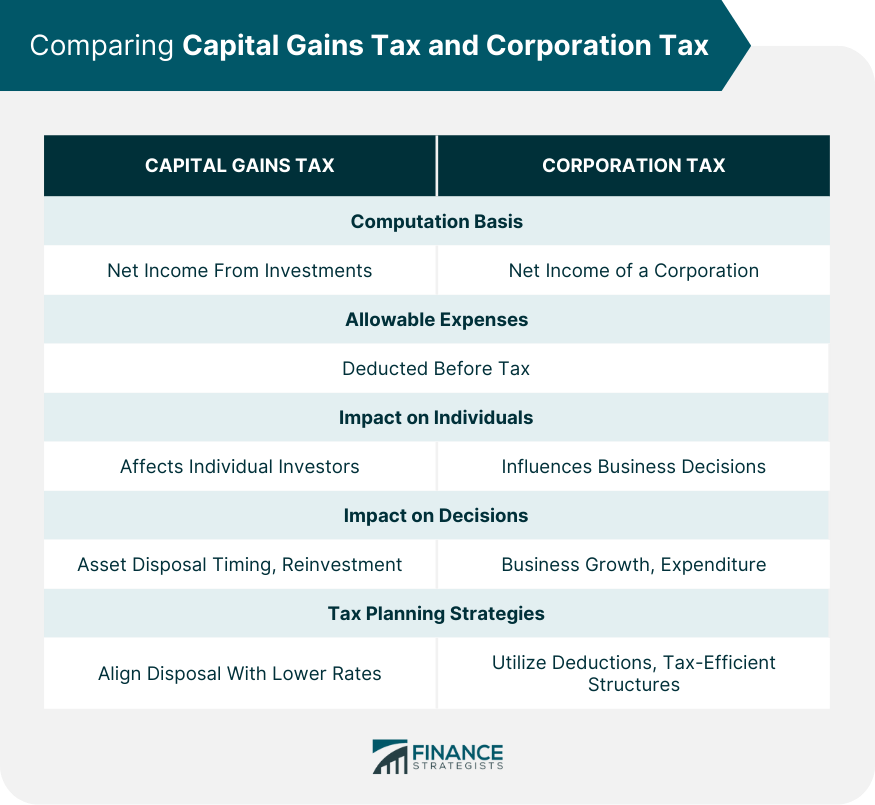

Both capital gains tax and corporation tax have a common denominator: they are computed on the basis of net income. However, the origins of this net income diverge. Capital gains tax zeroes in on the profits arising from investments, whereas corporation tax is concerned with the net income accruing to a corporation. The method for computing both taxes takes into consideration allowable expenses, which are deducted before the application of a certain tax rate to the remaining sum. To put it another way, after all, eligible costs have been deducted, the net profit or income is then subject to either capital gains or corporation tax, depending on whether the entity in question is an individual investor or a corporation.

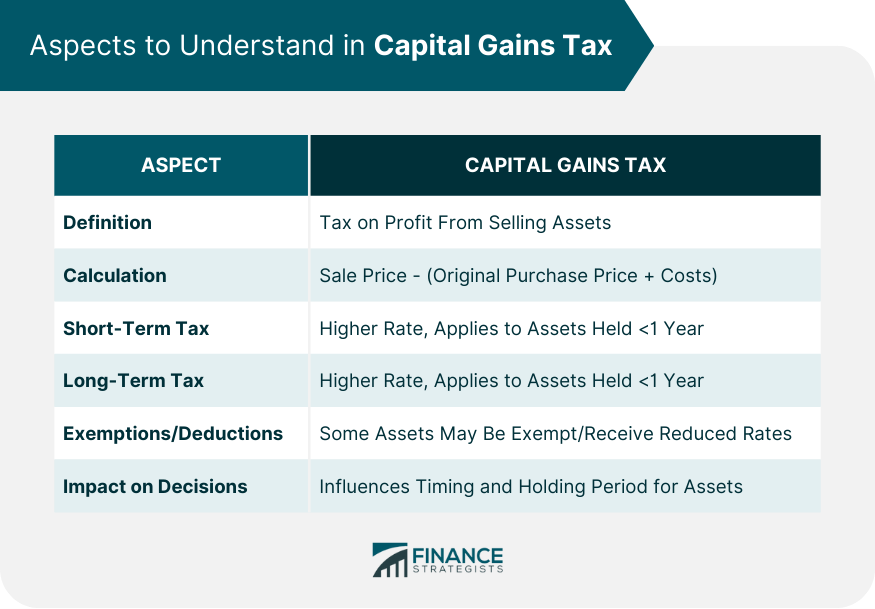

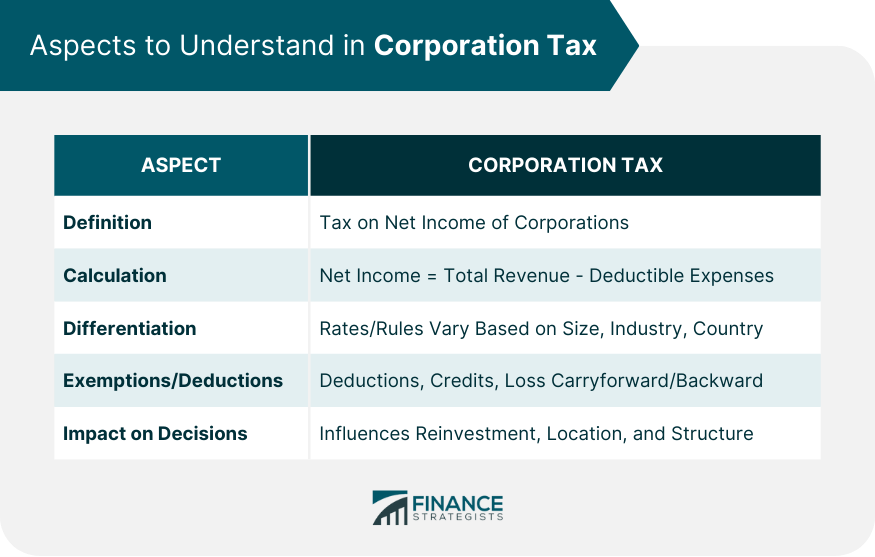

The ripple effects of each type of tax are distinct. Capital gains tax casts a larger shadow on the decision-making process of individual investors, whilst corporation tax leaves a more significant imprint on a multitude of business choices. These taxes hold sway over a range of behaviors, such as the optimal timing for asset disposal or the decision to channel profits back into the business. They may also impact considerations around business growth strategies, expenditure planning, and the evaluation of investment risk versus return. It's crucial to understand that while the immediate impact might be on decisions to sell assets or reinvest, the long-term effects can influence financial planning and the overall strategic direction of businesses or investment portfolios. Competent management and understanding of both types of taxes can translate into significant financial savings. In the context of capital gains tax, strategic planning could involve aligning the disposal of assets with periods of lower tax rates. This strategy may require monitoring market trends and understanding the implications of holding onto an asset for a longer period. For corporation tax, a similar objective could be achieved by making the most of available deductions and tax credits or by adopting a structure that is inherently tax-efficient. Businesses may also consider actions such as loss carryforward or carryback, where applicable, and the formation of strategic partnerships or alliances that could offer tax advantages. A strong grasp of tax legislation and the opportunities it offers can lead to optimized business operations and improved profitability. Capital gains tax is levied on the profit from the sale of a capital asset, such as stocks, real estate, or a business. The tax applies when the asset's sale price exceeds its original purchase price, effectively taxing the "gain" made on the asset. This tax is applied only when the asset is sold, not while it's held, making timing a crucial factor in managing capital gains tax liabilities. Capital gains tax is calculated by subtracting the cost basis, or the original purchase price plus any associated costs, from the sale price of the asset. However, it's not as straightforward as it might seem, as the rate of taxation can vary significantly. The duration of asset holding and type of asset can change the rate applied, potentially influencing investors' decisions on when and what to sell. Assets held for less than a year are subject to short-term capital gains tax, which is generally higher and applies at the same rate as the taxpayer's regular income tax. On the other hand, long-term capital gains tax applies to assets held for more than a year and often carries a significantly lower rate, incentivizing longer holding periods for investments. There are specific situations and types of assets that may be exempt from capital gains tax or subject to reduced rates. For example, in some countries, the sale of a primary residence or specific types of small business stock might be exempt. Understanding these exemptions and deductions is crucial for effective tax planning. Capital gains tax can significantly influence investment decisions. Due to the difference in short-term and long-term rates, investors may choose to hold onto assets longer to qualify for the lower tax rate. Alternatively, in years of lower income, they may opt to sell assets to take advantage of lower tax brackets. Corporation tax, also known as corporate income tax, is levied on the net income of corporations. The net income is calculated as total revenue minus deductible expenses. Like capital gains tax, corporation tax rates and regulations can vary significantly between countries. Corporation tax is calculated on the net income of a corporation. Net income is the total revenue generated by a corporation minus deductible business expenses such as wages, depreciation, and cost of goods sold. The resulting figure is then multiplied by the applicable tax rate to determine the corporation tax due. While all corporations are subject to corporation tax, the specific rules and rates can vary based on factors like the size of the business, the industry, and the country of operation. For instance, smaller corporations may be subject to lower tax rates in some jurisdictions, and certain industries might have specific deductions or credits available. Like capital gains tax, there are various exemptions and deductions available to corporations that can reduce their tax liability. These can include deductions for business expenses, tax credits for certain types of investment, and provisions for carrying forward or backward losses. Corporation tax plays a significant role in business decision-making. Businesses might choose to reinvest profits back into the business to reduce taxable income, or they may consider location and structure options that provide more favorable tax conditions. Capital gains tax and corporation tax are both calculated based on net income but differ in their application, impacting individual investments and corporate operations, respectively. The computation and impact of these taxes are further nuanced by factors such as asset holding period, corporate size, and country of operation. Capital gains tax, with its differing short-term and long-term rates, can shape investors' strategies, influencing when and what they sell. On the other hand, corporation tax influences broader business decisions, from reinvesting profits to business structuring. Understanding these taxes and their implications, as well as the exemptions and deductions available, is integral to effective tax planning and management. Whether as an individual investor or a corporation, navigating these complex tax landscapes can significantly affect financial outcomes.Comparing Capital Gains Tax and Corporation Tax

Similarities and Differences

Impact on Investments and Businesses

Tax Planning Strategies

Capital Gains Tax

Definition and Overview

Detailed Analysis

Calculating Capital Gains Tax

Short-Term vs Long-Term Capital Gains Tax

Exemptions and Deductions

Impact of Capital Gains Tax on Investment Decisions

Corporation Tax

Definition and Overview

Detailed Analysis

Calculating Corporation Tax

Differences in Corporation Tax for Different Businesses

Exemptions and Deductions

Impact of Corporation Tax on Business Decisions

Bottom Line

Capital Gains Tax vs Corporation Tax FAQs

Capital gains tax is levied on the profit from selling an asset, like stocks or real estate, when the sale price exceeds the original purchase price. Corporation tax, on the other hand, is levied on the net income of a corporation, calculated as total revenue minus deductible business expenses.

The timing of an asset sale can significantly affect the amount of capital gains tax due. Assets held for less than a year are generally subject to a higher short-term capital gains tax rate, whereas assets held for more than a year are taxed at the typically lower long-term capital gains tax rate.

Yes, the specific corporation tax rules and rates can vary based on factors such as the size of the business, the industry, and the country of operation. For instance, smaller corporations may be subject to lower tax rates in some jurisdictions.

Capital gains tax can influence when investors choose to sell their assets. For instance, due to the difference in short-term and long-term rates, investors might hold onto assets longer to qualify for the lower tax rate. They might also choose to sell in years of lower income to take advantage of lower tax brackets.

Businesses can use various strategies to manage their corporation tax liabilities. These can include reinvesting profits back into the business to reduce taxable income, taking advantage of deductions and credits, or structuring the business in a more tax-efficient way.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.