Capital Gains Tax (CGT) is a tax imposed on profits earned from selling or exchanging a capital asset. When it comes to reinvestments, one might assume that redirecting profits into a new asset would exempt them from this tax. However, that's not always the case. Reinvestment does not automatically shield an investor from CGT. In some jurisdictions, there are provisions allowing investors to "roll over" or defer the CGT if the proceeds from an asset sale are reinvested into a similar asset within a set period. One notable example in the U.S. is the 1031 exchange for real estate. However, specific conditions apply, and not all reinvestments qualify. It's crucial for investors to be aware of their potential CGT obligations, even when reinvesting, to avoid unforeseen tax liabilities.

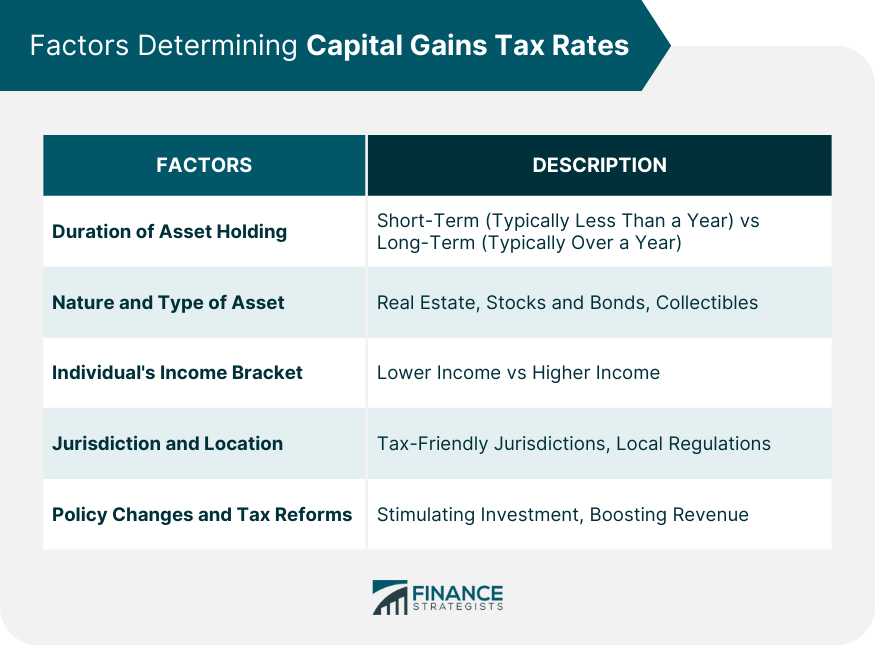

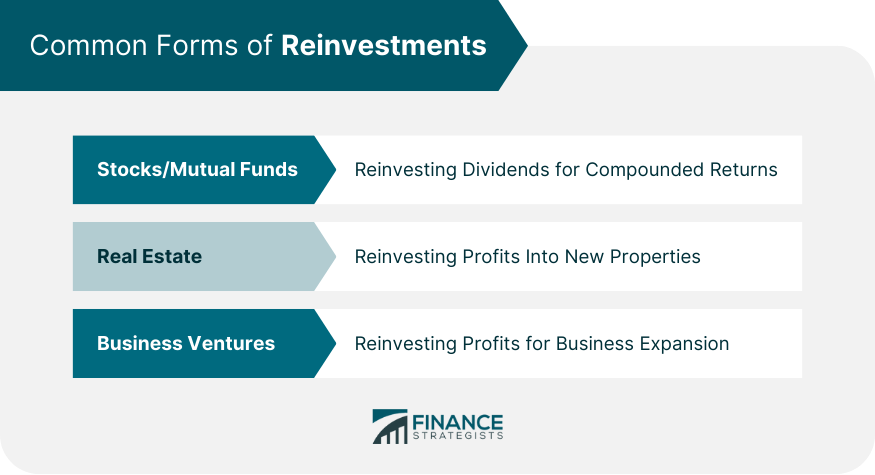

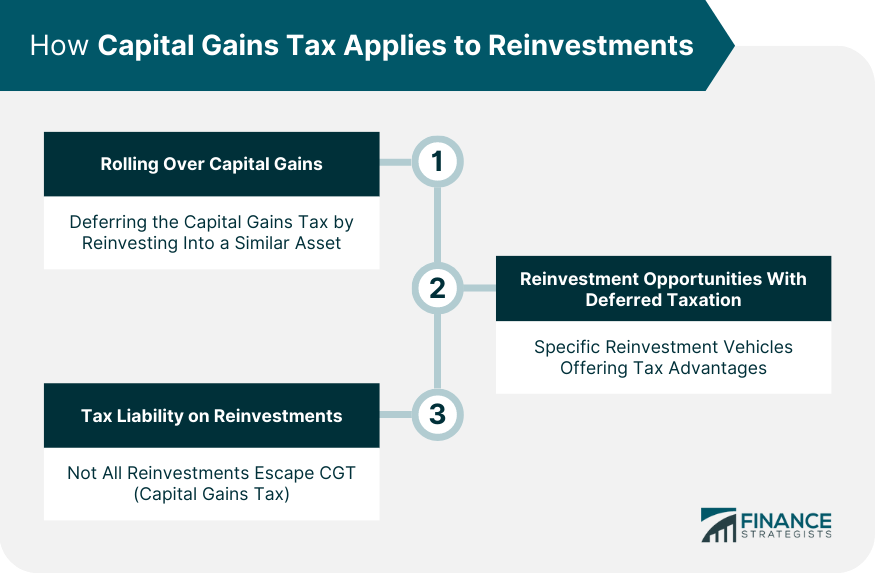

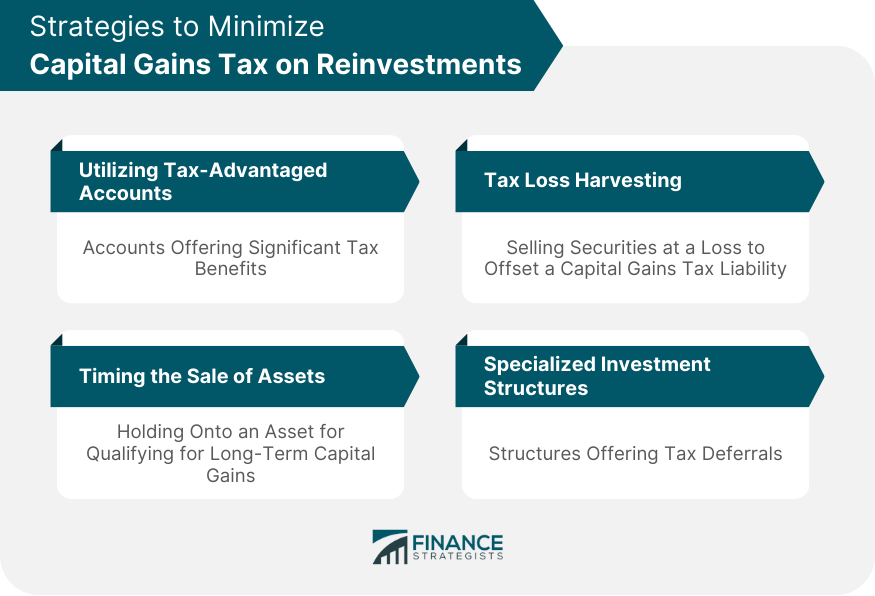

Short-term Assets: These are assets held for a short duration, typically less than a year. The gains from such assets are often taxed at the same rate as ordinary income. Long-term Assets: Assets held for longer durations, usually over a year, typically enjoy a reduced tax rate as they promote long-term investment. Real Estate: Properties, especially primary residences, might come with specific exemptions or reduced rates. Stocks and Bonds: These are the most common assets and have standard tax rates, depending on the holding period. Collectibles: Items like art, coins, or antiques might have a different tax rate compared to other assets. Lower Income: Individuals with lower taxable income might pay no or minimal capital gains tax. Higher Income: Those in higher tax brackets may be subjected to a more significant capital gains tax rate. Tax-Friendly Jurisdictions: Some countries are known for their investor-friendly tax regimes, attracting global investors. Local Regulations: Within federations, individual states or provinces might have their additional taxes on top of the national CGT. Stimulating Investment: During economic downturns, governments might reduce capital gains tax rates to incentivize investment. Boosting Revenue: At other times, rates might be increased to generate more revenue for the state coffer. Different avenues can be explored when considering reinvestments: Many investors choose to reinvest dividends received from their stocks or mutual funds. It allows their investment to grow exponentially, as they earn returns on returns. Another common avenue is the real estate market. Profits from one property can be reinvested into another, potentially upscale or in a burgeoning area, aiming for higher returns. Entrepreneurs often plow back their profits into their business, aiming for expansion, diversification, or entering new markets. Reinvesting doesn't always shield you from CGT. However, there are scenarios where it might provide some relief. In some jurisdictions, you can "rollover" or defer the capital gains tax if the proceeds from an asset sale are reinvested into a similar asset within a stipulated period. It essentially allows investors to postpone their tax liability. Certain reinvestment vehicles are specifically designed to offer tax advantages. For instance, in the U.S., the 1031 exchange allows real estate investors to reinvest the proceeds from a property sale into a "like-kind" property, deferring CGT. Not all reinvestments escape CGT. For instance, reinvesting stock dividends might still attract tax unless they're sheltered in a tax-advantaged account. There are actionable strategies investors can employ to potentially reduce their CGT liability: Accounts like IRAs or 401(k)s in the U.S. can offer significant tax benefits, including deferring or potentially eliminating CGT on reinvestments. By holding onto an asset for a duration that qualifies it for long-term capital gains, investors can benefit from reduced tax rates. This involves selling securities at a loss to offset a capital gains tax liability. It's a strategic move, especially in volatile markets. Structures As previously mentioned, structures like the 1031 Exchange can offer tax deferrals, but it's crucial to adhere to stipulated guidelines. Decisions Tax implications can be the pivot on which reinvestment decisions turn. The net benefit after tax often becomes the real indicator of an investment's merit. Before making a reinvestment, prudent investors analyze potential returns post-tax. This provides a clearer picture of the actual benefit and can influence the decision to proceed or look for alternatives. The holding duration can determine the rate at which capital gains are taxed. A longer horizon, in many cases, can mean reduced taxation. Investors often juggle multiple assets. Being aware of the CGT on each helps in making informed decisions and in creating a diversified portfolio that doesn't just spread risk but also optimizes after-tax returns. Capital Gains Tax (CGT) on reinvestments plays a fundamental role in shaping investment strategies. The rate of CGT is influenced by factors like the duration an asset is held, the nature of the asset, the investor's income bracket, jurisdiction, and prevalent tax policies. While reinvestments can sometimes offer tax relief through mechanisms like "rolling over" capital gains, they aren't always exempt from taxation. Savvy investors utilize strategies such as tax-advantaged accounts and tax loss harvesting to minimize their CGT liabilities. Globally, varying tax regimes require investors to navigate through complex terrains, taking into consideration both the appeal of tax-friendly jurisdictions and the intricacies of multinational investment. A holistic understanding of these elements ensures investors make decisions that not only seek optimal returns but are also tax-efficient.Capital Gains Tax on Reinvestments Overview

Factors Determining Capital Gains Tax Rates

Duration of Asset Holding

Nature and Type of Asset

Individual’s Income Bracket

Jurisdiction and Location

Policy Changes and Tax Reforms

Common Forms of Reinvestments

Stocks or Mutual Funds

Real Estate

Business Ventures

How Capital Gains Tax Applies to Reinvestments

Concept of “Rolling Over” Capital Gains

Reinvestment Opportunities With Deferred Taxation

Tax Liability on Reinvestments

Strategies to Minimize Capital Gains Tax on Reinvestments

Utilizing Tax-advantaged Accounts

Timing the Sale of Assets

Tax Loss Harvesting

Specialized Investment

Impact of Capital Gains Tax on Reinvestment

Assessing Net Benefit

Time Horizon Consideration

Diversification and Tax

Conclusion

Capital Gains Tax on Reinvestments FAQs

Capital gains tax on reinvestments refers to the tax levied on the profit made from selling an investment and then reinvesting the proceeds into another asset.

In the U.S., one can defer capital gains tax on reinvestments in real estate using a 1031 exchange, which allows you to reinvest the proceeds from a sold property into a "like-kind" property, postponing the tax liability.

Yes, tax-advantaged accounts like IRAs or 401(k)s can offer benefits, including deferring or possibly eliminating capital gains tax on reinvestments.

The duration determines whether the gain is classified as short-term or long-term. Typically, assets held for more than a year before being sold can benefit from lower long-term capital gains tax rates.

Yes, when stock dividends are reinvested to purchase more shares, they might still be subject to capital gains tax, unless they're placed in a tax-advantaged account.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.