreement is appropriate when the parties are unsure of the value of the business and want to wait and see how it develops before setting a price. This can be useful in situations where the business is still in its early stages or if there is uncertainty around future earnings. Additionally, if the parties are having difficulty agreeing on a price, a wait-and-see agreement can be a way to avoid disputes and move forward with the sale.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.