Donor-Advised Funds (DAFs) are philanthropic giving vehicles that enable corporations to make charitable contributions, receive immediate tax benefits, and recommend grants to nonprofit organizations over time. These funds allow corporations to streamline their philanthropic efforts, manage charitable assets, and make strategic grant recommendations. DAFs have become increasingly popular due to their flexibility, ease of use, and tax advantages. DAFs offer several advantages, including tax benefits, simplified administration, and flexibility in grantmaking. Corporations can enjoy immediate tax deductions for their contributions, reduced administrative burdens, and the ability to make grants anonymously. However, there are also disadvantages, such as a lack of direct control over grantmaking decisions and potential criticism for warehousing charitable assets without distributing them to nonprofits in a timely manner.

A sponsoring organization is a public charity that manages and administers DAFs. Corporations should choose a sponsor based on their philanthropic goals, investment options, fees, and grantmaking support. Some popular sponsoring organizations include community foundations, single-issue charities, and national DAF providers. The fund agreement is a legal document that outlines the terms and conditions of the DAF. It typically includes details about the fund's purpose, management, and administration. Corporations should work closely with their legal counsel and the sponsoring organization to ensure the agreement aligns with their philanthropic objectives and complies with relevant laws and regulations. To establish a DAF, corporations must make an initial contribution, which can be in the form of cash, stocks, or other assets. The minimum contribution varies depending on the sponsoring organization. Corporations can continue to contribute to the fund over time, with each contribution eligible for a tax deduction. DAF contributions are tax-deductible, providing corporations with immediate tax benefits. Deductions are typically limited to a certain percentage of the corporation's taxable income, and any excess can be carried forward for up to five years. Sponsoring organizations typically offer various investment options for DAFs, including mutual funds, exchange-traded funds, and socially responsible investments. Corporations should consider their risk tolerance, time horizon, and philanthropic goals when selecting an investment strategy to grow their charitable assets and support future grantmaking. Corporations can recommend grants from their DAF to qualified nonprofit organizations. Grant recommendations are subject to the sponsoring organization's approval, and corporations should be aware of any restrictions or guidelines set by the sponsor. Establishing clear grantmaking policies can help ensure that the corporation's philanthropic objectives are met and maintained. DAFs typically involve administrative fees and expenses, such as management and investment fees. These fees can vary depending on the sponsoring organization and the size of the fund. Corporations should carefully consider the fee structure when selecting a sponsoring organization to ensure transparency and cost-effectiveness. DAFs can play a crucial role in a corporation's overall social responsibility strategy by aligning philanthropic efforts with corporate values and objectives. By targeting specific causes or geographic areas, corporations can create a positive social impact and demonstrate their commitment to the communities in which they operate. Involving employees in the management and grantmaking process of a DAF can boost morale, foster a sense of community, and promote a culture of giving within the corporation. Employee participation can take various forms, such as volunteer opportunities, matching gift programs, and grant recommendation committees. This engagement can lead to increased job satisfaction and help attract and retain top talent. A well-managed DAF can enhance a corporation's reputation by demonstrating its commitment to social responsibility and community engagement. By supporting various charitable causes and making a positive impact on society, corporations can improve their public image and foster goodwill among stakeholders, customers, and employees. DAFs must comply with Internal Revenue Service (IRS) rules and regulations to maintain their tax-exempt status. Corporations should be aware of the requirements for tax deductions, restrictions on grant recipients, and reporting obligations. Working with legal counsel and the sponsoring organization can help ensure compliance with all relevant regulations. Corporations must ensure that their DAF grants do not support organizations or activities that are prohibited under anti-terrorism laws. Sponsoring organizations typically conduct due diligence on grant recipients to verify their legal status and ensure compliance with these laws. It is crucial for corporations to understand and adhere to these requirements to avoid potential legal consequences. DAFs must avoid self-dealing and conflicts of interest to maintain their tax-exempt status. Self-dealing occurs when a DAF provides benefits to the corporation or its insiders, such as executives or board members. Corporations should establish clear policies and procedures to prevent self-dealing and address any conflicts of interest that may arise. To ensure that DAF grants are effectively supporting charitable causes, corporations should monitor the performance of grant recipients. This can involve tracking progress toward defined goals, conducting site visits, and reviewing financial and programmatic reports. Monitoring can help corporations identify successful grantees, inform future grantmaking decisions, and ensure the efficient use of charitable assets. Assessing the social and environmental outcomes of DAF grants can help corporations understand the impact of their philanthropic efforts and communicate their achievements to stakeholders. Establishing clear metrics and evaluation criteria can provide valuable insights into the effectiveness of grants and inform future grantmaking strategies. Transparency in the management and administration of a DAF is essential for building trust with stakeholders and demonstrating accountability. Corporations should provide regular updates on their grantmaking activities, financial performance, and the impact of their philanthropic efforts. Clear and consistent reporting can help strengthen the corporation's reputation and foster public trust. Some corporations have leveraged their DAFs to develop innovative approaches to philanthropy, such as supporting social enterprises, impact investing, or cross-sector collaborations. Examining successful case studies can provide valuable insights and inspiration for corporations looking to maximize the impact of their philanthropic efforts. Successful DAFs often involve close collaboration with nonprofit organizations to develop targeted, high-impact programs. By partnering with nonprofits, corporations can leverage their expertise and resources to address complex social and environmental issues more effectively. Corporations can use their unique skills, resources, and expertise to enhance the impact of their DAF grants. This can involve providing pro bono services, technical assistance, or employee volunteer support to grant recipients. Leveraging corporate expertise can lead to more significant, sustainable outcomes and help nonprofits build capacity for long-term success. As technology continues to evolve, digital solutions will likely play a more significant role in the management and administration of DAFs. Advances in data analytics, artificial intelligence, and blockchain technology can streamline grantmaking processes, enhance transparency, and improve impact measurement. Embracing these technological advancements can help corporations stay at the forefront of philanthropic innovation. The philanthropic landscape is constantly changing, with new approaches and models emerging to address complex social and environmental challenges. DAFs will need to adapt to these changes and stay informed about emerging trends, such as impact investing, venture philanthropy, and the growth of the global philanthropy ecosystem. Staying current with industry trends can help corporations remain relevant and effective in their philanthropic efforts. As DAFs continue to grow in popularity and sophistication, there will be increasing opportunities for collaboration with other stakeholders in the philanthropic sector. This can include partnerships with other corporations, government agencies, and nonprofit organizations to tackle shared challenges and amplify their collective impact. By pursuing strategic collaborations, corporations can unlock new opportunities for growth and maximize the potential of their donor-advised funds.What Are Donor-Advised Funds?

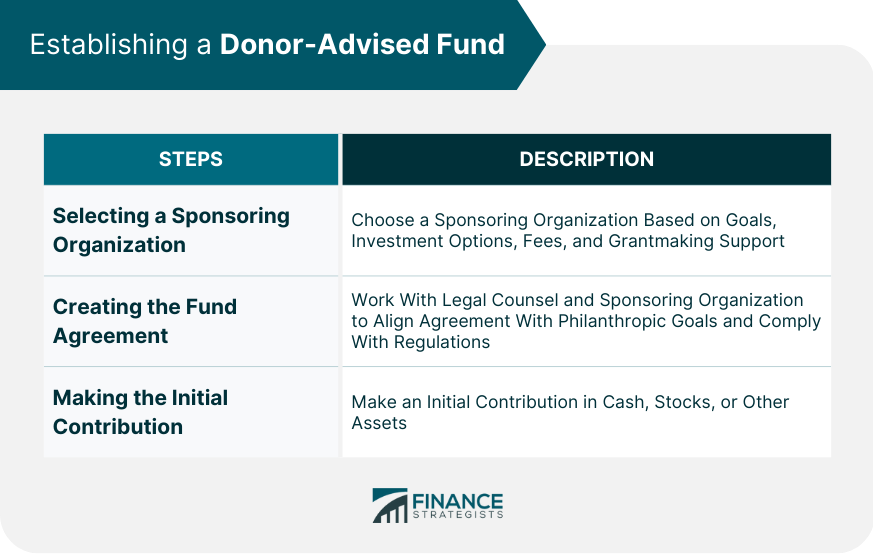

Establishing a Donor-Advised Fund

Selecting a Sponsoring Organization

Creating the Fund Agreement

Making the Initial Contribution

Managing a Donor-Advised Fund

Tax Implications and Benefits

Investment Options and Strategies

Grantmaking Policies

Administrative Fees and Expenses

Corporate Social Responsibility and Donor-Advised Funds

Aligning Corporate Values with Philanthropic Goals

Employee Engagement and Participation

Enhancing Corporate Reputation

Legal and Regulatory Considerations

IRS Rules and Regulations

Compliance With Anti-Terrorism Laws

Preventing Self-Dealing and Conflicts of Interest

Evaluating the Impact of Donor-Advised Funds

Monitoring Grantee Performance

Measuring Social and Environmental Outcomes

Reporting and Transparency

Case Studies: Successful Donor-Advised Funds

Innovative Approaches to Philanthropy

Collaboration With Nonprofit Organizations

Leveraging Corporate Expertise for Greater Impact

Final Thoughts

Donor-Advised Fund (DAF) FAQs

A donor-advised fund (DAF) is a charitable giving vehicle that allows donors to make tax-deductible contributions to a fund held by a sponsoring organization, which then distributes the funds to charities chosen by the donor.

To establish a DAF, a donor makes an initial contribution to the fund, which is held by a sponsoring organization. The donor can then recommend grants to eligible charities over time, and the sponsoring organization makes the distributions to those charities.

DAFs offer several benefits, including immediate tax benefits for the donor, flexibility in grantmaking, and the ability to simplify record-keeping and reduce administrative burdens associated with direct giving.

Some limitations to consider include restrictions on the types of assets that can be contributed, minimum contribution amounts, and fees associated with the management of the fund.

DAFs can be established by individuals, families, corporations, and other entities. However, it is important to note that certain sponsoring organizations may have specific eligibility criteria or minimum contribution requirements.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.