Tax filing is a crucial financial process that each eligible citizen must undertake yearly. It is essential for the smooth functioning of a nation's economy, as the collected funds are utilized for public services such as infrastructure development, defense, healthcare, and education. Filing taxes correctly and on time ensures fairness in wealth distribution and helps avoid penalties while also enabling individuals and businesses to take advantage of deductions and credits, thereby optimizing their financial situations. Accurate tax filing also reflects fiscal responsibility and integrity, and it provides a clear financial trail, which is significant for credit applications or business transparency. In essence, tax filing is a fundamental civic duty that fuels societal development and promotes financial accountability. It's an act that intertwines individual financial health with the broader economic stability and growth of the country. The short answer is—it depends. Many people can successfully file their taxes without hiring an accountant. However, some situations can increase the complexity of your tax situation, making the assistance of a professional helpful or even necessary. If you have multiple income sources, substantial investments, or significant life changes, a tax professional's knowledge and expertise can be invaluable. Not only can they help ensure you're complying with tax laws, they can also guide you towards potential deductions and credits you may not have been aware of, potentially saving you significant money in the long run. The degree of complexity in your financial situation can have a significant bearing on whether you need an accountant to assist with your tax filing. Aspects such as multiple sources of income, investments, owning a business or rental properties, or having undergone significant life changes like divorce or retirement, can complicate tax matters. If your income comes from a single source and you have no dependents or investments, your tax situation is likely simple. In this case, you might be able to handle the tax filing process yourself using tax software. These applications are designed to guide you through the process and make it more manageable, even for those who aren't tax experts. On the other hand, if you have multiple income sources or have investments, your tax situation is likely more complicated. Each source of income and every type of investment may be subject to different tax laws. Understanding and correctly applying these laws requires a significant amount of knowledge and experience. Another primary factor that might determine your need for an accountant is your comfort level with navigating tax laws and forms. Tax laws can be complicated and are often subject to changes. If you are confident in your understanding of these laws, it might be possible for you to file your taxes yourself. However, it's essential to stay updated with any changes to ensure you're filing your taxes correctly and taking advantage of any deductions and credits that you're eligible for. If you feel comfortable filling out tax forms and understand the implications of each line item, you may not need an accountant. Tax software can provide helpful guidance, but ultimately, understanding the information you're submitting is crucial to avoid mistakes. If you are not comfortable with tax laws or forms, or if your tax situation is particularly complicated, hiring an accountant can be a wise decision. An accountant has professional training to navigate tax laws and can ensure that your taxes are prepared correctly, which can save you time, stress, and, potentially, money. Tax filing involves accurately reporting your income and expenses to your country's tax authority, usually on an annual basis. It starts with gathering your financial records for the year, including forms from your employer showing your earned income, statements from banks or brokerages showing interest or investment income, and records of any deductible expenses. The specific forms you'll need to file your taxes depend on your financial situation. For instance, if you're an employee, you'll use a W-2 form provided by your employer. If you're self-employed, you'll likely need a Schedule C form. There are also various forms for reporting investment income, rental income, and itemizing deductions. Understanding which forms you need and where to report different types of income and expenses on these forms is essential for correct tax filing. If your financial situation involves any of the following scenarios, you might want to consider hiring an accountant to file your taxes. Self-Employed or Owner of a Small Business: Running your own business complicates your taxes, as you'll need to account for business expenses, self-employment taxes, and potentially home office deductions. Real Estate Transactions or Ownership: Owning rental properties, or buying and selling real estate, can also complicate your taxes due to the need to track rental income, expenses, and deal with capital gains taxes. Inheritance and Estate Planning: If you've inherited money, particularly if it involves an estate, there may be tax implications that require professional help to navigate. Investments and Stock Market Earnings: Selling investments, particularly stocks, can have tax implications. The same is true for earning dividends or interest. International Income: If you earn income from a source outside of your home country, this can complicate your taxes due to the potential for double taxation and the need to understand tax treaties. Penalties and Fines: Errors in tax filing can result in monetary penalties and fines. These are often proportional to the size of the error and may increase over time if left unaddressed. Potential for Audit: Mistakes on your tax return can draw the attention of tax authorities, leading to a detailed examination of your financial records, or an audit. This process can be time-consuming and stressful. Under-Reporting Income: Failing to accurately report all your income is a common error that can lead to fines or penalties. All income, regardless of the source, should be accurately reported to avoid this issue. Incorrect Deductions: Claiming deductions that you're not entitled to can result in fines and may increase your chances of being audited. It's essential to understand the rules regarding tax deductions to avoid this problem. Math Errors: Simple mathematical mistakes can result in incorrect tax calculations. These can typically be corrected without severe consequences but can cause delays and potential penalties. Legal Trouble: In severe cases, if the tax authority believes you've intentionally tried to evade taxes, it could lead to serious legal trouble, including criminal charges. Stress and Hassle: Correcting tax filing errors can be a stressful and time-consuming process. Having to rectify mistakes, communicate with tax authorities, and possibly pay fines can be a hassle and cause anxiety. Before deciding whether to hire an accountant for your taxes, it's important to weigh the advantages and disadvantages. Expertise and Knowledge: Accountants are well-versed in tax laws and can navigate the intricacies of your tax situation. They understand the tax code's nuances, potential deductions, and credits that you may not be aware of. Time-Saving: Preparing your tax return can be a time-consuming process, especially if your financial situation is complex. Hiring an accountant can save you the time and effort of doing it yourself. Peace of Mind: Knowing a professional has handled your taxes can provide reassurance. An accountant can ensure that your tax return is accurate and filed on time, reducing the likelihood of errors and the stress associated with them. Costs Involved: Hiring an accountant can be expensive, and for some, the cost may outweigh the potential tax savings. It's essential to consider your budget before deciding to hire a professional. Risk of Hiring Someone Inexperienced or Unqualified: While many accountants offer high-quality services, not all are equally skilled or experienced. Hiring someone inexperienced or unqualified can result in errors, potentially leading to fines or audits. Many individuals and small business owners turn to tax software as a middle ground between doing their taxes entirely on their own and hiring an accountant. Tax software programs like TurboTax, H&R Block, and TaxAct offer a more affordable alternative to hiring an accountant. These platforms guide users through the process of preparing their tax returns, offering prompts and explanations to help you understand each step. They also automatically calculate your tax liability or refund based on the information you input. The benefits of using tax software include cost-effectiveness, ease of use, and convenience. These programs are generally less expensive than hiring an accountant, making them an attractive option for those on a budget. Additionally, their user-friendly interfaces and step-by-step guidance can make the tax filing process less daunting. However, tax software also has its limitations. These programs are primarily designed for relatively straightforward tax situations. If you have complex financial circumstances—such as owning a business, substantial investment activity, or foreign income—tax software might not be sufficient. Tax software is ideal for individuals with relatively simple tax situations—those with a single source of income, few to no deductions, and no significant assets or investments. It's also a good option for people who are comfortable with technology and willing to take the time to understand and navigate the tax filing process. In conclusion, the decision to hire an accountant or use tax software depends largely on your individual needs, financial situation, and comfort level with the tax filing process. It's crucial to assess your circumstances and consider both the potential benefits and drawbacks before deciding the best route for you. Tax filing is a crucial civic duty that fuels societal development and promotes financial accountability. Whether or not you need an accountant to file your taxes depends on various factors. For individuals with simple tax situations, such as a single source of income and no significant investments, using tax software can be a cost-effective and convenient option. Tax software provides step-by-step guidance and is ideal for those comfortable with technology. However, if your financial situation is more complex, involving multiple income sources, investments, or significant life changes, hiring an accountant can provide valuable expertise and save you time and stress. Accountants have in-depth knowledge of tax laws and can ensure accurate filing, potentially leading to tax savings. It's important to weigh the advantages and disadvantages of hiring an accountant, considering factors such as cost and the risk of hiring an inexperienced professional. Ultimately, make an informed decision based on your specific needs and comfort level with the tax filing process.Importance of Tax Filing

Do You Need an Accountant to File Your Taxes?

Factors Influencing the Need for an Accountant

Complexity of Financial Situation

Single Source of Income

Multiple Income Sources and Investments

Comfort With Navigating Tax Laws and Forms

Familiarity With Tax Laws

Confidence in Filing Tax Forms

Need for Professional Guidance

Understanding the Basics of Tax Filing

Overview of the Tax Filing Process

Forms Involved and the Information Needed

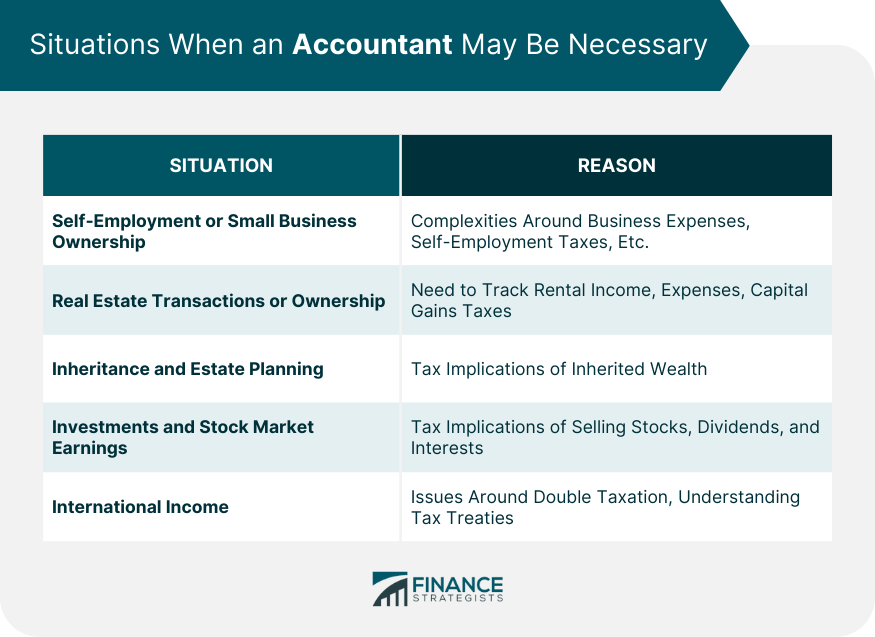

Situations When an Accountant May Be Necessary

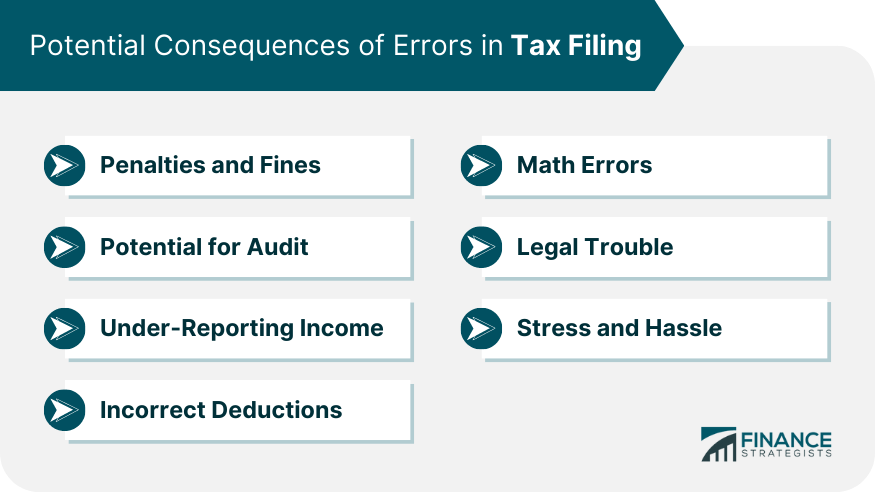

Potential Consequences of Errors in Tax Filing

Benefits and Disadvantages of Hiring an Accountant

Benefits of Hiring an Accountant

Disadvantages of Hiring an Accountant

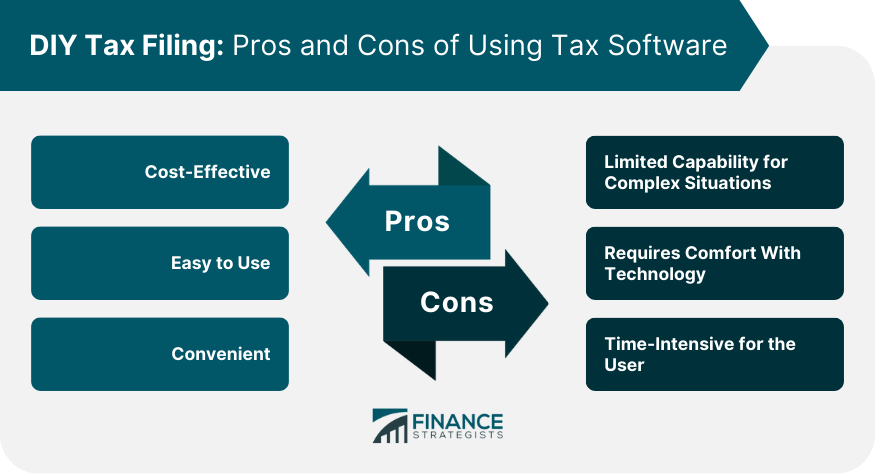

DIY Tax Filing: Using Tax Software

Overview of Available Tax Software

Pros and Cons of Using Tax Software

Ideal Situations for Using Tax Software

Bottom Line

Do You Need an Accountant to File Your Taxes? FAQs

Being self-employed or owning a small business often complicates your tax situation due to self-employment taxes, business expenses, and potential home office deductions. It might be beneficial to hire an accountant in this case.

The value of hiring an accountant depends on your individual circumstances, including the complexity of your financial situation, your understanding of tax laws, and your budget.

Yes, you can use tax software, and it's often a more affordable alternative. However, it's best suited for relatively straightforward tax situations. For complex scenarios, hiring an accountant might be more beneficial.

Errors in tax filing can result in penalties, fines, and even an audit by the tax authority. Serious legal trouble can occur if intentional tax evasion is suspected.

An accountant can provide expertise, save you time, and give you peace of mind knowing your taxes have been handled professionally. They can help optimize your tax situation, potentially leading to savings.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.