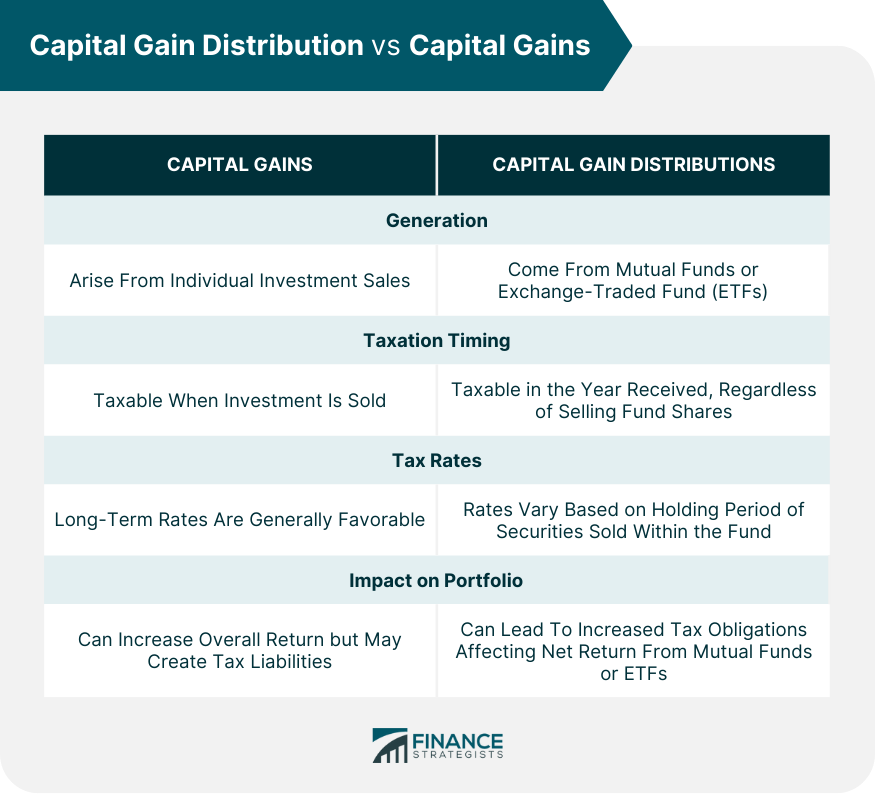

There are several key differences between capital gains and capital gain distributions. The primary difference lies in how they are generated. Capital gains arise from the sale of individual investments, while capital gain distributions come from a mutual fund or ETF. Additionally, while capital gains only become taxable when the investment is sold, capital gain distributions are taxable in the year they are received, regardless of whether the shares of the fund are sold. Capital gains and capital gain distributions are both subject to tax, but the rate can differ based on the duration of investment and the individual’s tax bracket. Long-term capital gains tax rates are generally more favorable, whereas short-term rates mirror the individual income tax rates. Capital gain distributions can be either short-term or long-term, depending on the holding period of the securities sold within the fund. Both capital gains and capital gain distributions can impact an investment portfolio. While capital gains can increase the overall return on investment, they can also lead to tax liabilities. Similarly, capital gain distributions can result in increased tax obligations, which can impact the net return from a mutual fund or ETF. Capital gain distributions originate from the activities of a mutual fund or exchange-traded fund (ETF) manager. These occur when the manager sells securities within the fund at a price higher than their purchase cost. The difference, the profit, is subsequently distributed to the shareholders of the fund. It's vital to note that these distributions are not dependent on an individual shareholder selling their shares but on the fund manager's decision to sell securities within the fund. Therefore, even if an investor hasn't sold their shares, they may still receive a capital gain distribution. Capital gain distributions carry their own set of tax implications. Similar to capital gains, these distributions are subject to taxes. However, a critical distinction lies in the taxation process. Capital gain distributions are taxed in the year they are received, irrespective of whether the fund itself was sold at a profit. This means that an investor may have a tax obligation from a capital gain distribution even if they haven't sold any shares in the fund. In addition, the tax rate applied to these distributions can be either short-term or long-term, depending on the holding period of the securities sold within the fund. This makes understanding and managing capital gain distributions an important aspect of investment tax planning. Capital gains come into existence when an investment, such as stocks or real estate, is sold for a price higher than its original purchase price. This difference in price forms the capital gain. To illustrate, if an investor acquires a stock for $100 and later sells it for $150, a capital gain of $50 is realized. It's essential to understand that capital gains only occur upon the sale of the investment. Therefore, an investment can increase in value, but a capital gain will only be realized when that investment is sold for a profit. The taxation of capital gains is influenced by whether the gains are classified as short-term or long-term. This classification hinges on the length of time the investment was held before being sold. Short-term capital gains, which are gains on investments held for a year or less, are subject to taxation at the same rates as ordinary income. This means the tax rate can fluctuate substantially based on the total income of the investor for the year. Therefore, higher-income individuals will often pay a higher tax rate on short-term capital gains. Long-term capital gains, conversely, are gains on investments that were held for more than a year before being sold. These gains enjoy a more advantageous tax rate that typically lies between 0% and 20%, contingent on the investor's income level. The policy behind this reduced tax rate is to incentivize and reward longer-term investments. It's a crucial aspect of tax planning for investors to consider, as holding an investment for longer than a year can significantly reduce the tax burden associated with the capital gain. When it comes to managing capital gains and distributions, several practical considerations can make a substantial difference in optimizing your investment returns and minimizing your tax liabilities. Here are some key points to keep in mind: Understand the Tax Implications: Familiarize yourself with how capital gains, both short-term and long-term, and capital gain distributions are taxed. This understanding will guide your decision-making process when buying or selling investments. Hold Investments Longer: If feasible, hold your investments for more than a year to take advantage of the lower tax rates on long-term capital gains. This strategy can reduce your overall tax liability and can be particularly beneficial if you are in a higher tax bracket. Offset Capital Gains With Losses: Consider selling investments that have lost value to offset capital gains. This strategy, known as tax-loss harvesting, can help reduce your tax burden. Reinvestment of Capital Gain Distributions: Be aware that if you choose to reinvest your capital gain distributions, they are still subject to tax in the year they are received, even though you haven't technically received cash. Investment Placement: Consider placing investments that generate significant capital gain distributions into tax-advantaged accounts, like IRAs or 401(k)s. Tax-efficient Funds: Consider investing in tax-efficient funds. These funds are designed to limit the amount of taxable distributions, thereby helping reduce your potential tax liability. Professional Advice: Each investor's situation is unique, with different financial goals, risk tolerance levels, and tax considerations. The intricacies of capital gains and capital gain distributions play a significant role in investment strategy and tax planning. While both are generated through profit-making sales, their origins, and tax implications differ. Capital gains result from direct sales of assets held by individual investors, whereas capital gain distributions stem from the sale of securities within mutual funds or ETFs. Notably, the tax treatment of these gains hinges on their classification as short-term or long-term and can significantly impact an investor's net return. Understanding these concepts and implementing practical strategies, like holding investments longer or employing tax-loss harvesting, is crucial. Lastly, considering tax-efficient investing options and seeking professional guidance can further optimize financial returns and minimize tax liabilities, tailoring the approach to the unique circumstances of each investor. Understanding and managing capital gains and distributions is vital to a successful and comprehensive financial strategy.Capital Gain Distribution vs Capital Gains

Key Differences

Tax Treatment Comparison

How They Impact an Investment Portfolio

Process of Generating Capital Gain Distributions

Tax Implications of Capital Gain Distributions

Formation of Capital Gains

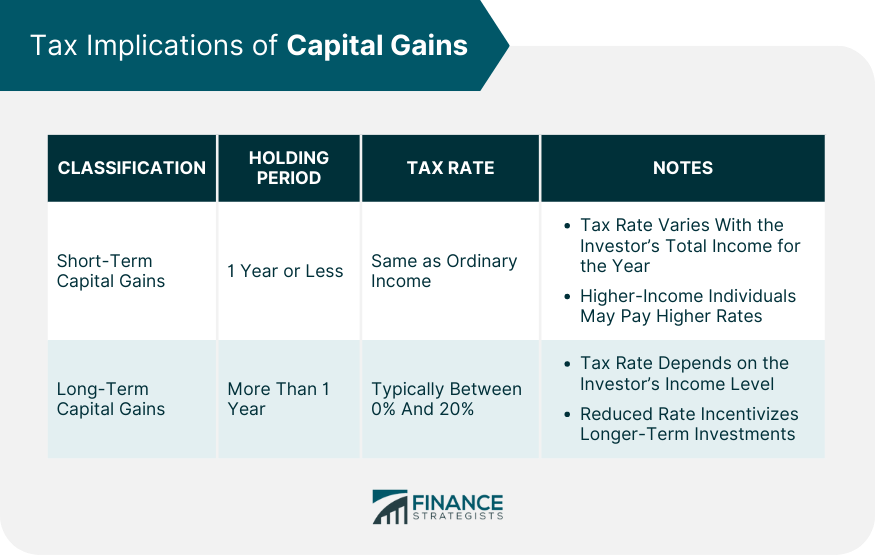

Tax Implications of Capital Gains

Tax Rates for Short-Term Capital Gains

Tax Rates for Long-Term Capital Gains

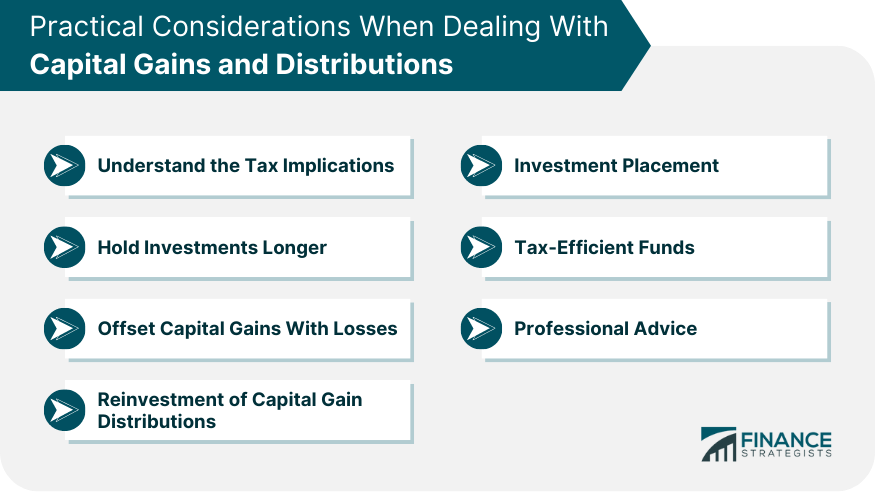

Practical Considerations When Dealing With Capital Gains and Distributions

The taxes on the distributions can then be deferred or even eliminated depending on the type of account.

Thus, consider seeking advice from a financial advisor or tax professional who can provide guidance tailored to your specific circumstances.

Bottom Line

Capital Gain Distribution vs Capital Gains FAQs

Capital gains refer to the profits an investor makes when they sell an asset for a higher price than what they bought it for. Capital gain distributions, on the other hand, are the profits distributed to investors when a mutual fund or ETF manager sells securities within the fund at a profit.

Capital gains are taxed based on whether they are short-term (held for one year or less) or long-term (held for more than a year). Short-term capital gains are taxed at the same rate as regular income, while long-term capital gains have a more favorable tax rate. Capital gain distributions are taxed in the year they are received, regardless of whether the fund shares were sold, and can be classified as short-term or long-term based on the securities' holding period within the fund.

You can minimize your capital gains tax by holding onto your investments for more than a year to take advantage of lower long-term capital gains tax rates. Another strategy is to offset your capital gains with capital losses, if applicable.

Capital gains can increase your overall return on investment but can also lead to tax liabilities. Capital gain distributions, on the other hand, can increase your tax liability, even if you haven't sold any shares in the mutual fund or ETF, especially if you choose to reinvest these distributions.

Tax-efficient investing involves strategically making investment decisions to minimize tax liabilities. This could include holding onto investments for longer periods to benefit from lower long-term capital gains rates or strategically selling investments at a loss to offset capital gains. For managing capital gain distributions, tax-efficient investing could involve choosing tax-efficient funds or placing funds in tax-deferred or tax-exempt accounts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.