Capital gains occur when you sell an investment for more than you paid for it, with the difference being the gain. They play a significant role in the context of mutual funds, pooled investment vehicles that aggregate money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other assets. Any time a mutual fund sells an asset that has increased in value, a capital gain is realized, which is then distributed proportionally among the fund's shareholders. These gains may be categorized as short-term (for assets held less than one year) or long-term (held for one year or more), each taxed differently. However, mutual fund investors can also experience capital gains if they sell their fund shares for more than the purchase price. These aspects make understanding capital gains vital for mutual fund investors to manage their tax liabilities and investment strategies effectively. Capital gains refer to the increase in the value of an investment or real estate that gives it a higher worth than the purchase price. The gain is not realized until the asset is sold. A capital gain may be short-term or long-term and must be claimed on income taxes. Short-term capital gains are typically taxed at a higher rate than long-term gains. Capital gains are a crucial aspect of investment strategies, with potential implications for tax planning, as their treatment can significantly impact the net return on an investment. Assets that are held for a brief duration—specifically, a period of one year or less—generate what we term as short-term capital gains upon sale. These gains are typically taxed at the individual's ordinary income tax rate. Given that this rate can vary, investors should be proactive in estimating potential tax liabilities. Regularly monitoring and assessing the duration of one’s investments can prove beneficial in tax planning. The realm of long-term gains covers assets held for over a year before being sold.These gains usually enjoy preferential tax rates, thus incentivizing investors to maintain a longer-term perspective. By holding onto their assets for extended periods, investors can capitalize on potential appreciation and reduced tax implications. Mutual funds are curated to offer investors a diversified investment exposure, reducing the individual risks associated with buying specific securities. For many, they represent a gateway to the vast financial markets, requiring less capital and offering expert management. These funds primarily target stocks with the aim of capital appreciation. Investors looking for potentially higher returns, and willing to assume corresponding risks, might gravitate towards equity funds. With a focus on bonds and fixed-income securities, debt funds aim to provide steady, albeit typically lower, returns. They're suitable for conservative investors seeking predictable income streams and a safer investment haven. By blending the attributes of both equity and debt funds, hybrid funds aim to strike a balance between risk and reward. They provide a middle ground, suitable for those who want a mix of growth and stability. Specialized funds, such as sectoral or index funds, cater to niche investment strategies. For instance, an investor bullish on the tech sector might opt for a tech-centric sectoral fund. As market dynamics shift, fund managers might decide to sell certain securities within the mutual fund portfolio. These sales can result in capital gains or losses, depending on the purchase and selling prices. It’s these activities that often dictate the fund's performance and investor returns. Securities within a mutual fund, like stocks or bonds, might distribute dividends or interest. While these aren't capital gains in the strictest sense, they do represent returns on investment and carry their own tax considerations. Investors should be cognizant of these distributions and their frequency. Each mutual fund share has a Net Asset Value (NAV), denoting its current market value. It fluctuates based on the underlying assets' performance. An increase in NAV can lead to capital gains when investors decide to redeem their shares, emphasizing the importance of timing in mutual fund investments. When equity mutual fund shares are sold after a brief holding period, the resulting gains are taxed as short-term. Investors must remain alert to potential tax obligations, especially when realizing profits in a buoyant market. Holding onto equity mutual fund units for extended periods can be financially rewarding, not just due to potential appreciation but also from a tax perspective. The long-term capital gains tax rate is often lower than its short-term counterpart. While dividends might be enticing due to their immediate nature, there are tax implications to consider. Certain jurisdictions might levy taxes on dividends before their distribution, impacting the net amount received by the investor. Similar to equity funds, gains from debt mutual funds held for a short duration are considered short-term. The tax rate might differ from that of equity funds, highlighting the need for investors to understand the nuances of their investments. For those who prefer to stay invested in debt funds for the long haul, there are specific long-term capital gains tax rates to consider. A unique advantage for long-term debt mutual fund investors is the benefit of indexation. This considers inflation over the holding period, potentially reducing the taxable amount of capital gains. Hybrid funds, given their diverse holdings, might be subject to tax rules of both equity and debt funds, depending on their asset distribution. Meanwhile, specialized funds might have tax treatments aligning with their primary investment focus, making it essential for investors to be well-informed. The demarcation between these two holding periods serves more than just a tax purpose; it often delineates investment strategies. While short-term investments might cater to immediate financial needs, long-term holdings often align with larger life goals or retirement planning. Every investor's goal is to maximize returns, and understanding tax liabilities plays a pivotal role in this. By strategically planning the duration of mutual fund investments, one can potentially reduce tax burdens and enhance net returns. The decision between opting for distributions or reinvesting gains can influence both investment growth and tax implications. In the Distribution Option, returns are periodically paid out to investors, offering liquidity and an immediate return on investment. Conversely, the Growth Option reinvests these returns, aiming for compounded growth over time. Immediate returns from the distribution option might seem appealing, but they could carry tax implications. On the other hand, the growth option defers these taxes, potentially resulting in a larger compounded gain, which is only taxed upon sale. By choosing funds known for generating fewer taxable distributions, investors can strategically minimize their tax liabilities. Research and a keen understanding of fund performances can guide these decisions. A fund's buying and selling activities, or its turnover, can influence its tax efficiency. A higher turnover might result in more taxable events, making it crucial for investors to consider this aspect when selecting a mutual fund. This strategy involves selling securities that have incurred losses to offset gains from other investments. It's a proactive approach, requiring periodic portfolio reviews, but can prove effective in managing capital gains tax. Investors should always be in the loop regarding their mutual fund's capital gains distributions. Purchasing a fund just before a large distribution can result in an unexpected tax liability, emphasizing the importance of timely investment decisions. Maintaining meticulous records of all mutual fund transactions is indispensable. This includes not just purchase and sale documents but also any tax-related forms provided by the fund house. A systematic approach to record-keeping can simplify tax filing processes. Different sections on tax return forms are allocated for short-term and long-term gains. Investors should ensure accurate reporting in these sections, as they're subject to distinct tax rates, helping to avoid any discrepancies or potential penalties. Understanding the nature of capital gains and their implications for mutual fund investments is vital for effective financial management. Mutual funds can generate capital gains through various channels - selling securities within the fund, receiving dividends or interest, and increasing the Net Asset Value (NAV). These gains, whether short-term or long-term, carry distinct tax implications depending on the type of mutual fund held. Being aware of your investment's holding period can influence tax liabilities and overall investment strategies. Exploring the Distribution and Growth Options can further refine an investor's tax planning. Meanwhile, strategies like tax-efficient investing, considering fund turnover, utilizing tax-loss harvesting, and monitoring capital gains distributions can assist in minimizing capital gains tax. Lastly, proper documentation and accurate reporting of gains on tax returns ensures compliance with tax obligations. To navigate these complexities and make the most of your mutual fund investments, seek professional tax planning services to guide you.Overview of Capital Gains and Mutual Funds

Basics of Capital Gains

Definition of Capital Gains

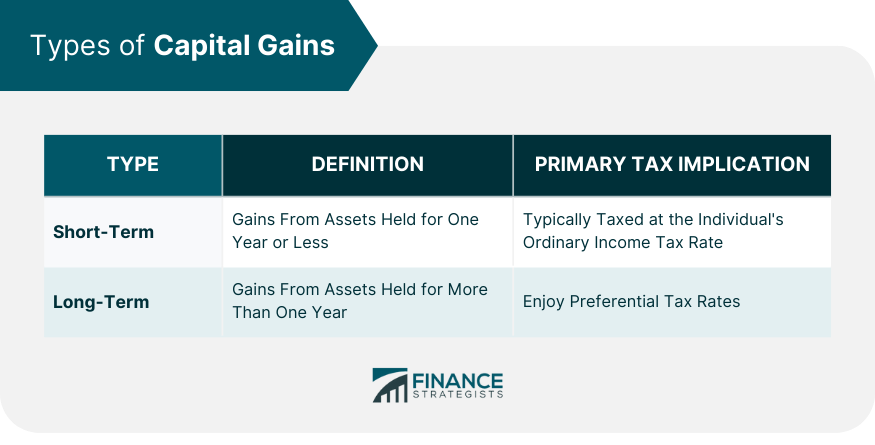

Types of Capital Gains

Short-Term Capital Gains

Long-Term Capital Gains

Basics of Mutual Funds

Definition of Mutual Funds

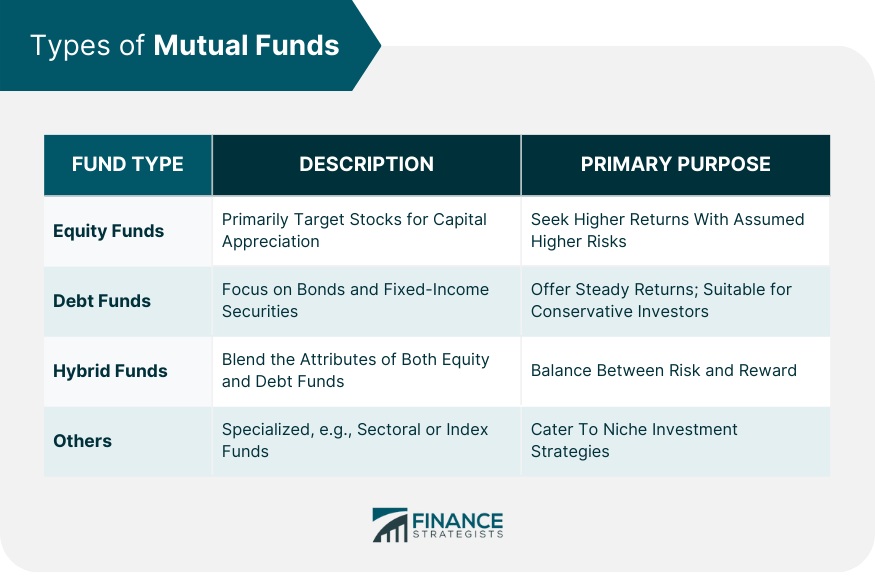

Types of Mutual Funds

Equity Funds

Debt Funds

Hybrid Funds

Others

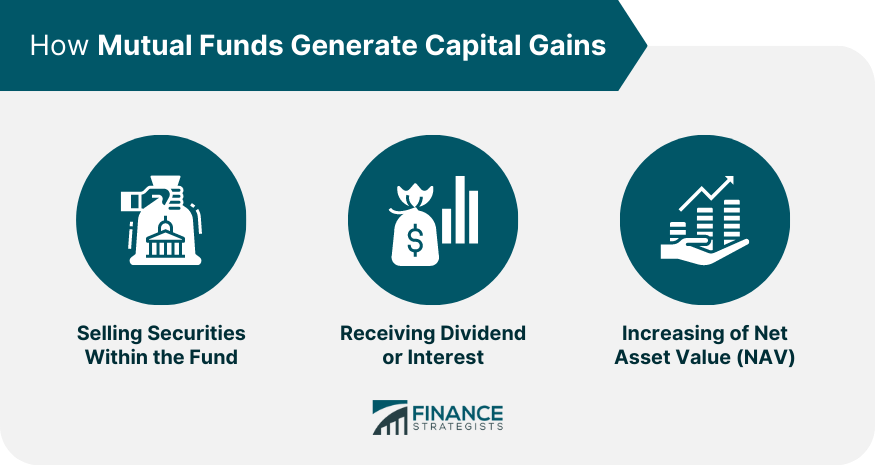

How Mutual Funds Generate Capital Gains

Selling Securities Within the Fund

Receiving Dividend or Interest

Increasing of Net Asset Value (NAV)

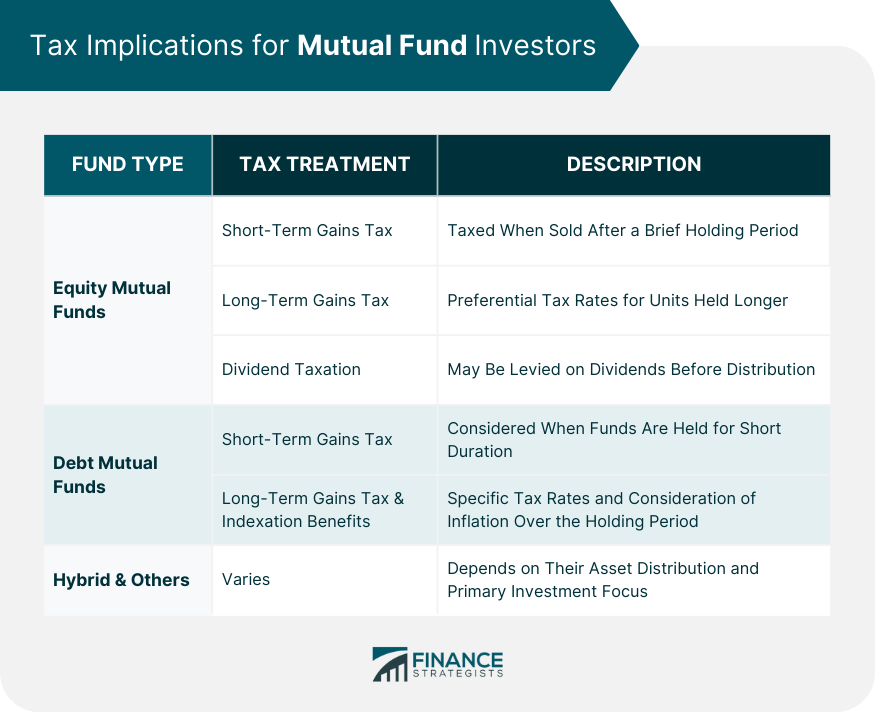

Tax Implications for Mutual Fund Investors

Tax Treatment for Equity Mutual Funds

Short-Term Gains Tax

Long-Term Gains Tax

Dividend Taxation

Tax Treatment for Debt Mutual Funds

Short-Term Gains Tax

Long-Term Gains Tax

Indexation Benefits

Tax Treatment for Hybrid and Other Fund Categories

Importance of Understanding the Holding Period

Distinction Between Short-Term and Long-Term Holdings

Impact on Tax Liability

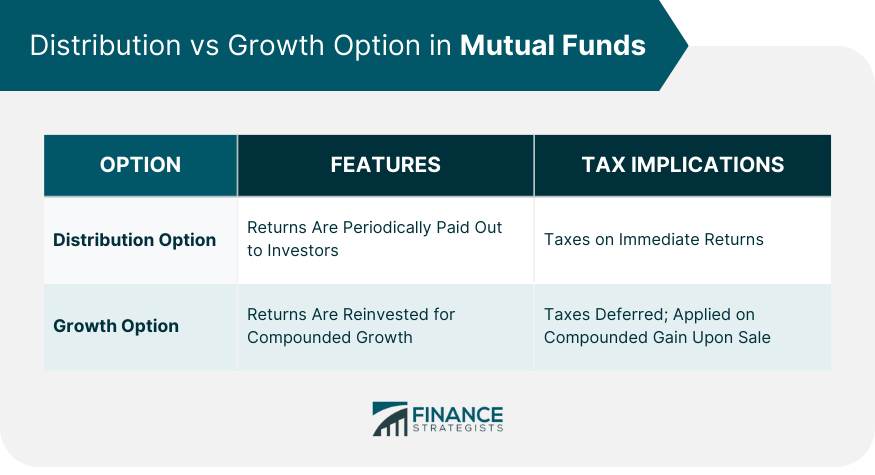

Distribution vs Growth Option in Mutual Funds

Understanding the Difference

Tax Implications for Each Option

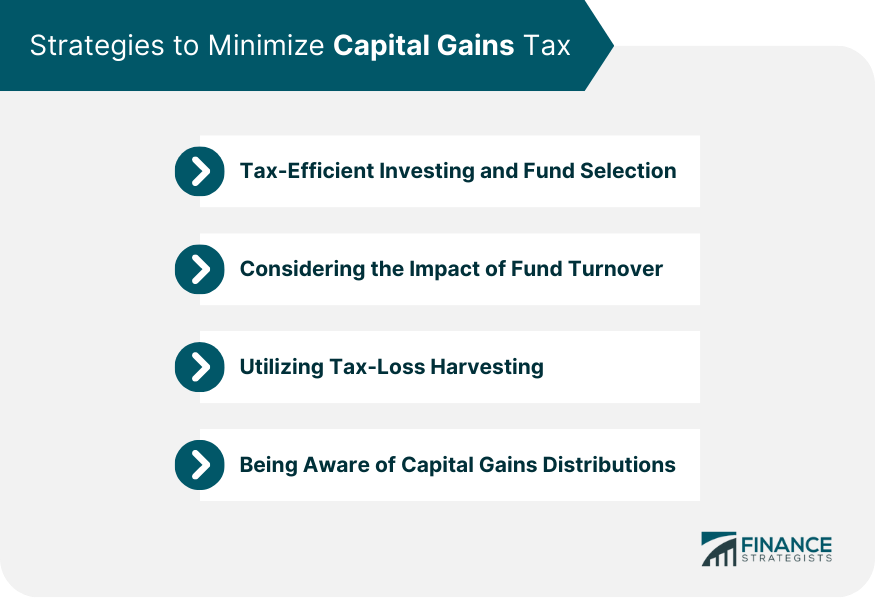

Strategies to Minimize Capital Gains Tax

Tax-Efficient Investing and Fund Selection

Considering the Impact of Fund Turnover

Utilizing Tax-Loss Harvesting

Being Aware of Capital Gains Distributions

How to Report Capital Gains From Mutual Funds

Ensure Necessary Documentation

Report Short-term and Long-term Gains on Tax Returns

Bottom Line

Capital Gains and Mutual Funds FAQs

Capital gains are the profits earned from the sale of mutual fund assets that have appreciated in value.

Short-term gains are typically taxed at ordinary income rates, while long-term gains benefit from preferential rates.

Mutual funds can be categorized into equity, debt, hybrid, and other specialized funds like sectoral or index funds.

Mutual funds generate capital gains through the sale of securities within the fund and from dividends or interest received.

Yes, strategies include tax-efficient investing, considering fund turnover, utilizing tax-loss harvesting, and being aware of capital gains distributions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.