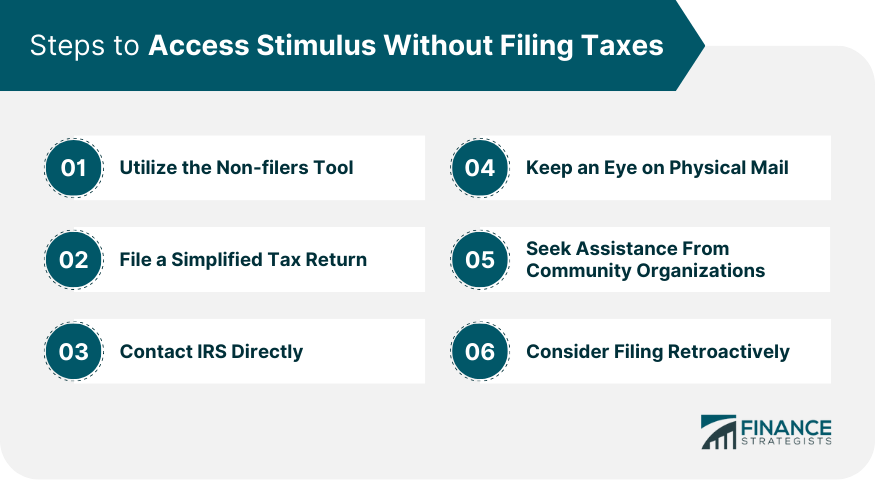

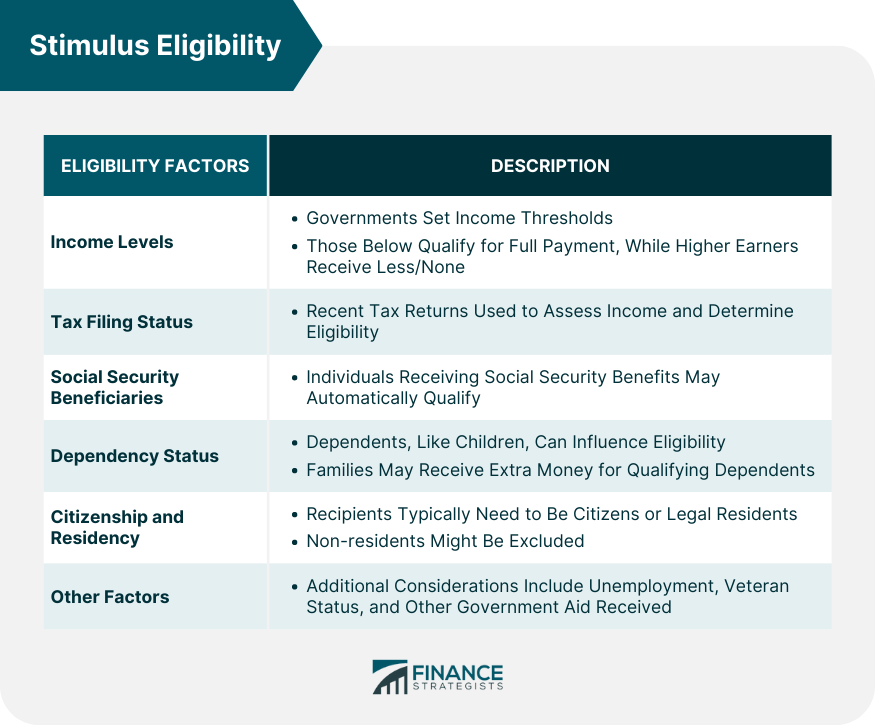

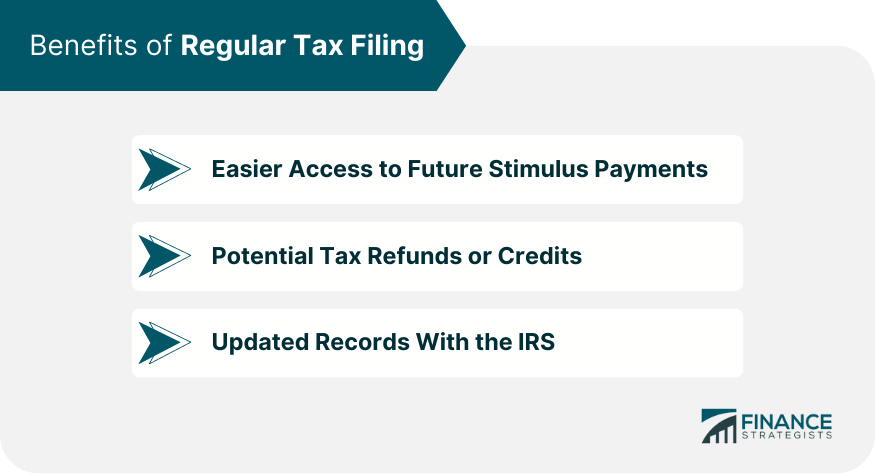

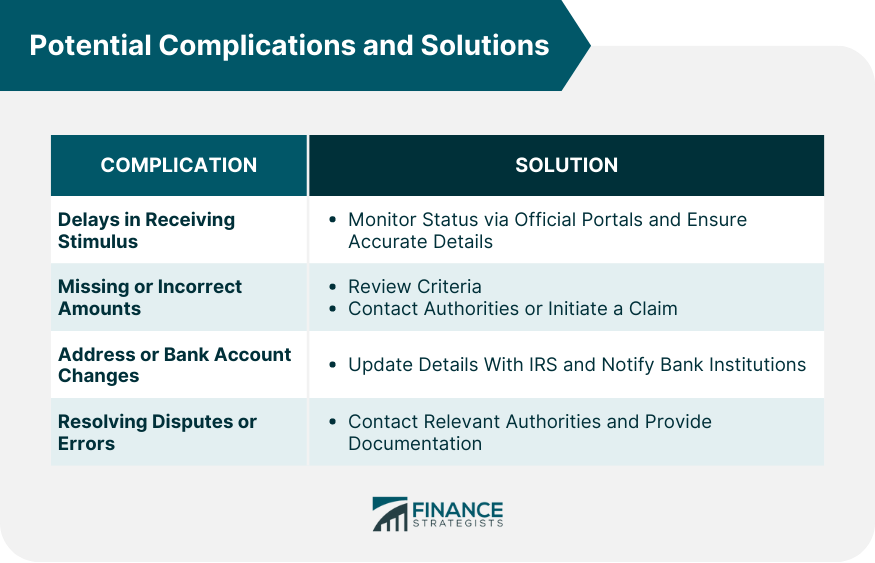

A stimulus payment, often referred to as an economic impact payment or relief check, is a financial incentive provided by governments to individuals, families, or sectors of the economy. These payments are typically dispatched in response to economic downturns, recessions, or unexpected crises that could jeopardize the financial stability of a nation's population. Often, governments use tax data to determine both eligibility and the amount of stimulus payment an individual might receive. For instance, during COVID-19 pandemic, countries anchored the distribution of their stimulus payments on recent tax returns. Those who had filed taxes were often the first to receive their economic impact payments, with the amounts based on their reported incomes. This underscores the importance of regular tax filings, not just for standard taxation purposes but also to ensure citizens are accounted for in times of financial interventions by the government. Navigating the complexities of stimulus payments can be daunting, especially for those unfamiliar with tax filings; here's a step-by-step guide to accessing these benefits without traditional tax returns. Begin by visiting the official Internal Revenue Service website or the respective government agency's site to access the Non-Filers Tool. This tool is specifically designed for those who don't typically file tax returns. Once there, you'll need to input your personal details, including your name, address, Social Security Number, and banking information for direct deposit. Ensure that all the information provided is accurate before submitting the form. If you've had minimal to no income, you still have the option to file a simplified tax return. Start by gathering any basic income statements or documentation that can verify your income. Many online platforms offer free tools for individuals to file simple returns. Utilize one of these tools, input your details, and opt for an electronic submission which generally ensures faster processing. In some situations, reaching out directly to the IRS can clarify your eligibility and status concerning the stimulus payment. The IRS often has dedicated hotlines for queries related to stimulus payments, which can be especially helpful. If the phone or online avenues prove challenging, you might also consider visiting a local IRS or taxation office in person to get guidance on your stimulus payment. Not all stimulus payments are made through direct deposit. Some governments opt to send physical checks or even prepaid debit cards to eligible recipients. Therefore, it's crucial to regularly check your mailbox to ensure you don't inadvertently overlook or discard these forms of payment. Many local nonprofits and community organizations assist residents in accessing governmental benefits, including stimulus payments. Identify these organizations in your area and approach them for guidance. Occasionally, they may also host workshops or informational sessions, providing valuable insights into how one can access benefits even without having filed taxes. If, for any reason, you believe you missed out on previous stimulus payments due to not having filed taxes, it might be beneficial to file a tax return for those years. Doing so might not only make you eligible for any missed payments but also introduce you to other potential benefits. While the specific criteria can vary depending on the country and the nature of the economic challenge, common determinants include: Income Levels: Many governments set an income threshold, with individuals or households earning below a certain amount being eligible for the full stimulus payment, while those earning above may receive a reduced amount or none at all. Tax Filing Status: Some stimulus programs base eligibility on recent tax return filings, utilizing them to assess income levels and determine payment amounts. Social Security Beneficiaries: Individuals who receive Social Security benefits, including retirement, disability, or survivor benefits, might automatically qualify for stimulus payments in certain scenarios. Dependency Status: Dependents, particularly children, can often affect eligibility. In some cases, families receive additional stimulus money for each qualifying dependent. Citizenship and Residency: Typically, recipients need to be citizens or legal residents of the country issuing the stimulus. Some programs may exclude non-residents or individuals without specific documentation. Other Factors: Governments might consider additional factors like unemployment status, veteran status, or whether an individual receives other forms of government aid. Consistently filing your taxes might seem like just another yearly obligation, but it brings along numerous advantages. Easier Access to Future Stimulus Payments: Those with updated tax records can swiftly receive their entitled financial assistance without extra legwork or delays. Potential Tax Refunds or Credits: By filing taxes regularly, individuals might uncover they've overpaid during the year and are eligible for a refund. Updated Records With the IRS: Regular tax filings ensure that the IRS or the relevant tax authority has your most recent income data, contact details, and other vital information. While stimulus payments aim to provide quick financial relief, several issues can arise. Here's a look at potential complications and their respective solutions: Though the government's plan for an expedited distribution of stimulus payments, a multitude of logistical barriers can cause unexpected delays. Always keep an eye on the status of your payment via the official government portals. Ensure that all your submitted details are accurate and up-to-date. There are instances where recipients might find the received stimulus amount different from their expectations. This can be due to calculation errors or misinterpretation of the eligibility criteria. Begin by revisiting the government's criteria for determining the stimulus payment amounts. If you identify any discrepancy, promptly get in touch with the concerned authorities or initiate a claim. Recent relocations or modifications in bank account details can potentially disrupt the receipt of stimulus payments. Prioritize updating your latest address or banking details with the IRS or the corresponding tax body. Proactive communication ensures your stimulus reaches the right hands. For direct deposits, it's prudent to also notify your banking institution about any anticipated incoming transactions, so they can assist if there's an issue. The possibility of disputes over eligibility or errors in disbursed amounts can add to the complexities. The first step is to contact the relevant tax or governmental authority to address your concerns. Be prepared with all necessary documentation to bolster your claim, ensuring a smoother resolution process. Familiarizing yourself with the authority's grievance redressal mechanism can further aid in speeding up resolutions. A stimulus payment serves as a crucial lifeline during economic crises, offering financial support to individuals, families, and sectors. These payments, initiated by governments in response to economic challenges, underline the significance of tax data in determining eligibility and payment amounts. For those unfamiliar with tax filings, accessing stimulus benefits can be simplified. The Non-Filers Tool, simplified tax returns, direct IRS contact, and community assistance are pathways to navigate this process. Eligibility factors, such as income levels, tax filing status, and dependency status, shape the distribution of stimulus funds. Addressing potential complications like delays, incorrect amounts, address changes, and disputes require vigilance, accurate record-keeping, and proactive communication with relevant authorities. In times of uncertainty, understanding the intricacies of stimulus payments empowers individuals to secure vital financial assistance.What Is Stimulus Payment?

Steps to Access Stimulus Without Filing Taxes

Utilize the Non-Filers Tool

File a Simplified Tax Return

Contact IRS Directly

Keep an Eye on Physical Mail

Seek Assistance From Community Organizations

Consider Filing Retroactively

Stimulus Eligibility

Benefits of Regular Tax Filing

Additionally, there are numerous tax credits available that can significantly reduce one's tax liability, but they can only be claimed if one files.

This updated record aids in smoother communications and lessens potential issues in the future.

Potential Complications and Solutions

Delays in Receiving Stimulus

Missing or Incorrect Amounts

Address or Bank Account Changes

Resolving Disputes or Errors

Conclusion

How to Get Stimulus if Taxes Are Not Filed FAQs

You can use the Non-Filers Tool on the official IRS website to provide your details and access the stimulus.

You can file a simplified tax return even with minimal income to access the stimulus. Online platforms offer tools for easy filing.

Absolutely, the IRS has dedicated hotlines for stimulus-related queries. You can also visit local IRS offices for guidance.

Yes, some governments send physical checks or prepaid debit cards. Regularly check your mailbox to avoid missing out.

You can file a tax return retroactively for those years to potentially become eligible for missed payments and other benefits.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.