Liquid net worth is the amount of cash and cash equivalents you have left after subtracting your liabilities from your liquid assets. It is quite similar to net worth. However, the major distinction is that non-liquid assets, which cannot easily be converted into cash, are not accounted for. Examples of these non-liquid assets include real estate or retirement funds. Calculating your liquid net worth might help you assess the condition of your financial safety net. It will also help you manage your regular and short-term financial needs. It is essential to know the difference between liquid and non-liquid assets to accurately calculate liquid net worth. Liquid assets are resources that are easily convertible into cash. Common liquid assets are: Their value is extremely stable because of the great degree of liquidity in their components. Just like mutual funds, you typically get the money from a sale the following day. Illiquid assets are any assets that cannot be sold rapidly without incurring a considerable loss in value. Alternatively, a home equity loan or a reverse mortgage can be used to access the equity of an investment property. However, setting up these arrangements requires time and effort. This is usually part of a larger compensation package. Although stock options can be extremely valuable, they are thought to be particularly illiquid investments since it may take years to actually own the promised stock. You have a chance to make significant gains if you can invest in private equity assets. However, these types of funds frequently impose stringent limitations on when you can sell your shares. Examples of intangible assets include company goodwill, brand recognition, intellectual property, and reputation. Intangible assets are particularly illiquid and can be challenging to value in the market. You can calculate your liquid net worth by deducting the total of your liabilities from the total of your liquid assets. For instance, you may have the following liquid assets and liabilities: As shown above, your total liquid net worth after subtracting your liabilities from liquid assets is $250,000. Liquid Net Worth = $280,000 - $30,000 = $250,000 Net worth may offer a sense of how much money you have. However, it does not reflect your financial security or freedom the way liquid net worth does. Liquid net worth demonstrates your level of financial preparedness for handling unanticipated circumstances or emergencies. With a high liquid net worth, you may not need to liquidate any assets below market value in order to pay your expenses. This is viewed by many as a sign of financial stability. There are a few essential ways to increase your liquid net worth. One of the simplest ways to increase your liquid net worth is to reduce your overall expenses. This will give you more cash on hand to invest in liquid assets or pay down debts. You can take a look at your current expenses to see if there are any specific areas where you can make savings. These savings can be in the form of larger changes, such as selling one of your vehicles, or smaller ones, such as canceling subscriptions to magazines you do not read. Another way to increase your liquid net worth is to focus on paying down debt with high interest such as credit card balances or personal loans. Paying off debt should always be a priority because it reduces the amount of money you need to pay in interest each month. This extra cash can then be utilized to invest in liquid assets or save for other financial goals. If you have a mix of both low- and high-interest debt, you may want to consider the debt snowball strategy to pay off your balances. With this method, you focus on paying off your smallest debt balance first while making minimum payments on your other debts. Once the small balance is paid in full, you move on to the next debt on your list and so forth. The debt snowball method can provide you a motivation to pay off your debts because you will see progress made each time a balance is paid in full. Plus, it can also save you money in interest over time. A savings account is a great way to grow your liquid net worth because it offers you a safe place to save and earn interest on your money. If you do not have a savings account, consider opening one today. Many banks and credit unions provide online savings accounts with competitive interest rates. Once you have opened an account, start contributing to it each month. Even a small monthly contribution can increase over time and help you reach your financial goals. One of the ways to improve your liquid net worth is to have an emergency fund. Your emergency fund should be used for unexpected expenses, such as a car repair or medical bill. This fund can help you avoid going into debt when an unforeseen event occurs. Long-term investments, such as stocks and mutual funds, can offer you the potential to earn a higher return than savings accounts or other short-term investments. However, they also come with more risk. When you invest in stocks or mutual funds, it is important to diversify your portfolio. This means investing in various stocks or funds to reduce the risk of losing money. You may also reduce your risk by investing in index funds, which track a specific market index, such as the Nasdaq Composite. Index funds offer you the potential to earn a return that is similar to the market average while minimizing your investment risk. If you are new to investing, many resources are available to help you get started. You can speak with a financial advisor or investment professional to learn more about growing your liquid net worth through long-term investments. The total net worth of a person or a company is the value of their assets less the amount of liabilities they owe. It is a crucial indicator of an individual or organization's present financial situation. Total net worth is often used in the financial industry to determine who is eligible for specific investment strategies or financial products like hedge funds and structured products. Although total net worth and liquid net worth are extremely similar, they differ in some important ways. One of the primary differences between the two financial measurements is the assets you take into account when calculating total net worth or liquid net worth. All assets, regardless of form, are included when determining total net worth. In contrast, you only count liquid assets that can be quickly converted into cash when determining your liquid net worth. This implies that the majority of individuals' liquid net worth may be much less than their total net worth. Another difference between liquid net worth and net worth is the purpose of the calculation. Although both can be useful for learning more about a person or institution's financial status, calculating net worth supplies general knowledge, while liquid net worth provides more specific details. For instance, with liquid net worth, you will have an idea of how much money you immediately access when needed. There are certain methods for growing liquid net worth that are also methods for increasing total net worth. Raising your income and selling tangible goods for cash are just some ways to raise your liquid net worth without affecting your total net worth. Alternatively, you can improve your asset-to-liability ratio by making debt payments This reduces your liabilities and raises your total net worth as well as your liquid net worth. Liquid net worth refers to the value of your liquid assets minus your liabilities. Liquid assets are cash or investments that can be quickly converted into cash. This includes savings accounts, checking accounts, and short-term investments such as mutual funds. Liabilities are any debts you owe, including student loans, credit card debt, and auto loans. There are several ways to increase your liquid net worth, including paying off debt, saving money, and investing in short-term investments. Liquid net worth is different from total net worth since it only includes liquid assets and does not take into account illiquid assets such as property or stocks. The bottom line is that liquid net worth is a helpful financial metric that everyone should strive to measure and improve. By increasing your liquid net worth, you can improve your financial health and be better prepared for unexpected expenses.What Is Liquid Net Worth?

Liquid Assets vs Non-Liquid Assets

Liquid Assets

Fully matured CDs and no penalty CDs can be withdrawn immediately and thus are considered highly liquid.

Thus, you can sell them right away for cash on the secondary market if you require their value before they mature.

They trade once daily and thus are marginally less liquid than stocks. You usually receive your money from a sale of mutual funds on the next business day.

Illiquid Assets

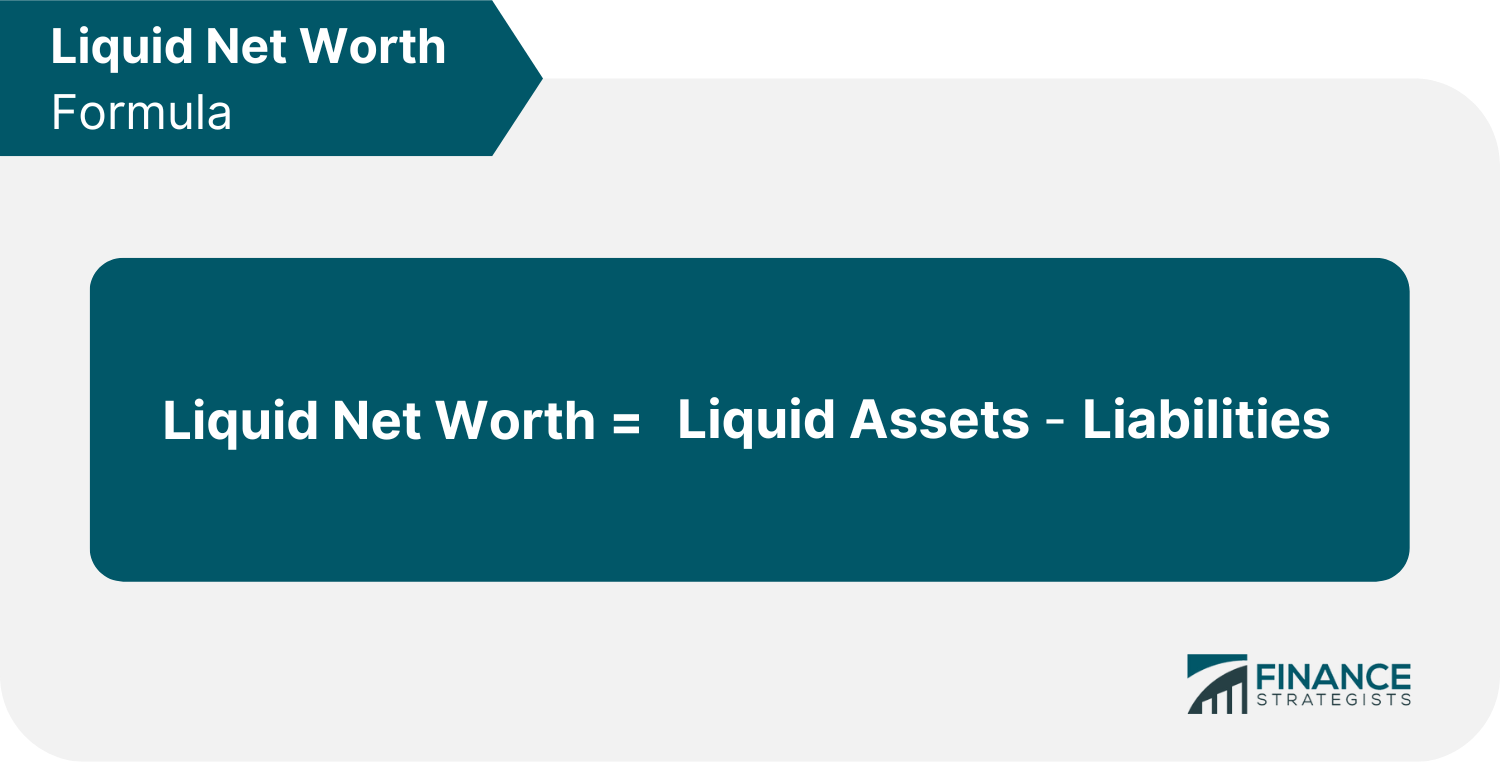

Liquid Net Worth Formula and Calculation

Importance of Liquid Net Worth

Ways to Increase Liquid Net Worth

Minimize Expenses

Reduce Debt

Open a Savings Account

Prepare an Emergency Fund

Build Long-Term Investments

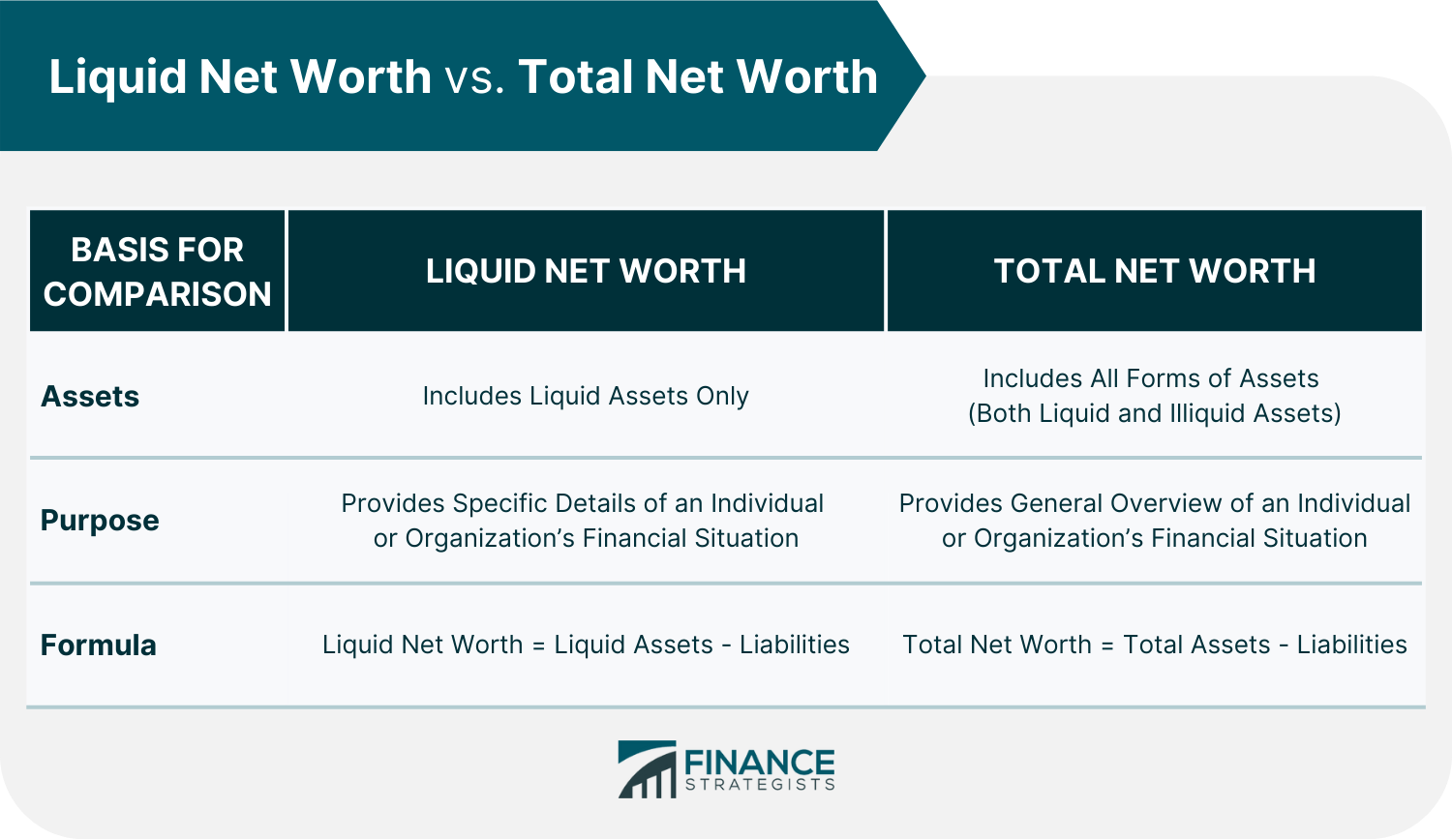

Liquid Net Worth vs Total Net Worth

Final Thoughts

Liquid Net Worth FAQs

Liquid net worth is calculated by subtracting your total liabilities from your total liquid assets.

Liquid net worth is the remaining cash or cash equivalents after deducting your liabilities from your liquid assets.

Liquid net worth only includes liquid assets, while total net worth also takes into account illiquid assets such as real estate, collectibles, and stock options.

Liquid net worth is a good indicator of your financial health and provides a more specific view of your current financial situation. It also reveals how much cash you have on hand to cover unexpected expenses.

There are several ways to increase your liquid net worth, including paying off debt, saving money, and investing in short-term investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.