The tax filing process, albeit often considered daunting, is a fundamental aspect of financial life in most nations, including the United States. Every year, individuals and corporations submit information about their income, deductions, and credits to their country's tax authority. This process helps determine whether they've paid the appropriate amount of taxes throughout the year or if they owe additional funds (or are due for a refund). The importance of tax filing cannot be understated. It funds essential public services, ensures financial transparency, and helps individuals maintain legal compliance. Understanding this process can not only keep you on the right side of the law but may also help you take full advantage of the various tax benefits available. The tax year in the U.S. runs from January 1 to December 31 for most individuals, but some taxpayers can use a fiscal year or a 52-53-week tax year that varies from 52 to 53 weeks. The deadline for submitting your tax return is typically April 15 of the following year, but it may vary depending on holidays or weekends. You’ll need personal identification details like your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) if you don’t have an SSN. You’ll need income statements such as W-2s or 1099s from your employers or other sources of income, not just from your employers. You’ll need records of deductible expenses (like charitable donations or business expenses) if you choose to itemize your deductions instead of taking the standard deduction. The U.S. tax system recognizes several filing statuses, such as Single, Married Filing Jointly, Head of Household, and others. Your status can influence the amount of tax you owe. Choosing the correct filing status is crucial because it impacts the standard deduction amount and the tax rates applicable to your taxable income. If you select the wrong status, it could lead to inaccuracies in your tax calculation. Manual Route Filing taxes manually involves filling out Form 1040, which replaced Form 1040A and 1040EZ for tax years after 2017. This form must be completed accurately and mailed to the IRS at the correct address. Tax software can simplify the filing process, reduce the risk of errors, and help you maximize your tax deductions and credits. Popular tax software options include TurboTax, H&R Block, and TaxAct, each with its unique benefits and cost structures. If your tax situation is complex, it might be beneficial to hire a tax professional. They can help ensure accuracy, provide tax planning advice, and represent you before the IRS if needed. Be sure to choose a reputable professional with relevant tax experience and qualifications. The process of computing your taxable income involves a bit of arithmetic. Start with your total income for the year, which includes all earned wages, tips, dividends, or other sources of revenue. From this sum, you'll subtract eligible deductions. These can be standard deductions or itemized deductions, depending on what benefits you more. You'll also subtract any personal exemptions you're entitled to. The result is your taxable income, the base on which your tax due is calculated. To fully comprehend how your tax is calculated, you'll need to grasp the U.S. progressive tax system, characterized by marginal tax rates. As your taxable income increases, so too does the rate at which the surplus is taxed, segmented into "tax brackets." This approach to taxation ensures that those with higher incomes pay more tax proportionally. Familiarizing yourself with these tax brackets and where your income lies within them can help you predict your tax liability with more accuracy. Deductions and credits are mechanisms that can considerably lower your tax bill. Deductions work by reducing the amount of your income that's subject to tax. These can include expenses like mortgage interest, state and local taxes, and charitable contributions. Credits, on the other hand, reduce your actual tax liability, dollar for dollar. Examples include the Earned Income Tax Credit (EITC) or Child Tax Credit. Applying these effectively can lead to significant tax savings, so it's worth exploring what you qualify for each tax year. IRS Payment Plans: If you find yourself unable to pay your tax bill in full, the IRS offers payment plans, allowing you to settle your tax debts over time. Explore Other Options: You can also consider other options, such as using a credit card or getting a personal loan, to pay your taxes. However, you should be careful about the possible impact on your credit score and the interest charges you might incur. It's essential to be meticulous when reporting your income on your tax return. This includes all sources of revenue, such as full-time or part-time employment, self-employed earnings, dividends, interest, and more. Under-reporting or overlooking some income streams, even unintentionally, can invite unwanted attention from the IRS, potentially leading to an audit or penalties. Keep a thorough record of all your income sources throughout the year to ensure accuracy. Don't miss out on money-saving opportunities. It's worth taking the time each year to assess your eligibility for tax deductions and credits. As tax laws or your personal circumstances evolve, so might the deductions and credits available to you. Stay informed and utilize these tax-relief measures to reduce your taxable income or your tax due. When it comes to tax filing, accuracy is paramount. Mistakes or discrepancies in your tax forms, such as math errors or inconsistent information, could delay your tax refund or, worse, trigger an IRS audit. Cross-check all your inputs, make use of tax software that can catch errors, or hire a tax professional to ensure everything is in order. One of the cardinal rules in tax filing is meeting the deadline, typically April 15th. Filing your tax return late can lead to penalties and additional interest charges. It's advisable to file on time, even if you can't immediately pay the full tax due. You can arrange for a payment plan with the IRS if necessary, but avoiding late-filing penalties should be a priority. Tax filing, although perceived as complex, is an indispensable component of one's financial responsibilities. The process begins with understanding the tax calendar and gathering necessary details like personal identification, income statements, and records of deductions and credits. The importance of choosing the correct tax status is paramount, as it significantly impacts your taxable income and tax rates. Filing methods vary from manual to digital software or even hiring a tax professional based on the complexity of your tax situation. Knowledge of tax brackets and the effective application of deductions and credits can considerably reduce your tax liability. Remember, if you cannot pay your taxes, the IRS offers payment plans, among other options. Lastly, steer clear of common mistakes, such as under-reporting income or overlooking eligible deductions, ensuring accuracy, and meeting the tax filing deadline. With a good grasp of these facets, the tax filing process can be less daunting and more rewarding.Overview of the Tax Filing Process

How to Start Filing Your Taxes

Understand the Tax Calendar

Gather the Necessary Information

Understand Tax Status

Determine File Status

Make the Right Choice

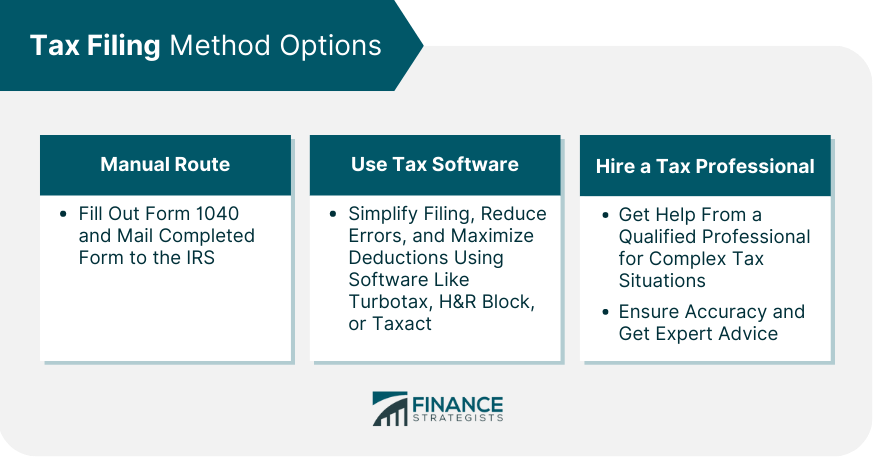

Choose a Tax Filing Method

Manual Route

Use Tax Software

Hire a Tax Professional

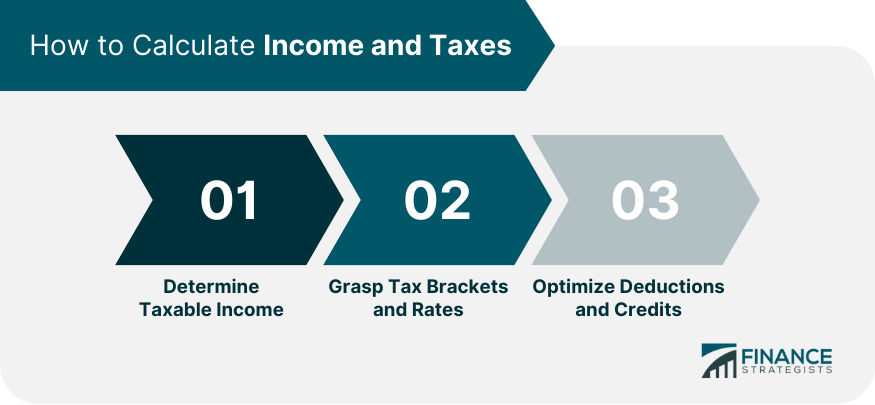

Calculation of Income and Taxes

Determine Taxable Income

Grasp Tax Brackets and Rates

Optimize Deductions and Credits

What to Do if You Can’t Pay Your Taxes

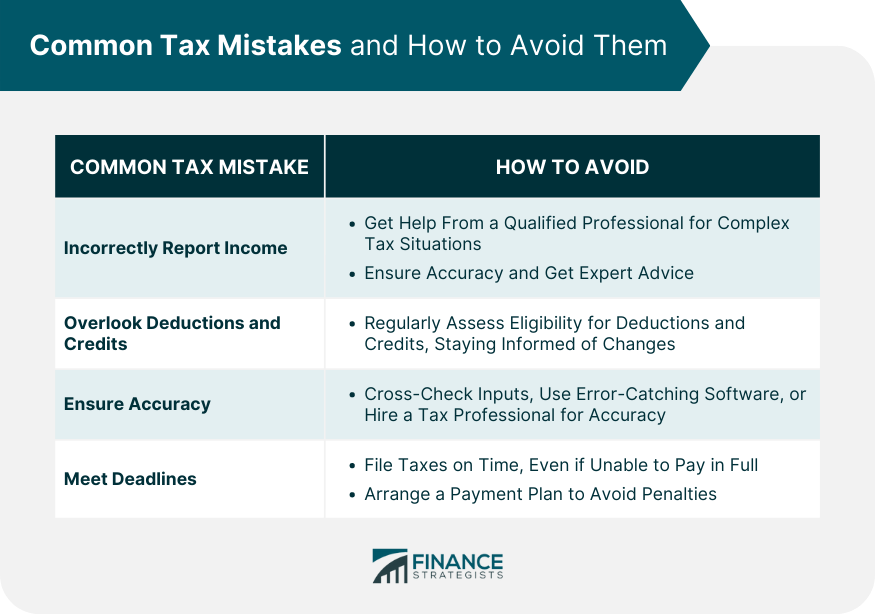

Common Tax Mistakes and How to Avoid Them

Incorrectly Report Income

Overlook Eligible Deductions and Credits

Ensure Accuracy

Meet Deadlines

Bottom Line

How to File Taxes FAQs

You'll need personal identification details like your Social Security Number, income statements such as W-2s or 1099s, records of deductible expenses (like charitable donations or business expenses), and details of any tax credits or exemptions you're eligible for.

Your filing status affects the standard deduction amount and the tax rates applicable to your taxable income. Selecting the correct status is crucial for an accurate tax calculation.

Tax software can simplify the filing process, reduce the risk of errors, and help you maximize your tax deductions and credits. It's often a more convenient option compared to manual filing.

If you can't pay your taxes in full, consider applying for an IRS payment plan, which allows you to settle your tax debts over time. Alternatively, you could explore other options like personal loans or using a credit card, but be mindful of potential interest charges and credit score implications.

Common mistakes include incorrectly reporting income, overlooking eligible deductions and credits, making mathematical errors, and missing the tax filing deadline. Ensuring accuracy, understanding your eligibility for deductions and credits, and filing on time can help avoid these errors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.