Capital gains deduction represents a tax strategy designed to reduce the net gain that is liable to taxation when an investment or real estate is sold. This mechanism is integral to many financial plans and investment strategies, as it can considerably lessen the tax burden associated with high-value asset sales. Capital gains are divided into two categories: short-term and long-term. Short-term capital gains are made on assets held for a year or less, while long-term capital gains arise from assets held for more than a year. The tax rate applicable varies, with short-term gains typically taxed at a higher rate compared to long-term gains. This distinction encourages long-term investment. Capital gains deductions can significantly impact both individual and corporate tax obligations. They can reduce the amount of taxable income, which can help lower an individual's or a corporation's overall tax liability. The cost basis of an asset is its original purchase price, adjusted for factors like commission fees, improvements, or certain events like stock splits. A clear understanding of the cost basis is essential for accurately calculating capital gains and hence, capital gains deduction. The sale price is the total amount received when the asset is sold. It may include cash, the fair market value of any property received, and any liabilities the buyer assumes as part of the sale. The capital gain or loss is determined by subtracting the cost basis from the sale price of the asset. If the sale price is higher than the cost basis, a capital gain is realized. If the cost basis is higher, a capital loss occurs. Certain amounts can be deducted from the calculated capital gain to reduce taxable income. These deductions may include expenses related to the sale, improvements made to the property, and certain types of losses. The Internal Revenue Service (IRS) sets forth specific rules for capital gains deductions. These rules include how to calculate capital gains and losses, how to report them on your taxes, and what deductions are permitted. Certain qualifications must be met to claim a capital gains deduction. These typically involve the type and duration of asset ownership, as well as the nature of the capital gain itself. There are specific exceptions and exemptions to the capital gains tax rules, such as the home sale tax exclusion. This allows you to exclude a substantial amount of capital gains on the sale of your primary residence if certain conditions are met. Over time, regulations governing capital gains deductions have changed, often in response to shifts in economic policy and financial landscapes. It's important to keep abreast of these changes to ensure accurate tax reporting. Capital gains deductions can significantly impact personal finance, as they may substantially reduce tax liability. These savings can be reinvested or allocated to other financial goals. For investors, understanding and leveraging capital gains deductions can be a critical aspect of investment strategy. By strategically timing the sale of assets, investors can optimize for long-term gains, which are typically taxed at a lower rate. On a larger scale, capital gains deductions can influence economic behavior by encouraging or discouraging investment. Policymakers may adjust capital gains tax rules to stimulate economic growth or curtail speculation. In real estate, capital gains deductions play a significant role. When selling a property, owners can deduct selling costs, improvements made to the property, and other specified expenses to reduce the capital gains subject to taxation. In stock investing, investors can offset capital gains with capital losses in a process called "tax-loss harvesting." They can also take advantage of lower tax rates for long-term investments to further reduce their tax liability. For other investment assets such as bonds, mutual funds, and collectibles, the principles of capital gains deductions apply. By carefully managing these investments, taxpayers can optimize their capital gains and deductions. Investors can minimize capital gains taxes by holding onto their assets for longer periods. Assets held for more than a year typically qualify for a lower long-term capital gains tax rate. Tax-loss harvesting involves offsetting capital gains with any capital losses incurred during the tax year. This strategy can effectively lower overall tax liability. Investments in tax-advantaged retirement accounts such as 401(k)s, and IRAs can grow tax-free or tax-deferred, offering a way to limit exposure to capital gains taxes. Gifting and inheriting assets can provide capital gains tax advantages, as the recipient's cost basis is stepped up to the fair market value at the time of the gifter or decedent's death. Capital gains deductions are pivotal to any sound financial plan or investment strategy, helping to significantly reduce tax liabilities tied to high-value asset sales. Calculating capital gains deductions involves several steps, including determining the cost basis and sale price, calculating the gain or loss, and adjusting for permissible deduction amounts. These deductions are influenced by a variety of factors, including fees, improvements, sale-related expenses, and even losses. Regulatory bodies, like the IRS, provide rules and guidelines for calculating and reporting capital gains deductions. While these regulations may change over time, adhering to them is crucial to accurate tax reporting. Through strategic planning, like long-term investments, tax-loss harvesting, and making use of tax-advantaged retirement accounts, individuals and corporations can optimize their capital gains and deductions, minimize their tax liabilities, and effectively achieve their financial goals.Understanding Capital Gains Deduction

Overview of Capital Gains Deduction

Types of Capital Gains

Impact on Individual and Corporate Tax Obligations

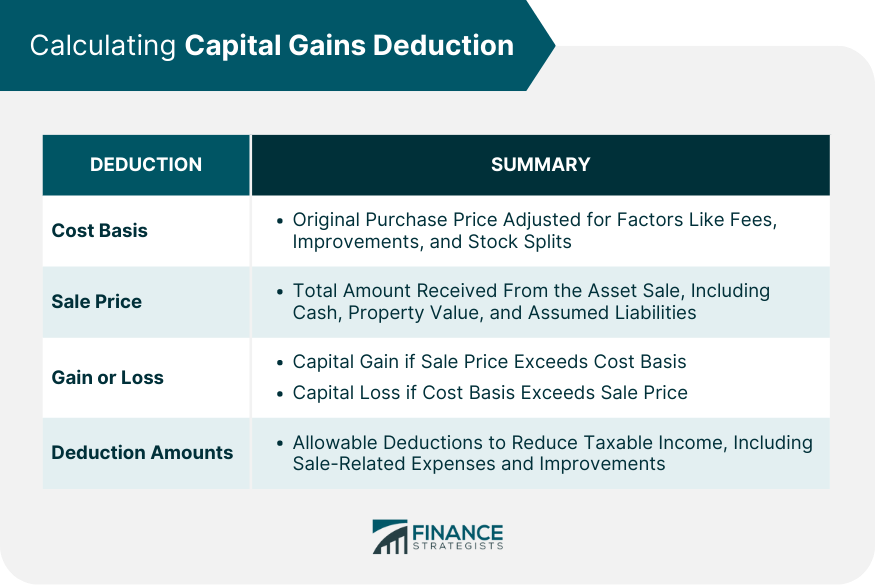

Calculating Capital Gains Deduction

Determining the Cost Basis

Determining the Sale Price

Calculating the Gain or Loss

Adjusting for Deduction Amounts

Capital Gains Deduction Rules and Regulations

IRS Rules Governing Capital Gains Deduction

Qualifications for Capital Gains Deduction

Exceptions and Exemptions

Changes in Regulations Over Time

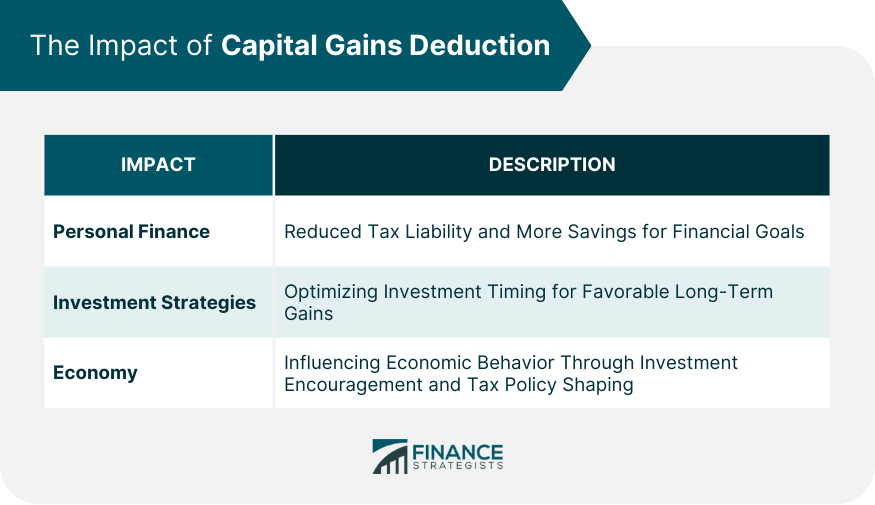

Impact of Capital Gains Deduction

On Personal Finance

On Investment Strategies

On Economy

Practical Examples of Capital Gains Deduction

Real Estate

Stock Investments

Other Investment Assets

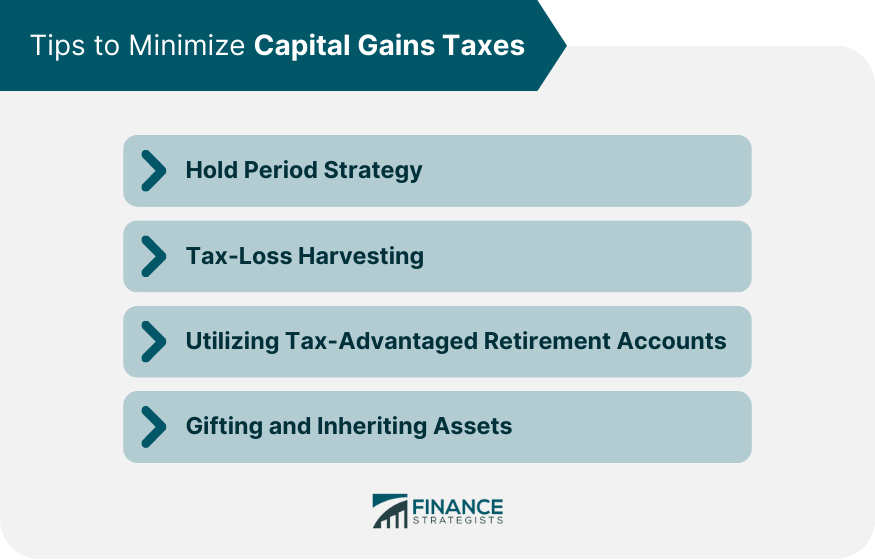

Tips to Minimize Capital Gains Taxes

Hold Period Strategy

Tax-Loss Harvesting

Utilizing Tax-Advantaged Retirement Accounts

Gifting and Inheriting Assets

Conclusion

Capital Gains Deduction FAQs

A Capital Gains Deduction is a provision that allows taxpayers to reduce the amount of capital gains that are liable to taxation. By using this deduction, individuals can decrease the taxable income resulting from the sale of an investment or real estate, thus potentially reducing their tax liability.

Qualifying for a Capital Gains Deduction typically involves adhering to specific IRS rules and guidelines. The qualifications often revolve around the type and duration of asset ownership, as well as the nature of the capital gain itself. It's essential to consult the current IRS regulations or a tax professional to ensure eligibility.

Yes, there are specific exceptions and exemptions to the capital gains tax rules. One common example is the home sale tax exclusion, which allows homeowners to exclude a substantial amount of capital gains on the sale of their primary residence if certain conditions are met. It's crucial to stay informed about these exceptions to maximize your Capital Gains Deduction benefits.

The Capital Gains Deduction can significantly influence personal finance by reducing overall tax liabilities. From an investment perspective, understanding this deduction can help investors strategically time their asset sales, emphasizing long-term gains that typically enjoy lower tax rates.

Yes. The principles of Capital Gains Deduction apply to a wide range of assets, including stocks, bonds, mutual funds, and collectibles. By managing these investments wisely and understanding the associated tax implications, investors can effectively leverage the deduction to optimize their tax outcomes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.