Do You Have to File Taxes for Financial Aid?

When applying for financial aid, particularly for federal programs like those accessed through the Free Application for Federal Student Aid (FAFSA), your tax return often plays a pivotal role.

This return provides a comprehensive overview of your financial situation, helping to determine your aid eligibility and amount.

In many cases, a recent tax return is required. However, exceptions exist. If your income is below the IRS filing threshold, or if you fall under specific categories, such as certain non-resident aliens, you might not need to submit a tax return with your financial aid application.

However, it's crucial to differentiate between not being required to file due to low income and choosing not to file despite having a taxable income.

The former might be acceptable for financial aid purposes, while the latter can complicate your aid eligibility. Always consult with a financial aid office or tax professional for guidance tailored to your situation.

Understanding the Free Application for Federal Student Aid (FAFSA)

What Is the FAFSA?

The Free Application for Federal Student Aid, commonly referred to as FAFSA, stands as the official form that prospective and current college students complete to determine their eligibility for financial assistance from the U.S. federal government.

This assistance encompasses a broad spectrum, including grants, work-study opportunities, and various loan programs.

Completing the FAFSA is a critical step for students who aim to lessen the financial burden of higher education, and it serves as the gateway to access numerous federal aid opportunities.

Furthermore, many state and institutional aid programs also rely on FAFSA data to allocate their own financial support, emphasizing its widespread significance in the financial aid landscape.

Thus, regardless of one's economic background, it's highly recommended to fill out the FAFSA to explore potential financial resources available for post-secondary education.

How Tax Information Affects the Expected Family Contribution (EFC) and Financial Aid Eligibility

Your tax information provides a comprehensive view of your financial status, which the FAFSA uses to calculate the Expected Family Contribution (EFC).

The EFC is an index number used by colleges to determine how much financial aid you would receive if you were to attend their institution. A lower EFC often results in more aid.

Using the IRS Data Retrieval Tool for Easier Submission of Tax Details

To make the process more straightforward, the IRS Data Retrieval Tool allows applicants to automatically transfer their tax return information into the FAFSA.

This ensures accuracy and reduces the risk of mistakes during the application process.

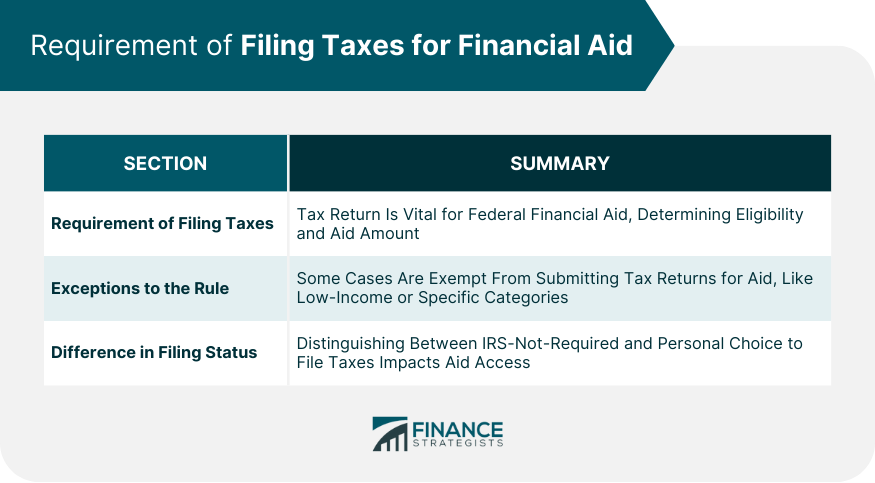

Requirement of Filing Taxes for Financial Aid

Need for a Tax Return When Applying for Federal Financial Aid

When considering federal financial aid for higher education, your tax return serves as a primary document.

It provides a clear picture of your financial situation, thereby helping determine your eligibility and the amount of aid you can receive.

This is why, in most cases, a recent tax return is required when you apply for federal financial aid.

Exceptions to the Rule

While tax returns are essential, there are specific instances where you may not need to submit them.

For instance, if your income falls below the IRS filing threshold or you fall under particular categories, such as certain non-resident aliens, you might not be obligated to submit a tax return with your financial aid application.

Difference Between "Not Required to File" and "Choosing Not to File"

It's crucial to understand that there's a significant difference between not being mandated by the IRS to file a tax return due to low income and choosing not to file even if you're above the threshold.

The former can be acceptable in the context of financial aid, while the latter might lead to complications or reduced eligibility.

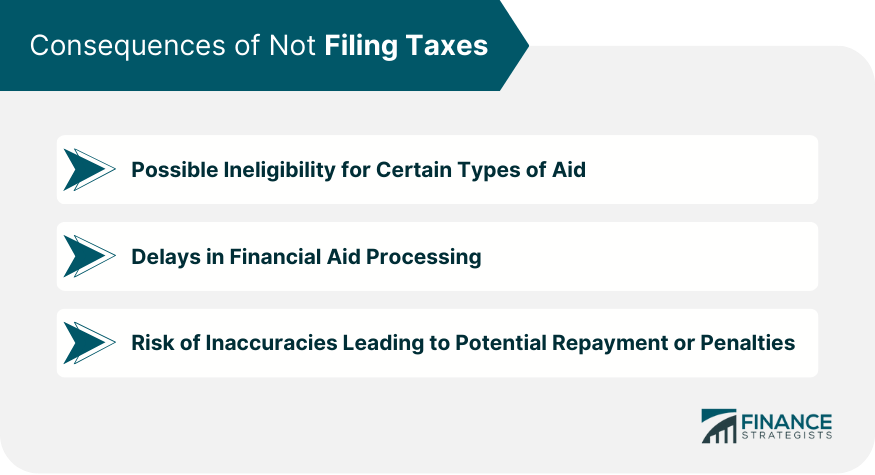

Consequences of Not Filing Taxes

Possible Ineligibility for Certain Types of Aid

By not filing taxes, you may render yourself ineligible for specific financial aid types, especially those that require detailed income verification. This can limit your opportunities and increase your out-of-pocket education expenses.

Delays in Financial Aid Processing

Without the necessary tax information, your financial aid processing might face delays. The financial aid office may need additional time to verify your financial status or ask for more documentation.

Risk of Inaccuracies Leading to Potential Repayment or Penalties

If you provide inaccurate financial details in the absence of a tax return, you might receive aid that you're not genuinely eligible for. In such cases, you might be required to repay the amount or face penalties.

Situations Where You Might Not Need to File Taxes

Income Thresholds for Mandatory Tax Filing

The IRS sets specific income thresholds under which individuals are not required to file taxes. If your income is below this threshold, it can impact your financial aid process.

Dependency Status and Its Impact on Financial Aid

Your status, whether dependent or independent, has implications for financial aid. For dependent students, it's the parents' tax information that matters. But if parents don't file, it can create hurdles in obtaining aid.

Specific Exceptions for Certain Groups

Certain groups, like some nonresident aliens, might not be obligated to file a tax return. These exceptions can affect their financial aid application and eligibility.

Special Considerations and Scenarios to File Taxes for Financial Aid

What to Do if You Are Granted a Filing Extension by the IRS

If the IRS has granted you an extension for filing your taxes, notify the financial aid office. They can guide you on the steps to ensure your financial aid isn't affected.

Addressing Amended Tax Returns

If you've made errors in your original tax return and have since filed an amended return, it's crucial to update your financial aid application. This ensures you get the correct amount of aid based on your revised financial situation.

How to Handle Situations When Parents of Dependent Students Don't File Taxes

In situations where parents of dependent students don't file taxes, additional documentation or verification might be required. It's essential to communicate openly with the financial aid office to navigate such circumstances.

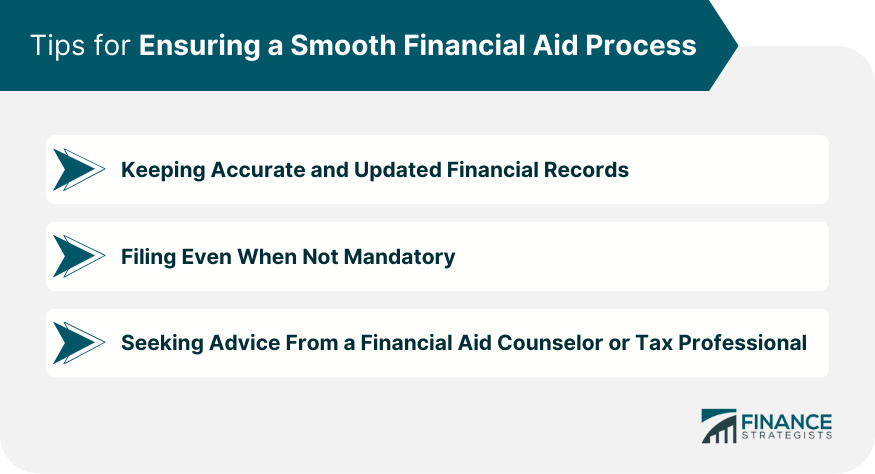

Tips for Ensuring a Smooth Financial Aid Process

Importance of Keeping Accurate and Updated Financial Records

Maintaining accurate and up-to-date financial records is crucial. It not only speeds up the financial aid application process but also ensures you receive the aid you're genuinely eligible for.

Potential Advantages of Filing Even When Not Mandatory

Even if you're below the income threshold for mandatory filing, there can be benefits to filing a tax return. For instance, you might be eligible for specific tax credits or refunds, and it can simplify the financial aid application process.

Seeking Advice From a Financial Aid Counselor or Tax Professional

When in doubt, seek guidance. Financial aid counselors or tax professionals can provide expert advice tailored to your situation, ensuring you make informed decisions.

Conclusion

Navigating the intricacies of financial aid can seem daunting, especially when it intersects with tax obligations. Primarily, tax returns play an instrumental role in determining financial aid eligibility, as showcased by the FAFSA process.

While there are situations where tax filing may not be mandated, such as low income below the IRS threshold or certain exemptions, choosing not to file when required can impact aid outcomes adversely.

Leveraging tools like the IRS Data Retrieval Tool ensures accuracy and eases the application process.

For dependent students, parental tax information becomes pivotal. To navigate this maze successfully, maintaining transparent financial records and consulting professionals for guidance can prove invaluable.

Whether you're a student or a guardian, it's essential to understand these nuances to ensure the best possible financial aid outcomes for higher education.

Do You Have to File Taxes for Financial Aid? FAQs

Tax information provides a detailed snapshot of an individual's or family's financial situation. This data helps determine eligibility and the amount of financial aid one can receive through programs like the FAFSA.

Yes, you can apply. However, you might need to provide additional documentation or explanations about your financial situation. It's essential to communicate with the financial aid office to understand specific requirements.

The IRS Data Retrieval Tool allows you to directly transfer your tax return information into your FAFSA. This facilitates a more accurate and streamlined application process, reducing the risk of errors.

It might. The financial aid process for dependent students relies heavily on their parent's financial information. If parents don't file taxes, you may need to provide additional documentation or verification. Communicate with the financial aid office for guidance.

If you've filed an amended tax return due to errors in the original one, you should update your financial aid application to reflect the accurate data. Reach out to the financial aid office to ensure you receive the appropriate aid amount based on the revised information.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.