Income tax, in its simplest form, is a legal obligation charged by governments on individuals' and corporations' financial incomes. Predominantly, it's applied to both earned income, such as wages and salaries, and unearned income, like dividends or rental income. Every time you receive a paycheck or make a profit from a venture, there's a portion of that sum the government claims as its share. To many, income tax seems like a straightforward deduction from their earnings, but its underpinning is rooted deeply in intricate legal and economic frameworks. The tax amount one pays isn't a flat rate but varies based on several factors, including the source and amount of income. Income tax funds essential public services such as infrastructure and healthcare, ensuring society runs efficiently. Beyond revenue collection, it helps redistribute wealth and, via incentives or disincentives, influences economic behaviors. Ancient civilizations, including the Egyptians, Romans, and Greeks, had their versions of taxes. While these might not have been income taxes in today's sense, they displayed the age-old understanding that for a society to function, communal contributions were necessary. For instance, the Roman Empire had a system where citizens paid taxes based on the value of their owned properties. These funds were then utilized to maintain the vast Roman infrastructure, from roads to aqueducts. The inception of the modern income tax system can be traced back to the 18th and 19th centuries. During times of war, nations like Britain and the U.S. implemented taxes on income to fund their military endeavors. Once the wars ended, these systems, to varying extents, stayed, evolving into what we recognize today. For the United States, the 16th Amendment in 1913 was a watershed moment, granting Congress the power to levy taxes on personal and corporate incomes. Since then, income tax has become a mainstay of the American fiscal landscape. Like any long-standing system, the income tax has undergone numerous reforms. These changes have been influenced by economic needs, political ideologies, and societal demands. From fluctuations in tax rates to overhauls of the tax brackets, each reform reflected the zeitgeist of its era. A recent example would be the tax reforms in the late 2010s, which saw significant modifications in deductions, corporate tax rates, and brackets. These changes not only impacted the immediate tax landscape but also set the direction for future fiscal policies. When most people think of income tax, they're picturing individual income tax. This form of tax is levied on personal earnings. The amount paid depends on several factors, such as total income, available deductions, and the taxpayer's filing status. While the idea of tax brackets and progressive taxation may seem daunting, they're instrumental in creating a fair tax system. Essentially, as one earns more, they're taxed at a higher rate. This progressive system is balanced out by various deductions and credits available to taxpayers, ensuring they aren't overburdened. Corporations aren't exempt from paying their fair share. Corporate income tax is levied on the profits businesses make. The rate at which they're taxed can differ vastly from individual tax rates. Small businesses often have different considerations compared to large corporations. They might be eligible for specific deductions or credits, reflecting their unique challenges and contributions to the economy. Across the board, businesses can reduce their taxable income through various deductions, from operational costs to investments in research and development. While federal income tax is a constant across the U.S., state and local income taxes can vary dramatically. Some states have no state income tax, while others do. The existence or absence of state income tax can influence decisions, from business locations to personal residences. When combined with federal income tax, the total tax burden on an individual or business can be significant, making understanding these nuances vital. The world of income tax calculations can seem labyrinthine, but breaking it down can demystify the process. It starts with understanding the difference between gross income, the total income earned, and taxable income, which is what's left after adjustments and deductions. Taxable income is the foundation upon which your tax owed is calculated. Aspects like deductions, whether standard or itemized, play a pivotal role in reducing this figure, ultimately determining the tax bill. Tax credits and tax deductions are the superheroes of the tax world, swooping in to save taxpayers money. But they operate differently. Deductions reduce the amount of income subject to tax, while credits directly reduce the amount of tax owed. For instance, a $1,000 tax deduction might save someone in a 22% tax bracket $220. But a $1,000 tax credit would reduce their tax owed by the full $1,000. Various credits and deductions exist, from those for higher education to incentives for green energy. Tax brackets are essentially ranges of income taxed at specific rates. As your income increases, the additional dollars earned enter higher tax brackets and are taxed at higher rates, exemplifying progressive taxation. This system ensures that those who earn more contribute a larger share, but not disproportionately. Understanding which bracket one's income falls into can offer clarity on tax obligations and potential strategies to minimize the tax burden. The journey to filing income tax begins with selecting the appropriate form. Whether it's 1040, 1040A, or another variant, this form is the canvas where all financial information for the year is painted. Yet, it's not as simple as picking any form. Each corresponds to specific financial situations, dictating what income, deductions, and credits can be reported. Therefore, it's crucial to choose the one that mirrors one's financial circumstances to ensure accuracy and maximize potential returns. The digital age has ushered in a plethora of tax software options. These platforms guide users through the tax preparation process, ensuring accuracy and often guaranteeing the maximum refund. For those with more complex financial situations or those simply seeking peace of mind, tax professionals can be invaluable. With their deep knowledge and expertise, they can navigate the intricate tax landscape, ensuring every eligible deduction or credit is utilized. April 15th is a date many in the U.S. have etched in their minds, the deadline for filing income tax. Meeting this deadline is crucial to avoid penalties, but life can be unpredictable. In instances where individuals or businesses can't file by this date, they can request extensions, granting them additional time. However, it's essential to understand that an extension to file isn't an extension to pay. Any owed taxes still need to be paid by April 15th to avoid interest and penalties. Maintaining accurate financial records isn't just an exercise in organization; it's a necessity for accurate tax filing. Whether it's proof of income, evidence of eligible deductions, or documentation of tax credits, having these on hand simplifies the tax preparation process. Moreover, should the IRS have questions or opt to audit, having comprehensive records can be the difference between a smooth process and a drawn-out ordeal. While the IRS typically goes back only three years, it's advisable to keep records for at least seven years, ensuring you're prepared for any eventuality. Nobody's perfect, and mistakes can creep into tax returns. Whether it's an overlooked income source or an unclaimed credit, sometimes amendments are necessary. Amended returns allow taxpayers to correct these errors, ensuring they pay the right amount and claim any refunds due. Filing an amended return isn't a sign of wrongdoing. It's merely an acknowledgment of an oversight. But it's essential to understand the process, from the forms to use to the timelines to expect, ensuring the amendment goes off without a hitch. From wages to freelance gigs and investment returns, every dollar earned counts. One of the most common mistakes taxpayers make is not reporting all their income, either from oversight or misunderstanding. It's not just about honesty; it's about accuracy. The IRS receives copies of all income-reporting documents, like W-2s and 1099s. Failing to report any of these can trigger red flags, leading to potential audits or penalties. The allure of deductions and credits is undeniable. They can significantly reduce tax obligations, leading to smaller bills or larger refunds. But it's crucial to only claim those genuinely applicable to one's situation. Claiming inappropriate deductions or credits isn't just a misstep; it can have repercussions. From simply having the claim rejected to incurring penalties, accuracy is paramount in ensuring a smooth tax experience. It might seem basic, but ensuring personal details, like Social Security numbers, are correct is vital. Mistakes here can delay returns, lead to confusion, or even have the IRS reject the return altogether. Remember, your tax return is a legal document. Presenting accurate and truthful information is not just recommended; it's a requirement. The tax world is governed by deadlines and obligations. Failing to adhere to these can result in penalties. Whether it's a late filing, late payment, or inaccurate claims, understanding the potential penalties can influence decisions, ensuring timely and accurate filings. No one enjoys penalties. They add an unnecessary layer of stress and financial burden. By staying informed and proactive, taxpayers can avoid these pitfalls, ensuring their interactions with the IRS remain positive. The only constant is change, and this adage holds true for tax laws. They evolve, reflecting societal needs, economic shifts, and political landscapes. For taxpayers, staying updated on these changes is crucial. A deduction available one year might be gone the next. A credit introduced could save hundreds or even thousands. By keeping a finger on the pulse of tax law changes, taxpayers can ensure they're always maximizing their financial positions. Income tax serves as the backbone of a nation's fiscal framework, funding essential services and playing a vital role in wealth redistribution. Rooted in ancient practices, the evolution of income tax reflects societal and economic shifts. Today's income tax landscape, characterized by diverse types and intricate calculations, emphasizes fairness through progressive systems and provides opportunities to minimize burdens through deductions and credits. Yet, it demands accuracy and knowledge, as failing to navigate correctly can lead to penalties or missed advantages. While technological tools and professionals ease the process, personal vigilance remains paramount. From reporting all sources of income to adapting to ever-changing tax laws, individuals and businesses must stay informed. In essence, understanding income tax isn't just about fulfilling obligations; it's about optimizing financial health in the broader context of societal contribution.What Is Income Tax?

History of Income Tax

Ancient Civilizations and Taxation

Modern Income Tax: A Brief Overview

Significant Changes and Reforms Over Time

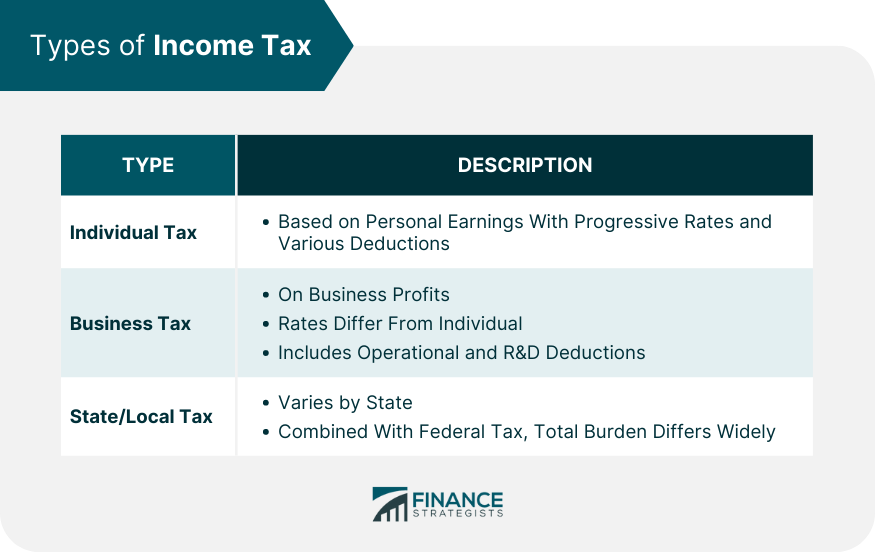

Types of Income Tax

Individual Income Tax

Business Income Tax

State and Local Income Tax

How Income Tax Works

Calculation Basics

Tax Credits vs Tax Deductions

Tax Brackets and Progressive Taxation

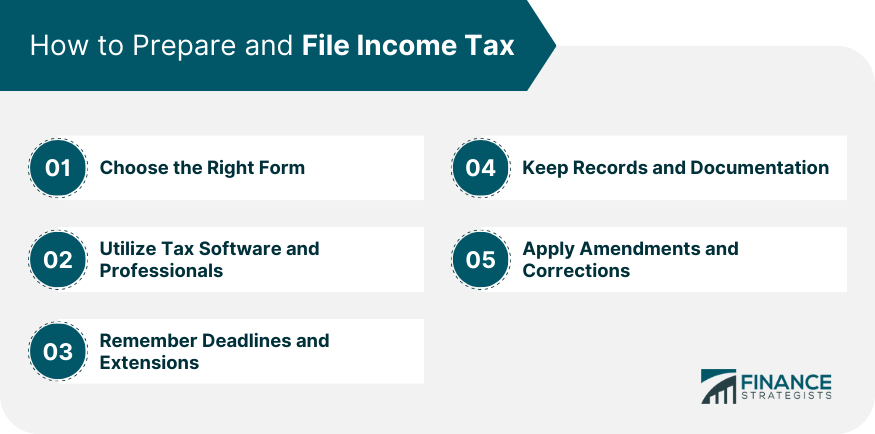

Preparing and Filing Income Tax

Choose the Right Form

Utilize Tax Software and Professionals

Remember Deadlines and Extensions

Keep Records and Documentation

Apply Amendments and Corrections

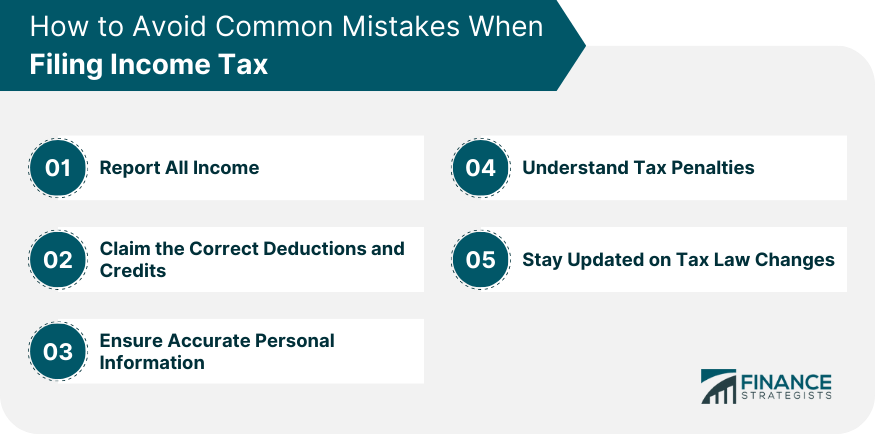

Avoiding Common Mistakes When Filing Income Tax

Report All Income

Claim the Correct Deductions and Credits

Ensure Accurate Personal Information

Understand Tax Penalties

Stay Updated on Tax Law Changes

Final Thoughts

Income Tax FAQs

Income tax is a legal obligation charged by governments on individuals' and corporations' financial incomes; both earned and unearned.

Income tax funds public services, redistributes wealth and can influence certain economic decisions through incentives or disincentives.

Individual income tax is levied on personal earnings, considering factors like deductions and filing status. Business income tax is applied to corporate profits with varying rates and deductions.

Tax brackets are ranges of income taxed at specific rates. Progressive taxation ensures higher incomes are taxed at higher rates, promoting fairness.

Accurate financial records simplify tax preparation and are crucial during audits or when addressing IRS inquiries, ensuring tax accuracy and compliance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.