The Goods and Services Tax (GST) is a comprehensive indirect tax levied on the supply of goods and services in a country. It is designed to replace multiple existing taxes like sales tax, value-added tax (VAT), excise duty, and service tax, streamlining the tax structure. GST aims to create a unified and efficient tax system by taxing the value addition at each stage of the supply chain. It eliminates the cascading effect of taxes, where taxes are levied on taxes, leading to a fairer and more transparent taxation process. GST has various components, including taxable goods, taxable services, input tax credit, and different tax rates for different goods and services. While it offers benefits like reducing tax evasion and improving compliance, its implementation can also pose challenges such as initial disruptions, sector-specific impacts, administrative complexities, and technological hurdles. The primary objective of GST is to subsume multiple indirect taxes into a unified tax structure, thereby eliminating the complexities of differing state and central tax regimes. By doing this, GST aims to ensure a seamless flow of credit across the value chain and across states, fostering a harmonized national market for goods and services. Moreover, GST seeks to broaden the tax base, enhance tax compliance, and boost revenue for the government. Under the GST framework, taxable goods refer to tangible items that are subject to the tax. This encompasses a wide range of products, from daily consumables to luxury items, unless they are specifically exempted. The tax rate on these goods may vary based on their classification, with essential goods attracting lower rates and luxury or sin goods being taxed at higher rates. Taxable services, as the term suggests, pertain to a wide range of services that come under the purview of GST. These include professional services, hospitality services, entertainment, and many more. Just like with taxable goods, the GST rates on services might differ based on their categorization. One of the foundational pillars of the GST system is the mechanism of the Input Tax Credit (ITC). This allows businesses to claim credit for the tax paid on the purchase of goods and services, which are then used to provide taxable goods or services. By ensuring that tax is only paid on the value added at each stage of the supply chain, the ITC system minimizes the cascading effect of tax. Within the GST system, there are certain goods and services that are either exempted from tax or are taxed at a zero rate. Exempted supplies refer to those goods or services that are outside the scope of GST, meaning no tax is levied on them. On the other hand, zero-rated supplies are those on which a 0% GST rate applies. While no tax is charged on these supplies, businesses can still claim ITC on their inputs. One of the most notable advantages of GST is that it offers a streamlined tax structure, eliminating the myriad of indirect taxes that were present before its implementation. By combining multiple taxes into one, GST reduces the complexities for businesses, making tax compliance and administration simpler and more efficient. GST, with its Input Tax Credit mechanism, effectively reduces the cascading effect of tax. This cascading effect is often referred to as tax on tax. It was a significant challenge under the previous tax regime, where businesses were taxed at every stage of the production or service delivery process without any provision to offset the previous tax paid. The GST system, built on a robust digital infrastructure, has paved the way for improved tax compliance. Through its centralized and digitized system, tracking transactions and ensuring compliance has become easier for tax authorities. Furthermore, the transparency offered by GST has reduced the chances of tax evasion and bolstered government revenues. By subsuming multiple state and central taxes and ensuring consistent tax rates, GST has removed inter-state barriers, enabling smoother movement of goods and services across the country. The shift to the GST regime was not without its initial hiccups. The transition to a new tax system led to disruptions in business operations as they adapted to new compliance requirements and processes. Firms had to reconfigure their accounting and IT systems, retrain personnel, and reorient supply chain arrangements, which consumed time and resources. While some industries, like logistics and manufacturing, largely benefited from a uniform tax regime, others, such as textiles and real estate, faced challenges due to the specifics of the tax rates and structures applied to them. This uneven impact led to concerns and demands for rate revisions in certain sectors. The introduction of GST necessitated a massive overhaul of the existing tax administration systems. There were technical glitches in the GST Network (GSTN), causing delays and difficulties in filing returns. Smaller businesses, in particular, found it challenging to adapt to the digitized processes, given the limited access and familiarity with technology. While GST aimed to ensure a more equitable distribution of the tax burden, certain decisions on tax slabs and categorizations raised eyebrows. The differentiation of products into luxury and necessity, and subsequently deciding their tax brackets, led to debates on what constitutes a luxury versus a necessity, especially with items like sanitary napkins initially being taxed at a higher rate. The immediate aftermath of GST saw a slight uptick in inflation, primarily because of the uncertainty and initial price hikes as businesses adjusted to the new tax structure. However, as the system stabilized, inflationary pressures were largely moderated, with the uniform tax system potentially acting as a deterrent to arbitrary price hikes. In the short term, there was a contraction in the economic growth rate post-GST implementation, attributed to transitional disruptions. But as businesses adjusted to the new regime and the advantages of GST began to manifest, India's GDP growth showed signs of recovery and stabilization, with experts attributing potential long-term growth benefits to the streamlined tax system. Initially, consumers faced increased prices on certain goods and services, leading to changes in purchasing behaviors. However, as input tax credits started reflecting in final product pricing and services and businesses passed on benefits to consumers, spending patterns began to normalize. The transparency in taxation also led to increased consumer confidence in the long run. The Goods and Services Tax (GST) is a comprehensive indirect tax on the supply of goods and services. GST replaces multiple pre-existing taxes, streamlining the tax structure and reducing complexities. Its primary purpose is to unify diverse state and central tax systems, fostering a harmonized national market for goods and services. Despite its promising advantages, such as streamlined tax structure and reduction of tax cascading, the implementation of GST has not been without challenges. Initial disruptions and sector-specific impacts marked the transition, while administrative and technological hurdles posed difficulties, particularly for smaller businesses. Furthermore, ensuring an equitable distribution of the tax burden and adjusting to new categorizations fueled debates. Economically, while inflation and GDP growth experienced fluctuations in the short term, GST's streamlined approach and transparency gradually brought stability and potential long-term benefits to India's economy.Definition of the Goods and Services Tax (GST)

Purpose of GST

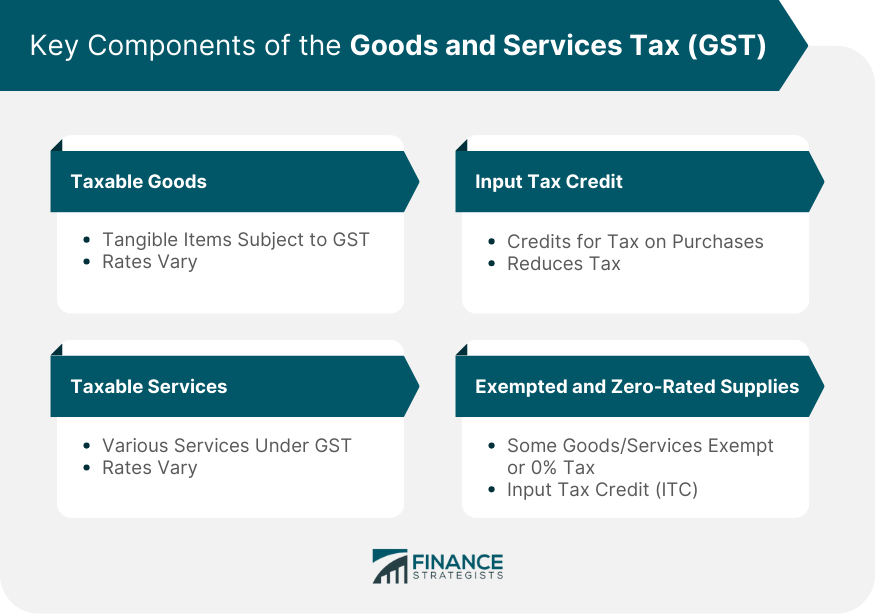

Key Components of GST

Taxable Goods

Taxable Services

Input Tax Credit

Exempted and Zero-Rated Supplies

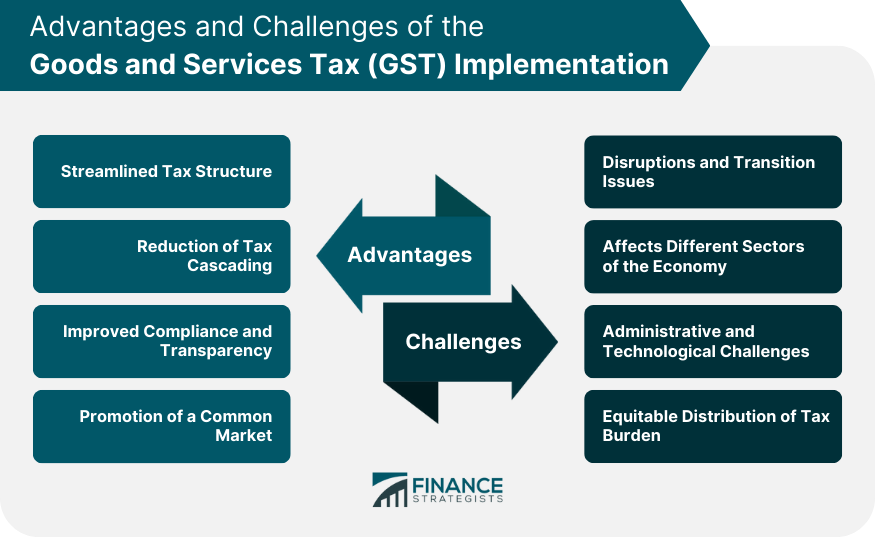

Advantages of GST Implementation

Streamlined Tax Structure

Reduction of Tax Cascading

Improved Compliance and Transparency

Promotion of a Common Market

Challenges of GST Implementation

Disruptions and Transition Issues

Affects Different Sectors of the Economy

Administrative and Technological Challenges

Equitable Distribution of Tax Burden

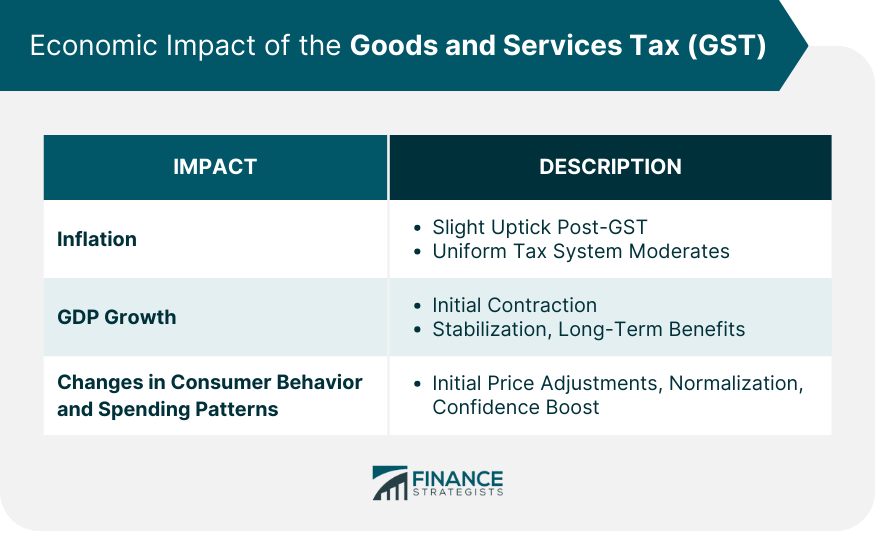

Economic Impact of GST

Inflation

GDP Growth

Changes in Consumer Behavior and Spending Patterns

Conclusion

Goods and Services Tax (GST) FAQs

The primary objective of GST is to consolidate multiple indirect taxes into a unified tax structure, simplifying tax compliance and ensuring a seamless credit flow across the value chain.

GST introduces the mechanism of Input Tax Credit (ITC), allowing businesses to claim credit for tax paid on purchases, ensuring that tax is levied only on value addition at each stage.

Different sectors had unique business models and tax considerations. The introduction of GST brought about changes in tax rates and structures which affected sectors differently. Some faced higher tax burdens while others grappled with understanding and implementing the new regulations.

There was a temporary uptick in inflation post-GST implementation due to initial adjustments. However, the effect moderated over time as the system stabilized.

While there was a short-term contraction in GDP growth post-GST, the long-term prospects are positive due to the creation of a unified, streamlined tax system that promotes ease of doing business.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.