Capital gains tax is a levy charged by the government on the profit made from the sale of an investment or asset. It applies to assets such as stocks, bonds, real estate, and more. This tax is only applicable when an asset is sold, and the gain is realized. The rate of capital gains tax is influenced by factors such as the duration for which the asset was held (short-term vs. long-term) and the investor's income level. Short-term gains are typically taxed at higher ordinary income rates, while long-term gains enjoy lower tax rates, incentivizing long-term investment. Understanding capital gains tax is vital for effective financial and investment planning.

Capital gains refer to the profits made from selling an asset or investment. They're calculated by subtracting the purchase price of the asset, also known as the "basis," from the selling price. For instance, if you bought a stock for $100 and sold it for $150, your capital gain would be $50 ($150 - $100). It's important to note that capital gains are only realized and taxed upon the sale of the asset. Understanding how capital gains are calculated is fundamental to effective financial planning and tax management. While salaries, business profits, and interest income are classified as ordinary income, capital gains are treated separately for taxation purposes. They are often taxed at a different rate, which can be more favorable than the ordinary income tax rate depending on the holding period of the asset. Capital gains are categorized into two types; short-term and long-term, each with its tax implications. Short-term capital gains arising from the sale of assets held for one year or less. These are taxed as ordinary income, with rates varying based on the individual's tax bracket. Long-term capital gains result from selling assets held for more than a year. They are typically taxed at lower rates, which is a key consideration in investment decision-making. Tax rates for capital gains vary significantly between short-term and long-term holdings. As short-term gains are taxed as ordinary income, the rates range from 10% to 37% in the U.S., depending on the taxpayer's income. Long-term capital gains tax rates are typically lower, ranging from 0% to 20% for most assets. The intent behind this differential treatment is to incentivize long-term investing.. The tax implications of investment choices can significantly impact an investor's strategy. Capital gains tax influences investment decisions, with the potential to yield or cost substantial sums. Investors often strategize to minimize tax liability, like holding onto assets for longer periods to qualify for lower long-term rates. The varying tax rates on different assets can also guide investors in their asset allocation. For example, assets like stocks, which potentially yield capital gains, might be held in taxable accounts, while interest-earning bonds could be better suited for tax-deferred accounts. The capital gains tax can influence decisions on when to buy or sell an asset. For instance, an investor might hold off selling an asset until it qualifies for the lower long-term capital gains tax rate. Smart planning can help manage and mitigate capital gains tax liabilities. This involves selling securities at a loss to offset capital gains, reducing the overall tax liability. The key is to balance gains and losses to lower the net taxable capital gains. Holding assets for over a year can significantly reduce capital gains tax due to the preferential rates applied to long-term investments. Accounts such as 401(k)s, IRAs, or HSAs offer tax advantages, including deferring or potentially eliminating capital gains tax. Gifting or inheriting assets can offer substantial capital gains tax benefits. For instance, assets received as an inheritance get a 'step-up' in a basis, which can reduce the taxable gain when the asset is sold. Navigating the documentation and reporting process for capital gains tax is essential for compliance and planning. Keeping a comprehensive record of all investment activities, including purchases and sales, is critical for accurately calculating capital gains or losses. In the U.S., for example, Form 8949 and Schedule D of Form 1040 are used to report capital gains and losses. It's important to understand and correctly fill out these forms. Typically, capital gains tax is paid through estimated tax payments or withheld income. Being aware of and adhering to tax deadlines can help avoid penalties and interest. Legal frameworks around capital gains tax are continuously evolving, driven by shifts in economic, political, and social landscapes. The U.S., for instance, saw considerable debate around capital gains tax rates under the Biden administration, with proposals to increase the top rate on long-term capital gains for high earners. Capital gains tax remains a hot topic, with perspectives varying based on ideological stances, fiscal priorities, and interpretations of economic justice. Understanding capital gains tax is critical for optimizing investment strategies and financial planning. This tax applies to the profit realized from the sale of various types of investments, including stocks, bonds, and real estate. Influenced by factors such as the duration of asset holding and an individual's income level, capital gains tax rates vary for short-term and long-term gains, generally favoring the latter to promote long-term investing. Numerous strategies can help manage tax liabilities, including tax-loss harvesting and utilizing tax-advantaged accounts. The legislative landscape around capital gains tax is constantly evolving, making it necessary for investors to stay informed about recent changes and debates. By gaining a comprehensive understanding of these factors, investors can make well-informed decisions, maximizing returns while minimizing tax burdens.Capital Gains Tax on Investments Overview

How Capital Gains Are Calculated

Difference Between Capital Gains and Other Types of Income

Types of Capital Gains

Short-Term Capital Gains

Long-Term Capital Gains

Capital Gains Tax Rates

Short-Term Capital Gains Tax Rates

Long-Term Capital Gains Tax Rates

How Capital Gains Tax Affects Investments

Impact on Investment Strategy

Role in Asset Allocation

Influence on Investment Decision-Making

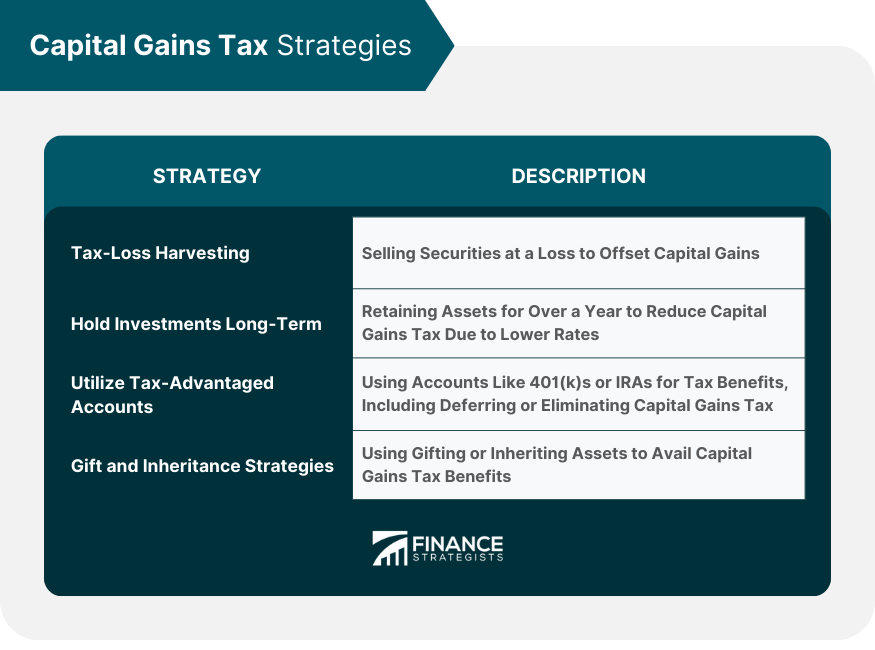

Capital Gains Tax Strategies

Tax-Loss Harvesting

Holding Investments for the Long-Term

Utilizing Tax-Advantaged Accounts

Gift and Inheritance Strategies

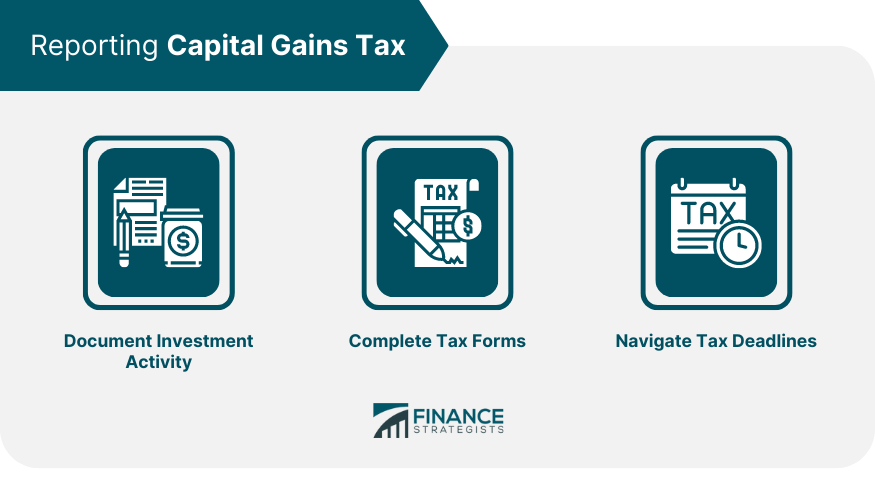

Reporting Capital Gains Tax

Documenting Investment Activity

Completing the Appropriate Tax Forms

Navigating Tax Deadlines

Capital Gains Tax and Legislation

Recent Changes to Capital Gains Tax Law

Ongoing Legislative Debates

Conclusion

Capital Gains Tax on Investments FAQs

Capital gains tax is a levy imposed by the government on the profit made from the sale of an investment or asset, such as real estate, stocks, or bonds. This tax is only payable when the asset is sold, and the gain is realized.

Capital gains taxes are calculated by subtracting the original purchase price of the asset (also known as the "basis") from its sale price. The resulting profit is the capital gain, which is then subject to capital gains tax at either short-term or long-term rates depending on how long the asset was held.

Short-term capital gains arise from the sale of assets held for a year or less and are typically taxed as ordinary income, with rates varying based on the individual's income tax bracket. Long-term capital gains come from selling assets held for more than a year, and these are typically taxed at lower rates to encourage long-term investing.

Several strategies can help minimize capital gains tax. These include holding assets for over a year to qualify for lower long-term rates, selling securities at a loss to offset capital gains (known as tax-loss harvesting), and utilizing tax-advantaged accounts like 401(k)s or IRAs, which offer the possibility of deferring or eliminating capital gains tax.

No, capital gains tax policies can vary significantly worldwide. For instance, some countries like Belgium, New Zealand, and Switzerland do not impose a capital gains tax, while others like Denmark and Finland have some of the highest capital gains tax rates. The U.S., U.K., and Canada each have unique rules and rates for capital gains tax.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.