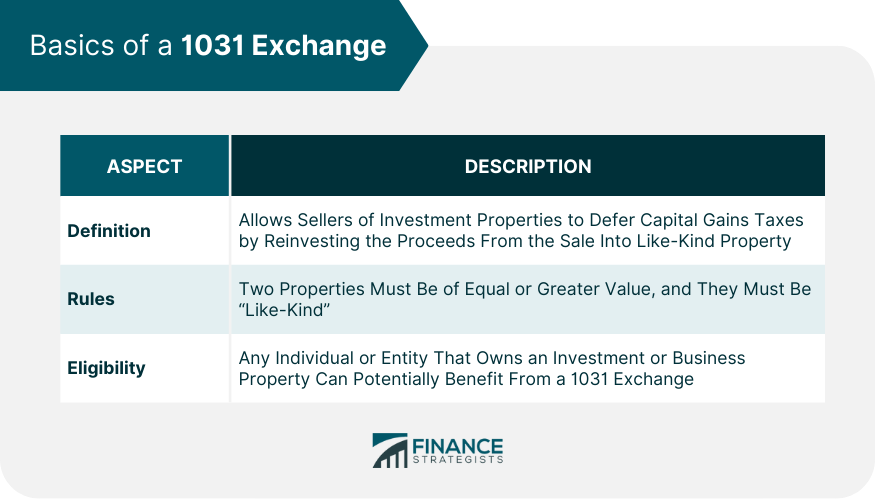

A 1031 Exchange, under Section 1031 of the Internal Revenue Code, is a transaction that allows sellers of investment properties to defer capital gains taxes by reinvesting the proceeds from the sale into like-kind property. Sellers can significantly benefit from this, as they can use the entire proceeds from the sale, including the amount otherwise due as capital gains tax, to invest in a potentially more profitable property. However, a 1031 Exchange comes with certain risks, such as the challenge of identifying a suitable replacement property within 45 days. Furthermore, the tax deferral is not indefinite - the capital gains tax will be due when the new property is sold without conducting another 1031 Exchange. Therefore, while offering financial advantages, a 1031 Exchange requires careful planning and compliance with strict rules. A 1031 Exchange refers to a swap of one investment property for another. The primary rule is that both properties must be similar enough to qualify as like-kind. A vital aspect is that it's tax-deferred, not tax-free. When the seller eventually sells the new property without going through another 1031 Exchange, capital gains tax will be due. Mostly, 1031 exchanges are used by real estate investors. However, they are not confined to them. Any individual or entity that owns an investment or business property can potentially benefit from a 1031 Exchange. Capital gains tax is a levy on the profit made from selling something you own, which in this context refers to real estate. The amount is calculated by subtracting the cost of purchasing and improving the property from the selling price. A 1031 Exchange allows for the deferral of capital gains tax. Instead of paying taxes on the realized gains from a property sale, sellers can reinvest those gains into another like-kind property. This allows for more capital to be reinvested, potentially leading to higher returns. By deferring taxes through a 1031 Exchange, sellers can put more money towards their next investment. This can lead to improved returns over time as the additional capital generates further profit. The 1031 Exchange allows sellers to use all their proceeds, including the amount otherwise paid as taxes, towards purchasing a better, potentially more profitable property. The flexibility of the 1031 Exchange can enable investors to diversify their real estate portfolio. Depending on their investment strategy, they can exchange one high-value property for multiple lower-value ones or vice versa. A 1031 Exchange is not without risks. There are strict guidelines and deadlines that must be adhered to, and failure to meet them can result in the loss of tax-deferral benefits. From the day the seller sells their property, they have 45 days to identify potential replacement properties and 180 days to complete the purchase. These tight deadlines can lead to rushed decisions or challenges if unforeseen delays occur. Identifying a suitable replacement property within the 45-day window can be challenging. If a suitable property isn't found, the 1031 Exchange fails, and the seller will owe taxes on the sale. 1031 Exchanges can increase demand for investment properties, as investors are incentivized to continue investing in real estate to defer taxes. Increased demand for properties can lead to higher property values. Sellers can potentially benefit from this increased market activity, especially in hot real estate markets. As we move beyond the immediate implications of a 1031 exchange, it's essential to understand its broader effects on a seller. A 1031 Exchange encourages a long-term investment mindset. The tax deferment incentives create a favorable environment for real estate holders to reinvest in the market rather than cash out their assets. This strategy promotes the growth and health of the real estate sector. 1031 exchanges can also play a significant role in estate planning. If held until death, the property's cost basis gets stepped up to its current market value, essentially eliminating all deferred taxes. Therefore, it's a practical tool for passing on wealth to the next generation without the burden of accumulated capital gains taxes. The impact of a 1031 exchange can vary depending on the real estate market in question. Here, we delve into some specifics. In high-value markets like New York City or San Francisco, a 1031 Exchange can be particularly advantageous. These markets often see high property appreciation rates, meaning significant capital gains taxes upon sale. A 1031 Exchange can defer these substantial taxes while allowing reinvestment in equally high-potential markets. Sellers in lower-value or emerging markets can also benefit. By selling a property and identifying multiple replacement properties in the same market, investors can spread risk and potentially increase overall returns. A 1031 Exchange, per Section 1031 of the Internal Revenue Code, provides a strategic tax-deferment tool to real estate sellers. It facilitates tax deferral by reinvesting proceeds from a sale into a like-kind property, which enables sellers to boost their investment returns and acquire more profitable properties. However, adherence to strict rules and deadlines is essential; failure could lead to the loss of tax-deferral benefits. Apart from immediate tax advantages, this provision encourages a long-term investment outlook and can significantly contribute to estate planning by eliminating deferred taxes upon death. Market conditions and potential regulatory changes can affect its benefits, requiring sellers to stay informed. Ultimately, a 1031 Exchange is not just about tax deferral—it's a powerful mechanism shaping investment portfolios and financial futures in the broader real estate landscape.How Does a 1031 Exchange Affect the Seller?

Basics of a 1031 Exchange

Rules of a 1031 Exchange

Eligibility for a 1031 Exchange

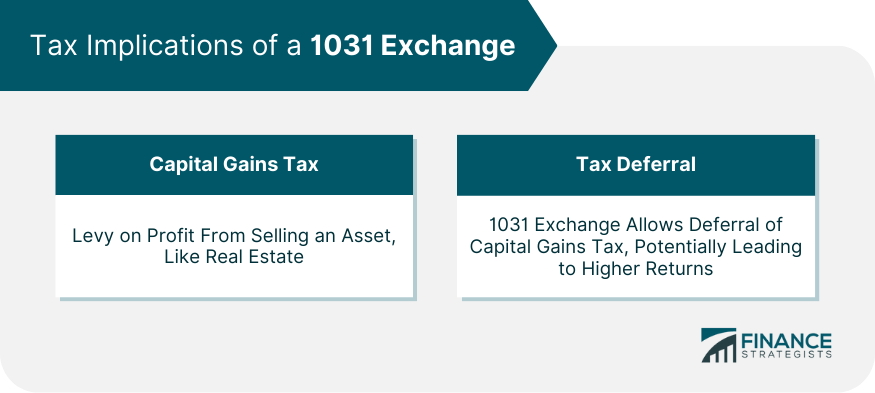

Tax Implications

Capital Gains Tax

Tax Deferral in a 1031 Exchange

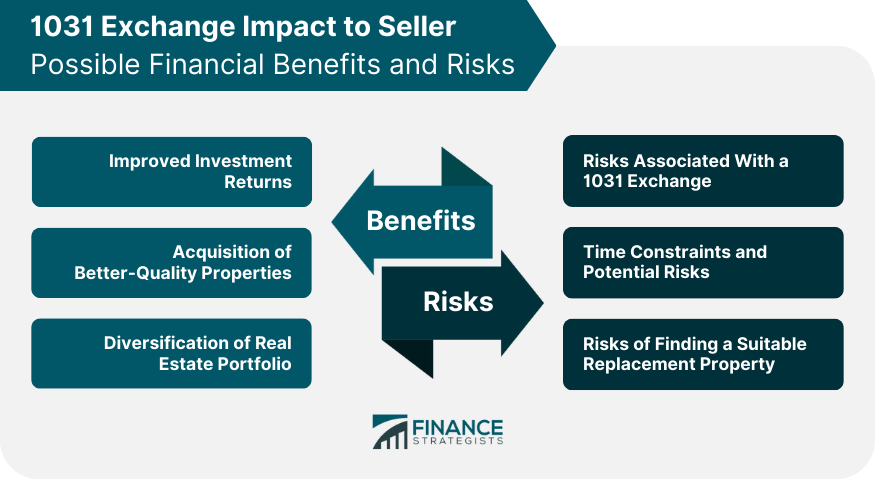

Potential Financial Benefits

Improved Investment Returns

Acquisition of Better-Quality Properties

Diversification of Real Estate Portfolio

Possible Financial Risks

Risks Associated With a 1031 Exchange

Time Constraints and Potential Risks

Risks of Finding a Suitable Replacement Property

Impact on Real Estate Market Dynamics

Effect on Demand for Real Estate Properties

Impact on Property Values

Broader Effects of a 1031 Exchange on the Seller

Promoting Long-Term Investment Mindset

Role in Estate Planning

Further Exploration

Impact on High-Value Markets

Impact on Lower-Value or Emerging Markets

Conclusion

How Does a 1031 Exchange Affect the Seller? FAQs

A 1031 Exchange, named after Section 1031 of the Internal Revenue Code, is a real estate transaction that enables sellers to defer capital gains tax by reinvesting the proceeds of a sold property into a like-kind one.

Any individual or entity owning an investment or business property can potentially benefit from a 1031 Exchange. It is commonly used by real estate investors for tax deferment and portfolio diversification.

The primary rule is that the exchanged properties must be of like-kind. Upon selling a property, the seller has 45 days to identify potential replacement properties and 180 days to complete the purchase to qualify for the tax deferral.

A 1031 Exchange allows sellers to defer capital gains tax, which can lead to improved investment returns. It also facilitates acquiring higher quality properties and diversifying the real estate portfolio.

The main risks include the strict deadlines for identifying and purchasing replacement properties. Failure to adhere to these guidelines can result in a loss of the tax-deferral benefits. Also, future regulatory changes and shifts in economic conditions can influence the benefits of a 1031 Exchange.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.