City tax is a local tax imposed by municipalities or city governments on residents, businesses, or specific transactions within their jurisdiction. At its core, this tax serves as a revenue source that funds a variety of local services and infrastructure projects. The amount and structure of this tax can vary widely from one city to another, depending on the municipality's unique needs, priorities, and fiscal policies. For instance, some cities might impose taxes on specific goods or services, like hotel stays, to cater to the influx of tourists. Others might levy a more generalized income tax on all residents and businesses. Regardless of the specifics, the underlying principle remains consistent: city tax is a critical instrument that powers local progress, enhancing the quality of life for its people. When it comes to the act of filing your city taxes, having a step-by-step blueprint can transform an otherwise overwhelming task into a manageable process. City’s Official Website: Most cities have dedicated portals for their residents where all necessary tax forms are available for download. Local Tax Office: If you prefer the traditional approach or need guidance, a visit to your local tax office can provide you with both the appropriate forms and some helpful advice. Personal Details: Ensure your name, address, and other personal details are accurate to prevent any mismatches or confusion. Income Declaration: Utilize your W-2s, 1099s, and any other income statements to declare your earnings for the year. Claiming Deductions: Use the receipts you’ve gathered to claim deductions. Be honest and accurate. Overestimating or incorrectly claiming deductions can raise red flags. Mail-In: Some cities allow you to mail in your tax returns. Ensure you're sending it to the correct address and consider using tracked mail for peace of mind. In-Person: If you're near the local tax office, dropping off your return can be efficient. Plus, you'll get instant confirmation of submission. City’s E-Filing System: Many cities have integrated e-filing systems that are user-friendly, quick, and come with built-in checks for errors. Approved Tax Software: There are third-party tax software solutions that cater to city taxes. These platforms often streamline the process, offer insights, and automatically apply any applicable deductions. Online Transfer: Most cities now offer online portals where payments can be made directly from your bank account. Checks or Money Orders: A more traditional method but still widely accepted. Installment Plans: If you're unable to pay your taxes in full, check if your city offers the option to make installment payments. Late payments can result in penalties or additional interest. Mark your calendar or set reminders to ensure you don’t miss the due date. Confirmation Receipts: Whether you file manually or electronically, always retain the confirmation or receipt. It’s your proof of timely submission. Payment Acknowledgment: Similarly, once you've made a payment, keep the acknowledgment slip or digital receipt safe. It confirms that your dues have been cleared. City taxes, much like their federal and state counterparts, operate on a set timeline. Typically, there's a designated due date each year when residents and businesses must file and, if necessary, pay their city taxes. This date can be synchronous with federal or state tax deadlines, but it's crucial to verify as some cities might choose different dates based on their administrative calendars. While annual filings are standard, certain city-specific taxes might have varied timelines. For instance, a city that imposes a quarterly business tax will require businesses to file every three months. Similarly, certain transactions, like property sales or specific business activities, might trigger immediate tax implications. In these cases, the tax might need to be filed soon after the transaction is completed. Always staying informed and consulting the local tax office or city's website ensures that you remain compliant and avoid any unpleasant surprises. Facing discrepancies in your city tax filings or the daunting prospect of an audit can be nerve-wracking. However, with a systematic approach, understanding the process, and being proactive, you can navigate these challenges efficiently. Always ensure any notice of discrepancy or audit comes from the city's official tax department. Be wary of scams or fraudulent communications. Thoroughly read the provided details. This will typically specify the nature of the discrepancy or the reason for the audit. It's essential to understand what's being questioned or reviewed. Keep your original tax returns, along with any supporting documents like W-2s, 1099s, and receipts for deductions. This acts as your primary line of defense. Maintain a file of any past correspondence with the city tax department, as this can provide context or evidence of prior resolutions. If you’re unsure about the discrepancy or audit process, consult a tax advisor or accountant. They can provide clarity, advise on the best steps forward, and even represent you if necessary. Every taxpayer has certain rights during an audit. Familiarize yourself with these or ask your tax advisor to explain them to you. It's crucial to respond to any official notice within the specified timeframe. Delaying can complicate matters. When addressing the discrepancy or during an audit, be clear and concise. Provide straightforward answers and only give information related to the issue at hand. Once the discrepancy is addressed or the audit is completed, ensure you get an official communication stating the resolution or outcome. Use this experience as a learning opportunity. Organize your tax documents better for future filings, and consider seeking regular advice from tax services professionals. By integrating straightforward tips into your routine, future city tax filings can become a more streamlined, hassle-free experience. The key lies in preparation and proactive management. Create a dedicated folder or digital space where you store all your tax-related documents. As you receive income statements, bills, or receipts that may impact your taxes, add them immediately. This way, when tax season arrives, you aren’t scrambling to find crucial documents. Embrace tax software or mobile apps designed to track expenses, income, and potential deductions. Many of these tools can automatically categorize and store information, making the filing process smoother. Additionally, they often offer built-in checks to ensure you're not missing out on any deductions or benefits. Tax codes and regulations can change. Regularly visit your city's official tax website or subscribe to their newsletters. Staying updated ensures you're always in line with current guidelines, reducing the risk of mistakes in your filings. Even if you're confident in handling your taxes, a yearly consultation with a tax professional can be beneficial. They can offer insights into new deductions, changes in tax codes, or strategies to optimize your filings. Mark your tax due dates prominently on your calendar. Better yet, set digital reminders a few weeks in advance. This gives you ample time to review your documents, seek clarifications if needed, and complete your filing without the last-minute rush. City tax serves as a vital revenue source for local municipalities, funding a range of essential services and infrastructure projects. Filing city taxes can seem daunting, but with a systematic approach, it becomes manageable. Obtaining the correct forms, detailing personal information, declaring income, and choosing a filing method are key steps. Payment options, staying mindful of deadlines, and retaining proof of submission are crucial to avoid penalties. Understanding city tax timelines is essential, as they may differ from federal and state deadlines. Addressing discrepancies and audits requires organization, seeking professional help, and responding promptly. Simplifying future city tax filings involves staying organized year-round, leveraging technology, staying informed about tax codes, seeking expert advice, and setting calendar reminders. By embracing these practices, taxpayers can navigate city taxes more effectively and ensure compliance while minimizing stress.What Is City Tax?

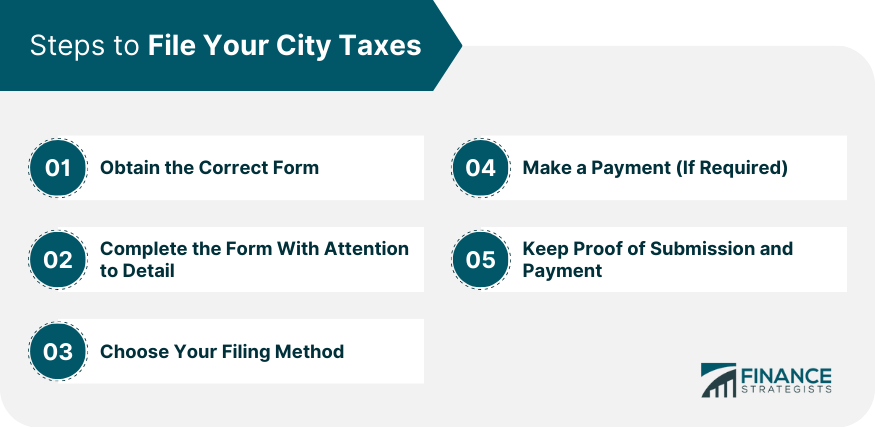

Steps to File Your City Taxes

Obtain the Correct Form

Complete the Form With Attention to Detail

Choose Your Filing Method

Manual Submission

Electronic Submission

Make a Payment (If Required)

Payment Options

Stay Mindful of Deadlines

Keep Proof of Submission and Payment

When to File City Taxes

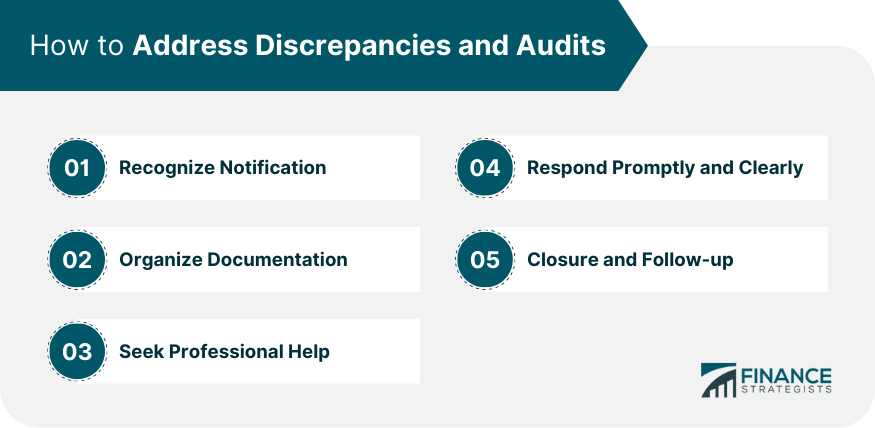

How to Address Discrepancies and Audits

Recognize Notification

Organize Your Documentation

Seek Professional Help

Respond Promptly and Clearly

Closure and Follow-up

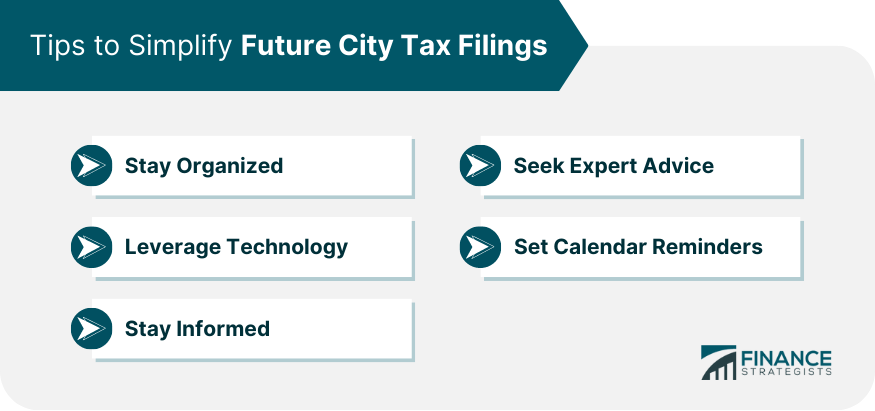

Tips to Simplify Future City Tax Filings

Stay Organized

Leverage Technology

Stay Informed

Seek Expert Advice

Set Calendar Reminders

Conclusion

How to File City Taxes FAQs

To file city taxes electronically, use the city's official e-filing system or approved third-party tax software. These options provide user-friendly interfaces and built-in error checks for smoother filing.

To file city taxes by mail, obtain the necessary forms from the city's official website or local tax office. Complete the forms accurately, then send them to the correct address. Consider using tracked mail for added assurance.

When filing city taxes with deductions, gather your receipts and documents to support your claims. Use these receipts to accurately claim deductions while filing online or on paper, ensuring honesty and accuracy.

To file city taxes on time, mark the due date on your calendar or set digital reminders. Stay informed about deadlines, which may differ from federal or state tax dates. Filing early or on time helps you avoid penalties and stress.

To file city taxes for a business, gather income statements and other relevant documents. Complete the appropriate tax forms, accurately declaring your business earnings. Choose your filing method – electronically or by mail – and ensure timely submission to the city tax office.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.