Tax extensions refer to the formal allowance granted by tax authorities, such as the Internal Revenue Service (IRS) that permits taxpayers to submit their tax returns after the typical due date. In essence, it provides individuals, businesses, and other entities with additional time to gather their financial documents, ensure the accuracy of their tax return, and complete their filing without incurring late-filing penalties. However, it's crucial to note that while an extension provides extra time to file, it doesn't necessarily provide more time to pay any taxes owed. Taxpayers are still expected to estimate and pay their tax liability by the original deadline to avoid potential interest and penalties on unpaid amounts. Following these steps ensures that you'll be able to file your tax extension accurately and efficiently. Before diving into the process, it's essential to evaluate your specific situation. Are you facing unexpected personal events? Waiting on crucial documents? Or simply dealing with a complex financial scenario? Recognizing the specific reasons that warrant an extension will ensure you're making the right decision and that the extension will genuinely be beneficial. For Individuals: The go-to form is the IRS Form 4868. This form is designed for individual taxpayers, including those who operate sole proprietorships or single-member LLCs. For Businesses: Depending on the type and structure of your business, you may need IRS Form 7004 or other specific forms relevant to your entity type. It's crucial to select the correct form to avoid complications later on. Personal Details: Ensure you have your essential details on hand, like your name, address, and Social Security number. Financial Estimates: You'll need an estimate of your total tax liability for the year. Based on your income and deductions, this will give the IRS an idea of what you owe. Yearly Payments: Document the total payments you've made throughout the tax year, including withholdings and estimated tax payments. Payment With Extension: Decide if you're paying any amount with the extension. Remember, while the extension gives you more time to file, any taxes owed should still be paid by the original deadline to avoid penalties. Electronic Submission: The IRS e-file system or other recognized tax software platforms can be used to submit your form online. This method offers quick confirmations and is generally more efficient. By Mail: If you're more comfortable with traditional methods, you can mail your form. Ensure you know the correct address, which varies based on your location and the type of form. • Online Options: Direct Pay is a direct debit option from a bank account. The Electronic Federal Tax Payment System (EFTPS) is another secure government option. Alternatively, payments can be made using a credit or debit card through authorized IRS payment processors. • Check or Money Order: For those not wanting to pay electronically, a check or money order can be sent. Make sure it's made out to the appropriate tax authority, contains the necessary memos or notes, and is mailed to the correct address. By implementing these strategies and perhaps seeking expert advice, you can ensure a smoother and more efficient tax filing experience. Centralize Documentation: Whether it's a designated drawer, a cloud storage folder, or specialized tax software, having everything in one place minimizes the chance of overlooking essential paperwork. Categorize and Label: Segment your documents by type - income statements, deductions, business expenses, etc. Properly labeled categories make it easier to locate and reference specific items when needed. Regular Check-ins: Instead of waiting until the extended deadline looms, set aside time at regular intervals (weekly or bi-weekly) to review, update, and organize your documents. Backup Everything: If you're storing documents digitally, ensure you have backups in different locations. For physical papers, consider scanning and storing them digitally or keeping photocopies in a separate location. Calendar Alerts: Utilize electronic calendars like Google Calendar or Outlook to set multiple reminders leading up to the deadline. This way, you're alerted a month, a week, and then a day in advance. Physical Reminders: Sticky notes on your desk, reminders on a wall calendar, or even setting an alarm clock can serve as additional nudges. Automate Reminders: Some tax software and apps offer automatic reminders as the extended deadline approaches. Utilizing these tools can offload the responsibility of remembering from you. Accountability Partners: Inform a family member, close friend, or colleague about your extended deadline. Sometimes, an external nudge or check-in from someone you trust can be the perfect reminder. Complex Financial Situations: If you have multiple income sources, intricate investments, or significant life changes (like marriage, purchasing a home, or starting a business), a tax professional can provide invaluable guidance. Uncertain About Deductions or Credits: If you're unsure about qualifying for specific deductions or credits, an expert can help ensure you don't miss out on money-saving opportunities. Peace of Mind: Even if you believe you've got everything under control, consulting with a professional can provide reassurance. They can review your return for potential red flags or areas of improvement. Stay Updated: Tax laws and regulations can change. A tax professional will be up-to-date with the latest changes and can inform you of any new implications for your situation. One of the most common misconceptions about tax extensions is that they offer extra time to pay your taxes. In reality, they provide additional time to file your tax return. If you owe taxes, it's crucial to pay the estimated amount owed by the original deadline to avoid potential penalties and interest. When requesting an extension, you're often asked to provide an estimate of your tax liability. It's essential to be as accurate as possible to prevent underpayment or overpayment. Underestimating can lead to penalties, while overestimating means you're providing the IRS with an interest-free loan until you get a refund. While you might file a federal tax extension, remember that state tax requirements may differ. Some states may grant automatic extensions when a federal extension is filed, but others may require a separate application. It's crucial to check the regulations for your specific state. Typically, for individual taxpayers in the U.S., an extension grants an additional six months to file. However, it's important to mark the new deadline on your calendar to ensure you don't miss it. Even with an extension, penalties can accrue if taxes are not paid by the original deadline. Understand the potential penalties for both late payment and late filing to make informed financial decisions. Once you've filed for an extension, ensure that you retain all related documentation. This includes the confirmation of the extension being granted, any payments made, and communication regarding the extension. Tax extensions offer a valuable lifeline for taxpayers who require additional time to prepare and file their returns accurately. These extensions provide individuals and businesses the chance to gather necessary documentation, ensure the correctness of their returns, and avoid late-filing penalties. Navigating the process involves a few key steps. Understanding the necessity for an extension, selecting the correct form, collecting essential information, submitting the form, and making any necessary payments. Critical considerations encompass misconceptions about extensions, the significance of accurate estimations, potential differences in state tax regulations, the duration of the extension, and awareness of penalties for late payments and filings. Effective organization tips, reminders, and consultation with tax professionals round out the strategies for a smooth and successful tax filing experience. Stay informed and proactive to ensure a confident and timely tax submission process.What Are Tax Extensions?

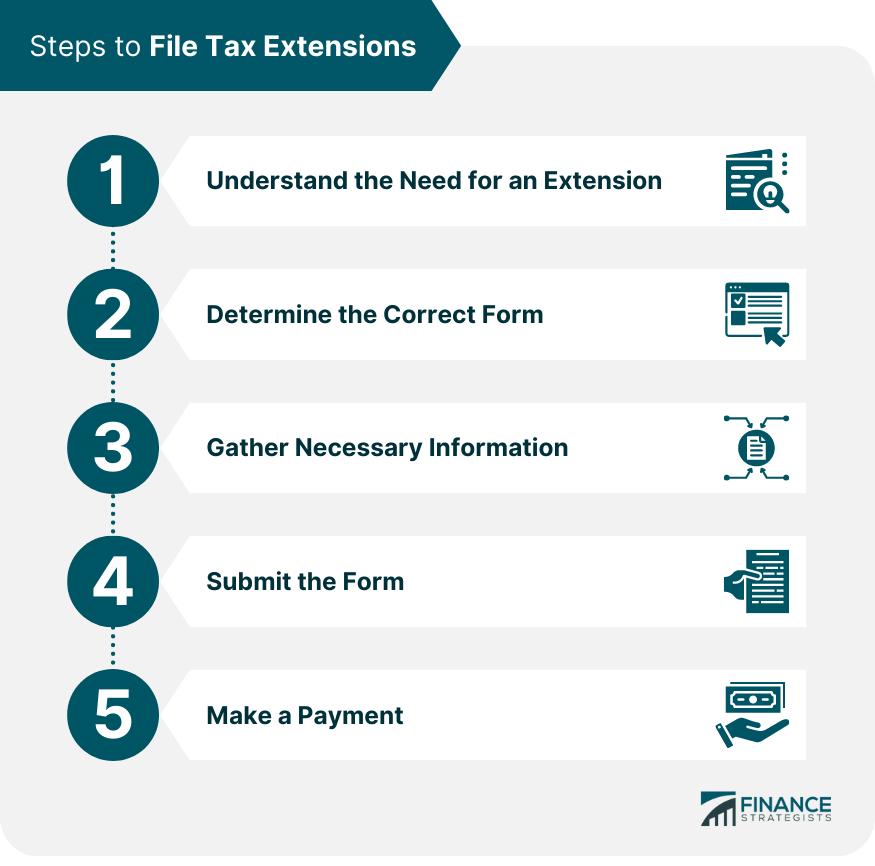

Steps to File Tax Extensions

Understand the Need for an Extension

Determine the Correct Form

Gather Necessary Information

Submit the Form

Make a Payment

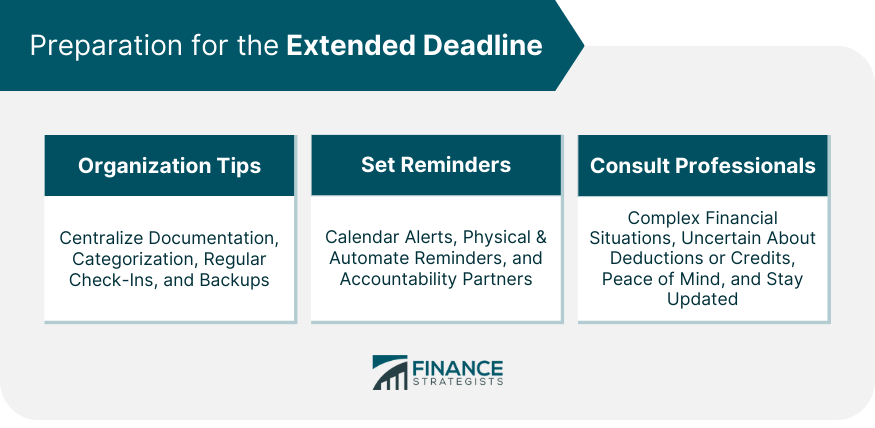

Preparation Strategies for the Extended Deadline

Organization Tips

Set Reminders

Consult Professionals

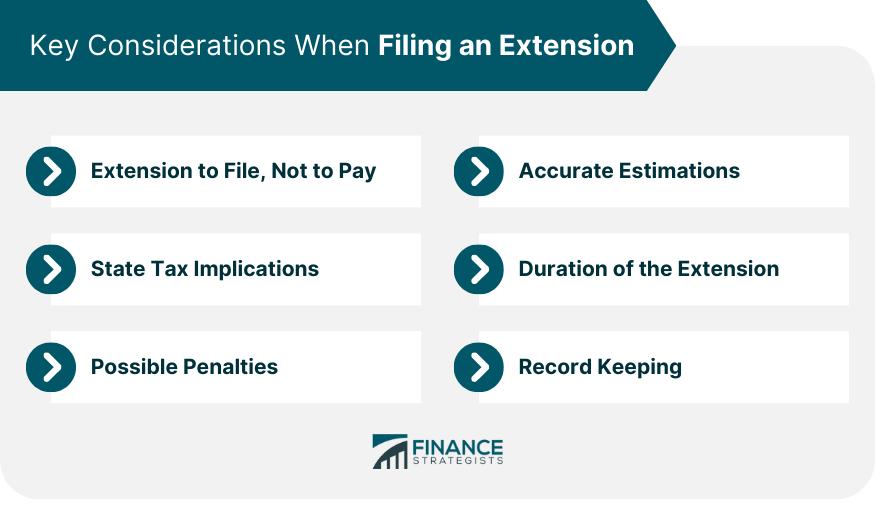

Key Considerations When Filing an Extension

Extension to File, Not to Pay

Accurate Estimations

State Tax Implications

Duration of the Extension

Possible Penalties

Record Keeping

Conclusion

How to File Extension for Taxes FAQs

To file a tax extension, you need to submit the appropriate form to the tax authorities before the original deadline. For individuals, this often involves using IRS Form 4868, while businesses might require IRS Form 7004 or other specific forms based on their entity type.

You can get more time to file your taxes by requesting a tax extension. This extension provides an additional period, usually six months, beyond the original due date.

You'll need to provide personal details like your name, address, and Social Security number. You'll also need to estimate your total tax liability for the year and document any payments you've made so far. Additionally, decide if you'll be making any payments with the extension request.

You can submit the tax extension form electronically using the IRS e-file system or other recognized tax software platforms. Alternatively, you can mail the form to the appropriate address.

There are generally no penalties for requesting a tax extension as long as you meet the necessary requirements and submit the form on time. However, it's important to pay attention to the original deadline for tax payments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.