Sales discounts are cash reductions offered to the customer in an attempt to ensure that they make prompt payments on their trade accounts. Sales discounts appear as a reduction in the price for a particular product. It is offered to the purchaser if they are able to pay off their credit purchases in a given period. An example of a sales discount is when a buyer is entitled to a 1% discount in exchange for paying within 10 days of the invoice date, rather than the normal 30 days. This is often stated in the invoice as "1% 10/Net 30" terms. Another example is "2% 10/Net 30" terms, which means that a buyer will enjoy a 2% discount if he settles his balance within 10 days of the invoice date, or pays the full price in 30 days. Sales discounts only appear as expenses on the income statement, and not on the balance sheet. Another term for sales discounts is cash discounts or early payment discounts. Sales discounts are not technically expenses because they actually reduce the price of a product. However, these cash reductions offered to customers have an effect on a company's financial statements so they must be recorded as a reduction in revenue under the line item called accounts receivable. Sales discounts do not reduce any assets or liabilities, only revenue which reduces net income. The sales discounts account is classified as a contra revenue account. It is a reduction of gross sales which correspondingly causes a decrease in the net sales figure. Sales discount will be reflected in the income statement this way:

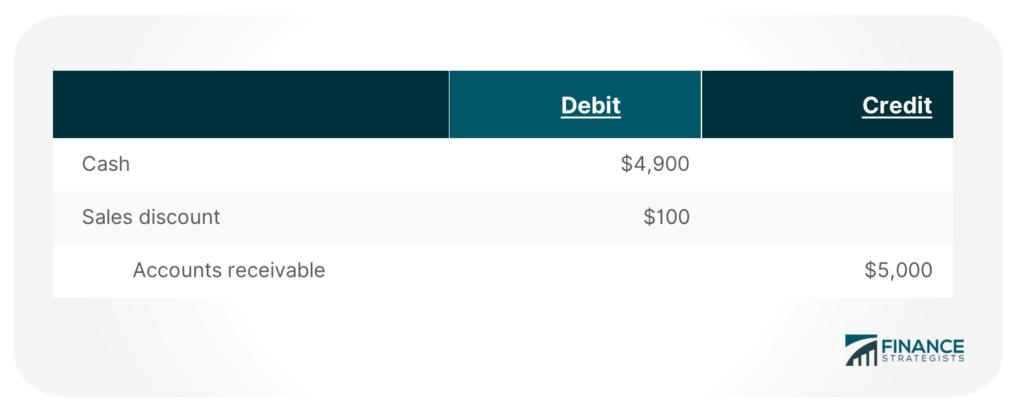

A company may choose to directly state its net sales in the income statement rather than specify gross sales less the amount of sales discounts especially when the amount of sales discounts is immaterial to affect any future decisions for its users. When a company offers sales discounts, it is essentially offering the customer a cash incentive to pay for their purchase earlier than when the account would normally be due. Below is a sample illustration for accounting for sales discounts. Isabella's Educational Supply issues a $5,000 invoice to a customer and offers a 2% discount if the customer is able to pay the invoice amount within 10 days. The customer pays on the 5th day from the invoice date entitling him to the given discount of 2%. The customer then pays an amount of $4,900 Isabella's Educational Supply will record the payment this way:

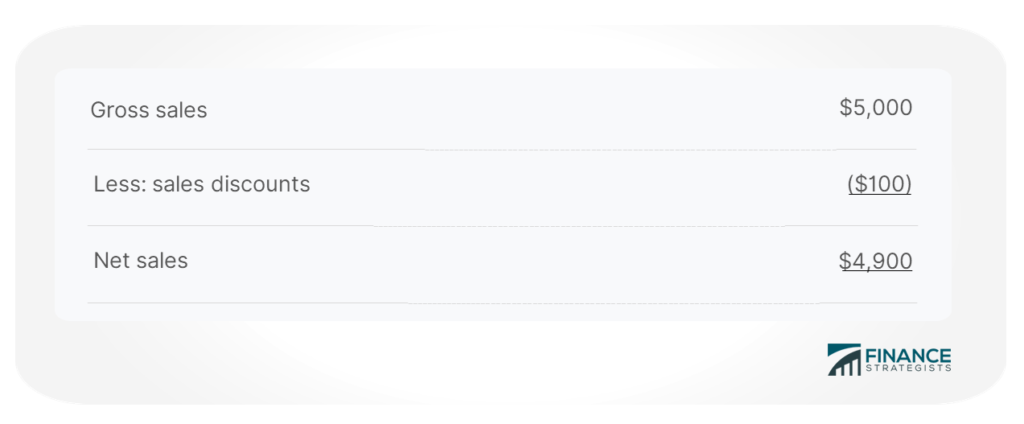

Using the same example above, the income statement of Isabella's Educational Supply will look like this: Sales discounts may induce a company to encourage prompt payment from its customers. The sooner a company receives cash after providing a good or service, the better off it is financially. Sales discounts allow companies to receive more money earlier at the expense of revenue which will be recognized in the future as time goes on. However, if a company has not been prompt in paying their suppliers, then offering sales discounts can help alleviate the situation because now both parties are being treated equally. It is beneficial for both parties to pay as soon as possible. Sales discounts also have a secondary effect on companies because it allows them to "control" their accounts receivable balances by knowing when they will receive payment. Sales Discounts are a useful tool for companies to encourage customers to settle their credit purchases now rather than later. Sales discounts are not expenses so they do not have any effect on assets or liabilities, only revenue that will reduce net income. However, even though sales discounts are considered a type of promotion to encourage the early collection of debts from customers, companies should still be cautious in implementing it because in a way it decreases their revenue and net income. Thus, companies should ascertain whether or not offering sales discounts will truly benefit them in the long run.Accounting Treatment for Sales Discounts

Sample Illustration of Sales Discounts

Final Thoughts

Sales Discounts FAQs

Sales discounts are cash reductions offered to the customer in an attempt to ensure that they make prompt payments on their trade accounts. Sales discounts appear as a reduction in the price for a particular product. It is offered to the purchaser if they are able to pay off their credit purchases in a given period.

Sales discounts are taken as contra revenue accounts. It is a reduction of gross sales which correspondingly causes a decrease in the net sales figure.

Sales discounts are recorded as a reduction in revenue under the line item called accounts receivable. Sales discounts do not reduce any assets or liabilities, only revenue which reduces net income.

Sales discounts are otherwise called cash discounts or early payment discounts.

Sales discounts will entice customers to pay ahead of time their credit purchases which in turn will improve the collection of a company’s accounts receivable. Sales discounts will allow companies to receive more money earlier at the expense of revenue which will be recognized in the future as time goes on.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.