Capital gains tax is the tax you pay on the profit you make from selling an asset, which may include properties, investments, or even valuable items such as art or antiques. The tax isn't levied on the total sale price, but rather on the gain - the difference between the purchase price (known as the 'basis') and the sale price. There are two types of capital gains tax: short-term and long-term. Short-term capital gains tax applies when you've held the asset for a year or less before selling it. These gains are usually taxed at your ordinary income tax rate. On the other hand, long-term capital gains tax is for assets held longer than a year. The rates for long-term capital gains are typically lower than short-term rates, providing a tax advantage to longer-term holdings.

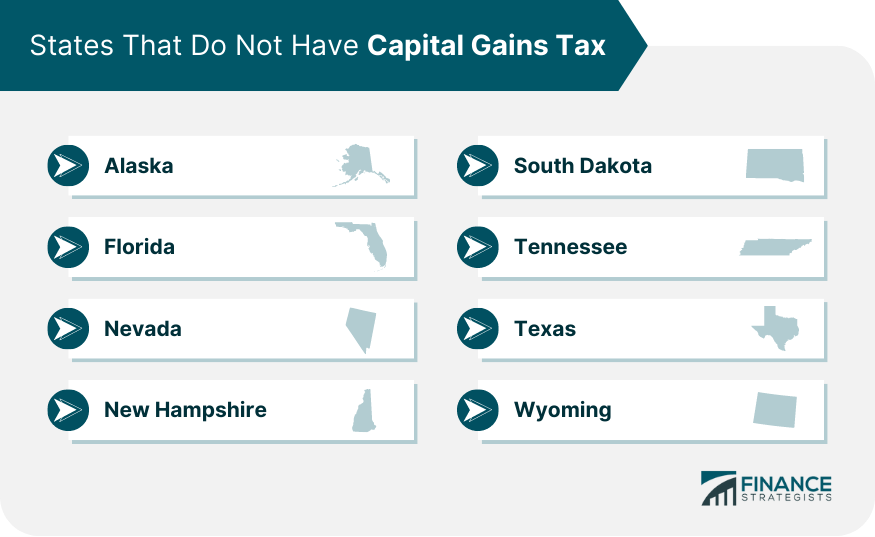

There are eight states that do not have any capital gains tax: These states are often referred to as "tax havens" because they offer low taxes on capital gains. This makes them attractive to investors who are looking to minimize their tax liability. The states with the highest capital gains tax are California, New Jersey, and Oregon. These states all have a top capital gains tax rate of 13.3%. This means that if you sell an asset that has appreciated in value by $100,000, you would owe $13,300 in capital gains tax. The states with the lowest capital gains tax are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. These states all have a capital gains tax rate of 0%. This means that you would not owe any capital gains tax on the sale of an asset, regardless of how much it has appreciated in value. STATE CAPITAL GAINS TAX RATE Alabama 5% Alaska 0% Arizona 2.5% Arkansas 5.50% California 13.30% Colorado 4.55% Connecticut 6.99% Delaware 6.60% District of Columbia 5.75% Florida 0% Georgia 5.75% Hawaii 7.25% Idaho 5.80% Illinois 4.95% Indiana 3.15% Iowa 6% Kansas 5.70% Kentucky 4.5% Louisiana 4.25% Maine 7.15% Maryland 5.75% Massachusetts 9% Michigan 4.25% Mississippi 5% Missouri 4.95% Montana 6.90% Nebraska 6.64% Nevada 0% New Hampshire 0% New Jersey 10.75% New Mexico 5.90% New York 8.82% North Carolina 4.75% North Dakota 2.90% Ohio 4.80% Oklahoma 4.75% Oregon 9.9% Pennsylvania 3.07% Rhode Island 5.99% South Carolina 6.4% South Dakota 0% Tennessee 0% Texas 0% Utah 4.95% Vermont 8.75% Virginia 5.75% Washington 7% West Virginia 6.50% Wisconsin 7.65% Wyoming 0% Other states, such as Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, and Wyoming, have no capital gains tax at all. It is important to factor in the capital gains tax implications when you are considering selling an asset. By understanding the capital gains tax rates in your state, you can make an informed decision about when and how to sell your assets. Capital gains taxes can significantly affect the net return on your investments. Therefore, knowing your potential tax liabilities can help you make more informed investment decisions. Let's say you're a California resident in the top tax bracket, and you've just sold an investment property, realizing a gain of $500,000. You'll owe federal long-term capital gains tax at a maximum rate of 20% (as of 2024), plus the 3.8% net investment income tax (NIIT), and the California state capital gains tax at 13.3%. This results in a substantial reduction in your profit. High capital gains tax rates may lead some investors to hold onto their investments longer to qualify for the lower long-term rates. In states with high capital gains tax rates, investors may also explore tax-efficient investment strategies to minimize their tax liability. There are a few key strategies that can help investors manage their capital gains tax. One is the 'hold' strategy – holding onto an asset for more than a year so it qualifies for long-term capital gains tax, which is generally lower than short-term. Another strategy is tax-loss harvesting. This involves selling investments that have declined in value to offset the capital gains realized from selling profitable investments. This strategy can reduce your overall taxable income. Lastly, consider investing in tax-advantaged accounts, such as 401(k)s or IRAs. These accounts offer tax-free or tax-deferred growth, helping reduce your overall tax liability. While these strategies can potentially lower your tax burden, it's always a good idea to seek advice from a tax professional. Tax laws are complex and change frequently, and each investor's situation is unique. A tax professional can provide personalized advice based on your specific circumstances. Next, let's discuss the impact of federal capital gains tax and how it works in combination with state taxes. Understanding the role of federal capital gains tax is crucial in grasping the total tax liability from capital gains. In 2024, the long-term federal capital gains tax rates are 0%, 15%, or 20%, depending on your income. The rates apply to assets held for more than a year. Short-term capital gains, from assets held for one year or less, are taxed as ordinary income. Additionally, some taxpayers may be subject to a 3.8% net investment income tax. It's important to remember that state capital gains tax is in addition to federal tax. Therefore, in states with high capital gains tax rates, the combined burden can be significant. Understanding both federal and state taxes allows you to plan your investment strategy effectively and minimize your tax liability where possible. In 2024, the landscape of capital gains tax exhibits wide disparities from state to state. States like California, New Jersey, and Oregon top the chart with a considerable 13.3% capital gains tax rate, while others, namely Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, and Wyoming, charge no capital gains tax at all. This variation can deeply influence investment decisions, with potential outcomes ranging from reaping full profits in tax-free states to paying hefty sums in high-tax states. The combined impact of federal and state taxes further complicates the equation for investors. It is essential, therefore, for individuals and investors to understand these rates and implications, thus ensuring that they navigate their financial decisions wisely. To navigate this complex financial terrain and make the most of your investments, seek expert tax planning services today.Understanding Capital Gains Tax

Capital Gains Tax Rates by State in 2024

Capital Gains Tax-Free States

States With the Highest Capital Gains Tax

States With the Lowest Capital Gains Tax

Table of Capital Gains Tax Rates by State in 2024

How These Rates Impact Your Investments

Real-World Impact

Considerations for Investors

Strategies for Minimizing Capital Gains Tax

Utilizing Tax-Efficient Investing Strategies

Seeking Professional Advice

Impact of Federal Capital Gains Tax

Federal Capital Gains Tax Rates for 2024

Combining Federal and State Taxes

Bottom Line

Capital Gains Tax Rates by State FAQs

The rates vary widely, with some states like Texas and Florida charging no state capital gains tax, while others like California can charge up to 13.3%.

The tax can significantly reduce your profit from the sale of an asset, depending on both the state and federal tax rates.

Strategies include holding onto assets for longer periods, tax-loss harvesting, and investing in tax-advantaged accounts like 401(k)s or IRAs.

The long-term federal capital gains tax rates are 0%, 15%, or 20%, depending on your income. Short-term gains are taxed as ordinary income.

State capital gains tax is in addition to federal tax. Therefore, in states with high capital gains tax rates, the combined tax burden can be significant.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.