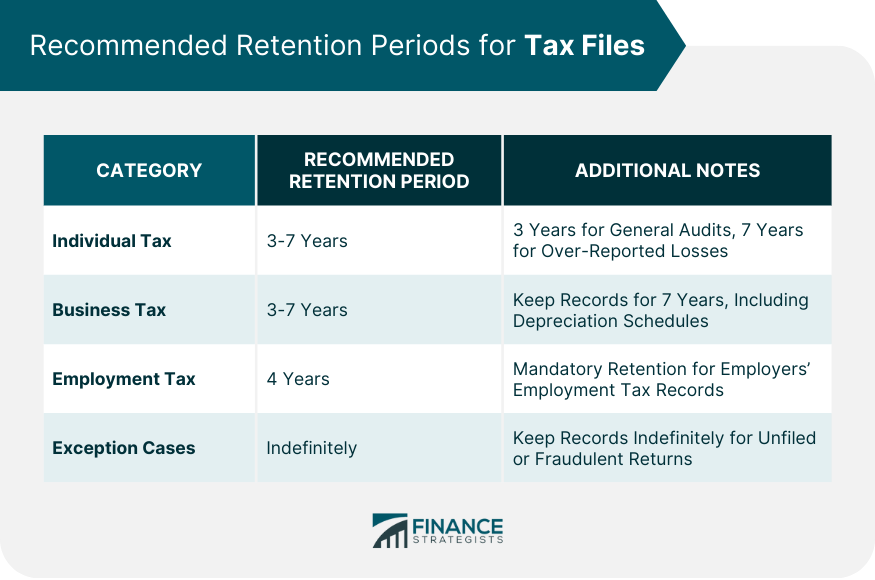

Generally, it's advisable to keep individual tax returns for a minimum of three years. This is primarily due to the Internal Revenue Service (IRS) having three years from your filing date to audit your return if it suspects good faith errors. If you have over-reported a loss, like claiming a loss for worthless securities or a bad debt deduction, then you should extend that duration to seven years. This ensures you can provide proof if the IRS queries a specific transaction from that year. Running a business comes with more complex financial records. While the three-year rule generally applies, certain records, like depreciation schedules, should be retained for seven years. Additionally, if you're an employer, you're mandated to keep employment tax records for at least four years after the date the tax becomes due or is paid, whichever is later. For employment tax records, it is generally recommended to retain these files for at least four years after the date that the tax becomes due or is paid, whichever is later. This period should be sufficient to cover any potential inquiries or audits by the Internal Revenue Service (IRS) regarding employment taxes. It's important to keep all relevant documents, including but not limited to, forms W-2 and W-3, tax returns, and records of tax payments. This retention period ensures compliance with IRS guidelines and aids in resolving any future discrepancies or questions about employment tax filings. There are, of course, outliers in every system. If you find yourself in the unique position of not filing a return or if you've filed a fraudulent return, you should keep the records indefinitely. In these situations, the IRS is not bound by the standard three-year audit window. No one cherishes the thought of an IRS audit. But should you find yourself in one, having comprehensive records can be your best defense. Detailed tax records give you the confidence to respond to any IRS inquiries and can potentially save you a significant sum. Mistakes happen. Maybe you realized you missed out on a major deduction or failed to report certain income. Keeping your tax records allows you to file an amended return, rectifying those errors, ensuring you only pay what you owe. Tax records aren't just about past financial decisions; they're a roadmap of your financial journey. By reviewing past returns, you can discern patterns, gauge your financial growth, and make informed decisions for future investments. If you own property, your tax records can be instrumental when selling. They allow you to account for improvements, which can adjust the cost basis of your home, potentially reducing taxable gain. Much like with home property, tax records are invaluable for reporting any loss or gain from investments, ensuring you're taxed the appropriate amount and can claim any due tax benefits. In our digital age, the paper feels almost archaic. There's an increasing shift towards digitizing records, and tax files are no exception. Digital records don't just save physical space; they're more resilient to natural disasters like fires or floods. They're also easier to organize, search through, and share should you need to consult with a tax professional. Using cloud storage ensures your records are backed up and accessible from anywhere. However, it's paramount to select a secure cloud service, preferably one with end-to-end encryption, to protect your sensitive financial information. Relying solely on digital files is not without risks. Technical glitches, accidental deletions, or cyberattacks can jeopardize your records. Regularly backing up your digital files on external hard drives or secure cloud platforms minimizes this risk. When the time comes to part with old tax files, safe disposal is crucial to prevent potential identity theft or misuse of your financial data. Simply tossing old tax documents in the bin is an invitation for trouble. Shredding them ensures that your personal and financial details remain confidential. For digital files, hitting the delete button is not enough. Use specialized software to permanently erase sensitive files, ensuring they're beyond recovery. Old tax software or backups stored on CDs, USBs, or hard drives should be securely wiped or physically destroyed to ensure your data remains uncompromised. Effective management of tax records can save you both time and stress during tax season and beyond. Keeping a Tax Record Checklist: A checklist ensures you're consistently maintaining all necessary records. It serves as a quick reference, ensuring you never miss out on any crucial documents. Organizing Files by Year and Type: A systematic organization makes retrieval efficient. Categorize records by year and further by type, like personal, business, or investment, to streamline your tax filing process. Setting Calendar Reminders for Annual File Reviews: A yearly review of your tax files helps in discarding old records safely and preparing for the upcoming tax season. Setting reminders ensures you don't overlook this critical activity. Tax file retention is a crucial aspect of responsible financial management. For individuals, a retention period of three to seven years is recommended, contingent on specific financial situations like over-reporting losses. Businesses face a similar timeline but with the added complexity of items like depreciation schedules. Beyond the specter of IRS audits, tax records play a pivotal role in financial reviews, rectifying errors, and navigating property or investment decisions. Embracing the digital age, many are opting for electronic storage, with its myriad benefits of accessibility, organization, and resilience. Yet, with digitization comes the challenge of security and the ever-present need for backups. Safe disposal methods for outdated tax records, both paper and digital, remain paramount to protecting personal information. Ultimately, proactive management, encompassing checklists, systematic organization, and annual reviews, ensures our tax history is both a shield and a guide in our financial journey.Recommended Retention Periods for Tax Files

Individual Tax Returns: 3-7 Years

Business Tax Returns: 3-7 Years

Employment Tax Returns: 4 Years

Exception Cases: Indefinitely

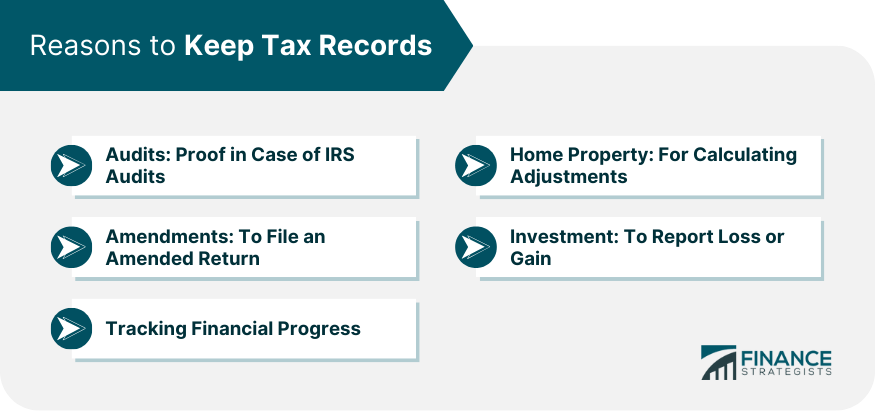

Reasons to Keep Tax Records

Audits: Proof in Case of IRS Audits

Amendments: To File an Amended Return

Tracking Financial Progress

Home Property: For Calculating Adjustments

Investment: To Report Loss or Gain

Digitizing Tax Files

Benefits of Digital Storage

Secure Cloud Storage Options

Importance of Backing Up Digital Files

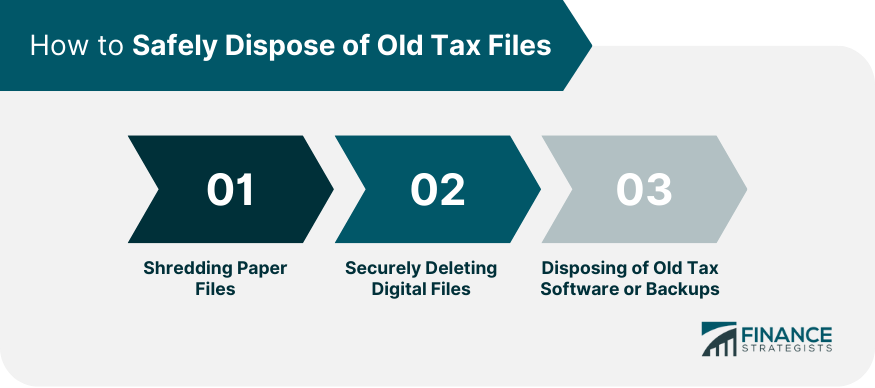

How to Safely Dispose of Old Tax Files

Shredding Paper Files

Securely Deleting Digital Files

Disposing of Old Tax Software or Backups

Additional Tips for Tax Record Management

Conclusion

How Long Should You Keep Tax Files FAQs

You should retain individual tax returns for at least three years, but in cases where you've claimed a loss for worthless securities or a bad debt deduction, it's advisable to keep them for seven years.

Business tax records, especially depreciation schedules, have a longer utility span. Plus, employment tax records need to be kept for four years after the tax becomes due or is paid. Some business transactions and assets have implications that might be relevant for up to seven years.

Digital storage can be secure if you choose platforms or services that prioritize encryption and security measures. It's essential to regularly back up digital files and use reputable cloud storage with strong security features.

For paper documents, shred them to ensure your personal and financial details remain confidential. For digital files, use specialized software to permanently erase them so they're beyond recovery. Always dispose of old software or backups securely.

An annual review helps in safely discarding outdated records and preparing for the upcoming tax season. It ensures your records are up-to-date, organized, and easily accessible when needed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.