A proportional tax is a type of tax where the tax rate is the same for all income levels. It is a flat tax where everyone pays the same percentage of their income. Proportional taxes are often used with other types of taxes, such as sales, property, or income, to generate government revenue. Proportional taxes refer to a tax system in which all taxpayers pay the same percentage of their income as tax. They are frequently combined with other types of taxes to generate revenue for the government. One of the characteristics of proportional tax is that it is simple and easy to understand. Another characteristic is that it is fair because everyone pays the same percentage of their income in taxes. To calculate proportional tax, you first need to determine the tax rate. The tax rate is the percentage of income that is paid in taxes. For example, if the tax rate is 10%, and your income is $50,000, you would pay $5,000 in taxes. The tax rate is the same for all income levels, which means that a person who earns $100,000 would pay $10,000 in taxes, and a person who makes $25,000 would pay $2,500 in taxes. An example of a proportional tax is the flat tax used in some countries. In a flat tax system, everyone pays the same percentage of their income in taxes, regardless of income level. This means that a person who earns $20,000 a year would pay the same percentage of their income in taxes as a person who earns $200,000 a year. These are the advantages involved in proportional taxes: Proportional taxes are simple and easy to understand because everyone pays the same percentage of their income in taxes. This means that individuals and businesses can easily calculate their tax liability. Proportional taxes are often viewed as fair because everyone pays the same percentage of their income in taxes, regardless of income level. This can appeal to those who believe in a simple and straightforward tax system. Proportional taxes can stimulate economic growth by reducing the tax burden on businesses and individuals. This can lead to increased investment, job creation, and economic development. Proportional taxes also have their drawbacks, such as the following: Proportional taxes can be regressive and place a more significant burden on lower-income earners than on higher-income earners. This is because a flat tax rate may need to consider the ability of different income groups to pay taxes. Proportional taxes can negatively impact government revenue because they need to consider the ability of different income groups to pay taxes. This can lead to reduced government services and investments in areas such as education, healthcare, and infrastructure. Proportional taxes can have political implications, as they are often viewed as either fair or unfair, depending on the perspective. This can appeal to those who believe in a simple and straightforward tax system but can also be seen as regressive and unfair to lower-income earners. Proportional taxes are used in different countries worldwide, including the United States, European countries, and developing countries. The federal income tax system is progressive in the United States, but some states use a proportional tax system. For example, Colorado uses a flat tax of 4.40%, meaning everyone pays the same percentage of their income in taxes. In European countries, such as Germany and Switzerland, a proportional tax system is used for certain taxes, such as the value-added tax (VAT). The VAT is a tax on goods and services that is added at every stage of production and distribution, and the rate is the same for everyone. In developing countries, proportional taxes are often used as a way to generate revenue for the government. For example, in some African countries, a flat tax is levied on businesses and individuals to raise revenue for the government. Proportional taxes can have an impact on different income groups in society. Some argue that proportional taxes can be regressive and burden lower-income earners more than higher-income earners. This is because a flat tax rate may need to consider the ability of different income groups to pay taxes. Proportional taxes can also affect economic growth. A flat tax rate can stimulate economic growth by reducing the tax burden on businesses and individuals. This can lead to increased investment, job creation, and economic development. However, others argue that a flat tax rate can have a negative impact on economic growth by reducing government revenue. This can lead to reduced government services and investments in areas such as education, healthcare, and infrastructure. Proportional taxes can have political implications, as they are often viewed as either fair or unfair, depending on the perspective. Supporters of proportional taxes argue that they are fair because everyone pays the same percentage of their income in taxes. This can appeal to those who believe in a simple and straightforward tax system. Opponents of proportional taxes argue that they are regressive and burden lower-income earners more than higher-income earners. This can appeal to those who believe in a progressive tax system that considers the ability of different income groups to pay taxes. Proportional taxes are a type of flat tax where everyone pays the same percentage of their income in taxes. They are used in different countries worldwide and can have advantages and disadvantages. Proportional taxes can be simple and easy to understand, but they can also be regressive and place a more significant burden on lower-income earners. Proportional taxes can also have an impact on economic growth and have political implications. Understanding the different types of taxes, including proportional taxes, is essential for individuals and policymakers to make informed decisions on tax services. It is crucial to consider the advantages and disadvantages of different types of taxes when designing a tax system that is fair, efficient, and effective in generating revenue for the government.What Is a Proportional Tax?

How Proportional Tax Works

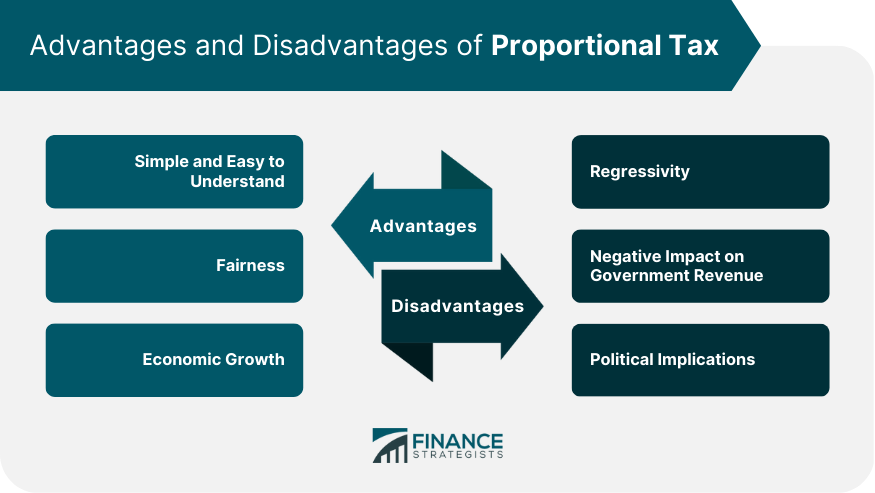

Advantages of Proportional Taxes

Simple and Easy to Understand

Fairness

Economic Growth

Disadvantages of Proportional Taxes

Regressivity

Negative Impact on Government Revenue

Political Implications

Proportional Tax in Different Countries

Effect of Proportional Tax on Society

Political implications of Proportional Tax

Conclusion

Proportional Tax FAQs

A proportional tax is a tax system where the tax rate is the same for all income levels.

To calculate a proportional tax, you first need to determine the tax rate. The tax rate is the same for all income levels, which means that a person who earns $100,000 would pay $10,000 in taxes, and a person who makes $25,000 would pay $2,500 in taxes.

The advantages of a proportional tax are that it is simple, easy to understand, and fair in that everyone pays the same percentage of their income in taxes.

The disadvantages of a proportional tax are that it can be regressive and place a greater burden on lower-income earners than on higher-income earners.

Proportional taxes are one of several types of taxes that governments can use to generate revenue. They are simpler and easier to understand than other types of taxes, but they can also be regressive and place a greater burden on lower-income earners. Progressive taxes, in which higher-income earners pay a higher percentage of their income in taxes, are often seen as fairer but can be more complex to administer.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.