Capital gains refer to the increase in value of an asset or investment over its purchase price. If you sell an asset for more than its original cost, the difference is your capital gain. There are two types of capital gains: short-term (assets held for a year or less) and long-term (assets held for more than a year). In many jurisdictions, capital gains are taxed, but at different rates for short-term versus long-term gains. Capital gains tax is a key factor that influences investment decisions, as the potential tax burden could significantly affect the profitability of an investment. Conversely, a capital loss occurs when an asset is sold for less than its purchase price. This loss can typically be used to offset capital gains, reducing the overall tax liability. Proper understanding and management of capital gains are important aspects of personal finance and investment strategy. The term 'capital assets' is quite expansive, encompassing virtually everything an individual or company owns or uses for personal use, pleasure, or investment. Essentially, capital assets are significant pieces of property such as homes, cars, investment properties, stocks, bonds, mutual funds, and even collectibles or art. When these assets appreciate in value and are then sold for more than their purchase price, the resulting profit is known as a capital gain. From an individual's perspective, the ability to classify an asset as a capital asset can potentially lower their tax burden. One of the most common types of capital assets is real estate property. This includes primary residences, vacation homes, and investment properties. When these properties are sold for more than the purchase price, the difference constitutes a capital gain. However, there are exclusions and deductions available for capital gains made on the sale of a primary residence. Another common capital asset is securities like stocks and bonds. The capital gain, in this case, is the positive difference between the purchase price of the security and its selling price. These assets are common in many investment portfolios and their gains or losses can significantly impact your tax obligations. Properties bought or developed for the purpose of investment, either through rental income or future resale, are classified as investment properties. The profit earned from the sale of these properties is subject to capital gains tax. It's important to note that expenses related to the improvement and maintenance of these properties can sometimes be deducted from the calculated gain. Items such as coins, art, antiques, and other objects of worth are also considered capital assets. The gain from the sale of collectibles may be subject to capital gains tax. Note that these types of assets are often subject to a different tax rate than other capital assets. Assets used in a trade or business, like machinery, equipment, or fixtures, can also trigger capital gains when sold at a profit. These can be a little more complex as they may involve elements of depreciation which could influence the capital gains calculation. The period for which an asset is held before its sale has a significant impact on the capital gains tax that is levied. Assets held for a year or less before being sold are classified under short-term capital gains, while those held for more than a year fall under long-term capital gains. Long-term gains are generally taxed at a lower rate than short-term gains. The precise period an asset has been held can significantly impact your tax liabilities. Ownership rights also play a pivotal role in determining capital gain eligibility. Generally, to be liable for capital gains tax, one must have legal ownership of the asset. This can sometimes get complex in situations like divorce or inheritance, so it's essential to understand who legally owns the asset before making decisions that could impact capital gains. The asset's use and purpose at the time of sale can also impact capital gains tax. For instance, selling a home that serves as a primary residence may have different tax implications compared to selling an investment property. Understanding the purpose of the asset and how it's been utilized can better inform your tax strategy. Short-term capital gains tax applies to assets held for a year or less. These gains are usually taxed at the same rate as ordinary income, which can range from 10% to 37%, depending on one's tax bracket. As such, understanding the potential short-term capital gains implications is vital before making quick sales of assets. Long-term capital gains tax applies to assets held for more than a year before being sold. The tax rates are generally lower than for short-term capital gains, with rates typically at 0%, 15%, or 20%, depending on your taxable income. Patience can therefore be a virtue when it comes to selling assets, as holding onto them for over a year can lead to lower tax obligations. Since long-term capital gains are taxed at a lower rate than short-term gains, holding assets for more than a year before selling can significantly reduce capital gains tax. This can often lead to more strategic decision-making when it comes to selling off assets, potentially resulting in greater overall wealth retention. This strategy involves selling securities at a loss to offset capital gains on other assets. This method can effectively lower your overall tax liability. However, it is important to note that this strategy should not supersede sound investment principles and should be considered as part of a broader financial plan. Certain retirement accounts, such as 401(k)s and IRAs, can provide tax advantages that help mitigate capital gains taxes. For instance, investments within these accounts can grow tax-free, or taxes can be deferred until retirement, when you might be in a lower tax bracket. Utilizing these accounts as part of your investment strategy can be an effective way to manage potential tax liabilities. When you inherit property, the cost basis of the property is "stepped-up" to its fair market value at the time of the owner's death. This means you would only pay capital gains tax on any appreciation that occurs after you inherit the asset. Understanding this rule can significantly affect decisions regarding holding or selling inherited property. Certain exclusions can also help reduce capital gains tax. For example, the IRS allows homeowners to exclude up to $250,000 ($500,000 for married couples filing jointly) of gain on the sale of their primary residence, provided certain conditions are met. Utilizing such exclusions can lead to substantial tax savings and should be considered during financial planning. Understanding capital gains, identifying eligible assets, discerning factors determining capital gain eligibility, and knowing the capital gains tax rates are integral to effective financial planning and investment growth. The broad spectrum of capital assets, from real estate and securities to collectibles and business-related assets, each come with their unique tax implications. The holding period, ownership rights, and asset use purpose significantly influence capital gains taxes. Short-term and long-term capital gains are taxed differently, emphasizing the importance of strategic decision-making in asset selling. Employing methods to reduce capital gains tax, such as holding assets long-term, tax-loss harvesting, utilizing tax-advantaged retirement accounts, leveraging inheritance rules, and applying capital gains exclusions, can be beneficial in financial planning. The complexity of this field underscores the value of professional guidance. For comprehensive, personalized strategies to minimize your tax burden and enhance wealth, consider seeking expert tax planning services today.Overview of Capital Gains

Identifying Assets Eligible for Capital Gains

Overview of Capital Assets

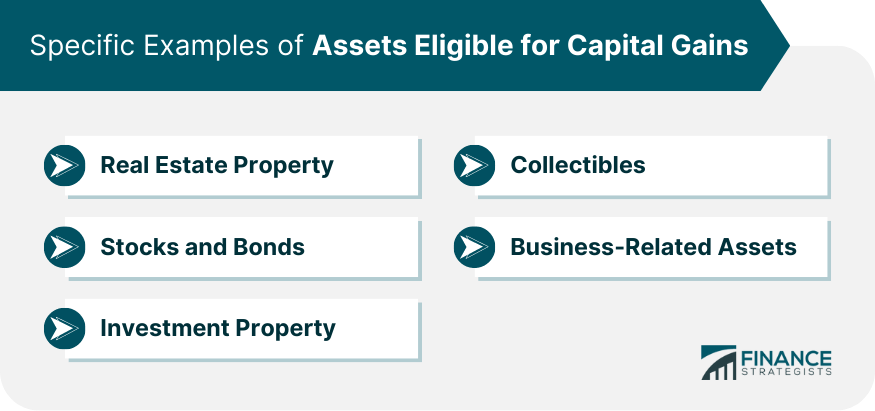

Specific Examples of Assets Eligible for Capital Gains

Real Estate Property

Stocks and Bonds

Investment Property

Collectibles

Business-Related Assets

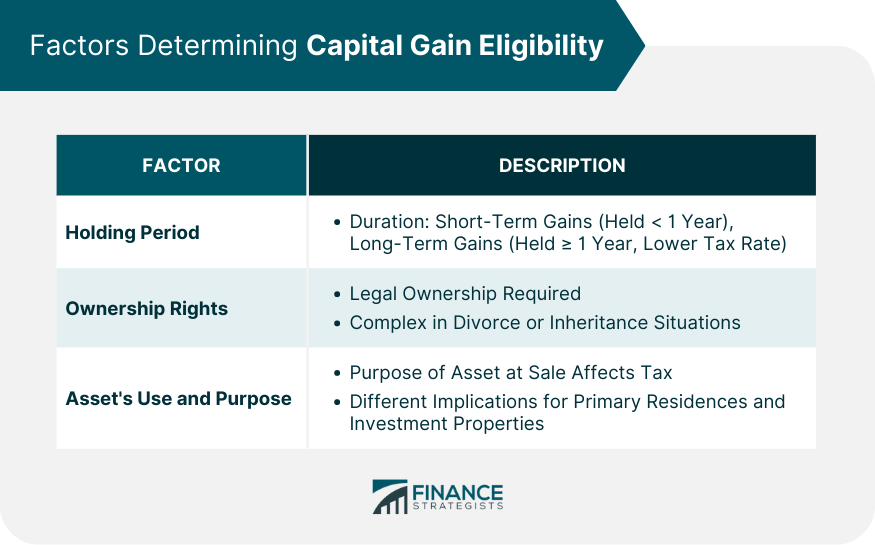

Key Factors Determining Capital Gain Eligibility

Holding Period

Ownership Rights

Asset's Use and Purpose

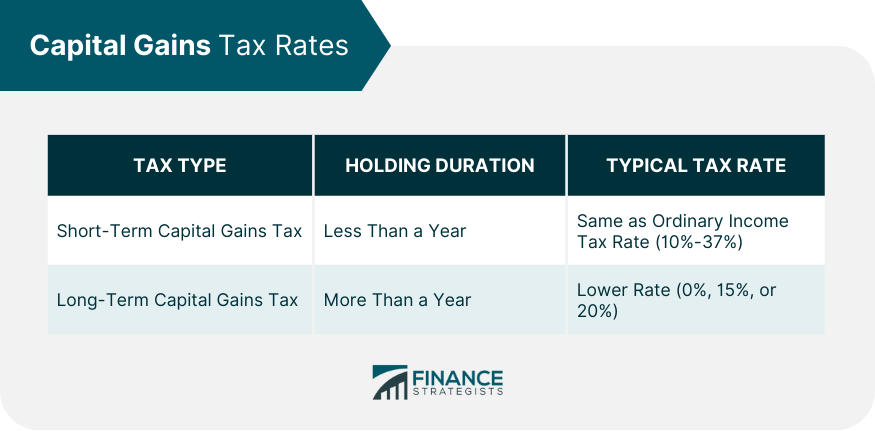

Capital Gains Tax Rates

Short-Term Capital Gains Tax

Long-Term Capital Gains Tax

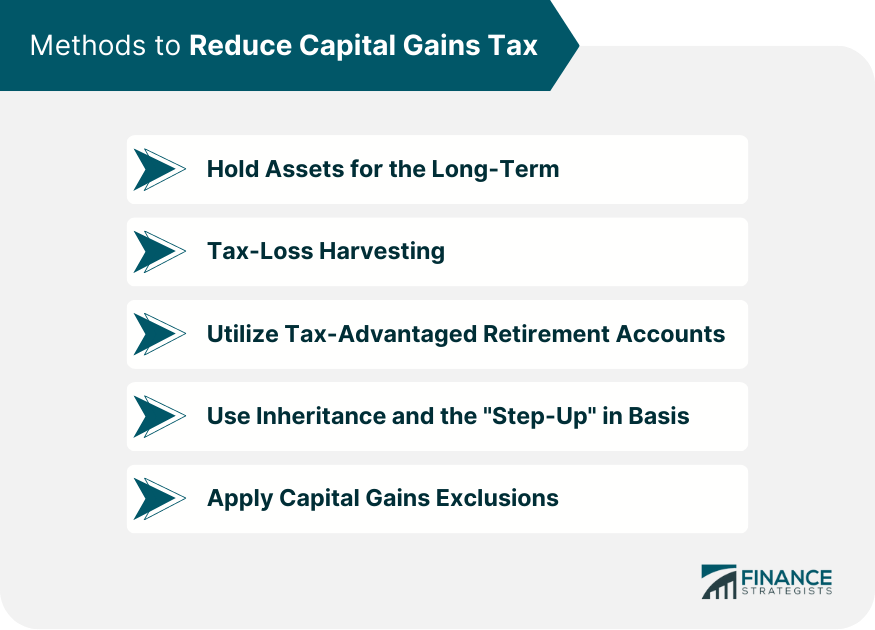

Methods to Reduce Capital Gains Tax

Holding Assets for the Long-Term

Tax-Loss Harvesting

Utilizing Tax-Advantaged Retirement Accounts

Using Inheritance and the "Step-Up" in Basis

Applying Capital Gains Exclusions

Bottom Line

Assets Eligible for Capital Gains FAQs

Assets like real estate properties, stocks, bonds, investment properties, collectibles, and business-related assets are all eligible for capital gains.

Assets held for less than a year fall under short-term capital gains, typically taxed at higher rates. Assets held for over a year are classified as long-term capital gains, taxed at lower rates.

Short-term capital gains tax applies to assets held for a year or less and is usually taxed at the same rate as ordinary income. Long-term capital gains tax applies to assets held for more than a year and generally has lower tax rates.

Methods include holding assets for the long-term, tax-loss harvesting, utilizing tax-advantaged retirement accounts, leveraging inheritance "step-up" in basis, and using capital gains exclusions.

Recent or future changes in tax legislation can alter capital gains tax rates and rules. Staying informed and adjusting investment strategies accordingly is crucial for effective tax planning.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.