Understanding Capital Gains Rollover

What Is a Capital Gains Rollover?

A capital gains rollover refers to the deferral of capital gains tax by reinvesting the proceeds from the sale of an asset into a similar type of asset within a specific timeframe.

Essentially, the tax obligation isn't eliminated but deferred, potentially allowing the investor to benefit from the time value of money. This allows for increased capital that can be reinvested and allows for potentially higher returns in the future.

Mechanics of a Rollover

In simple terms, the process begins when an investor sells an asset. Instead of realizing the gain and paying tax, the investor reinvests the proceeds into a similar asset.

It's important to note that there are often strict time limits and rules surrounding this process. Not adhering to these timelines can lead to the disqualification of the rollover, resulting in immediate taxation.

Situations Where Capital Gains Rollover Is Relevant

Transactions Where Rollovers Apply

Capital gains rollovers can be applied to various transactions. The most common are real estate transactions, known as 1031 exchanges.

However, other types of assets, like business properties or equipment, can also qualify under specific circumstances.

Knowledge of these different applicable situations is paramount for effective tax planning.

Scenario-Based Illustrations

For instance, consider a business owner who sells a piece of equipment and makes a profit.

If they reinvest the gains in a similar piece of equipment within the allowed time, they could potentially defer the capital gains tax on that profit. This capital can then be used for further investments or operational costs, fostering business growth.

How to Execute a Capital Gains Rollover

Process of Initiating a Capital Gains Rollover

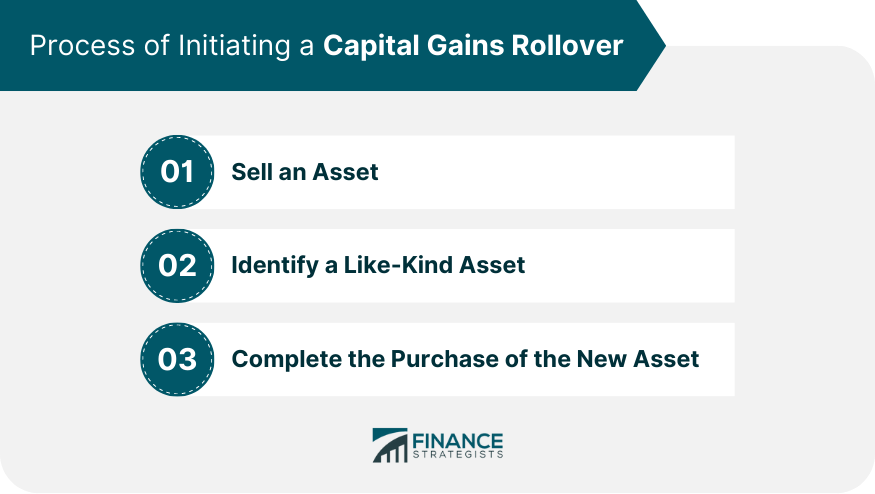

Initiating a rollover generally involves a few key steps, although the specific process may vary depending on the type of asset involved and the local tax laws. Here's a broad outline of the process:

Sell an Asset: The first step in a rollover is to sell an existing asset. This could be a piece of real estate, a business, or other types of investments. The aim is to generate a capital gain from the sale.

Identify a Like-Kind Asset: After selling the asset, the investor must identify a similar or 'like-kind' asset they want to acquire. The definition of a 'like-kind' asset can vary, but generally, it should be similar in nature or character to the asset that was sold.

Complete the Purchase of the New Asset: Once the new asset has been identified, the investor must complete the purchase within a certain period. This timeline can vary based on local tax laws and the type of asset involved.

Legal Requirements

Understanding and adhering to the legal requirements is critical to ensuring a successful rollover. These may involve specific timelines for identifying and purchasing the new asset, and rules regarding the handling of sale proceeds.

Failure to comply with these rules can lead to the rollover being invalidated, which can lead to an immediate tax liability.

Benefits of a Capital Gains Rollover

Potential Tax Deferrals

One of the significant benefits of a capital gains rollover is the potential for tax deferral. The time value of money concept suggests that a dollar today is worth more than a dollar in the future.

By deferring tax, investors can use those funds to generate additional returns. This offers investors flexibility and the potential for higher overall net worth over time.

Long-Term Financial Planning

Capital gains rollovers can play a crucial role in long-term financial planning. They can help manage tax liabilities, enhance cash flow, and aid in the strategic growth of investments.

In addition, it can help to stabilize financial plans by providing a buffer against sudden or unexpected tax payments.

Potential Risks and Considerations

Market Volatility

Market volatility can greatly impact the price of a replacement asset as the fluctuations in the market can cause the asset's price to change rapidly and unpredictably, often without any apparent reason.

This could make it challenging for an investor to buy the replacement asset at a favorable price or even result in a financial loss if the asset price decreases substantially after purchase.

Changes in Tax Laws

If tax laws change, the benefits of a rollover, such as the deferment of tax payment, could be reduced or eliminated. Depending on the extent of these changes, the investor may find themselves facing an unexpected and potentially substantial tax liability.

In a worst-case scenario, the changes could make the rollover more costly than beneficial, undermining the entire rationale for undertaking the rollover in the first place. It's essential to stay informed about potential tax law changes when planning for a capital gains rollover.

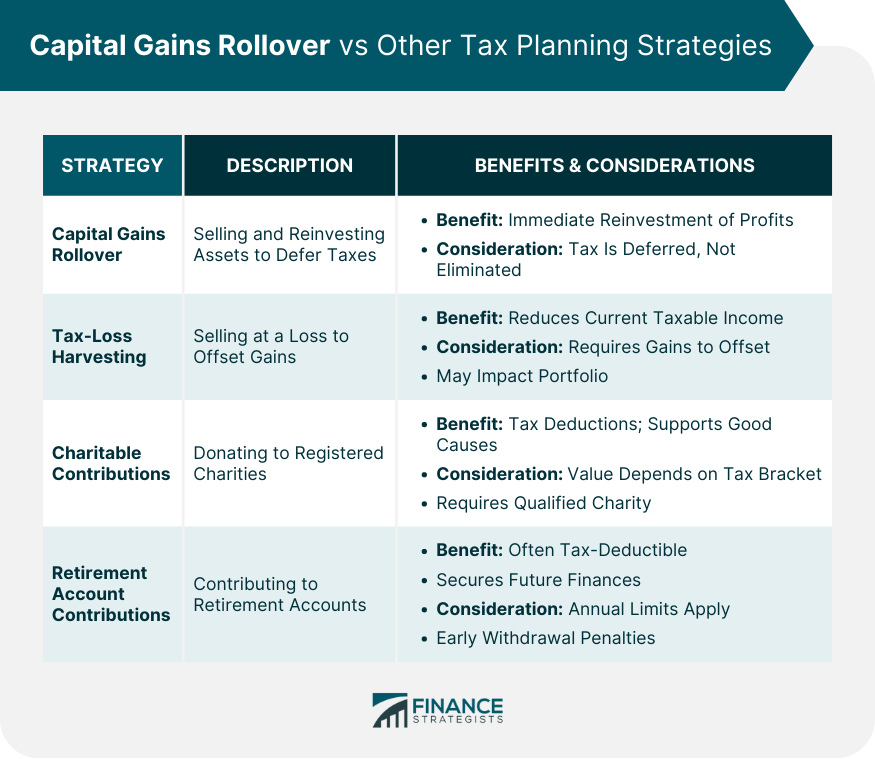

Capital Gains Rollover vs Other Tax Planning Strategies

Tax-Loss Harvesting

Tax-loss harvesting is a strategy that involves selling securities at a loss to offset capital gains in other investments.

The key advantage of this strategy is that it can help reduce taxable income in the current year. This strategy is most applicable for investors with both winning and losing investments in their portfolio.

Charitable Contribution

Charitable contributions involve donating money, goods, or securities to a registered charity. This strategy not only benefits the recipient charity but can also provide significant tax benefits for the donor.

In many jurisdictions, charitable contributions are tax-deductible, reducing the individual's taxable income.

Retirement Account Contribution

Contributing to retirement accounts is another effective tax planning strategy. Contributions to certain retirement accounts, such as a 401(k) or an Individual Retirement Account (IRA), are typically tax-deductible.

This strategy not only helps reduce current taxable income but also aids in securing the individual's financial future.

Bottom Line

Capital gains rollovers present a strategic opportunity for investors to defer capital gains tax, potentially enhancing their net worth over time.

The application of this strategy extends beyond real estate transactions (1031 exchanges) and can also encompass assets such as business properties and equipment.

It's crucial to understand the mechanics and legal requirements of a rollover, including strict timelines and the concept of 'like-kind' assets, to avoid immediate tax liabilities.

While capital gains rollovers offer significant benefits such as potential tax deferrals and aiding long-term financial planning, investors should also weigh in the potential risks like market volatility and changes in tax laws.

Just like tax-loss harvesting, charitable contributions, and retirement account contributions, capital gains rollover forms an integral part of effective tax planning.

Remember, a robust tax planning strategy is not one-size-fits-all but must be tailored to your unique financial situation.

Capital Gains Rollover FAQs

A capital gains rollover is a tax strategy that defers capital gains tax by reinvesting the proceeds from an asset sale into a similar asset.

A rollover begins when an investor sells an asset. Instead of paying tax, the investor reinvests the proceeds into a similar asset within specific time limits.

Rollovers apply to various transactions, most commonly in real estate transactions (1031 exchanges), but can also be used for business properties or equipment.

A capital gains rollover allows for potential tax deferral, thus enhancing cash flow and aiding in long-term financial planning and strategic growth of investments.

Risks include market volatility affecting the price of the replacement asset and changes in tax laws that could impact the benefits of a rollover.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.