Yes, a second home can qualify for a 1031 exchange, but it must meet certain conditions outlined by the IRS. Primarily, the property should be held for investment or business use, not personal use. To maintain its eligibility, owners should adhere to the "14-day or 10%" rule, implying the property should be rented out for at least 14 days per year, and personal use should not exceed the greater of 14 days or 10% of the number of days it is rented out. Furthermore, the "2-year rule" states that these conditions must be met for two of the five years preceding the exchange. Compliance with these rules and careful record-keeping are crucial to qualify a second home for a 1031 exchange. For more complex scenarios, professional advice is recommended. To grasp the potential for a second home to qualify for a 1031 exchange, it's vital to distinguish between a primary and secondary home. A primary residence is one's main domicile where they live for most of the year. In contrast, a secondary home—often a vacation property or an investment property—isn't used as the owner's principal residence. For a property to qualify for a 1031 exchange, it must be exchanged for a "like-kind" property. This term refers to the nature or character of the property, not its grade or quality. Essentially, it means any real property used for business or held as an investment can be exchanged for another real property used for business or held as an investment. The second home must adhere to specific conditions to qualify for a 1031 exchange. It should primarily serve as an investment or business asset, and personal use should be minimal. The more the property is used for personal enjoyment, the less likely it is to qualify. Section 1031 of the Internal Revenue Code provides an exception that allows the deferral of paying capital gains taxes when an investment or business property is sold to acquire another "like-kind" property. However, there are particular rules for second homes. Section 1031 is designed to encourage the continuous investment of capital in business and investment properties. It allows investors to defer capital gains taxes on the exchange of "like-kind" properties, facilitating the smooth transition of capital from one investment to another. The IRS specifies certain rules for a second home to qualify for a 1031 exchange. Two critical regulations are the 14-day rule and the 2-year rule. The 14-day rule stipulates that the property owner may only use the property for personal use for 14 days or 10% of the days it was rented, whichever is greater. The 2-year rule implies that the property must have been rented at fair market value for at least 14 days for two of the last five years before the exchange. Failure to meet these guidelines can lead to disqualification from the 1031 exchange. While the IRS rules seem stringent, there are exceptions where personal use might not disqualify the property from a 1031 exchange. The IRS provides a "Safe Harbor" rule in Revenue Procedure 2008-16. According to this rule, a dwelling unit qualifies as a property held for productive use in a trade or business or for investment if it meets specific requirements. This rule effectively gives property owners a "safe harbor" in which their exchange will not be challenged. Even with the safe harbor rule in place, the IRS allows for some personal use of the property. Owners can use their property for up to 14 days per year or 10% of the number of days the property is rented, whichever is less, without disqualifying the property for a 1031 exchange. Transforming a second home into a qualified property for a 1031 exchange requires methodical planning and execution. To qualify for a 1031 exchange, one must convert their second home into an investment property. This means renting out the property at a fair market value, restricting personal use, and adjusting how the property is represented in tax filings. Keeping a detailed record of the property's use is paramount. Document the number of days the property is rented out and the number of days used for personal purposes. Save all rental receipts and other related paperwork. Given the complexity of IRS regulations, it's recommended to seek advice from tax professionals or real estate attorneys with experience in 1031 exchanges. They can provide guidance tailored to the individual's situation. A successful 1031 exchange requires a qualified intermediary (QI) who acts as a facilitator during the process. Importance of Intermediaries: The QI holds the proceeds from the sale of the relinquished property and uses them to purchase the replacement property. This ensures the property owner doesn't gain "constructive receipt" of the funds, which would invalidate the exchange. Duties of a Qualified Intermediary: The QI's role includes preparing the exchange agreement, securing the funds, and handling the necessary documentation to complete the exchange. They ensure the exchange is conducted according to IRS guidelines. Despite the tax advantages of a 1031 exchange, there are potential risks and downsides. Financial and Tax Risks: The risk of depreciation, property taxes, and unexpected expenses can make the investment less profitable. Property Management Risks: Managing a rental property can be challenging, especially if the owner lives far away. It may necessitate hiring a property management company, adding an extra cost. Future Changes to 1031 Exchange Rule: The rules governing 1031 exchanges are determined by the IRS and Congress, and they can change. Future modifications could affect the benefits of conducting a 1031 exchange. A second home can qualify for a 1031 exchange, but specific IRS conditions must be met. The home should serve as an investment or business asset with limited personal use. The IRS applies the "14-day or 10%" and the "2-year rule" to monitor property usage. Converting a second home into an investment property involves renting it at fair market value, limiting personal use, and meticulous record-keeping. A Qualified Intermediary plays a crucial role in facilitating the 1031 exchange process, safeguarding the property owner from "constructive receipt" of the funds. While a 1031 exchange offers tax deferral advantages, potential risks include financial and tax burdens, property management challenges, and possible future amendments to 1031 exchange rules. It's recommended to seek professional advice to navigate these complexities successfully.Can a Second Home Qualify for a 1031 Exchange?

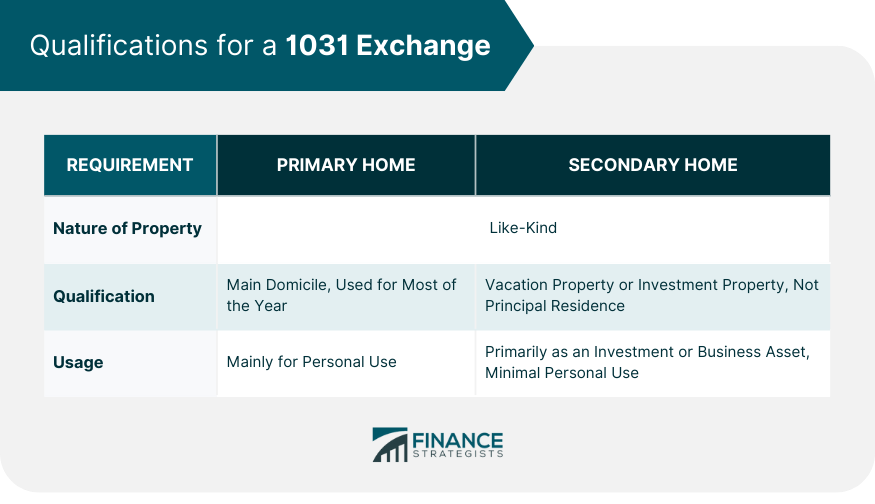

Understanding the Qualifications for a 1031 Exchange

Primary vs Secondary Home

"Like-Kind" Property

Conditions for Qualification

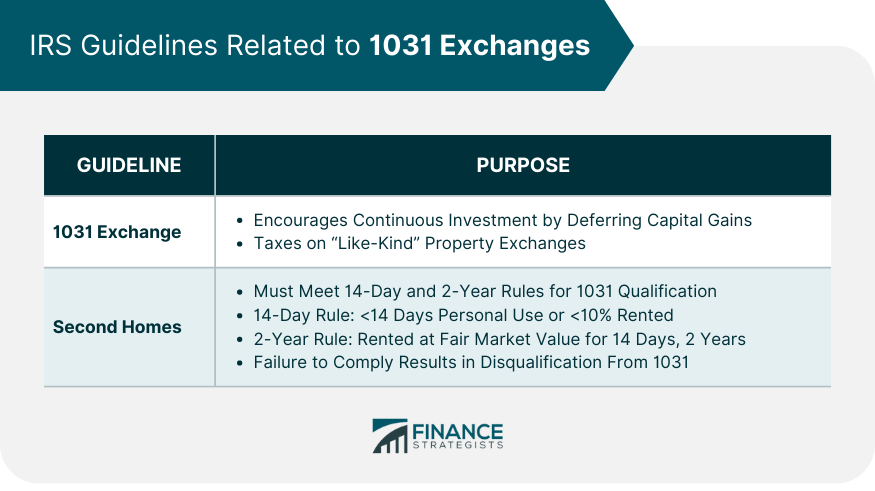

IRS Guidelines Related to 1031 Exchanges

Section 1031

Second Homes

Exceptions to the Rule: Personal Use of Rental Property

Understanding the Safe Harbor Rule

Exceptions for Personal Use

Practical Steps to Qualify a Second Home for a 1031 Exchange

Convert a Second Home Into a Qualified Property

Best Practices for Record Keeping

Seek Professional Advice

Role of Qualified Intermediaries in 1031 Exchanges

Possible Risks and Downsides of 1031 Exchanges

Additionally, while a 1031 exchange defers taxes, it doesn't eliminate them. If the property owner sells the replacement property without another exchange, the deferred taxes become due.Bottom Line

Can a Second Home Qualify for a 1031 Exchange? FAQs

A 1031 exchange, named after Section 1031 of the U.S. Internal Revenue Code, allows investors to defer paying capital gains taxes when they sell an investment or business property and reinvest the proceeds in a new property that is of "like-kind" or similar in nature.

Yes, a second home can qualify for a 1031 exchange, but it must adhere to specific conditions. The property should primarily be used as a business or investment asset and not for personal enjoyment. The IRS applies strict rules regarding personal usage of the property to maintain its eligibility for a 1031 exchange.

The IRS specifies the 14-day rule and the 2-year rule for a second home to qualify. The 14-day rule allows the owner to use the property for personal use for 14 days or 10% of the days it was rented, whichever is greater. The 2-year rule states that the property must have been rented at fair market value for at least 14 days for two of the last five years before the exchange.

A Qualified Intermediary (QI) is a professional facilitator in a 1031 exchange. The QI holds the proceeds from the sale of the relinquished property and uses them to purchase the replacement property. This prevents the property owner from gaining "constructive receipt" of the funds, which would invalidate the exchange. The QI also prepares the necessary documentation to complete the exchange according to IRS guidelines.

Potential risks and downsides of a 1031 exchange include financial and tax risks, property management challenges, and possible future changes to 1031 exchange rules. For instance, while a 1031 exchange defers taxes, it doesn't eliminate them. Also, managing a rental property can be challenging and may require hiring a property management company. Moreover, IRS and Congress rules governing 1031 exchanges can change, potentially impacting the benefits of conducting such an exchange.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.