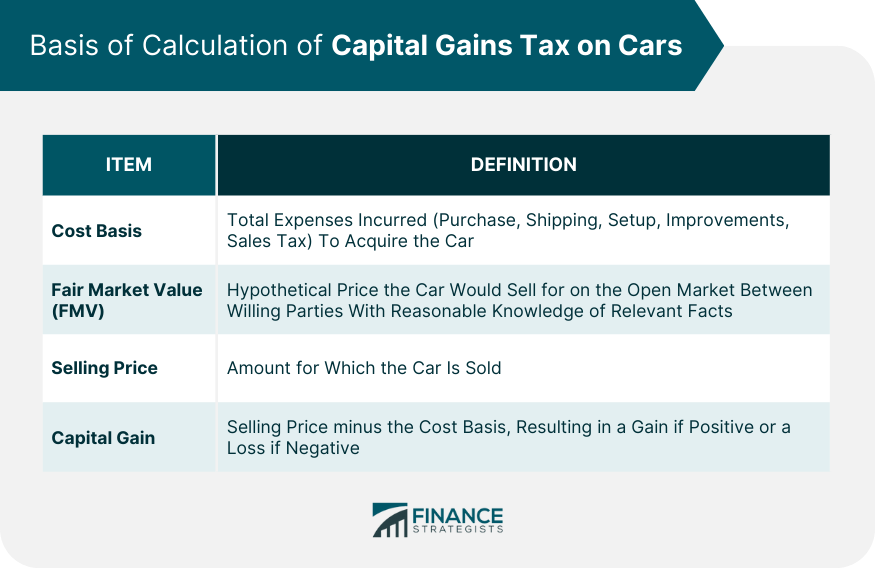

Capital Gains Tax on Cars refers to the tax levied on the profit realized from the sale of a car. This tax is generally applicable when a vehicle, often a classic or collector's car, appreciates in value over time and is sold for more than its initial purchase price. The purpose of this tax, as with other forms of capital gains tax, is to generate revenue from the sale of assets that have increased in value. The tax does not apply to cars sold at a loss, as is often the case with regular vehicles due to depreciation. It's crucial to accurately calculate and report these gains to avoid legal implications. Understanding the concept of Capital Gains Tax on Cars is vital, especially for car collectors, businesses, and individuals who invest in valuable vehicles. The first step to calculating capital gains tax on a car is to identify your cost basis. Your cost basis isn't just what you paid for the car. It also includes other expenses such as shipping costs, setup costs, improvements you made to the vehicle (not regular maintenance or repairs), and sales tax. These additional costs can increase your cost basis, which could lower your capital gain when you sell the car. When calculating capital gains tax, you'll also need to know your car's Fair Market Value (FMV). FMV is the price the car would sell for on the open market. It's the price that a willing buyer would pay to a willing seller when neither is compelled to buy or sell, and both have reasonable knowledge of the relevant facts. This can be a little trickier to calculate with cars, particularly rare or classic cars, but it can be done using tools like the Kelley Blue Book or consulting with an expert. After you have your cost basis and understand the FMV, you can then determine your selling price. If you sell your car for more than your cost basis, you have a capital gain. Conversely, if you sell your car for less than your cost basis, you have a capital loss. The difference between the selling price and the cost basis is your capital gain or loss. Collectors' cars, antique vehicles, or classic cars can appreciate in value over time. If you own such a car and sell it, it may result in a significant capital gain and a potential tax liability. But remember, if you sell a classic car for less than what you've invested in it (your cost basis), you may have a capital loss. If you use your car for business purposes and you sell it for a profit, this could also trigger a capital gains tax event. Like any other business property, the sale of a vehicle used for business can result in a taxable gain. When you receive a car as a gift or inheritance, the cost basis is usually what the previous owner paid for it, plus any improvements. However, the rules can vary depending on the specifics of the situation. If the car has appreciated in value and you later sell it, you might owe capital gains tax. In many cases, selling a car will result in a capital loss rather than a gain because cars typically depreciate in value. These losses can sometimes be used to offset other capital gains you may have. However, there are limits on how much you can claim, so it's essential to understand the rules. If you do have a capital gain from selling a car, you'll likely need to report it to the IRS. This is typically done using Schedule D (Form 1040), the capital gains and losses form. In general, capital gains from selling a car should be reported on your tax return for the year in which the sale occurred. If you miss the filing deadline, you could face penalties, so it's crucial to keep track of when you sold the vehicle. Failing to report capital gains accurately can lead to penalties from the IRS, including fines and interest charges. In severe cases, it could even lead to criminal charges. It's always best to consult with a tax professional if you're unsure about reporting requirements. One potential way to avoid capital gains tax on cars is through a like-kind exchange, also known as a 1031 exchange. However, this typically applies to business or investment property, and there are specific rules that must be followed. If you have capital losses from selling other assets, you may be able to use these losses to offset your capital gains from selling a car. This could potentially reduce your capital gains tax liability. If you donate a car to a qualified charitable organization, you may be able to claim a tax deduction. This won't avoid capital gains tax if the car has appreciated in value, but it can provide a tax benefit. Capital Gains Tax on Cars arises when vehicles, primarily classic or collector's cars, are sold for a profit exceeding their initial purchase price. Key elements in the calculation include understanding the vehicle's Cost Basis, incorporating all associated expenses from the purchase to improvements, and recognizing its Fair Market Value. The purchase price, holding periods, and other circumstances, such as owning collector cars, using vehicles for business, or acquiring through gifts or inheritance, can all affect the tax implications of selling a car. While it's imperative to report gains to the IRS using Schedule D accurately, several legal methods, like like-kind exchanges or leveraging capital losses, can reduce tax liabilities. Ultimately, understanding and navigating the intricacies of this tax ensures compliance and optimal financial decision-making, especially for car enthusiasts and investors.Overview Capital Gains Tax on Cars

Basis of Calculation of Capital Gains Tax on Cars

Identifying the Cost Basis of Your Car

Understanding Fair Market Value

Determining the Selling Price and Calculating Capital Gain

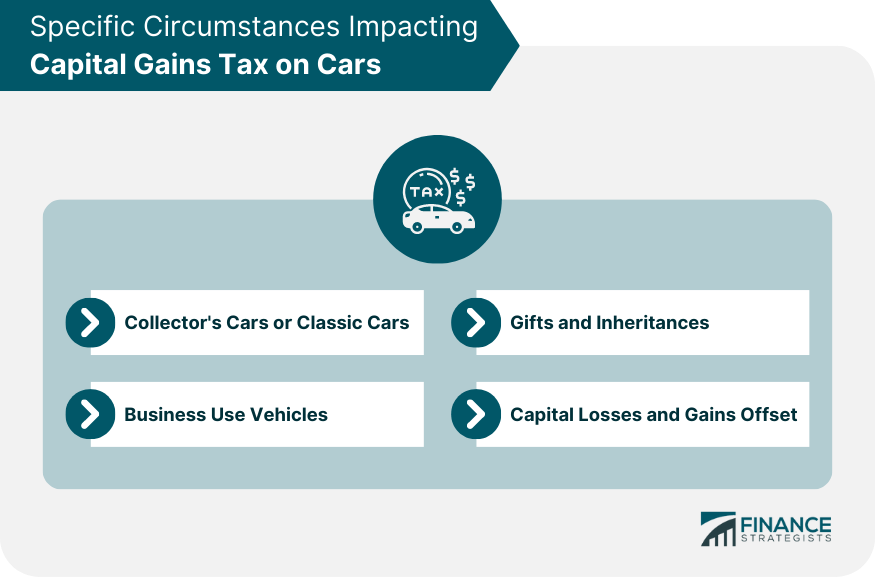

Specific Circumstances Impacting Capital Gains Tax on Cars

Collector's Cars or Classic Cars

Business Use Vehicles

Gifts and Inheritances

Capital Losses and Gains Offset

Reporting Capital Gains From Cars to the IRS

Relevant IRS Forms

Reporting Deadlines

Consequences of Not Accurately Reporting Capital Gains

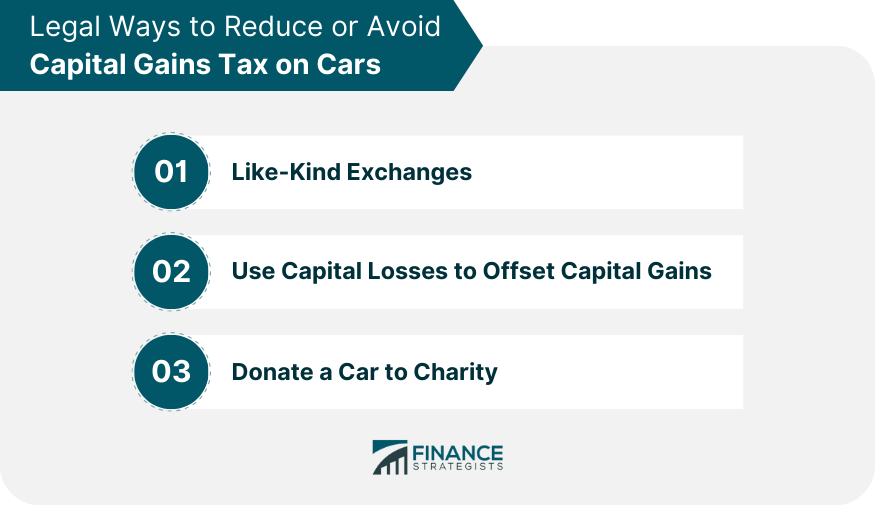

Legal Ways to Reduce or Avoid Capital Gains Tax on Cars

Like-Kind Exchanges

Using Capital Losses to Offset Capital Gains

Donating a Car to Charity

Conclusion

Capital Gains Tax on Cars FAQs

While technically, capital gains tax could apply to any car sold at a profit, it's most relevant to collector's cars, antique vehicles, or classic cars that have appreciated in value over time. This is because most regular vehicles depreciate in value over time, so it's less common to sell them at a profit.

Your cost basis includes not only the initial purchase price of the car but also additional expenses such as shipping costs, setup costs, improvements (not regular maintenance or repairs), and sales tax. These costs can reduce your potential capital gains.

If you use your car for business purposes and sell it at a profit, it could trigger a capital gains tax event. Like any other business property, the sale of a vehicle used for business can result in a taxable gain.

Capital gains from selling a car should be reported to the IRS using Schedule D (Form 1040), the capital gains and losses form. It should be reported in the tax year during which the sale occurred.

Yes, there are a few potential ways to reduce or avoid capital gains tax on cars, including like-kind exchanges (also known as a 1031 exchange), using capital losses from other assets to offset your capital gains, and donating a car to a qualified charitable organization.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.