A Qualified Charitable Distribution is a transfer of funds directly from an individual retirement arrangement (IRA) of a person at least 70 1/2 years old to a qualifying charity. For individuals aged 70 1/2 and above, QCDs of up to $105,000 may count toward their required minimum distributions (RMDs) for the year. Unlike regular IRA withdrawals, QCDs are not taxable income. On the other hand, once an RMD is made, it will be taxed as income, which may increase an individual’s tax bracket or restrict their eligibility for certain tax credits or deductions. Charitably inclined individuals may consider making a qualified charitable distribution from their IRA to avoid this. QCDs will help keep their taxable income level at a lower bracket and reduce their potential exposure to the Medicare surtax.

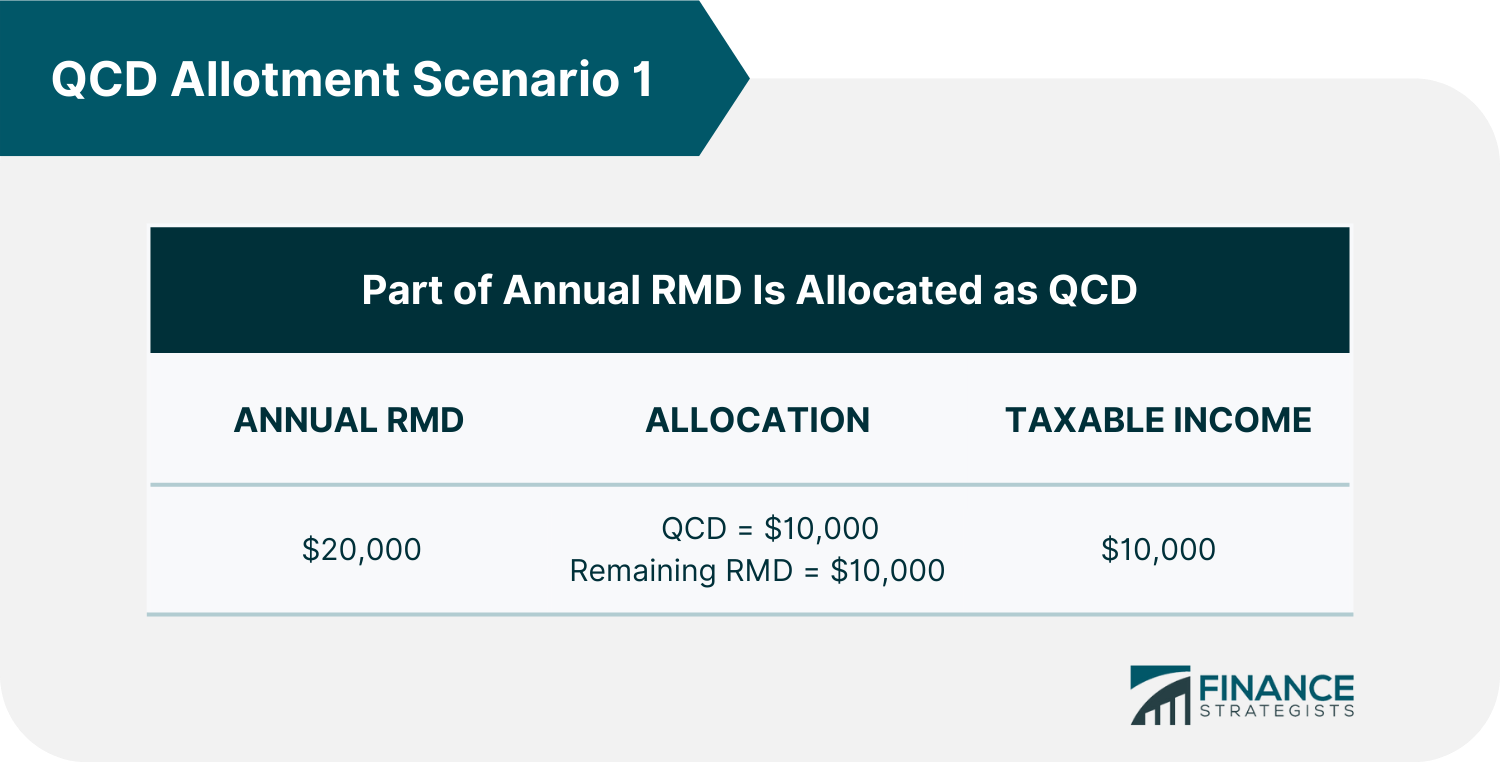

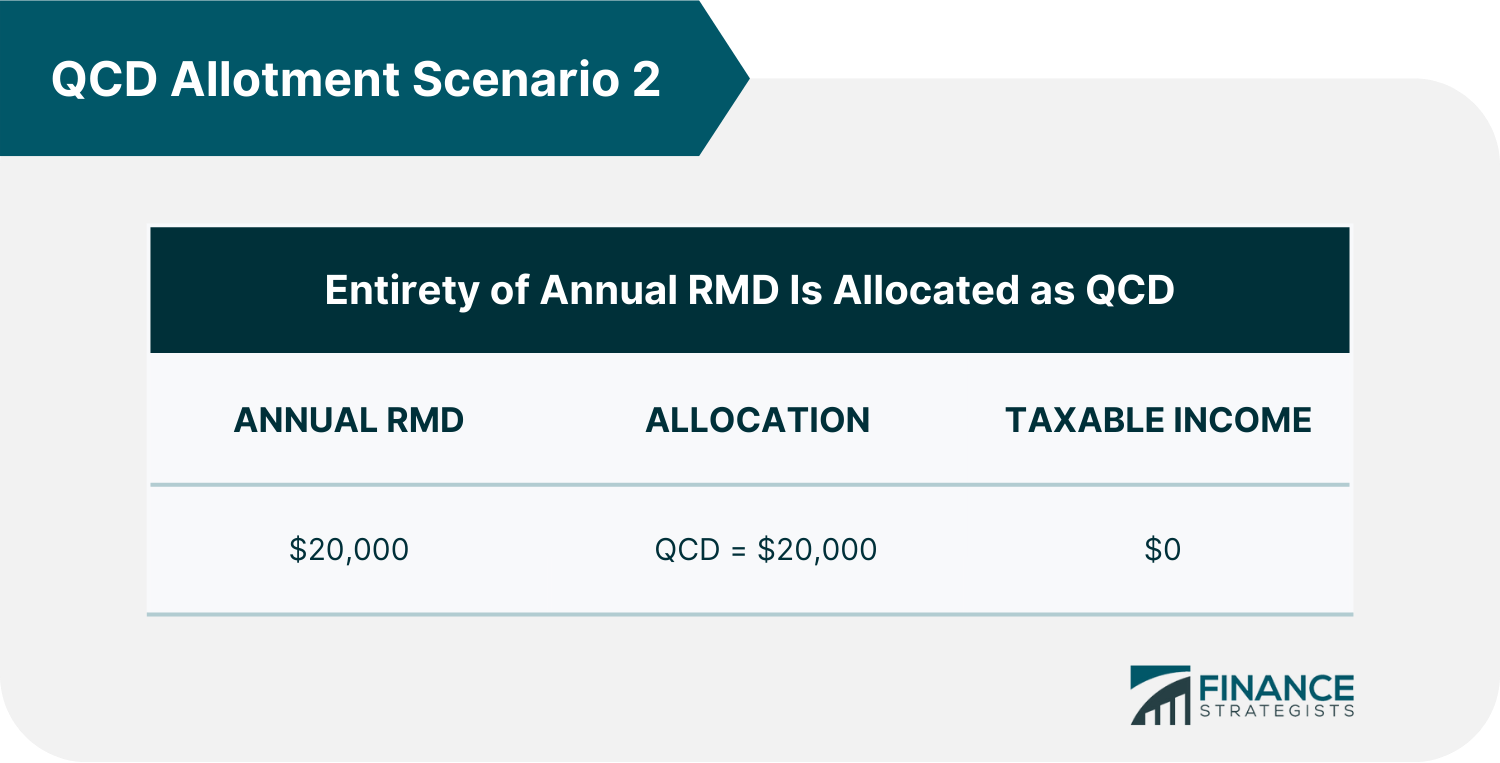

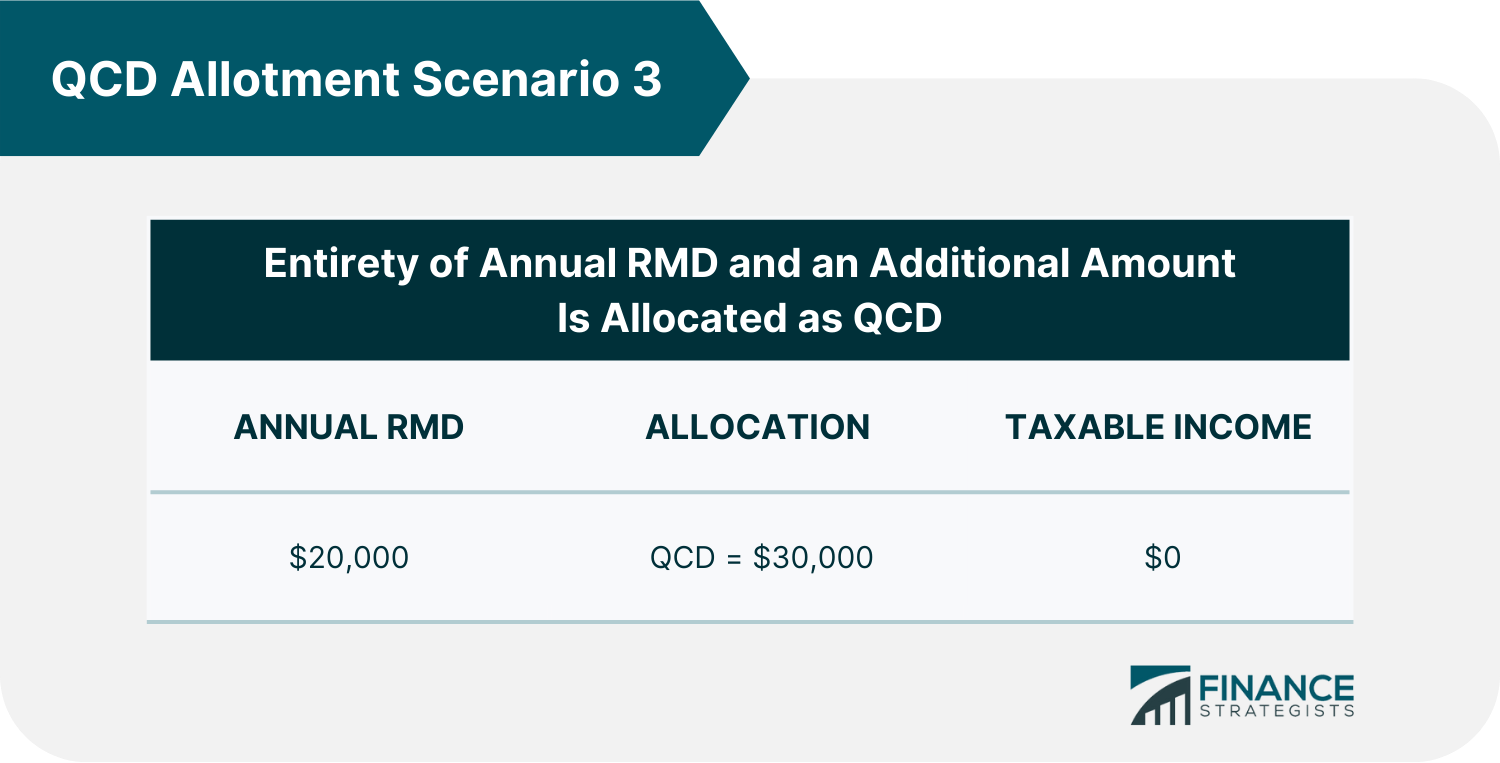

Donating money from an IRA to a charity would be a little more complicated and might cost more without the QCD policy. In this scenario, individuals would have to add the distribution or withdrawal from their IRA to their taxable income. They might still be able to deduct the amount given to charity from their income tax. However, the extra tax from the distribution might end up costing more than the deduction for the charitable donation. QCDs are essential because they help individuals bypass this lengthy and potentially costly process. Instead, the preferred amount is paid directly from the individual's IRA to the selected charity. This arrangement exempts the donated amount from income taxes while helping individuals fulfill their required annual minimum distribution. Below are some qualifications to become eligible for a qualified charitable distribution: Individuals must be at least 70 1/2 years old before they can make a qualified charitable distribution. Before this age, any donations directly transferred from an IRA to a qualified charity will still be counted as taxable income. For a QCD to count under an individual's RMD for the current year, the money must be withdrawn from the IRA by the deadline, typically December 31. The IRA custodian must issue a check payable to the charity and not to the individual who owns the IRA. Otherwise, the distribution will not be considered a QCD. The maximum yearly qualified charitable distribution is $105,000 per individual. If donations have been made to more than one charity, the sum of these amounts can reach up to $105,000. For spouses filing jointly, each can make a $105,000 QCD from their respective IRAs. Only traditional IRAs, inherited IRAs, inactive SEP IRAs, and inactive SIMPLE IRAs are eligible for QCDs. On the other hand, Roth IRAs do not have RMDs, and withdrawal of contributions is tax-free. Thus, making a QCD from a Roth IRA may not be favorable under most circumstances. Specific charities, including donor-advised funds, private foundations, and organizations supporting tax-exempt charities, cannot receive QCDs. Donors must not receive any benefits from their charitable contributions. For example, a donation will not qualify as a QCD if it covers the cost of joining a charitable sports tournament. Before making a QCD, prospective donors must choose a charitable organization and check if it satisfies the conditions the Internal Revenue Service (IRS) set forth. The donor must then inform their IRA custodian of the transfer details. The financial institution managing the donor’s IRA will issue a check payable to the chosen charity. The check may be forwarded to the organization directly or sent to the charity via the donor. Just like any regular IRA distribution, a QCD must be reported to the IRS using certain tax documents. For normal distributions from non-Inherited IRAs, the donor’s IRA custodian will report the QCD on IRS Form 1099-R as a normal distribution. On the other hand, for Inherited IRAs, the QCD will be reported as a death distribution. In either case, donors should keep an acknowledgment of the donation from the charity for their tax records. To understand the relationship between RMDs, QCDs, and taxable income, let us take the case of Cameron. He has been entirely withdrawing his annual RMDs for the past few years. This year, he has decided to make QCDs, to lessen his taxable income. Cameron is considering several scenarios on how to allocate his RMD as a QCD. Below are some of them: In scenario 1, Cameron's annual RMD is $20,000. He makes a QCD worth $10,000, then withdraws the remaining $10,000 to complete his annual RMD. Thus, the remaining RMD of $10,000 will be included in Cameron's taxable income. In scenario 2, Cameron’s annual RMD is $20,000. He makes a QCD worth $20,000. Thus, he completed his whole RMD when performing the QCD. His taxable RMD income is now $0, not $20,000. In scenario 3, Cameron's annual RMD is $20,000. He makes a QCD worth $30,000. Thus he completed his whole RMD when performing the QCD. His taxable RMD income is now $0, not $20,000. Cameron also reduced his IRA balance by $10,000, possibly minimizing his RMD for the following year. However, this additional QCD cannot be applied to future RMDs. In reporting QCDs on their income tax return, individuals like Cameron must report the total amount on the line for IRA distributions. They may enter zero on the line for the taxable amount, followed by "QCD" if the total amount is not taxable. Form 1040 contains additional data on how to report a QCD properly. Interested parties may also consult a tax advisor to confirm how making QCDs will affect their tax filing. A Qualified Charitable Distribution is a transfer of funds directly from an IRA to a qualifying charity. The transfer process is executed by the financial institution managing the donor's IRA through a check payable to the selected charity. Qualified charitable distributions can be an easy way for individuals to support their favorite causes while also getting favorable tax treatment. For instance, individuals aged 70 1/2 years and above may count QCDs towards their required minimum distributions for the year, lowering their taxable income. However, some qualifications and rules must be met for the distribution to be considered a QCD. A QCD's maximum annual amount is $105,000, which can be made to one or more IRS-approved charitable organizations. These QCDs must also be outright gifts and must not benefit the giver in any way. Moreover, only traditional IRAs, inherited IRAs, inactive SEP IRAs, and inactive SIMPLE IRAs are eligible for QCDs. Roth IRAS may technically make QCDs but with fewer tax benefits. The amount of taxable RMDs left after making a QCD varies depending on each individual's situation. Thus, interested individuals may consult a tax advisor for more information on how making QCDs affects income tax return filing. What Are Qualified Charitable Distributions (QCDs)?

Importance of QCDs

QCD Qualifications

Age Requirement

Filing Date

Transfer Process

Maximum Amount

Eligible Accounts

Qualified Charities

How to Make QCDs

QCD and Corresponding Tax Sample Scenarios

The Bottom Line

Qualified Charitable Distribution (QCD) FAQs

In addition to the benefits of charitable giving, individuals aged 70 1/2 years and above may count QCDs towards their required minimum distributions for the year, lowering their taxable income.

A Required Minimum Distribution (RMD) is an annual sum that retirement plan owners must withdraw to avoid excise taxes. A Qualified Charitable Distribution (QCD) is a direct funds transfer from an IRA to a qualifying charity, which may count towards an individual’s annual RMD, lowering their taxable income.

To record a qualified charitable distribution on your Form 1040 tax return, you must enter the whole distribution amount on the line for IRA distributions. If the entire amount was an eligible charitable distribution, indicate zero on the line for the taxable amount.

A Qualified Charitable Distribution (QCD) is a distribution from an individual’s IRA that is transferred directly to a qualified charity. It is not counted as taxable income as long as certain qualifications are met.

A maximum QCD amount of $105,000 may be made to one or more IRS-approved charities by an individual who is at least 70 ½ years old. The transfer should be made directly from either a traditional IRA, an inherited IRA, an inactive SEP IRA, or an inactive SIMPLE IRA to the chosen organization by the RMD deadline.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.