A Tenants-In-Common 1031 Exchange refers to a specific property transaction involving multiple investors. Under this arrangement, co-owners, each holding a distinct share, sell a jointly-owned property and use the proceeds to purchase another "like-kind" property. This transaction is guided by Section 1031 of the Internal Revenue Code, which allows the deferment of capital gains tax usually incurred on the sale of an investment property. The purpose of a Tenants-In-Common 1031 Exchange is to offer investors tax benefits, portfolio diversification, and potential increased cash flow. However, navigating it with caution is crucial as it presents challenges such as possible management disputes and co-ownership risks. In a Tenants-In-Common (TIC) structure, multiple investors each hold a distinct share in a property. This unique ownership framework enables multiple parties to invest in, and benefit from, a single real estate asset. In a 1031 Exchange, a TIC structure allows these co-owners to sell their jointly-held property and use the proceeds to purchase another "like-kind" property. This transaction is governed by Section 1031 of the Internal Revenue Code, which allows the deferment of capital gains tax typically incurred on property sales. The first requirement for a property to qualify for a Tenants-In-Common (TIC) 1031 Exchange is the ownership structure. The property must be jointly owned by two or more individuals, each holding an undivided interest in the property. The property must meet specific guidelines outlined by the IRS in Revenue Procedure 2002-22. For instance, the number of co-owners should not exceed 35, and each owner should hold a deed to the property, retaining the right to sell, transfer, or encumber their individual ownership interest. The exchanged property must be of like-kind, meaning it should be of a similar nature or character, irrespective of differences in grade or quality. This ensures that the property remains within the same investment or business purpose. Lastly, both the relinquished property and the replacement property must be held for investment purposes or for productive use in a trade or business. Personal residences do not qualify for a TIC 1031 exchange. Perhaps the most significant advantage of a TIC 1031 exchange is the deferral of capital gains tax. By reinvesting the proceeds from the sale of a property into another like-kind property, an investor can potentially defer all capital gains taxes that would otherwise be due upon the sale. TIC 1031 exchanges allow investors to diversify their portfolios by owning interests in multiple properties, rather than having all their capital tied up in a single real estate investment. This can spread risk and potentially lead to better overall returns. With a TIC 1031 exchange, an investor may be able to acquire an interest in a larger, higher-quality property that generates more rental income than they could afford individually. This can lead to increased cash flow and a potentially higher return on investment. A major risk of TIC ownership is the potential for disputes among the co-owners, particularly over management issues. Without clear agreements in place, disagreements over maintenance, repairs, improvements, and the eventual sale of the property can lead to costly and time-consuming conflicts. Co-ownership can bring its own risks. If a co-owner becomes bankrupt, their share of the property could become part of their bankruptcy estate. Furthermore, if a co-owner decides to sell their interest, the other owners may end up co-owning the property with an unwanted new owner. Selling a TIC property can be more challenging than selling a property owned by a single entity. Each co-owner has the right to sell their interest separately, which can complicate the sales process and potentially reduce the property's overall marketability. The first step in a TIC 1031 exchange is to identify a suitable replacement property. This must be done within 45 days of selling the relinquished property. It's essential to carefully consider the potential for return on investment, the stability of income, and the overall risk profile of the replacement property. The sale of the relinquished property must be handled by a qualified intermediary, who holds the sales proceeds to avoid "constructive receipt" by the seller and thus preserve the tax-deferred status of the transaction. Finally, the replacement property is purchased using the proceeds from the sale of the relinquished property, with each owner acquiring an undivided interest in the property as a tenant-in-common. The transaction must be completed within 180 days of the sale of the relinquished property. Tenants-In-Common 1031 Exchange is a strategic real estate investment approach, allowing multiple investors to defer capital gains tax through the sale and acquisition of like-kind properties. This process, governed by Section 1031 of the Internal Revenue Code, offers the benefits of tax deferral, portfolio diversification, and the potential for increased cash flow. However, it also poses risks such as management disputes and co-ownership issues. To qualify, properties must adhere to shared ownership structures, IRS guidelines, and investment intent stipulations, and be of like-kind nature. The execution process involves identifying a suitable replacement property, closing the sale of the relinquished property via a qualified intermediary, and acquiring the replacement property under Tenants-In-Common ownership. Investors must weigh these considerations carefully to ensure a successful Tenants-In-Common 1031 Exchange.Tenants-In-Common 1031 Exchange Overview

How Tenants-In-Common Fits in a 1031 Exchange

Defining Tenants-In-Common

Role of Tenants-In-Common in a 1031 Exchange

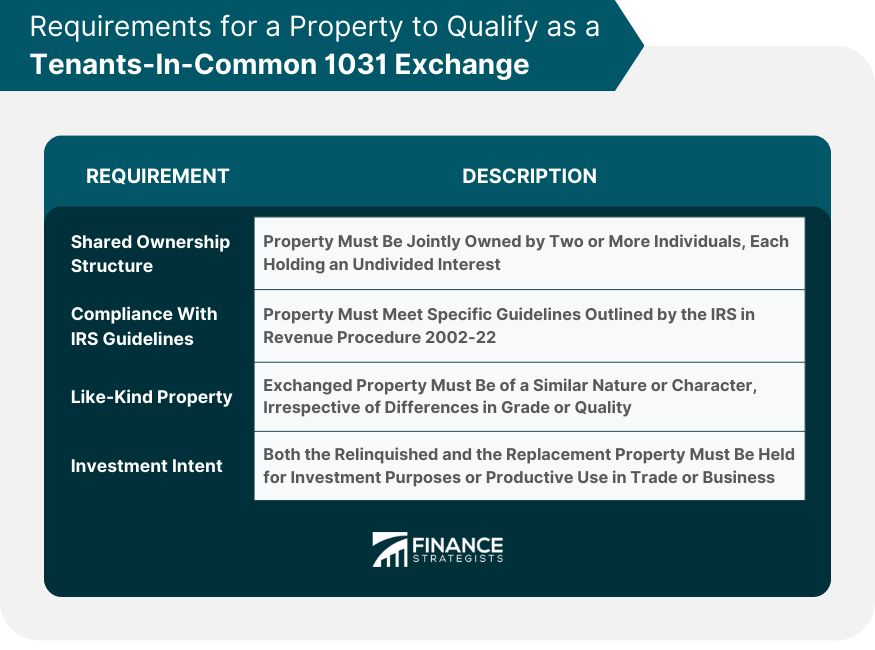

Requirements for a Property to Qualify as a Tenants-In-Common 1031 Exchange

Shared Ownership Structure

Compliance With IRS Guidelines

Like-Kind Property

Investment Intent

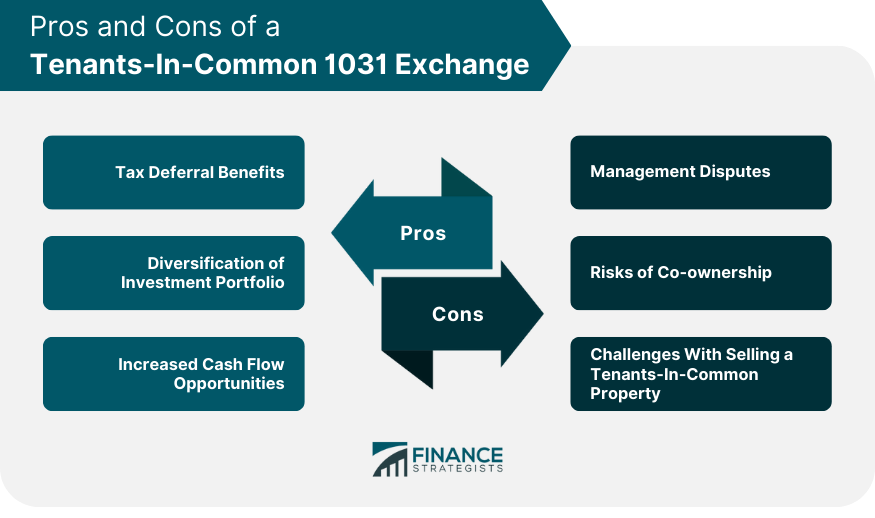

Pros of a Tenants-In-Common 1031 Exchange

Tax Deferral Benefits

Diversification of Investment Portfolio

Increased Cash Flow Opportunities

Potential Cons of Tenants-In-Common 1031 Exchange

Management Disputes

Risks of Co-ownership

Challenges With Selling a Tenants-In-Common Property

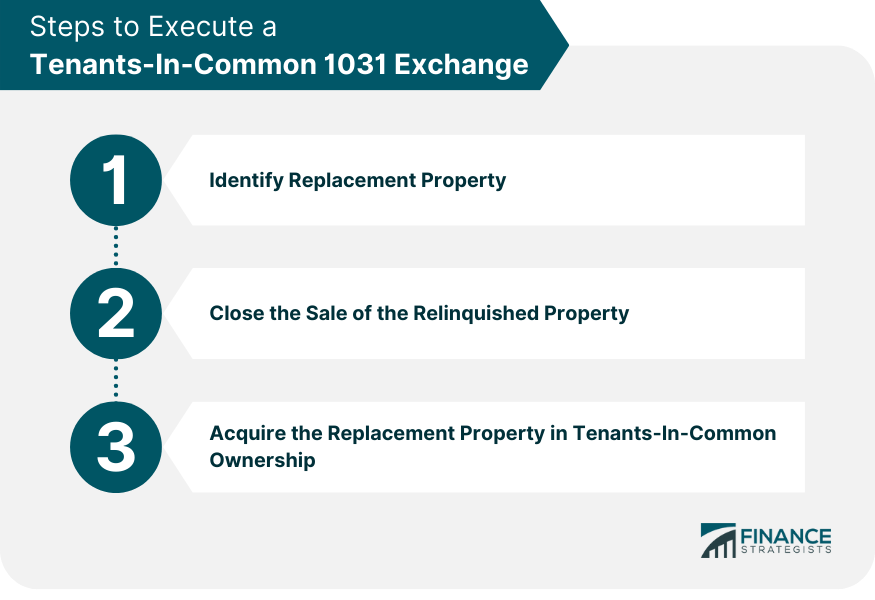

Steps to Execute a Tenants-In-Common 1031 Exchange

Identify Replacement Property

Close the Sale of the Relinquished Property

Acquire the Replacement Property in Tenants-In-Common Ownership

Conclusion

Tenants-In-Common 1031 Exchange FAQs

A Tenants-In-Common 1031 Exchange is a type of real estate transaction where multiple investors, as co-owners, sell a property and use the proceeds to acquire a like-kind property while deferring capital gains tax. This is done in accordance with Section 1031 of the Internal Revenue Code.

In a traditional 1031 Exchange, one investor sells a property and acquires another like-kind property. In a Tenants-In-Common 1031 Exchange, multiple investors, each holding individual ownership interests, jointly participate in the exchange, adding an extra layer of complexity and potential benefits.

The primary benefits of a Tenants-In-Common 1031 Exchange include deferring capital gains tax, diversifying your real estate investment portfolio by investing in multiple properties, and potentially increasing cash flow by acquiring interests in larger, income-generating properties.

Some risks associated with a Tenants-In-Common 1031 Exchange include management disputes among co-owners, risks related to co-ownership such as a co-owner's bankruptcy, and challenges with selling a Tenants-In-Common property due to its divided ownership.

Changes in tax laws, especially those related to Section 1031 of the Internal Revenue Code or the IRS's interpretation of "like-kind" exchanges, could impact the viability and benefits of Tenants-In-Common 1031 Exchanges. These changes could potentially alter the tax benefits or increase the complexity of these transactions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.