Asset location is crucial in finance and business management. It refers to the strategic placement and tracking of assets to optimize returns, minimize taxes, and reduce the risk of loss or theft. Asset location strategies vary depending on the context, purpose, and target audience. For instance, financial professionals may use asset location strategies to optimize their client's investment portfolios, while business owners may use asset location technologies to manage their physical assets more efficiently. Have questions about Asset Locations? Click here. Financial professionals, such as financial advisors, wealth managers, and tax professionals, use asset location strategies to optimize their clients' portfolios' tax efficiency and overall returns. One of the key asset location strategies for financial professionals is to allocate assets between taxable and tax-advantaged accounts. Taxable accounts, such as individual or joint brokerage accounts, are subject to capital gains taxes on investment earnings. In contrast, tax-advantaged accounts, such as 401(k)s, Individual Retirement Arrangements (IRAs), and Roth IRAs, offer tax benefits such as tax-deferred or tax-free investment growth and tax deductions or credits. Financial professionals can minimize their clients' tax liabilities and maximize their investment returns by strategically allocating assets between taxable and tax-advantaged accounts. Financial professionals can also use asset location tools like tax optimization software to streamline their asset location strategies. These tools can help financial professionals analyze their clients' portfolios, identify tax-efficient investment options, and rebalance their portfolios. Business owners and managers use asset location technologies to manage their physical assets more efficiently, reduce loss or theft risks, and optimize their asset utilization. The following are some common asset location technologies for business owners: RFID Technology: a wireless tracking system that uses radio waves to identify and track physical objects, such as equipment, inventory, or vehicles. GPS Tracking Technology: a satellite-based system that can track the real-time location of assets, such as vehicles or high-value goods. Barcode Technology: a visual tracking system that uses machine-readable codes to identify and track assets. Individuals and families can also use asset location strategies to optimize their investments, minimize taxes, and protect their assets from creditors. Individuals and families can use tax-advantaged retirement accounts, such as IRAs, 401(k)s, or Roth IRAs, to save for retirement and minimize their tax liabilities. Depending on the account type, these accounts offer tax benefits such as tax-deferred or tax-free investment growth and tax deductions or credits. Asset location offers several benefits for financial professionals, business owners, and individuals. Asset Location strategies offer several advantages for financial professionals, which can translate into improved client outcomes. Increased Investment Returns. Financial professionals can use asset location strategies to create diversified portfolios that balance risk and return, potentially leading to higher investment returns over the long term. Lowered Tax Liabilities. Asset location strategies can help financial professionals minimize their clients' tax liabilities, potentially leading to higher after-tax returns. Improved Risk Management. By diversifying their clients' portfolios across different asset classes, financial professionals can reduce their clients' risk of loss or volatility. Asset location technologies offer several benefits for business owners, including: Improved Asset Management. Asset location technologies help businesses track their assets more accurately and efficiently, reducing the risk of loss or theft. Increased Security. Asset location technologies can help businesses monitor their assets in real time, reducing the risk of theft or unauthorized use. This can increase security, lower insurance costs, and better compliance with industry regulations. Enhanced Efficiency. Asset location technologies can help businesses streamline their operations, reducing manual labor and improving efficiency. This can lead to lower operating costs, faster delivery times, and better customer satisfaction. Asset location strategies provide several advantages for individuals and families, including: Improved Investment Returns. Asset location strategies can help individuals and families optimize their investment portfolios, reducing taxes and maximizing returns. This can lead to higher long-term wealth accumulation and financial security. Lowered Tax Liabilities. Asset location strategies can help individuals and families minimize their tax liabilities, reducing their overall tax burden and preserving more of their wealth. Protected Assets. Asset location strategies like using trusts can help individuals and families protect their assets from creditors or other legal risks, providing greater financial security. Asset location is a crucial concept that applies to various contexts, audiences, and purposes. Financial professionals use asset location strategies to optimize their client's investment portfolios, while business owners use asset location technologies to manage their physical assets more efficiently. Law enforcement and security professionals use asset location techniques to track and recover stolen or missing assets. Individuals and families use asset location strategies to optimize their investments, minimize taxes, and protect their assets from creditors. Asset location strategies offer several benefits, including improved returns, lower tax liabilities, and asset protection. By understanding the various asset location strategies and technologies available to them, different audiences can maximize their asset utilization, reduce risk exposure, and achieve greater financial security. To achieve these benefits and achieve greater financial security, it is crucial to consult with a tax services professional who can help tailor an asset location strategy to your unique needs and goals. Overview of Asset Location

Asset Location for Financial Professionals

Asset Location for Business Owners

Asset Location for Individuals and Families

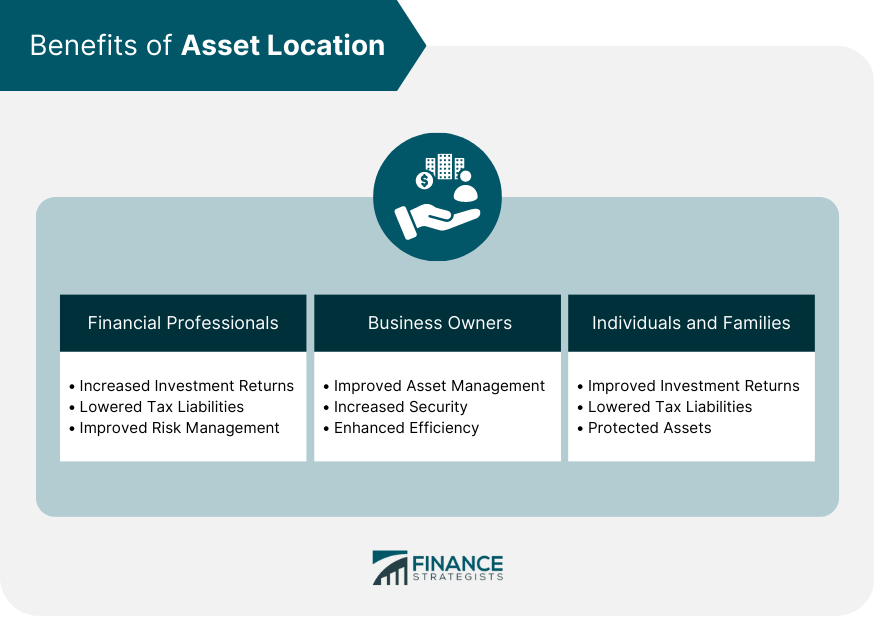

Benefits of Asset Location

Benefits for Financial Professionals

Benefits for Business Owners

This can lead to better inventory management, reduced downtime, and improved asset utilization.Benefits for Individuals and Families

Conclusion

Asset Location FAQs

Asset location refers to strategically placing and tracking assets to optimize returns, minimize taxes, and reduce the risk of loss or theft. It is crucial for individuals, businesses, and law enforcement professionals to achieve greater financial security and asset protection.

Financial professionals use asset location strategies such as allocating assets between taxable and tax-advantaged accounts, asset allocation strategies, and asset location tools to minimize their clients' tax liabilities and maximize their investment returns.

Business owners can use asset location technologies such as RFID, GPS tracking, and barcode technology to manage their physical assets more efficiently, reduce loss or theft risks, and optimize their asset utilization. These technologies offer improved asset management, increased security, and enhanced efficiency.

Law enforcement and security professionals use asset location techniques such as asset tracking and asset recovery techniques to monitor the location and movement of stolen assets, gather evidence, and identify suspects. These techniques offer benefits such as improved asset recovery, enhanced security, and better evidence collection.

Individuals and families can use asset location strategies such as tax-advantaged retirement accounts, allocating assets between taxable and tax-advantaged accounts, and trusts for asset protection. These strategies offer benefits such as improved investment returns, lower tax liabilities, and asset protection.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.