The capital gains tax is a levy charged on the gains realized from the sale of a capital asset. These gains represent the difference between the purchase price, also known as the "basis," and the selling price. Ignoring this tax can potentially erode a substantial amount of profits from investments. A thorough understanding of this tax type is a must-have for every savvy investor looking to maximize their returns. Capital gains tax was initially introduced to ensure that individuals did not escape paying taxes on growth in their wealth, particularly through investments. The aim was to balance the scales between earned income and profit-driven income. By capturing this secondary form of income, governments can gather the necessary resources to fund various sectors of the economy, from infrastructure to social services, creating a more balanced financial ecosystem.

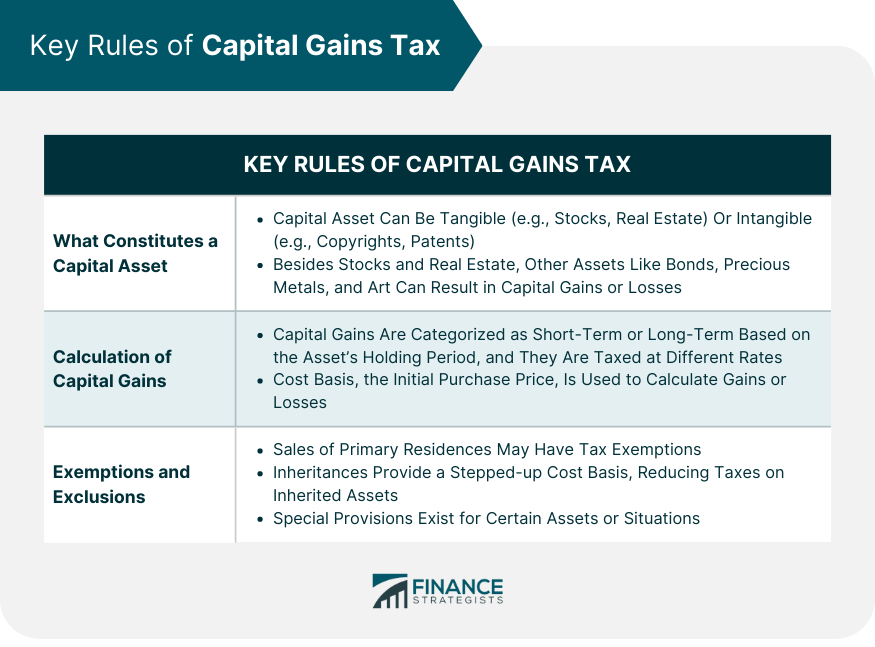

A capital asset is a tangible or intangible property owned by an individual or a company. Examples can be stocks, bonds, real estate, and certain types of personal property. Intangible capital assets could include things like copyrights or patents, among other intellectual property rights. Understanding what qualifies as a capital asset is the first step in deciphering the complexities of capital gains tax. Tangible assets are physical items that have a clear value, such as buildings, land, or a piece of art. On the other hand, intangible assets are those that lack a physical presence but still hold significant value. These could be business-related items such as the goodwill of a company, a business trademark, or intellectual property like patents and copyrights. Assets such as stocks and real estate often come to mind when discussing capital gains. However, many other types of assets are also frequently traded and can result in capital gains or losses, such as bonds, precious metals, collectibles, and sometimes expensive art pieces. Understanding how diverse these assets can be is vital to grasp the wide-reaching implications of capital gains tax. The duration for which you've held an asset determines whether it's considered short-term or long-term. Typically, assets held for less than a year are short-term, and those held for more than a year are long-term. The distinction between these categories is crucial as they're taxed at different rates, influencing your decision-making process when trading assets. The cost basis of an asset is what you initially paid for it, including any additional costs related to the purchase, such as fees or commissions. The cost basis is subtracted from the selling price to determine the gain or loss. Understanding your cost basis can help you accurately calculate your potential gains and the tax that will be due upon sale. In some jurisdictions, adjustments to the cost basis are made to account for inflation or other factors, ensuring that individuals aren't unfairly taxed for gains that are purely a result of inflation rather than real growth in the asset's value. This aspect is crucial for a fair tax assessment, reflecting the real gain from an investment rather than apparent growth due to price level changes. Many countries offer a tax break for gains from the sale of your primary residence. In the U.S., for example, individuals might exclude up to $250,000 (or $500,000 for couples) of gain from their income. This significant benefit can greatly reduce the tax burden for homeowners selling their primary residence, making real estate sales more profitable. Gifts and inheritances often have special rules associated with capital gains. In general, when you inherit an asset, the cost basis is "stepped up" to the asset's value on the deceased's date of death, which can significantly minimize taxes upon selling the inherited asset. This rule can provide a substantial tax benefit for individuals receiving an inheritance. There are various special provisions, like rollovers or deferrals, available for specific situations or assets. For example, certain types of small business stocks might qualify for exclusions. Such provisions can offer additional avenues for managing your potential tax liability and should be understood thoroughly to take full advantage. Short-term gains are usually taxed at the same rate as your ordinary income. This rate can often be higher than the long-term capital gains rate, making short-term trading less tax-efficient for frequent traders. Understanding this difference is crucial for strategic investment planning. Long-term gains are often taxed at a lower preferential rate compared to short-term gains. This preferential rate is provided to encourage long-term investment and reduce the tendency for speculative trading. It's one of the main reasons why investment strategies often emphasize the benefits of 'holding' assets. The tax rate applied to capital gains is influenced by several factors, including your total taxable income and your filing status. For example, as your income increases, including from capital gains, you may be pushed into a higher tax bracket. Therefore, understanding these factors can help you plan your asset sales strategically to minimize taxes. The timing of when you sell an asset can have a considerable impact on the amount of tax you owe. By holding an asset long enough for it to qualify as a long-term gain, you can benefit from lower tax rates, thereby keeping more of your profits. Timing can be a powerful tool in tax management strategy, making the difference between substantial tax savings and significant liabilities. This strategy, known as "tax-loss harvesting," involves selling off investments at a loss to offset capital gains from other investments. This practice can effectively reduce your taxable income, potentially saving a significant amount in taxes. It's a strategy worth considering for any investor looking to mitigate their capital gains tax liability. Tax-advantaged accounts, such as Individual Retirement Accounts (IRAs) or 401(k)s in the U.S., offer opportunities for your investments to grow either tax-free or tax-deferred. This allows investors to shield their investment returns from annual capital gains taxes, providing a valuable tool for wealth accumulation. Instead of selling an asset and potentially facing a high capital gains tax, you could consider gifting it. Gifting assets or transferring them into trusts can sometimes reduce or defer the capital gains tax owed. This approach can be a valuable strategy for estate planning and intergenerational wealth transfer. In the U.S., a 1031 exchange, also known as a "like-kind" exchange, allows investors to defer paying capital gains taxes when they sell an investment property and reinvest the proceeds in a similar type of property. This can be a valuable tool for real estate investors looking to grow their portfolios without incurring immediate tax liabilities. Owners of mutual funds should be aware that these funds can distribute capital gains to their shareholders, even if the shareholder hasn't sold any shares. These distributions can result in a tax liability, making it essential for mutual fund investors to understand these implications and plan accordingly. Tax laws, including those related to capital gains, can change based on shifts in political leadership, economic priorities, or other factors. It's essential to stay updated on these changes as they can significantly impact your tax liability. Regular consultations with tax professionals and consistent research can help investors navigate these changes effectively. The capital gains tax plays a critical role in balancing the taxation system and funding essential sectors of the economy. It is essential for every investor to understand the key rules of capital gains tax, such as determining capital assets, calculating gains, and being aware of exemptions and exclusions. Moreover, being mindful of tax rates and factors influencing them and employing effective strategies can significantly impact one's tax liability and overall investment returns. Investors who want to maximize their returns and minimize their tax liability should work with a qualified tax advisor. Tax professionals can offer personalized advice tailored to individual financial situations and ensure that investors take advantage of all available opportunities to manage their capital gains tax efficiently. Overview of Capital Gains Tax

Key Rules of Capital Gains Tax

What Constitutes a Capital Asset?

Tangible and Intangible Assets

Examples of Commonly Traded Assets

Calculation of Capital Gains

Short-Term vs Long-Term Capital Gains

Cost Basis Determination

Adjustments for Inflation or Other Factors

Exemptions and Exclusions From Capital Gains Tax

Primary Residence Exclusion

Gift and Inheritance Considerations

Special Provisions for Certain Assets or Situations

Tax Rates for Capital Gains

Short-Term Capital Gains Tax Rate

Long-Term Capital Gains Tax Rate

Factors Influencing Tax Rates

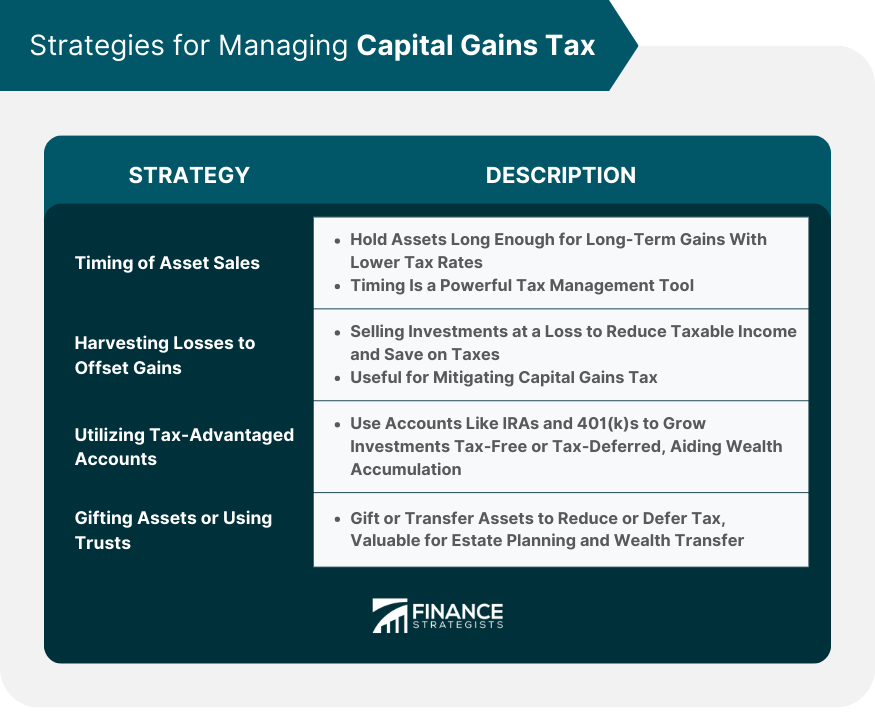

Strategies for Managing Capital Gains Tax

Timing of Asset Sales

Harvesting Losses to Offset Gains

Utilizing Tax-Advantaged Accounts

Gifting Assets or Using Trusts

Special Considerations on Capital Gains Tax Rule

Real Estate and the 1031 Exchange

Mutual Funds and Capital Gains Distributions

Impact of Changes in Tax Laws

Bottom Line

Capital Gains Tax Rule FAQs

It's a tax on profits made from selling assets that have appreciated in value.

The tax impacts your net returns and overall financial strategy, affecting both short-term and long-term investment decisions.

Yes, strategies include timing asset sales, tax-loss harvesting, using tax-advantaged accounts, and gifting assets.

Short-term gains are typically taxed at your ordinary income rate, while long-term gains often benefit from a lower preferential rate.

Yes, shifts in political or economic priorities can lead to tax law changes, affecting capital gains tax liabilities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.