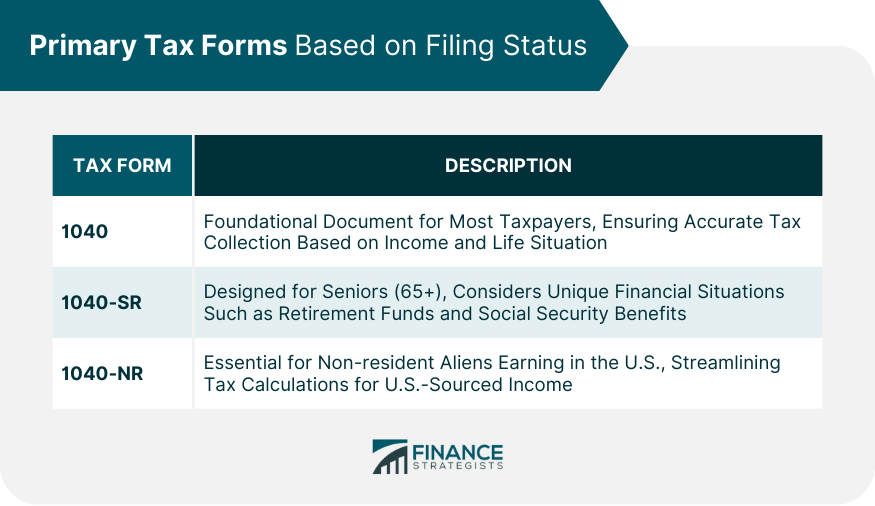

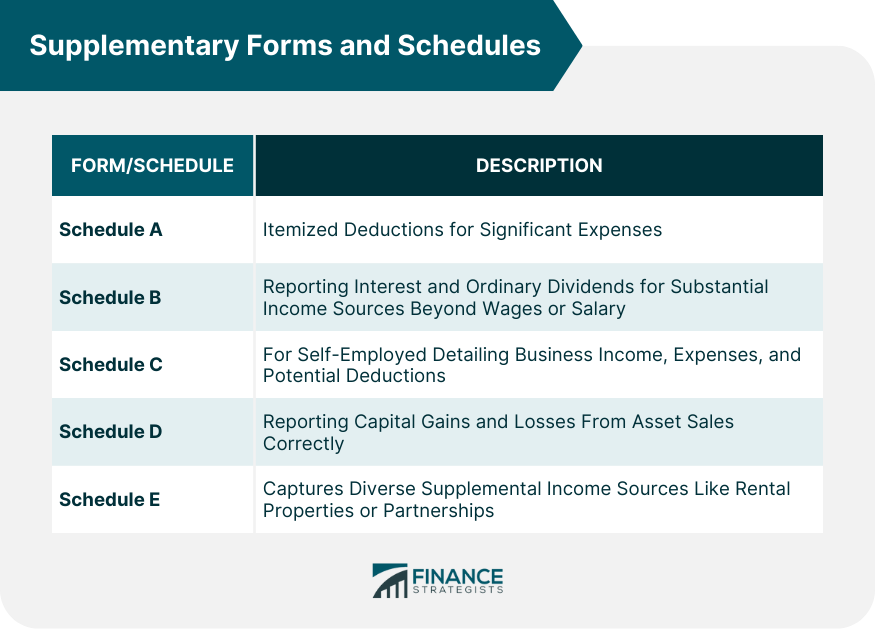

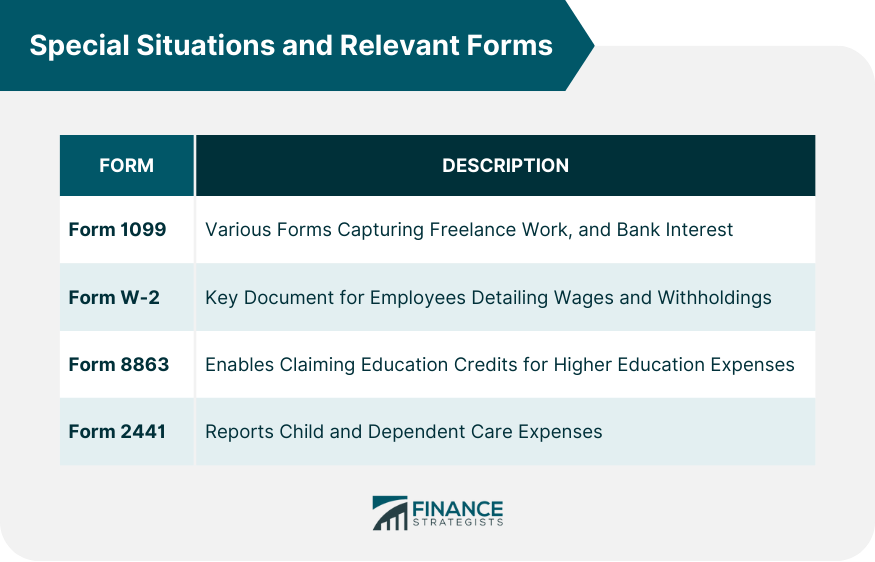

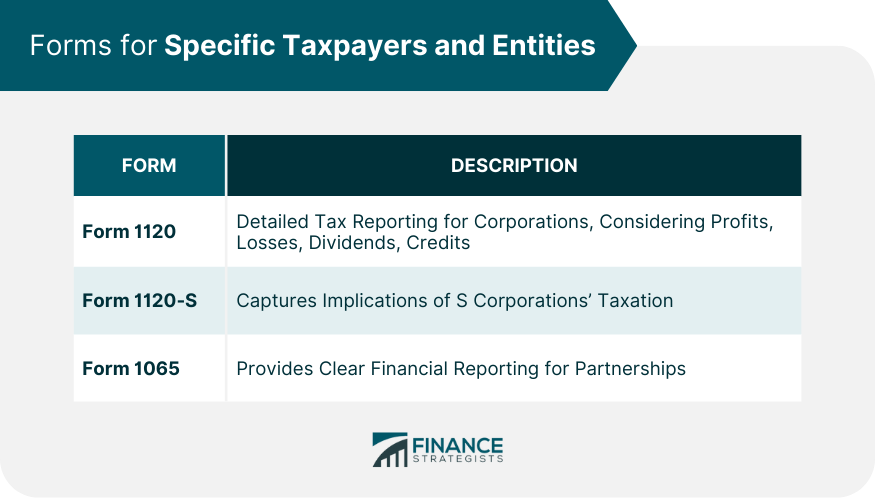

At its core, the act of tax filing serves a dual purpose. Firstly, it ensures that the government has the necessary funds to operate, maintain public services, and invest in crucial areas like infrastructure, education, and healthcare. Beyond this civic responsibility, tax filing also offers individuals and businesses an opportunity to assess their financial health, make informed decisions about their future, and ensure they are in compliance with the law. Neglecting this duty can lead to penalties, legal complications, and missed opportunities for deductions or credits. Each tax form is tailored to capture specific types of income, deductions, and credits. Choosing the right form is not just about compliance but also about ensuring that one pays only the taxes they owe – no more, no less. A mismatch or oversight can lead to overpayments, underpayments, audits, or even legal repercussions. Thus, understanding and using the appropriate forms becomes paramount for both accuracy and peace of mind. Tax forms tailored to your specific situation are vital to an accurate return. This form is the foundational document for most taxpayers. It ensures that the government collects the right amount of tax based on your income and life situation. Also, the 1040 is versatile, capturing a wide variety of incomes and tax scenarios, ensuring that individual taxpayers have a one-stop form for their needs. Specifically designed for those 65 and over, the 1040-SR takes into account the unique financial situations that seniors often face. Beyond standard income, it accommodates common senior sources like retirement funds and Social Security benefits. Essential for non-resident aliens earning in the U.S., this form ensures proper tax calculations based on U.S.-sourced income. Its design specifically caters to those who don't meet the standard residency requirements, making tax filing streamlined for this group. Each supplementary form fills in the details, providing a clearer picture of your financial year. For taxpayers with significant deductible expenses, this form can often lead to a larger refund or a lower tax due. By detailing expenses such as medical bills, mortgage interest, or charitable donations, you might find tax savings not captured by the standard deduction. Specifically for those with substantial interest or dividend income, this form ensures accurate reporting and taxation of these income types. Beyond basic wages or salary, interest and dividends can significantly impact your tax liability. Tailored to the self-employed and independent contractors, this form is vital for detailing business income and expenses. By providing a comprehensive look at business financials, it ensures accurate taxation and captures potential deductions. Selling assets can have tax implications, and this form ensures you report these sales correctly. It's crucial for anyone dealing in stocks, bonds, real estate, or other assets to understand their capital gains or losses. Diverse income sources, from rental properties to partnerships, find a home on Schedule E. By segmenting this supplemental income, the IRS can accurately assess tax based on these varied streams. Specialized income sources or tax situations often require their own forms: • Form 1099: These diverse forms capture everything from freelance work to bank interest. For instance, if you freelance, the 1099-MISC you receive is vital for accurate income reporting. Similarly, those with interest-bearing accounts will need to factor in the 1099-INT they receive. • Form W-2: A staple for employees, the W-2 is the key document detailing wages and withholdings. It's essential for both federal and state tax filings, ensuring that both you and your employer are on the same page regarding your income. • Form 8863: Higher education comes with costs but also potential tax benefits. Using Form 8863, students or their parents can claim vital education credits, helping offset some of those tuition bills. • Form 2441: Families know that child and dependent care can be expensive. This form not only allows for reporting of these expenses but also can lead to valuable credits that lower your tax bill. Different business structures and entities have unique reporting requirements: Form 1120: Corporations, with their myriad financial activities, need a robust form to detail their tax situation. From profits to losses, dividends to credits, the 1120 ensures corporations are taxed accurately. Form 1120-S: S Corporations offer a unique blend of corporation and partnership tax attributes. This form captures those implications, ensuring that both the business and its shareholders understand their tax responsibilities. Form 1065: Partnerships with multiple parties involved require clear financial reporting. This form ensures each partner understands their income, deductions, and tax responsibilities. Whether you need extra time to file or are handling unique tax situations, these forms come into play: Form 4868: Sometimes, you just need a bit more time to get your tax details right. With the 4868, taxpayers can ensure they don't rush their filing, potentially avoiding errors. Form 8802: In an increasingly global world, proving U.S. residency for tax purposes can be essential. This form provides that verification vital for various international tax scenarios. Filing taxes is a fundamental civic responsibility that serves both individual and societal purposes. The 1040 form captures diverse incomes and scenarios, while the 1040-SR caters to seniors' unique financial situations, and the 1040-NR simplifies tax filing for non-resident aliens. Supplementary forms like Schedule A, B, C, D, and E provide insights into deductions, dividends, business profits, capital gains, and supplemental income. Special situations demand specialized forms, such as Form 1099, Form W-2, Form 8863, and Form 2441. For various entities, forms like 1120, 1120-S, and 1065 address corporate, S Corporation, and partnership reporting requirements. Lastly, procedures like Form 4868 and Form 8802 accommodate extensions and international tax scenarios, reflecting the complexity of our globalized tax landscape. Understanding and utilizing these forms ensure accurate tax reporting, compliance, and the optimization of available deductions and credits. Importance of Filing Taxes

Primary Tax Forms Based on Filing Status

1040: U.S. Individual Income Tax Return

1040-SR: U.S. Tax Return for Seniors

1040-NR: U.S. Nonresident Alien Income Tax Return

Supplementary Forms and Schedules

Schedule A: Itemized Deductions

Schedule B: Interest and Ordinary Dividends

Schedule C: Profit or Loss from Business

Schedule D: Capital Gains and Losses

Schedule E: Supplemental Income and Loss

Special Situations and Relevant Forms

Forms for Specific Taxpayers and Entities

Procedures and Miscellaneous Forms

Conclusion

What Tax Forms Do You Need to File Your Taxes? FAQs

To file your taxes, you typically need Form 1040, the U.S. Individual Income Tax Return. This foundational form covers most taxpayers' income and situations.

Yes, if you're 65 or older, you can use Form 1040-SR, the U.S. Tax Return for Seniors. It's designed to accommodate senior-specific financial sources like retirement funds and Social Security benefits.

Non-resident aliens earning in the U.S. should use Form 1040-NR, the U.S. Nonresident Alien Income Tax Return. This form ensures accurate taxation based on U.S.-sourced income.

For self-employed individuals, Form Schedule C, Profit or Loss from Business, is vital. It helps detail your business income, expenses, and deductions accurately.

Form Schedule D, Capital Gains, and Losses, is used to report capital gains or losses from selling assets like stocks, real estate, or bonds. It ensures accurate reporting of these transactions for tax purposes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.