Capital gains distribution is the payment made to shareholders by mutual funds or exchange-traded funds (ETFs) from the profits generated when they sell investments within their portfolio. These assets can range from stocks and bonds to various other types. Essentially, when a fund manager sells an asset for more than its purchase price, the profit is shared among the fund's shareholders. This distribution serves a dual purpose: it not only provides a portion of the return on investment to the shareholders but also carries notable tax implications. Therefore, the handling of these distributions can significantly affect an investor's after-tax return and overall financial strategy. Capital gains are realized when the fund manager sells an asset for more than the purchase price. It's important to note that only realized capital gains are subject to distribution. Unrealized capital gains, which are gains from assets that have increased in value but have not been sold yet, are not distributed and remain within the fund. This means that a fund may have a significant amount of unrealized gains that are not yet subject to taxes. The distributable capital gains are computed by first taking the total capital gains and then reducing any capital losses and operating expenses. It's important to note that mutual funds are required by law to distribute any net capital gains to the shareholders annually. This requirement ensures that shareholders receive their share of the profit that the fund makes, but it also means they'll need to pay taxes on those gains. Mutual funds play a critical role in the distribution of capital gains. As they buy and sell assets within their portfolio, they generate capital gains or losses. After deducting any losses and expenses, the net gain is distributed to the shareholders. As intermediaries, mutual funds are responsible for carrying out the process and ensuring that distributions are calculated correctly. The taxation aspect of capital gains distribution is of great importance to investors. In the United States, the tax rate on capital gains distributions depends on whether they are short-term or long-term. Short-term capital gains distributions are taxed as ordinary income, while long-term capital gains distributions enjoy a lower tax rate. Understanding this differential can help investors plan their investment strategy in a tax-efficient manner. Short-term capital gains distributions stem from the sale of assets that the fund has held for a year or less. These gains are usually taxed at the investor's ordinary income tax rate, which could be higher than the long-term capital gains tax rate. Therefore, they could significantly impact an investor's after-tax return. As a result, investors often prefer funds that generate fewer short-term capital gains, given the potentially higher tax implications. Long-term capital gains distributions originate from the sale of assets the fund has held for more than a year. These gains typically enjoy a more favorable tax rate compared to short-term capital gains, which often ranges from 0% to 20%, depending on the investor's taxable income. This lower tax rate can make funds generating more long-term capital gains more attractive to investors, particularly those in higher tax brackets. It's worth noting that this favorable tax treatment encourages long-term investment strategies. The capital gains distribution process begins when a fund sells an asset at a profit. This scenario arises when the sale price of the asset, such as a stock or bond, exceeds its original purchase price. The resulting profit is termed a "capital gain." Once the capital gain is generated, the fund needs to determine how it will be distributed to shareholders. To do this, the total amount of capital gains is divided by the number of outstanding shares in the fund. This calculation yields the per-share distribution amount. It's important to note that any capital losses that the fund incurs can offset these gains, potentially reducing the amount available for distribution. After the per-share distribution amount is determined, the fund will distribute the gains to the shareholders. This distribution is proportional to the number of shares each shareholder owns. In essence, shareholders with more shares receive a larger portion of the distribution. This distribution is typically done on specific dates, known as distribution dates, and may be taken as cash or reinvested into additional shares, depending on the investor's preference. Market conditions heavily influence capital gains distributions. If the market is doing well and the fund is selling its assets at a profit, the capital gains distributions would be higher. Conversely, if the market is performing poorly, the fund may realize losses rather than gains, which could reduce the capital gains distributions. The investment strategy of the fund can also affect the distribution. A fund that frequently trades its assets will likely generate more short-term capital gains, which might result in larger, but more heavily taxed distributions. Conversely, a fund that employs a buy-and-hold strategy will likely have more long-term capital gains, which are taxed at a lower rate. Investor activity, especially redemptions, can impact the frequency and amount of capital gains distributions. When investors redeem their shares, the fund may need to sell assets to pay them, possibly realizing capital gains which are then distributed to remaining shareholders. Therefore, a high level of redemptions could result in a larger capital gains distribution than might otherwise be the case. As mentioned earlier, the tax rates on capital gains distributions depend on whether the gain is short-term or long-term. The maximum long-term capital gains tax rate is 20%, while short-term capital gains are taxed as ordinary income, which can be as high as 37%. This distinction encourages long-term investing by rewarding longer-held investments with a lower tax rate. Investors can employ several strategies to manage the tax implications of capital gains distributions. One common strategy is tax-loss harvesting, where investors offset capital gains with capital losses to reduce their tax liability. Tax planning can be a complicated process, but it's an integral part of an effective investment strategy. Capital losses, when a fund sells an asset for less than the purchase price, can be used to offset capital gains and reduce the amount of taxable distribution. It’s also worth noting that if a fund has more capital losses than gains, it can use these losses to offset future gains. This carryover can help manage taxes in future years, providing some compensation for the losses suffered. Several strategies can help lower the tax impact of capital gains distributions. These include investing in tax-efficient funds, holding investments longer to qualify for long-term rates, and strategically timing the purchase of mutual fund shares to avoid buying before a distribution. Each strategy has its own considerations, so investors should carefully evaluate their own circumstances before implementing any of them. Investing through tax-advantaged accounts like individual retirement accounts (IRAs) or 401(k)s can provide a shelter from taxes on capital gains distributions. These accounts either allow your investments to grow tax-free or defer the taxes until you withdraw the funds. Using these accounts can be an effective way to mitigate the tax implications of capital gains distributions and improve net returns. Capital gains distribution is a crucial aspect of mutual fund investments, presenting a dual-edged sword for investors. It provides a share of the profit made by the fund while carrying notable tax implications. The taxation on this distribution, whether short-term or long-term, can significantly influence an investor's net return. Market conditions, investment strategies, and investor activity all play a role in determining the amount and nature of these distributions. Properly managing these distributions requires a nuanced understanding of the process, the tax implications, and effective tax-planning strategies. These may include investing in tax-efficient funds, leveraging tax-advantaged accounts, and executing techniques like tax-loss harvesting. All these facets underscore the importance of an informed and strategic approach to investing. Don't let tax complications dampen your investment returns. Reach out to a professional tax planning service to maximize your gains while minimizing your tax liability.What Is Capital Gains Distribution?

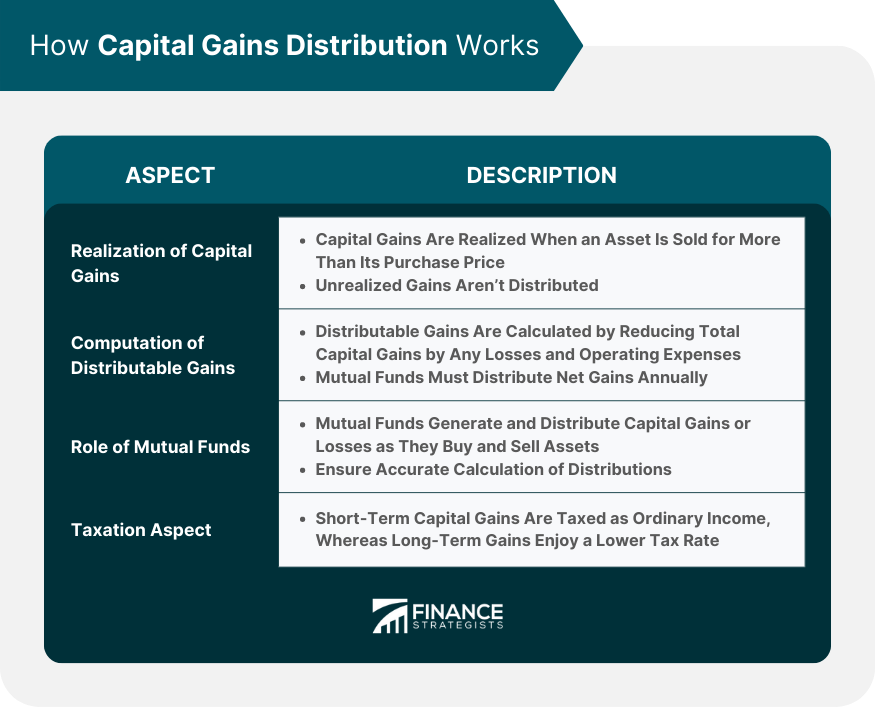

How Capital Gains Distribution Works

Realization of Capital Gains

Computation of Distributable Capital Gains

Role of Mutual Funds

Taxation Aspect

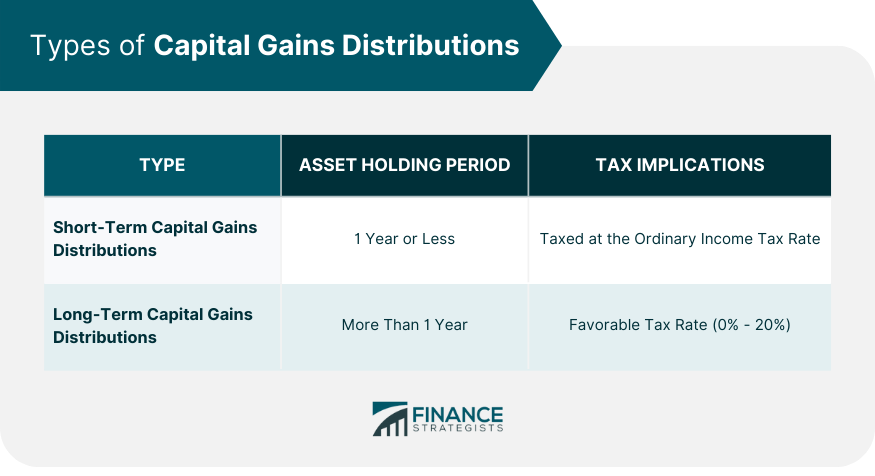

Types of Capital Gains Distributions

Short-Term Capital Gains Distributions

Long-Term Capital Gains Distributions

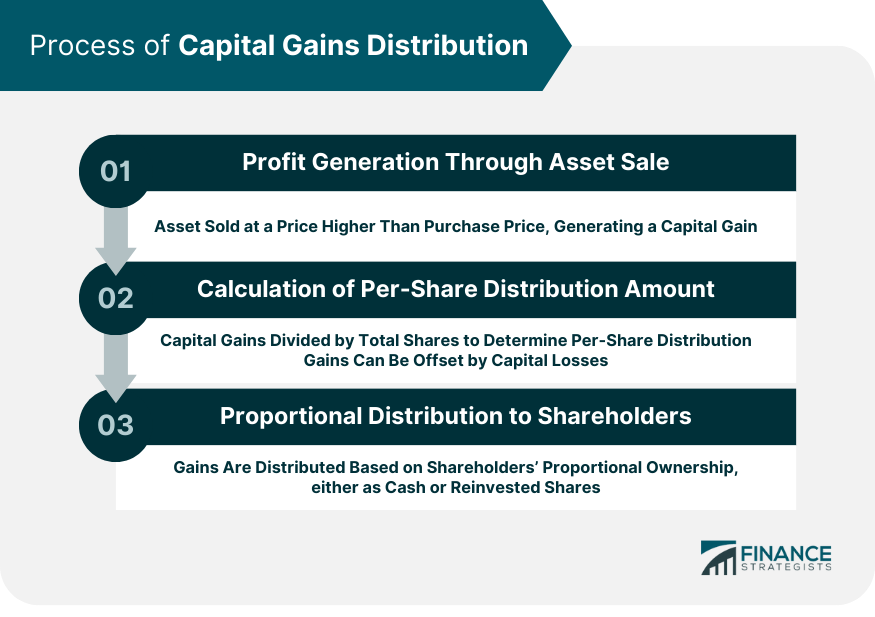

Process of Capital Gains Distribution

Profit Generation Through Asset Sale

Calculation of Per-Share Distribution Amount

Proportional Distribution to Shareholders

Factors Influencing Capital Gains Distributions

Market Conditions

Investment Strategies

Investor Activity

Tax Implications of Capital Gains Distributions

Tax Rates and How They Apply

Tax Planning Strategies

Capital Losses

How to Manage Capital Gains Distributions

Strategies for Lowering Capital Gains Taxes

Role of Tax-Advantaged Accounts

Final Thoughts

Capital Gains Distribution FAQs

Capital gains distribution refers to the profit payments made by mutual funds or ETFs to their shareholders when investments within the portfolio are sold at a profit.

There are two types of capital gains distributions: short-term (from assets held for a year or less) and long-term (from assets held for more than a year).

In the U.S., short-term capital gains distributions are taxed as ordinary income, while long-term capital gains distributions are taxed at a lower rate.

Factors include market conditions, the fund's investment strategy, and investor activity, such as redemptions.

Strategies include tax-efficient investing, tax-loss harvesting, investing in tax-advantaged accounts, and timing the purchase of mutual fund shares.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.